What If Inflation Remains High? 2 REITs That Could Outperform

Summary

- Investors should prepare for a scenario of sticky inflation.

- The implied chances are close to 100% that inflation will remain above 4.00% over the next year.

- REITs tend to do well in elevated inflation environments, but investors need to be selective given the current situation of high inflation, rising rates, and weakening economic growth.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

slowmotiongli

This article was coproduced with Leo Nelissen.

To me, it seems that a lot of market participants are preparing for a return to normal. In this case, normal refers to the period between 2009 and 2021, which came with very subdued inflation, accommodative central bank policies, and consistent economic growth.

While that may be true, I believe that investors need to incorporate investments into their portfolios that do well in case we’re not going back to a period that caused growth and tech stocks to fly.

At the end of last year, legendary investor Howard Marks wrote a highly fascinating memo titled Sea Change. In this memo, he discussed what I believe to be one of the most important topics of the market: a scenario of sticky inflation, elevated rates, and related issues.

Although it was roughly nine months ago that he published his memo, the content couldn’t be more important, as it seems that investors are pricing in elevated rates.

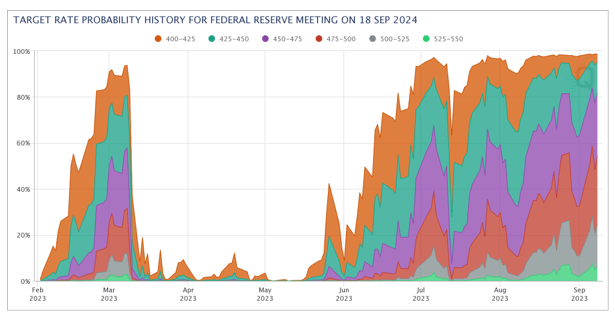

The chart below shows the implied chances of a Fed Funds rate of higher than 4.00% on September 18, 2024. That’s roughly one year from now.

CME Group

Earlier this year, the implied chances were roughly 90%. Then, they went to zero, as investors believed that the Fed had beaten inflation.

Suddenly, inflation is accelerating again, boosted by higher oil prices, sticky and elevated wage inflation, and secular issues like an aging population (which is a minor reason right now).

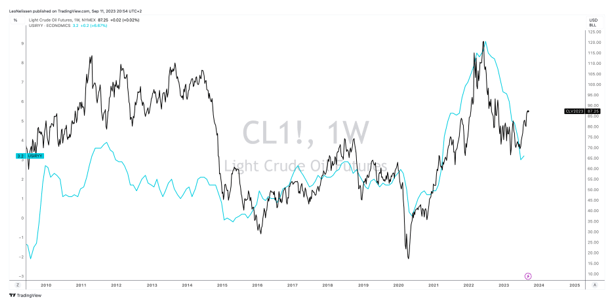

This is what the comparison between crude oil and year-over-year inflation looks like:

TradingView - NYMEX Crude Oil, U.S. Y/Y Inflation

Now, the implied chances of a 4.00% Fed Funds rate (or higher) one year from now are close to 100%.

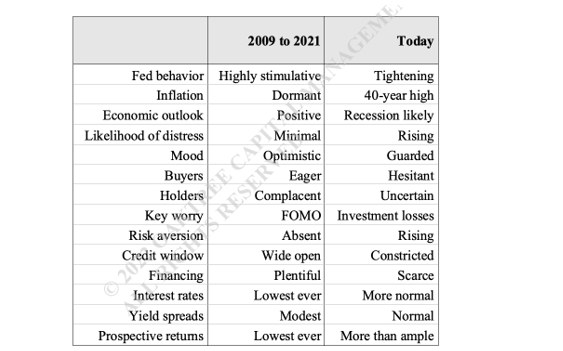

Going back to Marks’s memo, he made the case that we are in a paradigm shift.

Between the end of the Global Financial Crisis in 2009 and the onset of the COVID-19 pandemic in 2020, ultra-low interest rates prevailed. This period saw explosive market gains, strong economic growth, and a shift towards risk-taking.

However, in early 2021, inflation began to reemerge, driven by factors like excess money chasing limited goods and services. The Federal Reserve's response, characterized by subdued interest rates and quantitative easing, further fueled demand.

It also doesn’t help that the oil market is going from oversupply to declining supply growth, paving the road for triple-digit dollar oil prices in a scenario of returning global economic demand growth – but more on that in a future article.

Using the table below, Marks makes the case that we are no longer in a stimulative period. Inflation is elevated (albeit not at a 40-year high anymore), economic growth is very poor (a recession is on the table), investors are more reserved when it comes to taking risks, credit is constricted, financing has become scarce, and yield spreads have normalized.

Howard Marks

According to Howard Marks (emphasis added):

“Inflation and interest rates are highly likely to remain the dominant considerations influencing the investment environment for the next several years. While history shows that no one can predict inflation, it seems likely to remain higher than what we became used to after the GFC, at least for a while. The course of interest rates will largely be determined by the Fed’s progress in bringing inflation under control. If rates go much higher in that process, they’re likely to come back down afterward, but no one can predict the timing or the extent of the decrease.”

Having said that, like Marks, I also do not believe that I can predict the economy. All we can do is make assumptions. While nobody wants to admit it, predictions are nothing more than educated guesses.

However, being prepared still makes sense. Personally, I have put 20% of my portfolio into energy stocks that benefit from higher inflation. I own aerospace companies with strong pricing power and railroads capable of raising prices above inflation.

So, what about REITs?

Year-to-date, the Vanguard Real Estate Index (VNQ) is down 1%. The S&P 500 is up 17%.

VNQ is 30% below its all-time high. It’s also back at 2015 levels. Please note that these numbers exclude dividends.

TradingView - VNQ ETF

Something is off.

Why?

Because real estate investment trusts ("REITs") tend to do really well when inflation is elevated.

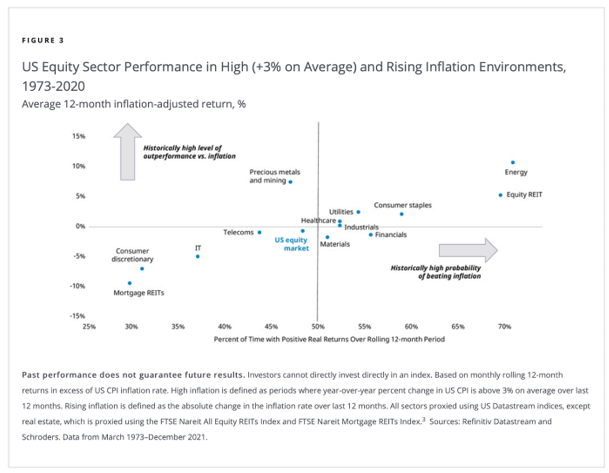

According to data collected between 1973 and 2021, energy and equity REITs are the place to be when inflation is elevated.

Hartford Funds

So, what’s going on?

I believe that it is now more important than ever to be a picky REIT investor. After all, we’re not in a normal situation of simply elevated inflation. No, we’re in somewhat of a perfect storm. This storm consists of elevated inflation, high rates, weakening economic growth, and (related) severe economic weakness.

Even the strongest REITs like Realty Income (O) are being sold, as investors are afraid to hold companies with limited pricing power and potential risks of store closures, as retailers need to adapt to a changing demand environment.

Please note that I’m not saying that Realty Income needs to be avoided. It’s probably the best retail REIT in the world. I’m just explaining why its stock price is currently having a tough time.

Most REITs are dependent on contracts with minimal rent growth. Even most inflation-linked contracts tend to be capped at a certain inflation rate.

This is not what investors are looking for.

So, in this article, we’ll give you two REITs that do have pricing power. Although both REITs come with capped-inflation contracts, both have above-average pricing power, strong tenants, and the ability to use internal growth to boost dividend growth above the sector median.

Both REITs are on my watchlist, and both REITs are outperforming the VNQ ETF by a mile.

So, let’s discuss these stocks!

VICI Properties Inc. (VICI) – 5.3% Yield

This company, which seems to own half of the Las Vegas strip, is a great way to generate income, receive inflation-beating dividend growth, and sleep well at night.

Yielding 5.3%, VICI Properties has helped major casino operators turn their business models into asset-light business models.

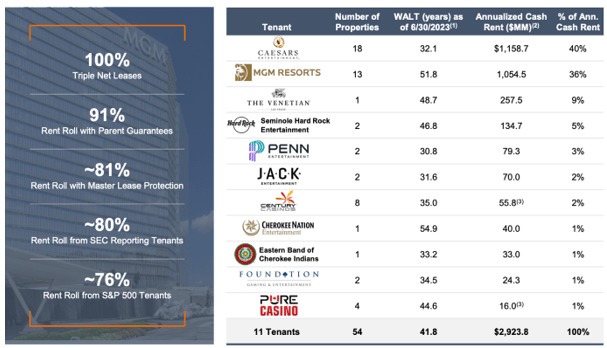

The company owns 54 properties that generate more than $2.9 billion in annual revenue! Close to 80% of its revenues come from Caesars Entertainment (CZR) and MGM Resorts International (MGM).

VICI Properties

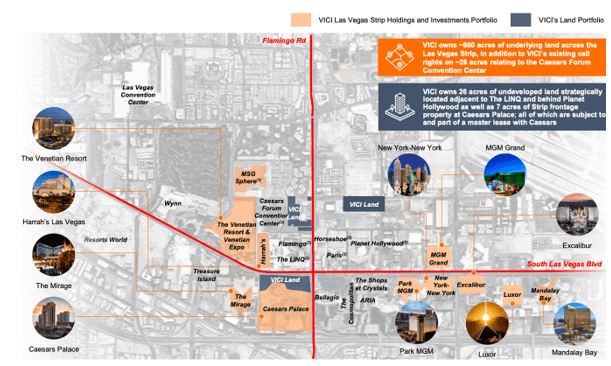

While I like to avoid companies with a concentrated customer base, we’re not dealing with an average REIT here. The company’s buildings have tremendous replacement value. Even better, its buildings aren’t just at a great location (48% of its revenues come from the Vegas Strip), they ARE the reason why its tenants are so successful.

VICI owns the MGM Grand, New York-New York, Park MGM, Mandalay Bay, The Venetian, The Mirage, Caesars Palace, and more.

VICI Properties

Even its non-Vegas assets are owned by solid operators who have turned these buildings into attractive destinations for gamblers and everyone looking for a good time.

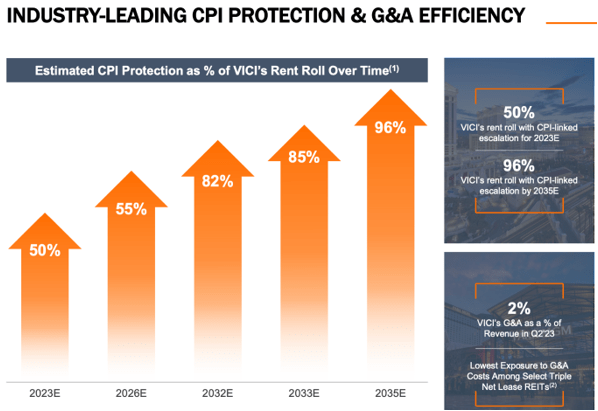

Having said that, VICI has inflation protection. Not only does it have 100% rent collection, but 96% of its contracts come with long-term inflation protection. The industry range is 16% to 85%, which puts VICI in a much better spot than its peers.

Looking at the chart below, we see that the company’s rent escalation increases over time as new contracts are due.

VICI Properties

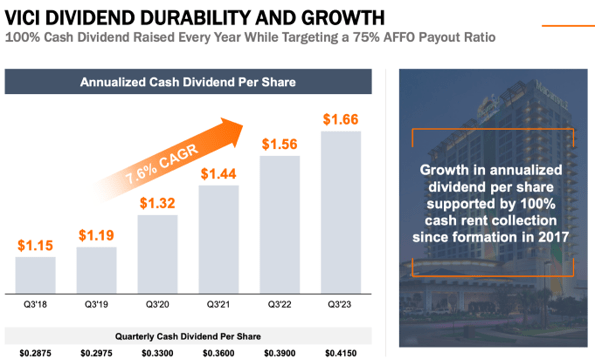

Between 3Q18 and 3Q23, the company has hiked its dividend by 7.6% per year. This includes a recently announced 6.4% hike.

Not only is this dividend backed by a 78% AFFO payout ratio (based on 2023E guidance), but also by rent growth.

VICI Properties

It also helps that almost all of its tenants are in a good spot to raise their own prices. After all, Vegas, and resorts in general, aren’t the places where people inspect every cent. So what if that cocktail costs $20? It’s Vegas!

I’m obviously a bit exaggerating, but you get the point.

Having said that, the company is not immune to high inflation. If inflation remains above 3-4%, it needs to accelerate internal growth or acquisitions to boost its income.

That’s because most of its contracts have CPI ceilings.

According to the company (emphasis added):

“While certain of our Lease Agreements contain escalation provisions that are tied to changes in the CPI, these annual escalators, in some cases, do not apply until future periods as specified under the applicable Lease Agreements. In addition, certain of these annual escalators are subject to a maximum cap, which could result in lower rent escalation than any such CPI increase in a single year or over a longer period. For example, under the MGM Master Lease, the CPI escalator is fixed at 2.0% for two through ten of the MGM Master Lease and, for the remainder of the term, the escalator is the greater of 2.0% and CPI, subject to a 3.0% cap. As a result, our results of operations and cash flows and distributions to our stockholders could be lower than they would otherwise be if we did not enter into long-term triple net leases or entered into such leases on different terms.”

Moreover, VICI is a triple-net lease company, which means its tenants pay insurance, maintenance, and taxes. That’s a huge benefit in an inflationary environment.

Given the bigger picture, I remain bullish on VICI and like it as a long-term income play that can protect your dividend income against inflation.

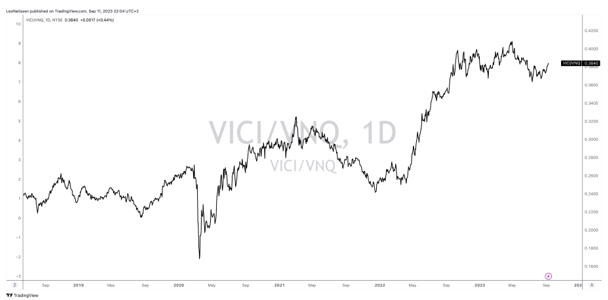

Looking at the chart below, we see that VICI has outperformed VNQ since inflation accelerated. That is no coincidence!

TradingView - VICI/VNQ

Valuation-wise, the company is trading at 14.7x 2023E AFFO. The sector median is 13.4x, which makes VICI relatively cheap.

The consensus price target is $37.50, which is 20% above the current price.

We have a Buy rating on the stock.

It also comes with a BBB-rated balance sheet. 99% of its debt has a fixed rate. 82% of its debt is not backed by collateral. It has 6.4 weighted average years to maturity.

In other words, investors aren’t just protected against moderately high inflation but also against elevated rates.

Number two is also one of my all-time favorites. A stock I’m following like a hawk, to buy it on the next correction.

Rexford Industrial Realty, Inc. (REXR) – 2.9% Yield

This industrial REIT is one of the favorites on my watchlist, and I hope to make it a holding in my portfolio soon.

Founded in 2001, the company is an industrial REIT focused on the Southern Californian real estate market. While I get that a lot of investors want no exposure in California due to its political developments, REXR services the largest industrial market in the world.

The SoCal industrial real estate market is larger than the one in Germany, the U.K., Canada, and France. SoCal is also larger than New York/New Jersey, Chicago, and Philadelphia combined!

Despite political risks, SoCal has a population of roughly 21 million. It has close to 600,000 businesses and a severe supply/demand imbalance.

Not only is it hard to get permits for new buildings, but SoCal’s natural barriers make it hard to boost the supply of industrial residential and related real estate projects.

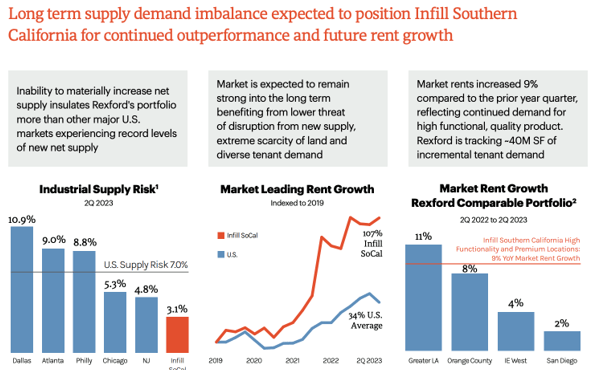

In other words, unlike other markets, operators in SoCal are not subject to the significant risks of new supply. Since 2019, market rents have grown by 34% in the U.S. In SoCal’s infill markets, rents have more than doubled.

Rexford Industrial Realty

So, without looking at REXR’s numbers, we can assume that the company is in a better spot, as it has more pricing power than its non-SoCal peers. In an inflationary environment, that is highly beneficial.

Since 2018, REXR has grown its funds from operations by 15% per year. Even adjusted for share dilution, that number is 11% per year per share. For 2024, the company is expected to grow FFO per share by 13%. The peer average is just 6%.

Having said that, like VICI and most REITs, REXR has capped rate contracts.

According to the company (emphasis added):

“In addition, most of our leases provide for fixed annual rent increases of three percent or greater. However, the impact of the current rate of inflation of 6.5% may not be adequately offset by some of our annual rent escalations, and it is possible that the resetting of rents from our renewal and re-leasing activities would not fully offset the impact of the current inflation rate. As a result, during inflationary periods in which the inflation rate exceeds the annual rent escalation percentages within our lease contracts, we may not adequately mitigate the impact of inflation, which may adversely affect our business, financial condition, results of operations, and cash flows.”

With that in mind, the company is in a great spot to maintain high growth rates in an inflationary environment.

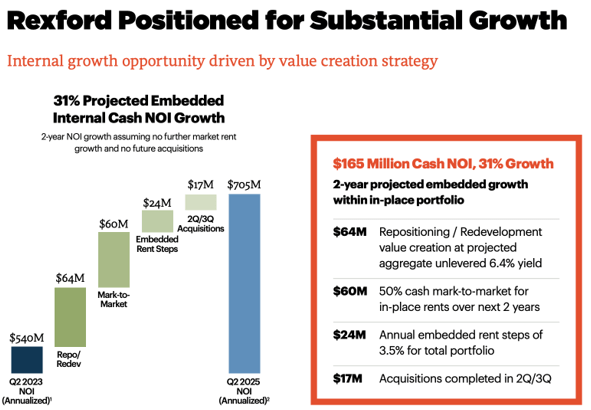

For example, over the next two years, the company expects $165 million of incremental net operating income growth. That’s 31% projected growth.

$64 million of this is expected to come from its repositioning pipeline.

Moreover, and this is one of the reasons why REXR is included in this article, the company projects $60 million of incremental NOI from the fact that it rolls below-market leases to higher market rents.

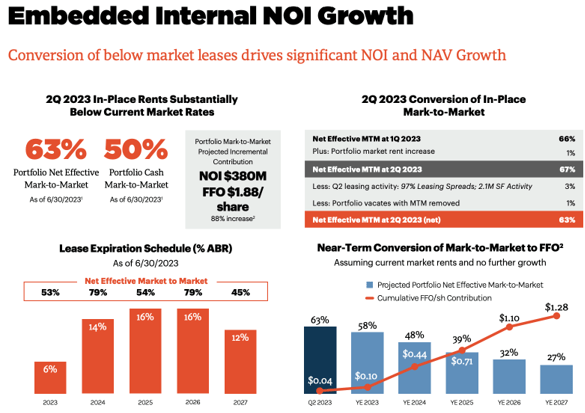

While most of its contracts have capped rates, it has a tremendous amount of rents that are valued below market. Once these are rolled over, more value can be unlocked. This translates to a 50% cash mark-to-market for in-place rents over the next two years.

Rexford Industrial Realty

Especially after 2024, the company is in a great spot to benefit from mark-to-market, as 30% of its leases expire between 2024 and 2025.

Rexford Industrial Realty

At this point, I need to mention that having high lease expirations comes with a risk. After all, that’s the point some tenants may consider leaving. However, given the dynamics of the SoCal market and the good relationship REXR has with its tenants, I believe these risks are subdued – even if the economy takes a hit.

Also, as of 2Q23, the SoCal infill market had a vacancy rate of just 1.9%. Moving to save on rent is a tough task in SoCal, and I doubt many companies are willing to relocate to other states.

Why?

Because SoCal isn’t just an average industrial landlord.

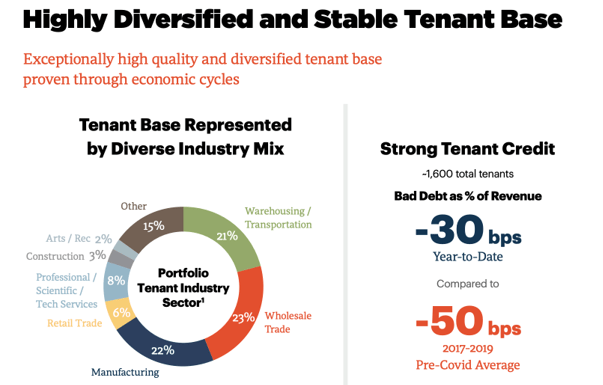

Only 22% of its 1,600 tenants are manufacturers. This includes high-tech companies engaged in aerospace and defense. These companies depend on their Californian clusters.

Close to 50% of its tenants are warehousing/transportation and wholesale companies. While the port of LA/Newport is currently seeing lower volumes, SoCal is a key market for North American logistics.

Rexford Industrial Realty

Of course, REXR will see pressure on occupancy if economic growth implodes. However, I’m saying that I’m not worried about the structure of its tenants and markets. REXR will eventually recover if things were to go south.

The same goes for its balance sheet.

Because REXR used common stock funding (and preferred equity) to fund large parts of its operations (without seriously hurting the per-share FFO performance, as we just discussed), it has a very healthy balance sheet.

REXR has a BBB+-rated balance sheet. This is one step below the A-range.

It has a net leverage ratio of just 3.7x EBITDA, no meaningful maturities in 2023, and $1.5 billion in liquidity.

Moreover, the company has consistently outperformed the VNQ ETF. I expect this to continue – especially if inflation remains elevated.

TradingView - REXR/VNQ

The company is trading at 29.4x NTM AFFO. While that may seem elevated, the company has above-average growth rates.

It has a 2.9% dividend yield. The 5-year dividend CAGR is 17.9%. On March 29, the company hiked by 20.6%.

The consensus price target is $62.50, 18% above the current price.

We have a Strong Buy rating on the stock.

While I do not own it, REXR is on my watchlist, as it would be a perfect fit for my portfolio. Depending on the market environment and other capital allocations (I have a lot of stocks I want to buy), I may make REXR a long-term holding in my industrial-focused dividend growth portfolio.

Takeaway

In today's uncertain economic landscape, it's essential to adapt our investment strategies to the changing times. As Howard Marks wisely points out, we seem to be in the midst of a paradigm shift, with sticky inflation, elevated rates, and economic uncertainty becoming the norm. Predicting the future may be a daunting task, but preparedness is the key.

Personally, I've allocated a significant portion of my portfolio to energy stocks, aerospace companies with pricing power, and railroads capable of raising prices above inflation. But what about REITs?

REITs have historically thrived in times of elevated inflation, but it's crucial to be selective in this environment. In this unique situation of high inflation, rising rates, and weakening economic growth, I've identified two REITs worth considering:

- VICI Properties stands out with its impressive portfolio, strong tenants, and inflation protection. With 96% of contracts offering long-term inflation protection, VICI is well-positioned to weather inflation storms and provide steady income.

- Rexford Industrial Realty, focused on Southern California's industrial real estate market, offers pricing power in an environment of rising inflation. Its growth prospects and robust balance sheet make it an attractive option for those looking to invest in REITs.

While nobody can predict the future with certainty, these REITs offer potential insulation against the challenges of inflation and high rates. It's a wise move to keep them on your investment radar, given the current economic landscape.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 175,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022 and 2023 (based on page views) and has over 111,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies (Wiley/Amazon).

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI, REXR, O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.