ProFrac Holdings: A Whole-Lot Of Frac'ing Going On

Summary

- ProFrac Holding Corp. has experienced a significant drop in share price due to a decrease in active frac spreads and missed earnings.

- The company's thesis revolves around acquiring market share through acquisitions and participating in major shale plays.

- The drilling market is expected to pick up, potentially leading to an increase in demand for ProFrac's services and a higher stock price.

- We think ProFrac is in a buy zone for risk-tolerant investors.

Frazer Harrison/Getty Images Entertainment

Introduction

After ProFrac Holding Corp.'s (NASDAQ:ACDC) precipitous drop from the middle $20's in March, to around $11.00, I wrote them up with a Strong Buy. I certainly did not, at that time, think the pullback in the smaller, North American-centric OFS companies would be as severe as it has turned out to be. Active frac spreads have dropped from 295 at the end of March, to 252 as of last week, or about 15%. As a result, shares of ACDC have stayed in a tight $11-12 range.

Price Chart for ACDC (Seeking Alpha)

Normal trading volume for the company is about 300-500K shares daily. There was a big spike of nearly 2 mm shares on the 10th of August, on their Q2 earnings release as investors dumped the stock. The selloff was understandable, as the company missed on the top and bottom lines, and was a bit vague in commentary on fleet utilization, and noted they had reduced capex for the rest of the year. We will touch on that more, later.

Analyst

I believe you should have had about 35 active fleets in 2Q. Can you provide some commentary on the magnitude of the fleets that you guys put on the sidelines in June and then in August?

Matt Wilks CEO of ProFrac

We're not going to provide any commentary on it. What we focused on is maximizing the utilization of every asset that we have and focusing on rightsizing the cost structure associated with that. What we've seen across the industry is a pullback in overall available active fleet.

Not very inspiring, and I can almost see the analyst in question, hitting the sell button on his terminal as Matt was talking. So let's revisit our thesis for ACDC and see if we should take any action prior to their Q-3 earnings release in October.

The thesis for ACDC

The general thesis for the company has been as a aggregator of market share through acquisitions-Rev Energy-frac spreads, and Producers Services-frac spreads, and U.S. Well Services-frac spreads and technology. It's also bought a bunch of little to medium-sized sand companies this year-here, here, here, and here. The idea being to participate in all major shale plays, and streamline logistics with having sand available nearby. This has an advantage of encouraging operators to bundle sand and pumping, something they got away from a few years back. Sand contribution margins have improved dramatically-at 5-year highs as noted in the U.S. Silica, (SLCA) Q2 2023 call, and this was a good move for ProFrac. It should be noted that in so doing they've racked up a lot of debt, resulting in a leverage ratio of 1.66. That's getting a little uncomfortable, particularly for a player in a volatile industry, like OFS.

ProFrac has about 12% of the market (my personal research). This corresponds fairly well to the Analyst's estimate of 35 active fleets in Q2. If you take my quick and dirty average of 274 active fleets for the quarter, that figure gives you 12.7%. The market has deteriorated to an average of 258 active fleets so far in Q3, so using that 12.7% ACDC's share has fallen to about 33 fleets, or a drop of two in Q3.

With all of that said, the thesis for ACDC revolves around the notion that operators are going to ramp up fracking, and put some spreads back to work as we head off into Q4, and 2024.

My answer is probably so, and that might make the current sales price for ACDC a pretty good entry point. Let's see how we get there.

A catalyst for the frac market

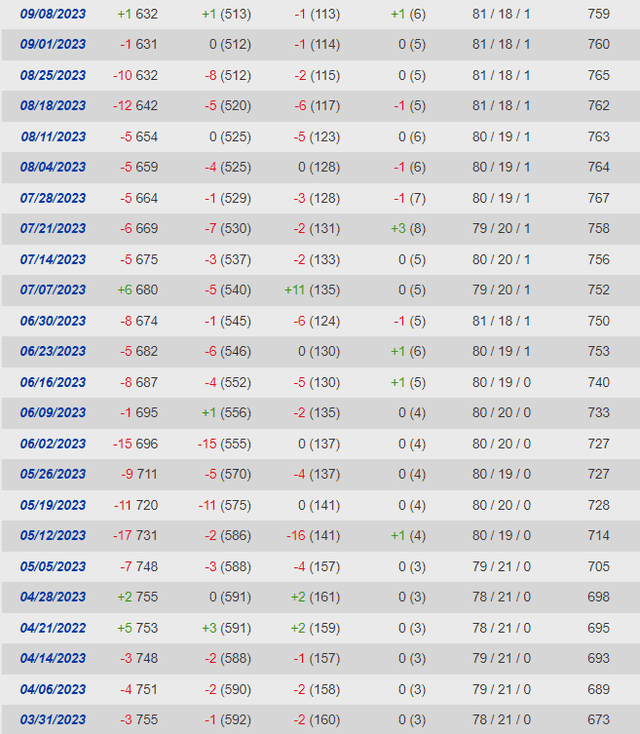

Here's the thing-drilling is set to pick up. A strong price signal has been sent to the market, and rigs are going to go back to work. There is a reasonable delay, usually, 2–3 months between strong price signals and a response from Opcos to initiate new drilling. You will note that we added a rig to the total for the first time in since April 28th. Here's a table from American Oil & Gas Reporter, that tells the tale since late March, where we've shed 123 rigs. The way it works is you make a hole, then you fill it full of sand, so at some point we need new drilling for the magic to continue. We may be about at that point.

Frac Spread Count (American Oil & Gas Reporter)

The turn in oil prices began in early July, so you can see we are right in that 9-12 week lag (give or take a week or so) that is associated with a pickup in activity.

Finally, the ratio of frac spreads to rigs also gives us a clue. March 1st, when we had 755 rigs turning to the right, there were 2.55 rigs for each frac spread. Now with 632 rigs we are at 2.50 rigs to spreads, so there's a reasonable relationship established.

Now we get into a bit of spitballin' - (something old mud engineers are pretty good at). How many rigs are going back to work? My sources tell me we aren't likely to see 755 again soon-we don't need them to maintain output, but we might see 700. Let's work with that figure.

Here's the math. Last year, with about an average of 700ish rigs running, we drilled 786 wells per month. Now, with 632 rigs running, we are drilling at a rate of ~720 wells per month (Discussions with industry sources). Logic would then suggest that we move back toward that 700 rigs figure, or pick up about 68 rigs and about 30 frac spreads to maintain that rough ratio. With 12% of the market, that could mean another 5-6 spreads for ProFrac.

Whew...all that cipherin' makes my head hurt. Let's move on.

Q2 2023 and guidance

For the second quarter of 2023, revenues totaled $709.2 million, down approximately 17% sequentially. The decrease was driven primarily by a lower average active fleet count and associated material sales, when compared to the first quarter of 2023.

Net loss for the second quarter was ($4.6) million, or a $0.02 loss per share of the Company's Class A common stock.

Adjusted EBITDA decreased 26% from the prior quarter and totaled $182.5 million. Operating cash flow came to $153.7 mm.

Outlook

Here's a quote from the press release as regards capex and business outlook. This is what took the stock down as much as anything.

As the Company looks forward to the remainder of 2023, ProFrac is deploying a more disciplined approach to capital allocation to align with its E&P customers' activity levels. The Company lowered its active fleets in June and again in August, and as a result of these fleet reductions, we have made meaningful reductions to our cost structure that we believe will help maintain the per fleet profitability metrics. We believe stronger commodity prices and improved credit markets should allow our customer base to increase activity levels and demand for our services in the back half of 2023, which we expect to increase further in 2024. We remain prepared to be in a position to reactivate fleets as customers solidify their budgets and determine activity levels for next year.

Capital Expenditures and Capital Allocation

Capex totaled $98.1 million in the second quarter. During the second quarter, the Company decided to reduce capital expenditures for the remainder of the year to more closely align with activity levels and to maintains target returns thresholds on capital investments. The Company now expects to incur approximately $300 million of capital expenditures in 2023, down about 15% from 2022. It was also noted that the new guidance reflected a deferral of ProFrac's fleet upgrade program, including Tier 4 upgrades and electric fleet deployments.

Balance Sheet and Liquidity

ACDC had gross debt outstanding as of June 30, 2023 was $1,205.6 million, after a reduction of approximately $85.6 million from the prior quarter. Total cash and cash equivalents as of June 30, 2023 was $26.9 million.

As of June 30, 2023 the Company had $163.5 million of liquidity, including $26.9 million in cash and cash equivalents and $136.6 million of availability under its asset-based credit facility, excluding letters of credit outstanding.

Risks

The only risk worth mentioning is that of WTI prices. If we don't sustain the $80 level, the pain could continue and make an investment in ACDC dead money, as it has been since March. That's not the way I'm betting at this point.

Your takeaway

I think the easiest path forward is higher. Analyst price targets range from $12 on the low side to $18.00 on the high side, with a median of $15.00. EPS for Q-3 is forecast to be $0.15 per share, an increase of $0.17 from the -$0.02 per share for Q-2. The current EV/EBITDA of ACDC is 3.85X or a NTM basis.

If they hit that $0.15, EBITDA would move back toward a NTM of $932 mm, or a multiple of 2.85X. To keep that multiple the same at 3.85X, the shares need to rerate toward $15.50, giving the stock a 26% upside from current prices. If they were to beat it, the stock might regain previous highs in the mid-$25's.

I think ProFrac Holding Corp. presents an attractive entry point at current prices, and investors with a reasonable risk tolerance may wish to jump in here.

This article was written by

I am an oilfield veteran of 38+ years. Retired from Schlumberger since 2015. My background is drilling and completion fluids. I have authored a number of technical papers on completion topics. I have worked around the world- Brazil, Russia, Scotland, and the Far East. I still maintain a training and consulting practice and am always willing to help people who want to learn.

New- The Daily Drilling Report is Live!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ACDC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.