Tencent Stock: Unveiling Short-Term Catalysts And Long-Term Promise

Summary

- Tencent, the leading global video game publisher, is strategically positioning its esports business ahead of the Hangzhou Asian Games, set to attract significant viewership between September 23 and October 8, 2023.

- Asiad marks a pivotal moment for esports, with Tencent-owned titles such as Honor of Kings and Game for Peace featured among the seven games to be held as official events.

- Tencent's optimistic long-term outlook is reinforced by its massive project, Penguin Island (to be completed in 2026). This initiative reflects the company's confidence in its growth and strong local government support.

- Tencent's well-diversified revenue structure, evenly distributed across gaming, fintech, enterprise services, and advertising could give itself steady growth into the long-term future.

- Tencent appears undervalued relative to comparable peers like Google and Meta, as indicated by its low P/E ratio (13) and PEG ratio (0.38), along with a higher free cash flow yield (6.6%).

Yijing Liu

Short-term catalyst ahead

Tencent Holdings (OTCPK:TCEHY), the world's leading game publisher, is strategically positioning its esports division in anticipation of the Hangzhou Asian Games scheduled for September 23 to October 8, 2023. Asian Games, also known as Asiad, is a continental multi-sport event held every fourth year among athletes from all over Asia.

This event represents a pivotal moment for esports, with Tencent's flagship mobile games, Honor of Kings and Game for Peace, prominently featured among the seven official events. The other 5 events are League of Legends (developed by Riot Games, owned by Tencent), FIFA 4 (owned by EA), Street Fighter (OTCPK:CCOEY), Dota 2 (owned by Valve), Dream Three Kingdoms. The significance lies in the potential to reshape public perception of mobile games and esports in China, elevating it to a mainstream form of entertainment.

Tencent's Honor of Kings, boasting 150 million Monthly Active Users (MAU), and Game for Peace, ranking third with 85 million MAU, are poised for increased global exposure. This visibility surge could lead to heightened user engagement and expanded revenue streams from in-game purchases and advertising. "The Asian Games will make esports more accessible, opening up new opportunities," said Hou Miao, who heads Tencent's esports division. Foreseeable large amount of gaming content will be shown or spread across the internet during the time. Tencent will be benefited from three aspects:

- Esports Growth: Esports is a rapidly growing industry, and Tencent has a strong presence in it through titles like "Honor of Kings," "League of Legends," and others. The Hangzhou Asian Games could further validate esports as a mainstream form of entertainment, attracting more players and sponsors to the industry, which could benefit Tencent.

- Short-Term Hype: Events like the Hangzhou Asian Games can generate short-term hype and excitement around the companies involved. This could lead to increased trading volume and short-term price fluctuations in Tencent's stock.

- Long-Term Impact: While events like the Asian Games can have short-term effects, their long-term impact on a company's stock price is often tied to how well the company capitalizes on the opportunities they offer. Tencent would need to sustain and monetize the increased interest in its games and esports activities beyond the event to have a lasting effect on its stock.

Long-term prospect remains bright

Tencent's ambitious project, Penguin Island (net city), stands as one of Shenzhen's largest construction ventures. Scheduled for completion in 2026, this project has an estimated total cost of approximately $5 billion, which is equivalent to the cost of Apple Park. It signifies Tencent's forward-looking approach. This move aligns with industry giants like Amazon (AMZN), Meta, Google, and Apple, which have historically expanded their office spaces ahead of headcount and revenue growth surges. Tencent's geographic scaling strategy is a pivotal qualitative aspect to consider when analyzing its long-term prospects.

Furthermore, this project serves as a testament to the Shenzhen government's commitment, as they plan to construct tunnels, bridges, and metro lines for convenient access to the island. This underscores the government's recognition of the crucial role played by tech firms in creating high-paying jobs and their proactive support in building the necessary infrastructure.

Addressing past concerns about government regulations potentially hindering the gaming industry's growth, the support for Tencent suggests that the regulatory limits may be near. Government backing is expected to continue, ensuring a favorable policy environment for Tencent's operations.

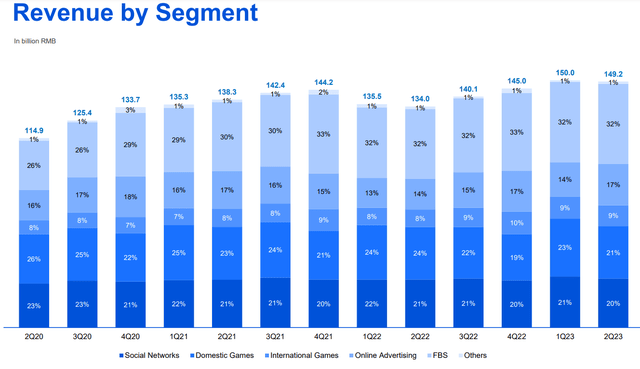

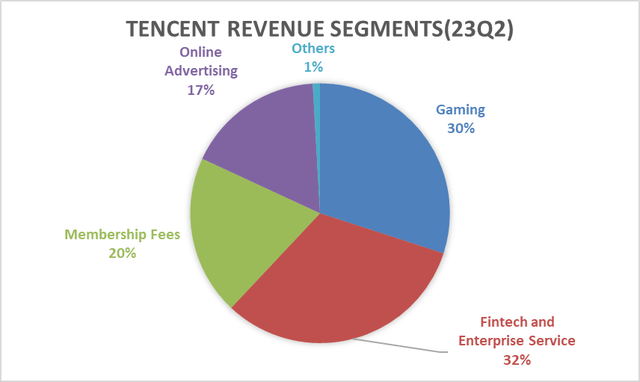

Diversification characterizes Tencent's revenue structure, with gaming, fintech, enterprise services (cloud), and advertising each contributing roughly one-third to its total revenue. This balanced portfolio diminishes reliance on a single revenue source, enhancing resilience against economic fluctuations and industry-specific challenges.

Fundamental drivers are displaying robust growth. Increased total gaming time, enhanced advertising algorithms, and steady growth in fintech operations are noteworthy. In the most recent quarter, advertising revenue surged by 34% YoY, while fintech and enterprise services grew by 15% YoY. This resulted in a solid 11% YoY growth for the entire group, despite the gaming segment's more modest 5% YoY growth.

Figure 1: Tencent’s Revenue by Segment, in comparison with Meta

Tencent's investor presentation Tencent's investor presentation Meta's financial disclosures

Source: Tencent and Meta’s financial disclosures

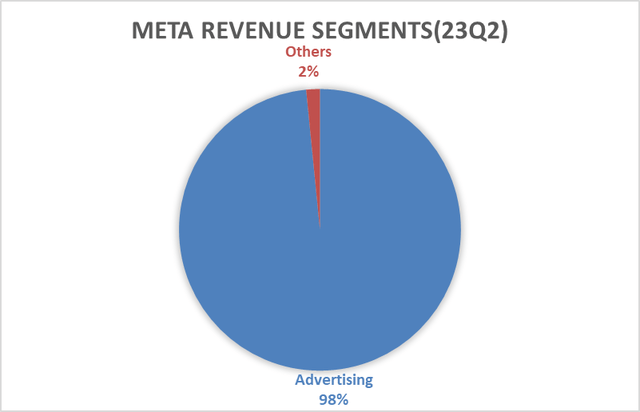

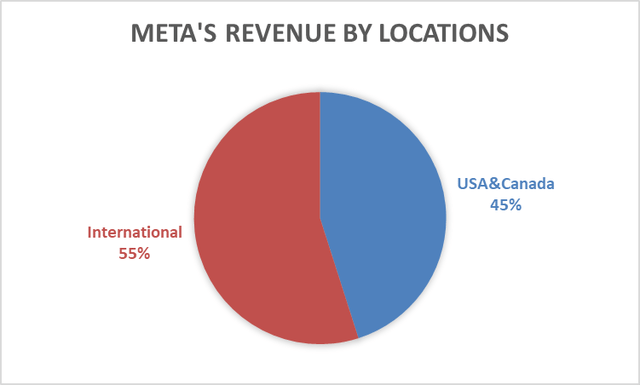

Taking a page from Meta's successful growth drivers, which primarily revolved around algorithmic improvement, ad density increase, and global expansion. Tencent currently maintains a relatively low ad density on its WeChat platform. In fact, personal observations indicate that Tencent's ad load on WeChat is roughly half to one-third of what's typically found on Facebook and Instagram. This suggests significant untapped potential for increasing ad density. Furthermore, Tencent's international presence is currently limited. As it looks ahead, there is ample room for Tencent to explore and expand its footprint overseas. As of today, international games account for one-third of the total games revenue, and this percentage is on the rise.

Figure 2: Tencent’s revenue by geographic locations, in comparison with Meta

Tencent's financial disclosures Meta's financial disclosures

Source: Tencent and Meta’s financial disclosures

Figure 3: Tencent’s $5 Billion Investment in New Headquarters – Penguin Island (net city) in Shenzhen

Not Fully Valued as of Now

Tencent boasts a robust financial position, featuring substantial free cash flow of $11 billion in the first half of 2023, equivalent to 3% of its entire market capitalization. Furthermore, Tencent has approximately $100 billion in investments, with 55% allocated to public companies.

From a valuation perspective, Tencent trades at a P/E of 13 and a PEG of 0.38, markedly lower than comparable peers like Google (GOOG), Meta (META), and MercadoLibre (MELI), and Electronic Arts. Additionally, its Free Cash Flow (FCF) yield stands at 6.6%, significantly higher than Google and Meta.

Figure 5: Tencent’s Comparable Valuation

Market Cap($b) | P/E | 23Q2 Revenue Growth | 23Q2 Earning's growth | P/E/G | |

Tencent | 399 | 13 | 11% | 34% | 0.38 |

1720 | 29 | 7% | 15% | 1.93 | |

Meta | 770 | 35 | 11% | 16% | 2.19 |

Mercado Libre | 72 | 96 | 31.5% | 113% | 0.85 |

Electronic Arts | 33 | 37.4 | 9% | 29% | 1.3 |

Share price | FCF per share (TTM) | FCF yield | |

Tencent | $40.29 | $2.66 | 6.6% |

$136.38 | $5.40 | 4% | |

Meta | $297.8 | $9.18 | 3.1% |

Mercado Libre | $1428 | $25.38 | 1.8% |

Source: company financials and GuruFocus

Risks

A potential risk arises from foreign equity holders, with PROSUS N.V. being the largest shareholder at 25.42%. PROSUS N.V. has signaled its intention to gradually reduce its ownership by 2% to 3% annually, targeting an ownership level of 24% to 25% by the conclusion of 2023. It introduces two negative aspects:

- Selling pressure: This impact could cause selling pressure, as it could put downward pressure on Tencent's stock price if there isn't sufficient demand from other investors to absorb the shares being sold. Tencent mitigated this by repurchasing shares, accounting to Tencent's fillings, Tencent purchased 81.5 million shares or 0.9% of total shares outstanding year-to-date in 2023. In May of this year, Tencent commenced its share repurchase plan that could purchase up to 10% of total shares. Considering Tencent's Free Cash Flow (FCF) yield of 6.6%, it is likely that Tencent can manage this 2%-3% ownership sell-off on its own.

- Market Perception: Investors and the market may interpret PROSUS N.V.'s decision to reduce its ownership stake as a lack of confidence in Tencent's future prospects. However, this may be influenced by factors such as Tencent's sustained growth and performance, potentially mitigating the perception of reduced confidence.

A gradual reduction in ownership could lead to a more diversified shareholder base and less dependence on a single major shareholder in the long term. Tencent holds a $100 billion investment portfolio, so the effects of PROSUS N.V.'s actions could be offset by other factors, including the potential sale of partial investments to buy back shares. Investors and analysts could monitor developments and assess the implications for Tencent's future performance and strategy.

Figure 6: PROSUS N.V. ownership in Tencent

| Amount Sold (mm) | Selling Price (in HKD) | Amount Left (mm) | Ownership Percentage | |

| 8/24/2023 | 58.4 | 345 | 2429 | 25.42% |

| 4/25/2023 | 87.6 | 292 | 2488 | 25.99% |

| 1/3/2023 | 13.4 | 292 | 2575 | 26.93% |

| 12/13/2022 | 103.3 | 292 | 2589 | 26.99% |

| 09/08/2022 | 76.8 | 292 | 2692 | 27.99% |

| 4/08/2022 | 191.9 | 595 | 2769 | 28.86% |

In conclusion, Tencent's strategic positioning for the Hangzhou Asian Games (ASIAD), its ambitious infrastructure project, diversified revenue streams, attractive valuation, and investor sentiment dynamics collectively underscore its promising outlook in both the short and long term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TCEHY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

GBARDTencent has sold off a significant amount of its stake in other companies in recent months. In January 2023, Tencent sold 3 billion dollars worth of its stake in Sea, a Singapore-based gaming and e-commerce firm. In June 2023, Tencent announced that it would sell another 4.4 billion dollars worth of shares in Prosus, a Dutch-listed investment company that owns a majority stake in Naspers, a South African media and internet group.The total amount of Tencent's stake sales in 2023 so far is around 7.4 billion dollars. This is a significant amount of money, and it is likely to have an impact on Tencent's financial performance in the coming quarters.It is difficult to say definitively how much Tencent has sold off of its total value, as this depends on a number of factors, including the market value of Tencent's shares and the value of the stakes that it has sold. However, it is likely that Tencent has sold off around 2% of its total value in 2023 so far.It is important to note that Tencent is still a very valuable company, with a market capitalization of over 380 billion dollars. However, the recent stake sales have raised concerns about Tencent's future growth prospects. It remains to be seen whether Tencent will be able to maintain its position as one of the world's leading technology companies in the long term.