Energy Transfer: An Old Adversary Threatens A Material Future Change

Summary

- Energy Transfer faces potential shutdown of the DAPL pipeline as the Army Corps of Engineers presents five alternatives, ranging from increased operation to removal.

- The ongoing court case and uncertainty surrounding the pipeline's future overshadow Energy Transfer's other activities and contribute to its cheap valuation.

- The quant system is unable to accurately forecast the impact of the potential liability. Management likewise has a similar stance but believes the liability is insignificant.

- The Quant system "Hold" rating appears to demonstrate some market trepidation about the future despite the relatively low price and high distribution yield.

- Once the DAPL decisions have been made based on the report from the Army Corps of Engineers, the court fights are likely to resume again.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

onurdongel

Energy Transfer (NYSE:ET) has had a quiet time since the Army Corps was ordered to come up with a new study on the effects of the DAPL pipeline. That has led more than a few investors to think that the issue died away and there was nothing left to it. In another words, Energy Transfer escaped another close call. But even though these things move very slowly, the Army Corps of Engineers has now prepared that court ordered study and now has five alternatives listed from leaving the pipeline operated at roughly double the current volume to removing the pipeline. In terms of costs, that range goes from a lot more profits to some potentially very large costs. That makes this issue very unacceptable to income shareholder despite the large yield.

Making matters dicier was the fact that the company continued to operate the pipeline and finished construction knowing there were court issues outstanding (as I had noted in past issues). Also, an Illinois court had vacated an expansion permit of the pipeline. That means there were now both a permit in Illinois, and the easement in North Dakota that needed resolution. This situation did allow the pipeline (in both cases) to continue to operate until the federal review was completed. The study by the Army Corps was originally expected months before now. But it had been delayed.

Now it looks like the process will again get going. One of the main issues in the past included the Energy Transfer operator record in Pennsylvania. Those issues are now settled and a matter of record. How those results weigh into what is about to happen is another matter.

Here is the note from Phillips 66 Partners, which is now part of Phillips 66 (PSX):

" Since 2016, there has been ongoing litigation challenging permits and easements issued by the U.S. Army Corps of Engineers to Dakota Access, LLC related to the Dakota Access Pipeline. The outcome of the litigation is uncertain, and there can be no assurances that the pipeline will not be shut down, either temporarily or permanently."

Source: Phillips 66 Partners Fiscal Year 2020 10-K.

Before this discussion continues, it needs to be noted that Energy Transfer management has long held that the company has strong defenses and at this time considers this litigation a normal part of business where the liability either cannot be determined or is likely to be insignificant. Whether the upcoming public comment time period of court action after that changes this stance is pure speculation at this point.

Since Phillips 66 Partnership was the smallest partner in the DAPL partnership and was its own legal entity at the time, there was a good deal more detail on the ongoing dispute in the legal filings of this entity (until it was merged into Phillips 66). This management stated in several conference calls that they expected the court fight to continue for years.

The problem was that everything "died down" until the latest study was complete. There really was nothing legal to be done until the results became public. Now it appears there will be a period of public commenting before the next step. That means that any court filings are likely to happen next year.

The key is that as the operator of this partnership, this news is likely to overshadow anything else Energy Transfer does and the uncertainty surrounding this issue is one significant reason that the partnership common units are considered cheap and are likely to stay cheap until this issue is resolved.

Profitability

Those of us who have followed Energy Transfer long term know that the record here is probably on the minimal side from all these issues that are likely to detract from profitability.

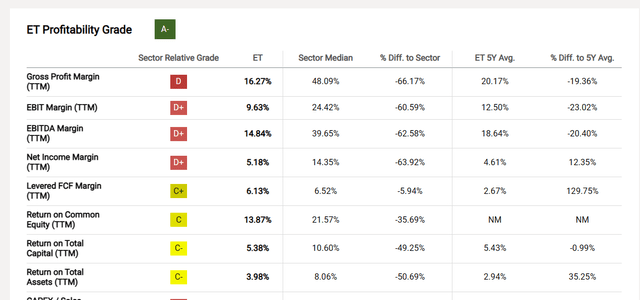

Seeking Alpha Summary Of Energy Transfer Profitability Ratios (Seeking Alpha Website September 15, 2023, 2022.)

As the Seeking Alpha website shows, this is one of the least profitable operators in the industry. It is also very large and investment grade. A court case like this, if it goes in a "big time" unfavorable direction, could have a material impact on the future of the company overnight.

Quant System

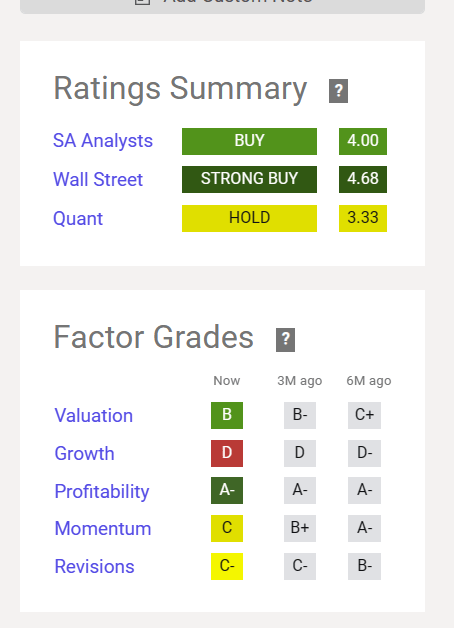

One of the things about the Quant system is that it is primarily a numbers system. There is really no impact on a system like this for something like the DAPL case that is really a footnote in most official reports. The only real cost at the current time is legal fees, which are likely to be very small compared to the operations of a big company like this.

Seeking Alpha Quant System Outlook For Energy Transfer (Seeking Alpha Website September 15, 2023)

Therefore, the quant system is really unable to forecast the effects of a potential liability like this. Instead, evaluating the liability is a qualitative process. Once the court case is decided and all appeals and other motions have been dealt with, then there will be considerably more certainty to the outlook that something like that quant system can deal with.

Still, the system has a "hold" rating on the common units. This does indicate some trepidation in the market that likely relates to the uncertainty of all options listed in the Army Corps of Engineers report (study).

Evaluating Risk

One of the things that investors nearly always under-estimate is risk. David Dreman in his latest book "Contrarian Investment Strategy: The Psychological Edge" has noted this. But so have many other authors.

The mathematical argument would be something like this:

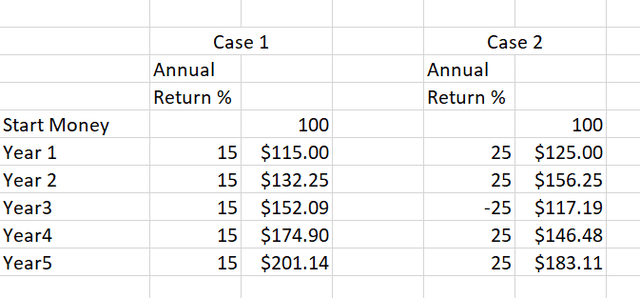

Comparison Of Returns To Show The Effect Of One Loss Year (Author)

The reason is that many will go for Case 2 because the returns look good until a loss year happens. Many times, that loss year is far in excess of the 25% shown. But many investors assume that year will not happen because it did not in the past.

For me, I have followed many examples like this. The latest of those was my coverage of California Resources (CRC) up until the bankruptcy filing in fiscal year 2020. The comments to my articles clearly state that the company had "valuable land" that would get it out of trouble. Alternatively, the company had a lot of reserves behind each share (never mind that no one reviewed the high cost of those reserves or lack of profitability of the company compared to debt levels).

So, when California Resources soared before bankruptcy, clearly it was going to go far higher based upon those optimistic assumptions and actually many more. So, there was no reason to sell. That stock did rally again after that (but not as much). That was clearly time to back up the truck.

But then came fiscal year 2020 and my mailbox filled with investors that lost a lot of money and were disgusted. That was a total loss. The 100% brought more than a few investors to zero which was far worse than the chart above.

I have many more of these in my profile. One 100% loss can hurt a lot when you have "backed up the truck".

As against that are those who took that same level of risk and got away with it. Those comments are similar to the comments to my California Resources articles in the years leading up to the bankruptcy. Clearly there was no risk because nothing bad happened in the past. So exactly "what was I worried about?" Because clearly, there was nothing to worry about.

Key Ideas

Probably there is still a lot of sentiment that Energy Transfer as an investment carries no risk because it has because the dispute has had no consequences so far and the last 18 months or so have been quiet ("therefore there is no problem anymore").

The Army Corps of Engineers clearly states that shutting down the pipeline and removing it is an option. It also clearly states that allowing the pipeline to operating at a higher capacity is also an alternative. But that range of possibilities is too much for income investors that demand a safe level of returns.

There are many investors that assert that Energy Transfer is not going to go broke over this, and there certainly could be more years of court battles ahead. However, the company does not have to go under for that distribution to be cut or even eliminated in the future. Removing a pipeline under court order could prove to be expensive before you get to lawsuits claiming all sorts of things related to an unfavorable court outcome. There is a range of outcomes here, from a big negative number to a large positive number.

Suitability

That makes these common units (and probably the preferred as well) suitable for investors that can understand the risk. These investors can also take profits and walk away before trouble hits.

This happened in the past for me when Mcdermott (OTC:MCDIF) got financially stretched and eventually filed bankruptcy. I covered this as a speculative opportunity as McDermott had gotten stretched in the past. But the groups I knew got in and doubled their money and then were long gone before the company filed bankruptcy. So, for them, my coverage was an opportunity. It was not anything close to that for the average investor that cannot walk away.

Energy Transfer management has long held in official documents that any possible liability cannot be determined, and management has strong defenses. That may or may not turn out to be the case when this is over. But the key for any investor invested in any Energy Transfer security is "do you have a plan that protects you just in case?" Because so many investors have told me in the past that they did not and are now feeling the consequences.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

I analyze oil and gas companies and related companies like Energy Transfer in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (80)

Well, after a lengthy hiatus, the “Long Lummox” returns. Once again, the sound of futility, signifying nothing. Your (one of many) ridiculous thoughts:

“For me, I have followed many examples like this. The latest of those was my coverage of California Resources (CRC) up until the bankruptcy filing in fiscal year 2020.” Why not cite Enron or Bernie Madoff or perhaps Disney, a company that truly made poor decisions and “woke” itself into a greater than 50% drop in market value. You sir are, well, sad. Like a dog with a bone, no meat on it, splintered, stuck in its craw but continues chewing as it knows no better. You really should stick to small Canadian oil plays. There you can throw a dart and likely do better than 50%, likely a great result for you. $6.00 gas and $6.00 eggs are not going to put rational folks in the minds of the sky is falling crowd, encouraging less fossil energy independence, while realizing that fossils will be the mainstay of our, (the world’s) energy needs for decades to come. A prediction: DAPL and Keystone will both be operating, long after the lunatics in the current administration are gone and well-forgotten. And, incidentally, this “article” would have been rejected by my 8th grade English teacher for content, lack of a compelling, or even reasonable thesis, along with syntax. Great job and though it is difficult to image it was yours, the headline is ridiculous.

reviewed the question do we leave or do we stay and grow by Compounding

we stayed and built our Cash Flow to enough to live a superb life on just ET.

No way will we ever sell to much Capital Gain and we profited in 20 by just buying more ENBL after the cuts in distribution. We did in 21 and 22 shift to building EPD investment to twice ET and feel very secure with that choice.

Obviously risk is present but we buy going up and we buy going down the key thing is Compounding that wonderful Return of Capital with no Current Tax Load. In all our adventures of Roll Ups and Mergers we learned that a real

General partner like especially the Duncan’s but also the Warren’s are what

allows us to avoid the real risk to an MLP; sale of the Partnership creating a huge Taxable Event. It’s very nice to have our top three holdings be EPD, ET

and WES.

Currently we are hitting all time portfolio highs but it’s the Cash Flow growth that we watch, last year almost exactly 25 % this year YTD 17.2% will pass 20% by year end over 22. Thank goodness we chose to move to Hard Asset driven

income with a very important Tax Deferral till Step up Basis do we part.

ET is Safe Enough. Heck I could have kept T,F,CS,PFE etc talk about risk that

would have been pure loss. Not to mention those risk free Bonds in 22, never wanted those at all, still don’t. I remember the replacement of the “dollar” in 71.

Obviously we are in a dangerous period as to Midstream specifically Consolidation is high risk to holders of many MLP’S.

I know every Corporation General Partner swears they will never sell but they will if the Management is rewarded. The owner investor General Partner can’t take the Tax hit.

Best Luck Partners

John

PS LongPlayer I retired from SA unfollowed everyone but can’t resist ET and EPD articles yet; soon. Busy over in the Creative world, the thing for you to sell

is WBD.

-RM

So only 3 and 4 are possible and probable solutions when all the different environmental impacts analyzed in the study are accounted. 3 would be politically not very intelligent because the lawsuits wouldn’t end with further insecurity. So the most probable outcome is that all the interested parties would accept a negotiated solution 4.

Conclusion: the author just didn’t do objective homework. Second, the Dakota pipeline will be operated basically untouched. The study made it easy for the judge.

Thoughtful analysis and #4 is a reasonable outcome. The writer (as opposed to “author”) rarely, if ever, does “homework.