My Top 2 High Yield Buys For Fall

Summary

- Dividend growth stocks provide passive income and have long-term outperformance potential.

- Realty Income Corporation and Enbridge are high-quality, big-yielders with solid business models and over 25 years of annual dividend growth.

- Both companies are pivoting to ensure future growth and offer attractive valuations for investors.

- Looking for a helping hand in the market? Members of The Dividend Kings get exclusive ideas and guidance to navigate any climate. Learn More »

spawns/iStock via Getty Images

I lean towards dividend growth stocks for a number of reasons. Foremost is that I love watching my passive income increase markedly with little effort. Furthermore, there is a significant body of research indicating stocks with yields in the second quintile outperform the market long term.

Even so, I pepper my portfolio with a handful of high quality big yielders. After all, quality is quality, and the best high yielders exhibit reduced volatility and also provide market beating returns. Furthermore, considering the S&P posts an average 10% annual return, it doesn’t take gargantuan growth with a big yield to meet that mark.

Some are avoiding dividend stocks in favor of bonds and the like. I contend that is likely a mistake at this juncture. I’m not referring to investors that take their cash-stash and put it in bonds while awaiting an alluring opportunity. I’m referring to those that are effectively out of the market for the foreseeable future.

Realty Income Corporation (O) and Enbridge (ENB), yielding about 5.5% and 7.8% respectively, currently trade near 52-week lows. The companies have solid business models, strong financial foundations, and over a quarter century of annual dividend growth.

Recent events reveal both firms are also pivoting a bit, perhaps to insure future growth.

Why I Eschew Bonds And Embrace Dividend Stocks

Before I launch into my defense of dividend stocks, let me get this straight…I’m neither berating nor belittling those investing in bonds and similar investments. I’ve never claimed that I’m prescient or that I never err. I’m simply providing my perspective and some food for thought.

Having said that, I note that none other than Warren Buffett takes a somewhat dim view of bonds as investments. His will stipulates that only 10% of his money will be invested in short-term government bonds.

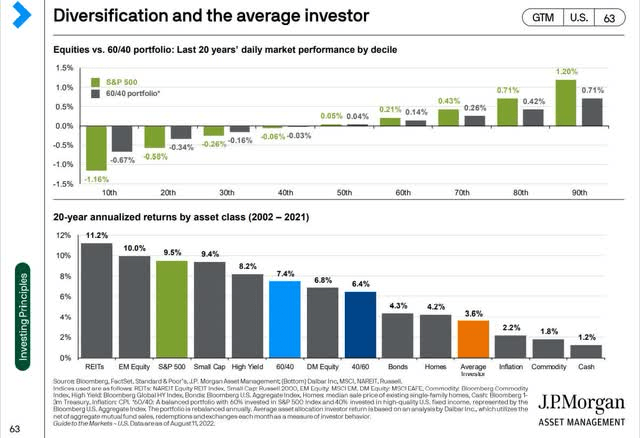

Now take a gander at the following chart outlining the 20 year returns for differing assets. On the left hand side you have REITs, noted for paying hefty dividends. They outperformed the S&P 500 by a significant margin over a two decade time frame, and trounced the returns for bonds.

JP Morgan Asset Management

I’m aware that the chart shows high yield investments underperforming the S&P, but here is where stock-picking comes into play. I also understand that bonds are providing yields we haven’t seen for a prolonged period, but that is only half of the story.

I contend, and emphasize, that elite high yielding stocks, when purchased at attractive valuations, can match or exceed S&P 500 returns.

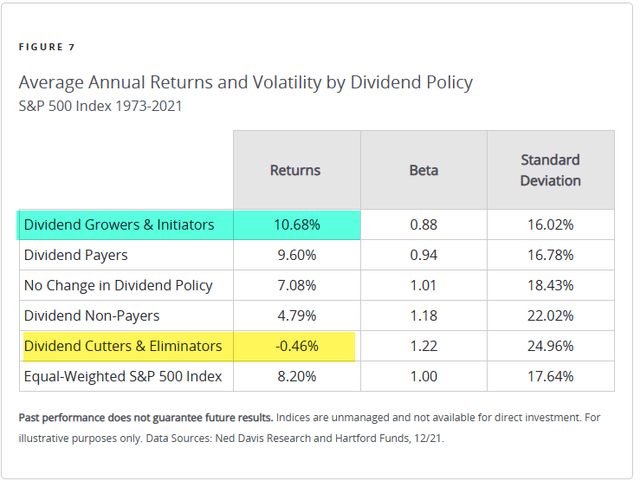

The next chart shows how companies that grow their dividends tend to outperform the markets over the long haul. Note that stocks with low betas also tend to beat the S&P.

Ned Davis Research and Hartford Funds

Realty Income has a beta of 0.79 while Enbridge sports a beta of 0.86.

Does that prove that O and ENB will outperform the market? Of course not. Nonetheless, it is one of many factors that should be weighed.

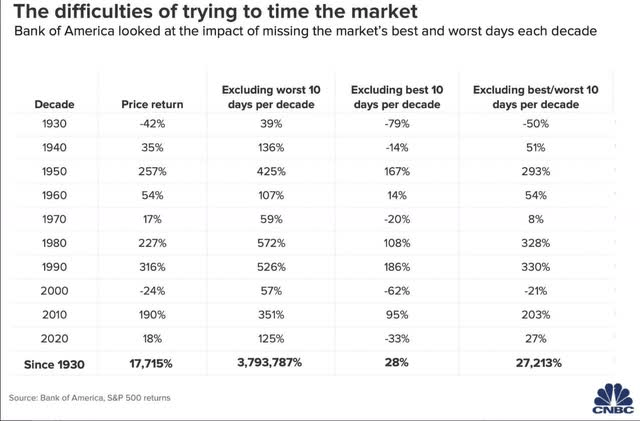

Now last, but far from least, take a look at the following chart. It shows how investors that attempt to time the market underperform the S&P 500. Note the chart outlines the difference provided an investor only misses the top ten days per decade.

CNBC

Don’t misunderstand me. I generally maintain some cash on the sidelines to take advantage of the sort of nonsensical opportunities the market regularly provides; however, I never put money aside for extended periods due to market movements.

And let me make this clear, I consider the poor performance of dividend stocks to essentially be a market within the market. Case in point: dividend stocks recorded their worst performance since 2019 in the first half of this year.

When the market offers opportunities, I’m eager to add to my positions, and I contend that there are ample opportunities today in dividend stocks.

Realty Income: How Do I Love Thee? Let Me Count The Ways

With over 13,100 properties, Realty is one of only 64 Dividend Aristocrats. One of the top five global REITs, the company provided a compound annual shareholder returns of 14.2% since it was first listed in 1994.

Since then, O paid 637 monthly dividends, and raised the dividend on a quarterly basis 103 times. The average CAGR for Realty’s dividend is 4.4%, versus an average of 3.1% for REITs in the S&P 500.

During the pandemic (2020), Realty was the only retail net lease REIT and the only REIT listed in the S&P 500 that increased the dividend. In fact, management emphasizes in quarterly presentations that the dividend is “sacrosanct to our mission.”

And during the Great Recession, O recorded the lowest operational and financial volatility of any A-rated S&P 500 REIT. Realty also recorded EPS growth in 26 of the last 27 years, with median AFFO per share increasing by a median rate of 5%.

The REIT is diversified on several levels. With properties in Spain, Italy and the UK, it operates a European portfolio worth $6.8 billion.

Retail assets constitute 76% of the company’s property holdings, with 15% of the portfolio in non-retail and 9% classified as “other.”

Realty also operates in all fifty states and Puerto Rico. No single state provides more than 11% of the company’s portfolio. With 1,303 clients in 85 industries, management estimates that 91% of total rent is resilient to economic downturns and/or isolated from ecommerce competition. Investment grade clients provide 40% of rent.

Realty ended the last quarter with occupancy at 99%, the third consecutive quarter at that level. The largest renter constitutes 3.8% of O’s properties, and the ten largest tenants make up about 27% of annualized contractual rent.

Realty Income Investor Presentation

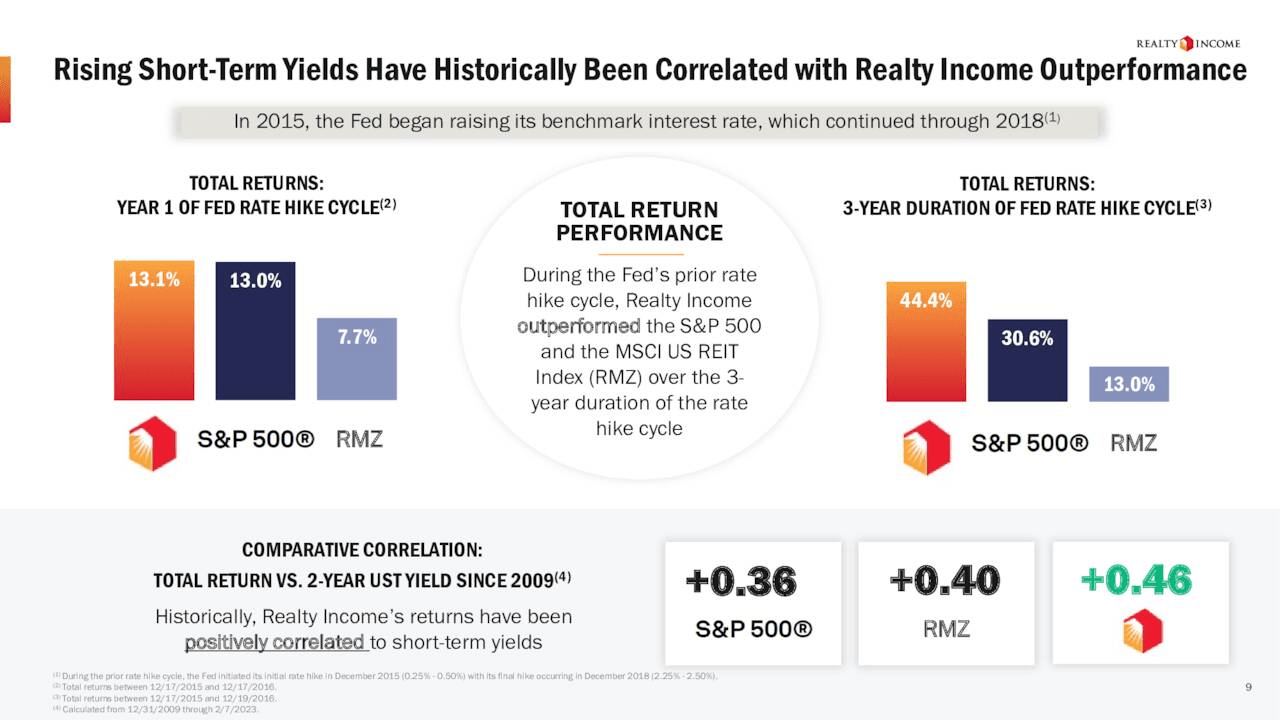

While Realty’s share valuation is currently near a 52 week low, historically the stock has outperformed the S&P 500 by a wide margin following rate hikes.

Realty Income Investor Presentation

Realty is able to borrow in Europe at rates that are significantly lower than those that currently prevail in the US.

Bears claim Realty lacks growth prospects, in part due to the size of the company; however, management notes that public net lease REITs constitute a mere 3% of the total addressable market in the US and less than 1% of the market in Europe.

In the US, the combined enterprise value of all net lease REITs is $150 billion. That contrasts with Europe where the combined enterprise value of public net lease REITs is a mere $4 billion. To match the level of investments in Europe that prevail in the US, Realty would have to grow 13 fold.

Realty Income investor Presentation.

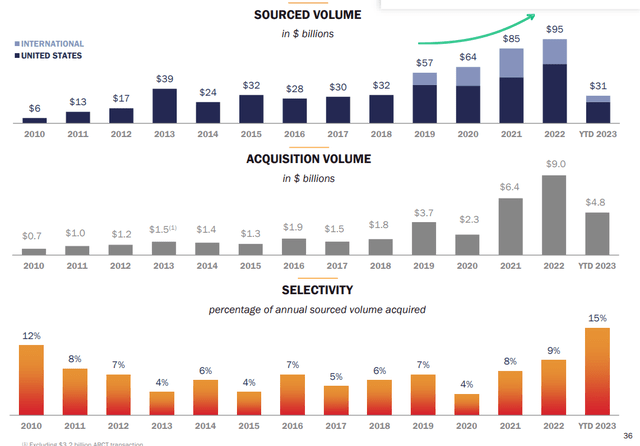

In 2022 alone, O acquired $9 billion in new properties. Since 2019, international opportunities added 30% to Realty’s sourcing volume.

Realty is one of only seven S&P 500 REITs with two A3/A- ratings or better.

Early on, I noted that Realty and Enbridge are pivoting to different types of investments. Realty recently announced a joint venture with BREIT to acquire a 95% stake in The Bellagio Las Vegas. At a total cost of $950 million, Realty will acquire a 21.9% indirect interest in the property. The deal is expected to close in the fourth quarter.

This isn’t Realty’s first venture into the gaming industry. Early last year, the company purchased the land of the most popular Massachusetts casino, Encore Boston Harbor, for $1.7 billion.

This deal highlights the scale advantage Realty Income holds. In a relatively short time frame, the company invested nearly $2.6 billion into gaming properties. Now consider that Gaming and Leisure Properties (GLPI), a REIT focused on casinos, has a market cap of $13.16 billion.

My point is that size matters in the REIT world. It provides Realty with the ability to make deals with a degree of alacrity that others lack, and this is a particular strength during economic downturns, when real estate deals are often brokered at bargain prices.

Another plus for Realty is the firm’s position as a net lease REIT. That means renters pay the costs of insurance, maintenance, and taxes, while O collects the rents. That is a major reason why Realty's AFFO margin is 77%.

The risks associated with an investment in Realty include that the firm’s properties are easily replicated by rivals, so the REIT has no moat. Realty Income’s sheer size could inhibit growth. And with low built in growth in Realty’s leases, the company is susceptible to rising interest rates and inflation.

Realty Income has a current yield of 5.56%, an AFFO payout ratio of approximately 76%, and a 5-year dividend growth rate of 3.71%. This REIT pays a monthly dividend. As previously stated, O is trading at less than a dollar above its 52 week low, and nearly 20% below the 52 week high.

Enbridge

Like Realty Income, Enbridge is a giant within its industry. ENB is the largest energy infrastructure company in North America. The firm operates a network of natural gas and crude oil pipelines, as well as a large portfolio of regulated gas distribution utilities. ENB is also building out a renewable energy platform.

ENB transports about 30% of the crude oil produced in North America through its Liquid Pipelines business, and 20% of the natural gas consumed in the United States. The company’s pipelines move 65% of U.S.-bound Canadian production and account for 40% of total U.S. crude oil imports.

ENB is also the third-largest natural gas utility, by consumer count, in North America. As Canada’s largest natural gas utility, ENB serves 15 million people in Ontario and Quebec alone.

Enbridge has C$8 billion invested in renewable energy and power transmission projects (currently in operation or under construction.) Once completed, the company’s renewable projects will meet the energy needs of 966,000 homes.

With an earnings profile that mimics utilities, over 80% of Enbridge's EBITDA is protected against inflation, and over 95% of its customers are investment grade.

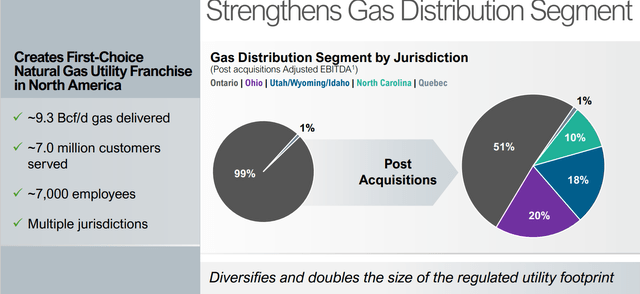

Early this month, Enbridge announced a deal to acquire three utilities from electric services company Dominion Energy (D). This is the 11th natural gas utility that ENB has acquired since 1994.

Enbridge investor presentation

At a cost of $14 billion, the deal will make ENB the largest natural gas utility in North America. Expected to close in 2024, Enbridge will pay for the assets with $9.4 billion of cash and $4.6 billion of assumed debt. Management expects the deal to be accretive to adjusted EPS in the first full year of ownership.

The acquisition will double the size of ENB’s regulated utility footprint and will expand ENB’s gas utilities in Ohio, North Carolina, Utah, Idaho and Wyoming.

Just after the deal was announced, Wells Fargo downgraded the stock to Equal Weight. Analysts cited the rising debt levels associated with the deal as the primary cause. However, it is interesting to note that WFC praised some aspects of the deal:

While we think Enbridge (ENB) paid a reasonable price and see the long-term merits of the deal (cash flow diversification, enhanced stability of cash flows), high leverage and a funding gap could act as overhangs.

ENB is issuing CAD $3 billion in new shares ( 4.2% dilution) and also taking on CAD $4 billion in debt from Dominion. This resulted in S&P downgrading its outlook to negative.

However, Enbridge currently holds BBB+ credit, so even if the rating takes a hit, it would still be solidly investment grade.

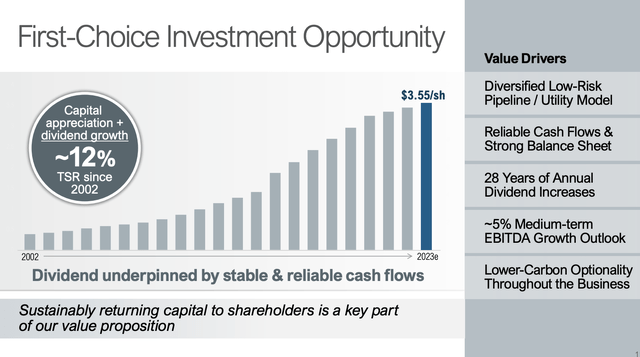

Enbridge has 28 years of annual dividend increases to its credit. Management guides for long term growth in the range of 4% to 6%.

ENB Investor Presentation

It should be noted that as a Canadian company, there is a 15% dividend tax withholding in taxable accounts; however, there is no withholding in IRAs, 401K and other retirement accounts.

Enbridge's risks are largely related to a variety of regulatory and legal challenges that routinely beset the company.

Summation

Arguably the greatest argument against owning either of these stocks is that each company's dominance of its industry means growth may be muted moving forward.

ENB is guiding for growth in a range of 4% to 6%. Assuming management meets even the lower end of that target, combining that with a yield well over 7% gives us market beating returns for the long haul.

Realty is guiding for $7 billion in acquisitions following a 2022 that saw the company acquire $9 billion in properties.

Both companies have solid financial foundations, over a quarter century record of dividend raises, and a bullet proof source of steady cash flow.

Even if Enbridge or Realty fails to provide annual returns that meet that of the S&P 500, it is difficult to find an investment with the degree of safety these two provide.

Some are avoiding dividend stocks in favor of bonds and the like. I contend that is likely a mistake at this juncture. I’m not referring to investors that take their cash-stash and put it in bonds while awaiting an alluring opportunity. I’m speaking of those who are effectively out of the market for the foreseeable future.

When one considers that dividend paying stocks racked up the worst first half performance since 2019, I think now is the time to buy high yield stocks.

I rate O and ENB as BUYS.

I added to my position in both stocks recently, and I intend to add to my positions moving forward.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

As of 08/1023 I am rated among the top 3.4% of authors in terms of overall results. This is according to TipRanks, which provides a 64% success rate and an average 16.5% annual return for my articles. (I update this score on at least a quarterly basis for readers.)

I could be characterized as a safety first investor. My primary focus is on dividend bearing stocks. I seek a degree of safety in my investments by concentrating on companies with competitive advantages and strong balance sheets.

I am a also value / buy and hold investor. Since I require a discount in the share valuations of my investments, my ratings are generally very conservative. My valuation requirements, combined with the high quality companies that I often highlight mean many stocks I rate as a hold perform well over the long term. Readers should consider this when weighing my buy/hold/sell recommendations.

I am a retail investor, with no formal training in investing.

I am a graduate of the U.S Army Ranger school and a former member of the 1st Ranger Battalion and The Old Guard (U.S Army Honor Guard.) I am a retired law enforcement officer. I have approximately 20 years experience as a retail investor.

Best of luck in your investments, Chuck

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O, ENB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)