3 Keys To Navigate REIT Market Volatility

Summary

- REITs are facing challenges due to the Fed's decision to increase interest rates, impacting their ability to generate cash flows and distribute capital.

- Investing in REITs with fortress balance sheets, well-laddered debt maturity profiles, and distant lease terms can help protect dividends and ensure long-term value creation.

- Examples of REITs with these elements include Realty Income, STAG Industrial and Alexandria Real Estate Equities, which have strong balance sheets and ambitious acquisition plans.

NVS/iStock via Getty Images

In early 2022, the easy days of REIT investing came to an end. Prior to the Fed's decision to massively hike interest rates, the underlying business of REITs was stable and structurally profitable. In other words, whenever there was a shock in the financial markets, the Fed stepped in and provided stimulus to mitigate risks by either expanding the balance sheet or directly decreasing the cost of financing.

Given that the key fundamental way how REITs derive value is based on the spread of property cap rates and the cost of capital, having depressed interest rates helped a lot.

Plus, the corresponding stability and low discount rates warranted conditions in which the property values remained high, thus making the external financing process even more attractive (e.g., secondary offerings at high share prices and assumption of debt against high collateral values).

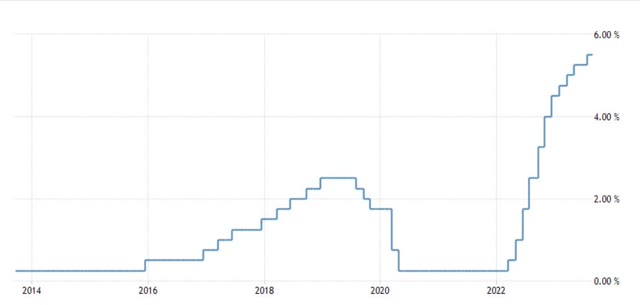

TRADING ECONOMICS

Yet, now when the Fed Fund Rate is 5.25 - 5.5%, the underlying business of capturing excess spreads (i.e., delta between the cap rates and cost of capital) has significantly deteriorated.

REITs, which historically have relied on massive leverage and before 2022 had balance sheets with very little headroom for downward correction are now facing notable struggles to safeguard the existing cash flows and ability to distribute capital.

It is even worse for REITs operating in specific sectors such as office and retail (although there are positive exceptions as well), which have to deal with weaking prospects of the demand for their properties on top of the more expensive financing.

Small-cap REITs also are battling with a more conservative banking players, which have become reluctant to further expose their balance sheets to commercial real estate sector in general.

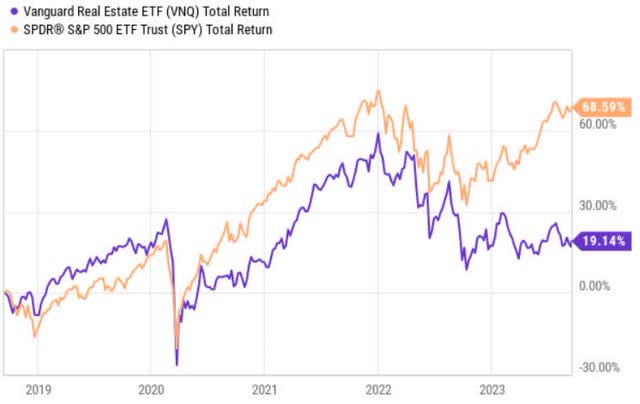

Ycharts

In the chart above, we can see how REITs have managed to rebound from COVID-19, but starting from 2022 have been on a structural decline given the unfavorable rate of change in the Fed Funds Rate. From 2023, the ride has been volatile with no recognized gains.

On a go forward basis, if higher-for-longer scenario takes place, the probability is very high that REITs will continue to trade sideways or experience further declines.

The key driver of this is the gradual increase of financing costs, which the companies will have to register as the current borrowings that are based on fixed interest rates come due.

Given that it is not structurally possible to increase rents at the same magnitude as the financing costs are set to grow, the net effect is clearly damaging to the free cash flows or FFO.

If we couple this with high degree of leverage and, even worse, downward volatility in rents or leases, the outcome is not something that investors could enjoy.

So, the objective of this article is the following:

- Provide three key elements, which should keep REIT investors safe and their dividends protected.

- Introduce some concrete examples of REITs, which embody these elements.

#1 Fortress balance sheet

In times of economic distress it is critical to have strong balance sheets as this way companies have more flexibility to assume additional debt to manage short-term gaps in the internal cash flows or mitigate the risk of unsuccessful refinancing.

As mentioned earlier, in REIT business the essence is the spread between the property yields and your cost of capital. So, the lower cost of financing, the more residual cash flows there are to either fund dividends or make accretive investments.

Investors, who want to maximize the predictability of their current income stemming from their REIT investments should seriously consider investment grade rated balance sheets. My personal preference is an upper investment grade territory, which brings in an extra cushion of safety in terms of balancing the financial and business risk.

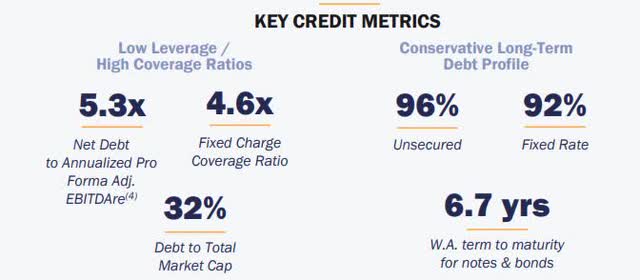

For example, Realty Income (NYSE:O) is a double rated company with an upper investment grade level having two A ratings.

Realty income investor relations

As a result of fortress balance sheet, O is able to keep the WACC balanced at ~6% (5.5% related to cost of debt), which is more than enough to service the existing debt holders without sacrificing dividends.

Plus, having so low WACC, the M&A process becomes more rational and doable even in these conditions, when the cap rates have not increased significantly.

And this leads us to an additional aspect of why it is necessary to have a robust capital structure. REITs with a sufficient buying power will be the ones, which will eventually benefit from the market volatility, where asset holders with heavily indebted balance sheets are forced to divest just to keep their companies afloat.

STAG Industrial (NYSE:STAG) just as O is also a great example, which has an IG balance sheet with a notable ambition to step up the acquisitions volumes from ~$2.4 billion in 2022 to over $3 billion in 2023, this year.

In a nutshell, by allocating into IG rate REITs the investors not only protect their dividends but also secure a ground for a long-term value creation.

#2 Well-laddered debt maturity profile

In the higher-for-long scenario, it is important to have borrowings isolated from the variable interest rate component and have the maturity dates as distant as possible.

For most REITs the debt holdings are based on fixed interest rates and in only few instances we can see that variable debt is present in a meaningful fashion.

However, the key question lies in the outstanding debt maturity profiles, which while are based on fixed interest rates will reprice as the maturity dates kick in.

It is clear that REITs rely heavily on external financing to capitalize on the relatively predictable cash flows and bring down the WACC thereby widening the spread between cap rates and cost of capital. The problem is that whenever you possess notable amounts of debt, it becomes almost impossible to retire debt by the use of internal cash flow generation (especially considering the emphasis to pay dividends).

In higher interest rate conditions that we have now, each debt portion that has to be refinanced imposes a negative effect to the underlying cash flow through incrementally higher cost of financing.

As a result, REIT investors should focus on cherry picking companies, which have a well-laddered debt maturity profile with as low debt portions coming due in the short- to medium-term as possible. This way higher financing costs are brought further in the future offering time for REITs to accumulate internal cash flows to decrease the amount that has to be refinanced at unfavorable terms and / or leaving REITs with more cash flows to make more sizeable and accretive M&A moves, while cost of capital is still low.

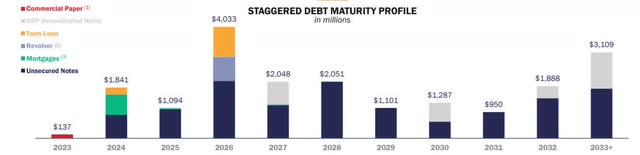

We can again take a look at O as an example. In the chart below, we can see how O has perfectly structured its debt maturities so that there are no significant refinancing events until 2026.

Realty income investor relations

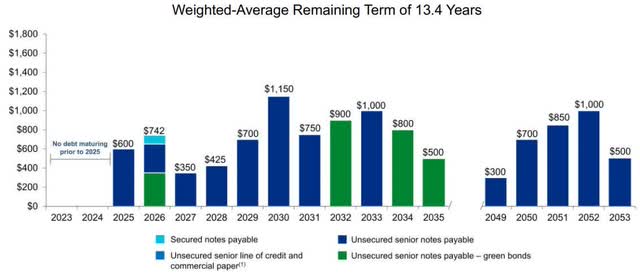

Alexandria Real Estate (NYSE:ARE) has even more favourable debt maturity profile with the weighted average remaining term of more than 13 years. In fact, over 2023 and 2024 there are no maturities at all meaning that if ARE does not assume incremental debt financing, the interest costs should remain fairly stable.

ARE investor relations

#3 Distant lease terms

Based on a rather similar principle as the previous element, having distant lease maturities come in handy as well, especially during uncertain macroeconomic environments.

The primary effect from long lease maturities is a significantly reduced risk of suffering from negative like-for-like NOI growth duet to either lower pricing or increased vacancy rates. Moreover, oftentimes tenant rotation requires REITs to inject additional CapEx proceeds to redevelop or enhance the asset so that it can attract new tenants.

In the current situation when the commercial real estate market is out of vogue and the bargaining power has shifted in the hands of tenants (especially in retail and office segments), long lease maturities are helpful.

The secondary effect from distant leases is that it gives the management the necessary cash flow visibility to embark on tactical investments when lucrative opportunities arise.

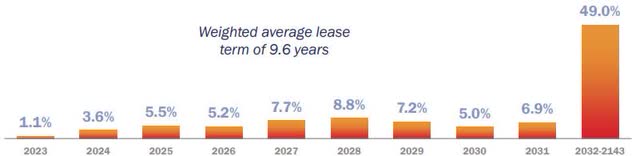

Here O's case also serves as a great example. The weighted average lease term is 9.6 years, which is very long. As of now only about 10% of the total leases expire until 2025.

Realty income investor relations

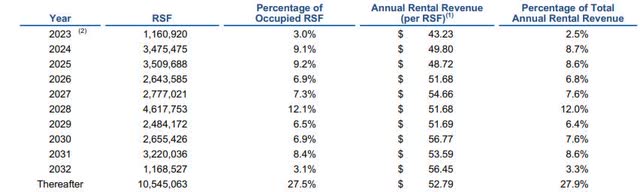

In ARE's case we can see, however, a bit different picture, where lease maturities until 2025 account for almost 20% of the total leases. Given that ARE operates in an extremely volatile segment (i.e., office), this implies a more elevated risk on having the existing cash flows protected from an uptick in vacancy rates or decreased lease pricing.

ARE investor relations

Even though each maturing lease gives REITs the opportunity to negotiate more favorable terms stimulating the like-for-like NOI growth, my preference is to have as minor maturities as possible considering the context of very unstable macro environment.

The bottom line

REITs are in general rather interest rate sensitive vehicles. The higher-for-longer scenario imposes clear risks for many REITs to maintain their ability to cover dividends and sustain value creation.

REIT investors, who seek dividends and cash flow stability should seriously consider focusing on companies with investment grade balance sheets with well-laddered debt maturities and minor lease maturities over the short- to medium-term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.