How I'm Building A Monster Dividend Portfolio

Summary

- Being a dividend growth investor does not require buying low-yielding stocks, nor does being an income-oriented investor require buying high-yield stocks.

- Ideally, a dividend growth investor's passive income stream should be as safe, large, and fast-growing as possible. Balancing these three is tricky, but very important.

- I've designed my portfolio like a Medieval galley ship, consisting of strong, high-quality "rower" stocks, calculated higher-risk "sail" stocks, and diversified dividend ETFs to act as the "ballast."

- Looking for a helping hand in the market? Members of High Yield Landlord get exclusive ideas and guidance to navigate any climate. Learn More »

solvod

I'm a dividend growth investor.

Often, people think that being a DGIer necessarily means investing in very low-yielding but high-growth stocks such as those found in the sub-2%-yielding Vanguard Dividend Appreciation ETF (VIG) or WisdomTree US Quality Dividend Growth ETF (DGRW). Those who invest in stocks with yields in the neighborhood of 4%, 5%, 6%, or higher are relegated as "income investors."

This is a false dichotomy.

Being a DGIer does not require buying low-yielding stocks. Neither does being an income-oriented investor require buying high-yielding stocks.

It all depends on your time horizon.

If you need to use the dividend income to fund your living expenses today, then sure, buy the safest high-yielding stocks you can.

But if you're still in your working and accumulating years, like me, or if you're retired with the fortunate ability to keep saving and investing a substantial portion of your income, you can afford to design a more nuanced approach.

My own goal is to build the safest, largest, and fastest growing passive income stream possible.

- The safety aspect causes me to veer toward quality businesses

- The largeness goal makes me favor higher yielding stocks over lower yielding stocks and therefore provides a value tilt -- or, "quality at a reasonable price"

- The fast growth element comes from both regular dividend increases and reinvestment of dividends

These are the three core "legs of the stool" of dividend growth investing, in my view, if the goal is passive income rather than total returns.

While I do not claim to be some kind of guru that everyone should emulate, I believe it can be valuable for other DGIers to see how a fellow pilgrim on the passive income path thinks through the core design decisions of their portfolio.

With that in mind, allow me to elucidate how I'm building a monster dividend portfolio.

The Galley Ship Portfolio

It's useful to remember that the underlying assets generating the dividends in any kind of DGI or income investing strategy are real businesses.

It's also useful to acknowledge that while the market is not perfectly efficient (otherwise, why invest in individual stocks at all?), it also isn't stupid either.

That's what makes a "quality at a reasonable price" or "QARP" strategy so appealing. How many yield traps and dividend cuts could investors have avoided over the years if they had prioritized quality over yield?

That's also why I like to weight holdings by conviction and quality rather than value. If you mostly buy the most undervalued stocks, then your largest holdings will probably end up being the weaker, riskier names in your portfolio.

But if you consciously allocate more available capital to the higher quality names about which you feel the most conviction (by which I mean sureness of being right in your thesis), then your top holdings will end up being a bedrock for your portfolio.

My favorite way to envision my portfolio is as a Medieval galley ship -- the kind with both oars for rowing and sails for wind propulsion.

The core constituents of my portfolio are strong, high-quality, defensive compounders that keep growing steadily regardless of market or macro conditions. They are akin to the rowers on a Medieval galley ship. Those oars propel the ship forward whether the wind is favorable or not.

The muscly-armed rowing captain at the front of the ship is Agree Realty Corporation (ADC), my largest individual stock holding. A while back, I wrote a full article explaining "Why Agree Realty Is My Largest Holding."

In short, it combines the ultra-defensiveness of its investment-grade retail net lease properties with a truly fortress balance sheet (almost no debt maturities until 2028), a peer-leading cost of capital, highly selective investment strategy, and a significantly shareholder-aligned management team led by CEO Joey Agree (the second generation Agree to lead the REIT).

The result of this combination of strengths is a safe, generous, and steadily growing dividend.

ADC September 2023 Presentation

ADC provides the template of what to look for in a solid, steady compounder.

I've been writing a lot about these types of high-quality compounders today, because I believe there are some incredible bargains available today. Consider some of the examples I've written about recently:

- Cullen/Frost Bank: Phenomenal Buying Opportunity For This Quality Texas Bank

- REIT Meltdown: 3 Rarely Discounted Buying Opportunities

- Bloodshed On REIT Street: 5 High-Quality Landlords I'm Buying For The Long Haul

(Apologies for the self-promotion. I am but a humble Internet writer, and if I don't hawk my wares, who will?)

But I also own a handful of "sails" -- higher risk plays that sometimes give my portfolio and dividend income stream a massive boost, and other times fail to play out as expected.

I consider names like NextEra Energy Partners (NEP), Arbor Realty (ABR), Innovative Industrial Properties (IIPR), B. Riley Financial (RILY), and Trinity Capital (TRIN) to be "sails." These are calculated risks that I believe will result in very nice payoffs as measured primarily by dividend income and secondarily by total returns.

- NEP has historically relied on low interest rates and steady stock price appreciation to make its heavy use of convertible equity financing work. Management is now transitioning NEP away from this model toward what will hopefully become a more sustainable way of financing the rapid portfolio growth plans.

- ABR is a higher risk way to invest (leveraged lending) in a lower risk asset class (multifamily real estate). You have to trust in the skill of the practitioners for this one. Founder Ivan Kaufman really knows what he's doing.

- IIPR is the first and only pure-play cannabis REIT traded on a major US exchange, which gives it major competitive advantages as a landlord-financier to the fledgling legal cannabis industry in the US. But it's no secret that cannabis operators are struggling mightily with competition (both from legal and black market sources) and high costs of capital. Will federal legislation save the day? Who knows. It isn't the first time cannabis investors have gotten their hopes up.

- RILY is a small investment bank with lots of irons in various fires, from small cap stock analysis to retail liquidation to ownership of a handful of mall retail brands like "Justice" and "Limited." The co-CEO Bryant Riley is massively long the stock and keeps buying more. But the way RILY reports earnings makes it difficult to calculate a payout ratio and assess dividend safety.

- TRIN is a business development company that extends short-term loans to VC-backed growth companies. It's got some big name success stories like Impossible Foods and UnTuckit. But like IIPR's cannabis tenants, TRIN's borrowers are almost all in cash burn mode, which increases the fragility of the investment strategy.

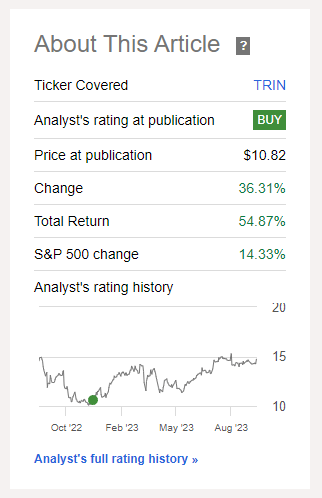

Sometimes, these "sail" holdings work out phenomenally well, such as this bullish article on TRIN from December 2022:

Seeking Alpha

Wow! How could I possibly be so smart?

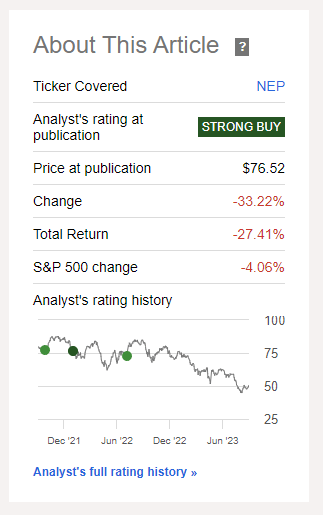

And sometimes, these "sail" buys work out really, really poorly, such as this strongly bullish article on NEP from January 2022:

Seeking Alpha

Wow. How could I possibly be so dumb?

But I acknowledge the risks present for these names, which is why I have sized the positions smaller than most of my steady compounders, or "rowers."

The real risk, as I see it, isn't a stock price selloff but rather a dividend cut, or at least far more muted dividend growth than I assumed when I bought the stock. A stock price can drop for all kinds of reasons, but that doesn't necessarily mean the dividend is in trouble.

The idea behind "sail" holdings is to take calculated risks that should ultimately result in a big payoff as measured by dividends.

A portfolio of only "sails" would be too risky, in my opinion. But a portfolio of only rowers? Well, that just wouldn't be as fun. You've got to kick off your Sunday shoes every now and then.

The Portfolio Ballast: Diversified Dividend ETFs

A "ballast" is some sort of heavy material kept at the bottom of a ship to give it greater stability and balance. Back in the Medieval era, it would often just be rocks or gravel.

If high-quality, steadily compounding stocks are the "rowers" of the ship and calculated higher-risk/higher-reward stocks are the "sails," then I would argue that diversified dividend ETFs are the "ballast" of the ship.

There are 4 high-quality dividend ETFs that I've previously called the "foundation of my portfolio," but you could just as easily swap the word "foundation" for "ballast."

Allow me to highlight my two largest ETF holdings:

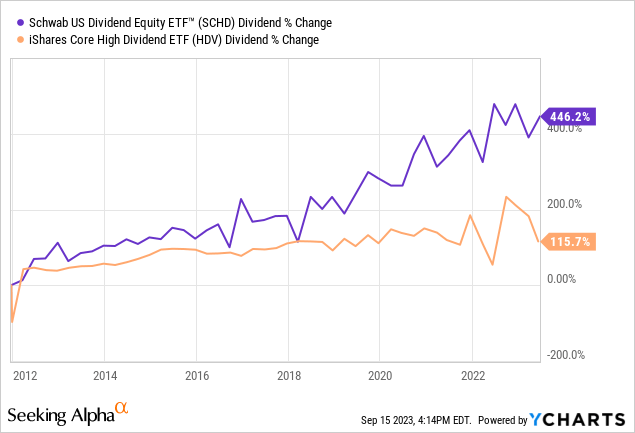

SCHD pays about a 3.5% dividend yield, while HDV pays about a 4% yield. But SCHD's dividend growth has been much more impressive over time:

I've written before, such as in "Why SCHD Is A Dividend Growth Investor's Dream ETF," about the amazing combination of quality, growth, and yield that SCHD brings together in one passive, ultra-low cost ETF (0.06% expense ratio). But I haven't been quite as vocal about HDV's strengths.

So what makes HDV worth holding?

Well, my individual stock portfolio is fairly light on energy companies, aside from midstream pipeline & storage owners with contractually fixed revenue streams and little fee volatility from shifting oil and gas prices. That's what makes HDV such a good addition to the portfolio ballast for me.

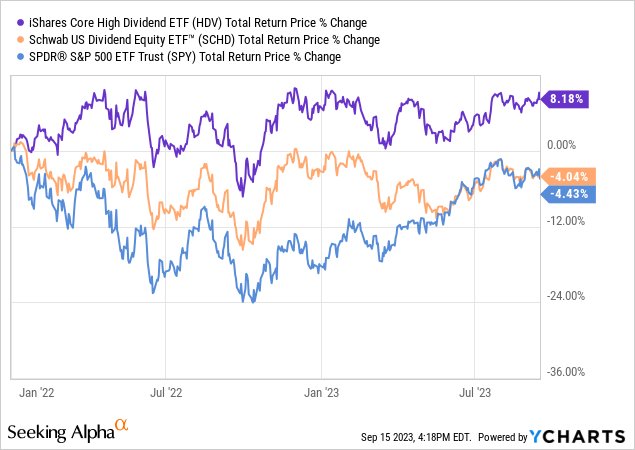

Since the beginning of 2022, HDV has outperformed both SCHD and the S&P 500 (SPY).

Why? Because about 28% of HDV's stock portfolio is in energy companies. That's much higher than SCHD's ~10% allocation to energy. In fact, it's higher than almost any other dividend ETF on the market. It may have the highest allocation to energy among dividend ETFs.

In today's world, inflation and specifically spikes in oil prices seem to be a bigger risk than deflation or declining demand for oil.

The rest of my portfolio should perform extraordinarily well if inflation and interest rates decline, but HDV acts as a hedge against inflation -- specifically energy-related inflation.

Bottom Line

Investing is basically an expression of one's own personality and preferences, so every DGIer's investment philosophy and portfolio will be unique. That's a good thing. The strategy wouldn't work if we were all formulaically buying the same stocks at the same time!

Even if one adopted this galley ship strategy in their own investing, it would inevitably look different than the way I do it.

To repeat, the point of constructing a portfolio this way is to generate the safest, largest, and fastest growing passive income stream possible.

That's exactly how it has worked out for me over the last five years or so of active investing.

To be clear, my own portfolio has not beaten the market. In fact, I've trailed the market quite significantly because of my underemphasis on tech stocks and overemphasis on REITs.

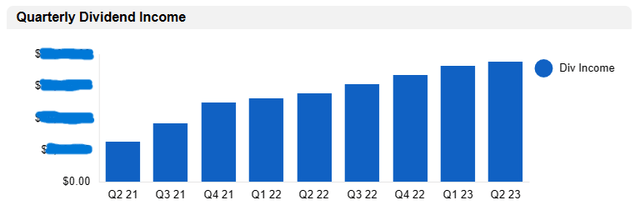

But because of the powerful combination of investing savings from my income, selectively reinvesting dividends, and owning stocks that regularly increase their dividends, my quarterly passive income from dividends keeps going higher.

Every single quarter of total dividends over the last five years has been higher than the one that came before it. The continuation of that trajectory is what defines success in investing for me.

Although the way you think about your portfolio may be subtly or significantly different, I hope the ideas above help you in honing your own investment philosophy.

Opportunities are Abundant! Act Now!

Here at High Yield Landlord, we are loading up on deeply discounted real estate at the moment. Opportunities are abundant and now is time to act while the market is volatile!

We are sharing all our Top Ideas with our 2,000+ members. And you can get access to all of them for free with our 2-week free trial!

You will get instant access to our 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!

This article was written by

I write about high-quality dividend growth stocks with the goal of generating the safest, largest, and fastest growing passive income stream possible. My style might be called "Quality at a Reasonable Price" (QARP) in service to the larger strategy of low-risk, low-maintenance, low-turnover dividend growth investing. Since my ideal holding period is "lifelong," my focus is on portfolio income growth rather than total returns.

My background and previous work experience is in commercial real estate, which is why I tend to heavily focus on real estate investment trusts ("REITs"). Currently, I write for the investing group, High Yield Landlord.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABR, ADC, HDV, IIPR, NEP, RILY, SCHD, TRIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (39)

So, slow growth slow dividend. BUT now that the price has dropped to a level where I can earn 5%….well I guess my interest is returning.

Also I agree an investor can mix/match ETFs based on sector allocation to achieve ones objective. I do not hold any single stock in my IRAs. REITS are ground zero for that concept right now, getting crushed. One can hold SCHD/SPY as a long term holding and with the volatility of REITS end up at the same place. LVHD looks enticing now-> 55% REITS/Staples/Utilities. 4% yield.

But I would not overweight Energy substantially....too volatile. Tradeable.

April 2020 BBL oil = -$37.

Definitely best in class top shelf