Jackson Financial's Complexity Creates Opportunity

Summary

- Jackson Financial shares trade at a fraction of book value, presenting substantial value for investors, even if book value is unlikely to be achieved.

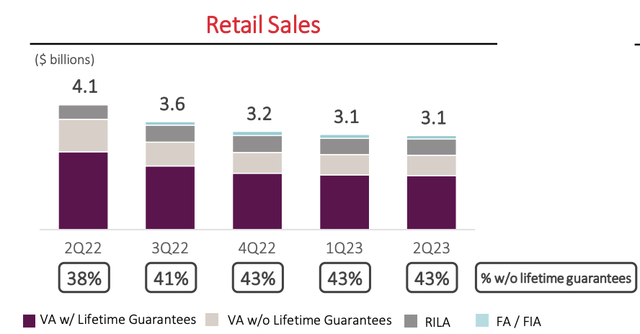

- The company's operating earnings have decreased due to higher rates and lower equity markets, but sales are stabilizing.

- Jackson has excelled in capital returns to shareholders through buybacks and dividends, with the potential for further repurchases.

- Its hedge portfolio creates volatility but is working as intended over time.

Kobus Louw

Shares of Jackson Financial (NYSE:JXN) have had a strong run over recent months toward a 52-week-high. That said, shares trade with a single-digit multiple at just a fraction of book value. While I do not expect shares to ever reach book value, I see substantial value in what is a “melting ice cube” business that generates significant cash flow for capital return to shareholders.

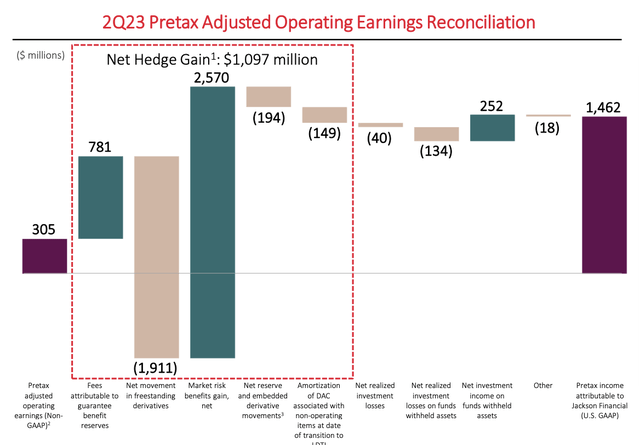

In the company’s second quarter, it earned $3.54 in adjusted operating EPS when excluding items ($3.34 with items), $0.05 ahead of consensus. This was still substantially lower than the $4.52 earned last year. Notably, headline EPS was $14.21. This dramatic difference was due to net income being $1.2 billion, whereas operating earnings were $283 million.

Large differences between net income and operating income are common for Jackson and peer companies like Brighthouse Financial (BHF). Jackson National is an annuity provider. When you buy an annuity, you give the insurance company money upfront and then receive monthly payments, either fixed or tied to a degree to market performance. Annuity providers price these annuities based on prevailing interest rates and market conditions. They then hedge out the market risk to smooth results over time and protect against poor returns that could make it difficult to make the required payments to the policyholders.

The gains and losses on these hedges relative to the market performance can move dramatically quarter by quarter, but if properly constructed, should cancel out over time. They can drive extremely large impacts to headline EPS and net income. That is why it is better to look at operating results to see how the underlying business is doing and then look at hedging results separately to determine the efficacy of the program (more below).

Looking first at operating results, as noted above, adjusted operating earnings of $283 million were down from $407 million last year as higher rates and lower equity markets reduced results. JXN charges an investment management fee, and so as the equity market declines, its fees mechanistically fall (typically on a bit of a lag, given billing cycles). Markets have been rallying back in recent months, which over time will lead to higher fee income and support an increase in earnings from this source. Aside from this, it should be noted that the company is seeing slower annuity sales from last year, when the initial rise in rates sparked a flurry of activity. That said, sales do seem to be stabilizing in the low-$3 billion area. Jackson has also been tightening standards, which has contributed to slower sales.

More broadly, annuity products have become less popular than pre-financial crisis, due to concerns about fees tighter standards (many pre-2008 policies proved to be too generous to policyholders), and a prolonged period of low rates. While Jackson is by no means a business in “run-off,” it is a business that is shrinking as its legacy annuity contracts pay out steadily. Last quarter, net annuity flows were -$1.5 billion. I would expect flows to stay structurally negative with the company gradually shrinking, though tighter underwriting may support greater profits per policy.

Like any other business that is shrinking, capital returns to shareholders are critical. Jackson has excelled on this front as it has repurchased 18% of the company over the past 2 years. Thus far this year, it has paid $224 million in dividends and buybacks, vs a full year target of $450-550 million. Accordingly, the buyback pace should pick up a bit over the balance of the year, with another 5-7% of the company repurchased.

Importantly, the company has the balance sheet flexibility to do this. The holding company has $1 billion in cash and liquid securities. The company’s risk-based capital ratio also rose sequentially and sits in management’s 425-500% target.

Jackson’s adjusted book value per share is $101.32, more than double the current share price. As it buys back stock below book value, that also pushes book value even higher. With such a discount to book value, the market is clearly discounting some concern over the attainability of that value.

The first potential concern is over the value of its assets, perhaps it has an investment portfolio that may be forced to take losses. That does not appear to me to be the case. JXN maintains a diverse fixed income portfolio, and 98% of the portfolio is invested in investment grade securities. These experience low default rates and should result in minimal credit losses.

Just 3% of the portfolio is in commercial mortgage-backed securities. There has obviously been a lot of concern over office valuations given higher rates and the return to work. Just $700 million of its portfolio is in loans to offices, and all are investment grade. Even if we assumed a draconian 50% loss on these investments, that would reduce book value by less than $5 per share. Concerns over the investment portfolio are not driving the discount to book value.

Instead, I would focus on the hedges mentioned earlier, and what I would call the “complexity” discount JXN has. The more complex a business, the harder it is to understand, and the greater chance there is a risk that you as an investor are unaware of. If there were two business that generate the same income, but one has an easy-to-understand business and the other has many moving parts, all else equal, most would be willing to pay a higher multiple for the simple business.

Annuities are complex. They are long-term contracts, with mortality risk, plus investment risk across an array of asset classes. Plus, if an insurance company misprices auto insurance, that will be a 1-year impact (given most policies last one year), and they can raise premiums in 12 months. Mistakes are manageable. Annuities may last 30+ years, so if a mistake is made in 2012 underwriting, it can impact results for decades, and it may even take a few years to realize an error is made (particularly as mortality can take time to play out). It is also difficult to hedge investment risk out that long, requiring the use of derivatives, assumptions around correlations, etc. At a high level, it makes sense that a company like Jackson would trade at a discount multiple.

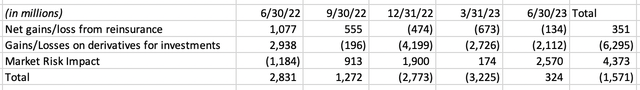

Jackson attempts to hedge out as much risk as it can, through reinsurance, derivatives on financial markets, and so forth. But it can be impossible to know, for certain, that these hedges will work perfectly all the time in all market environments. They do swing dramatically—just last quarter the company had a net $1 billion gain as it made more from markets than it lost on hedges.

As reported in their financial supplement, you can see that massive swings occur most quarters. Over time, though, they do tend to converge.

Jackson Financial, my calculations

While in the past five quarters, there was a net $1.6 billion loss from the program, this was largely giving back gains registered prior to then. At the end of the second quarter, Jackson had market risk assets of $5.96 billion, market risk liabilities of $4.46 billion, and derivative liabilities of $2.0 billion for a net liability of $500 million. For a company with $64 billion in investments, that is remarkably balanced. Indeed, given one often has to pay a premium to hedge risk, some net liability is the cost of smoothing results and protecting from tail risk. Considering the extraordinary market movements of the past year and a half, including 500bp of rate hikes, a $500 million gap, or less than 1% of assets, is a testament that this program is quite well-balanced and working as intended.

Moreover, unlike a bank whose deposits can leave anytime (a risk highlighted earlier this year), insurance policyholders cannot just cash out whenever they like. As such, this gives insurers time when markets and hedges become dislocated to wait it out rather than being a forced seller. Still, given the quarterly volatility, there is always some concern that annuity providers could face impairments from extreme market events that erode their capital and book value.

I view this “complexity discount” as a permanent feature of Jackson’s valuation, which is why I believe investors should always expect the stock to trade at a discount to book value. However, results point to Jackson managing its complexity well, keeping capital within targets, and having ample liquidity to support ongoing buybacks, even as annuity balances decline. The market recovery should also support higher fee income.

Given the risk of the business and its slow growth, I would target a capital return (dividend+buyback) yield of 10% for shares. With its $500 million run rate, that would translate to a $61 share price, still a 40% discount to book value. At its current share price, investors are enjoying a 6+% dividend and 8% buyback, for a 14% capital return yield. I view this as an attractive entry and would be a buyer here. While book value may be out of reach, there remains substantial upside.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

- Is the annunities business in permanent, or just temporary, decline? I don't have a sufficient industry insight to tell. You seem to be implying the decline is long-term and permanent, product of low interest environment where the product is simply not interesting due to low yields offered?

- My understanding is that the example of the net quarterly gain you reference is really just a timing difference, as you basically have a host of outstanding derivatives and other positions in the market to secure the required yields on your instruments that your actuaries have calculated, but then you have to take a snapshot every quarter end of their fair value, which leads to these extreme swings in net GAAP income, as you cannot possibly have all your open positions net out to zero at the end of every trading session. What is important is that these positions do converge over time in aggregate, as they should, which you have explained well.