Sprout Social: Expensive Amid Deceleration, Acquisition (Rating Downgrade)

Summary

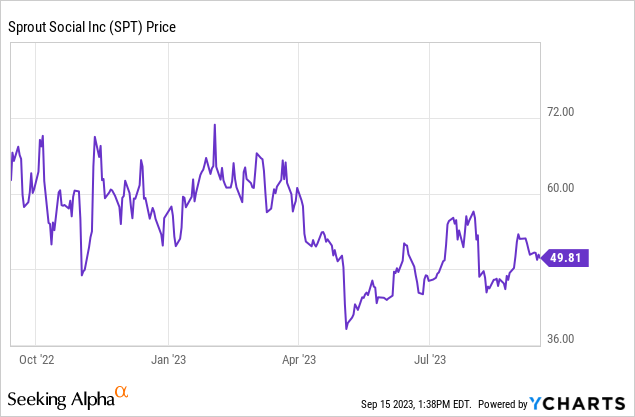

- Sprout Social's stock has underperformed and remains expensive despite beating expectations in Q2 earnings.

- The current macro landscape is unfavorable for Sprout Social's niche as companies are cutting sales and marketing budgets.

- The company's liquidity is relatively tight, and it may need to raise capital in an expensive environment soon.

- Its ~6x forward revenue multiple does not entail a good entry point while revenue growth is decelerating.

Urupong/iStock via Getty Images

By and large, in spite of results that generally beat expectations in the Q2 earnings season, most individual stocks were unable to surmount downside pressure from high interest rates. This is especially true of unprofitable growth stocks, and even more so for companies that are experiencing a decelerating growth trajectory.

Sprout Social (NASDAQ:SPT) is one such name. A software platform for managing social media posts and engagement, the company is down double digits year-to-date: underperforming most peers in the software and internet sectors. And yet, in spite of this recent downside, the stock still remains untenably expensive.

I last covered Sprout Social in mid-May when the stock was trading closer to the $40 range. Since then, a number of things have happened: Q2 results have come in softer from a growth perspective; Sprout Social has rallied to a higher valuation, and the company also spent the majority of its cash to execute a horizontal merger. In light of these factors, I'm downgrading my opinion on Sprout Social to bearish.

Here are the core red flags that are driving that recommendation:

- Sprout Social is purpose-built for social media managers, and the current macro landscape is unfavorable for this niche. Companies are slashing their sales and marketing budgets - both for advertising spend as well as the G&A headcount that supports it. While social media management as a core company function will continue to see secular tailwinds, we'll likely see retrenchment over the next year as companies tighten their belts.

- Relatively tight liquidity. Sprout Social only had ~$180.5 million of cash on its most recent balance sheet, and it just spent $140 million of that in an all-cash transaction to acquire Tagger. The company is just barely over breakeven on an operating cash flow basis, so it may be forced to raise capital in an expensive environment relatively soon.

My biggest concern on the company, however, is its bloated valuation in the current environment. At current share prices near $50, Sprout Social trades at a market cap of $2.77 billion. After we net off the $180.5 million of net cash on the company's Q2 balance sheet (which doesn't yet factor the all-cash consideration for Tagger), its resulting enterprise value is $2.59 billion.

Meanwhile, for next year FY24, Wall Street is expecting Sprout Social to generate $424.3 million in revenue, up 29% y/y (data from Yahoo Finance). This pegs the stock's valuation at 6.1x EV/FY24 revenue.

While not egregiously overvalued, I think it's difficult to justify a ~6x revenue multiple even for ~30% growth when most other software companies (that are growing in the high teens to low 20s) have slid down to a ~4-5x multiple, and when the outlook for social media and advertising is still cloudy.

I'd recommend investors sell off any gains they've had on this stock to date and invest elsewhere until Sprout Social comes back down into the ~$40 range.

Q2 download

Let's now go through Sprout Social's latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Sprout Social Q2 results (Sprout Social Q2 earnings release)

Sprout Social's revenue grew 29% y/y to $79.3 million, only slightly coming ahead of Wall Street's expectations of $78.7 million (+28% y/y). Note as well that the company has been a long decelerating trajectory, falling from 31% y/y growth in Q1, 33% y/y growth in Q4, and 37% y/y growth in the prior Q3.

It's worth noting as well that consensus revenue targets calling for 29% y/y growth in FY24 would have Sprout Social's growth holding from current levels, factoring in M&A contribution. Tagger's revenue contribution has not yet been disclosed, but assuming Sprout Social's $140 million offer constituted a 6x revenue multiple (in line with its own valuation), Tagger would contribute roughly $23 million (or 7 points of growth) to FY24 revenue.

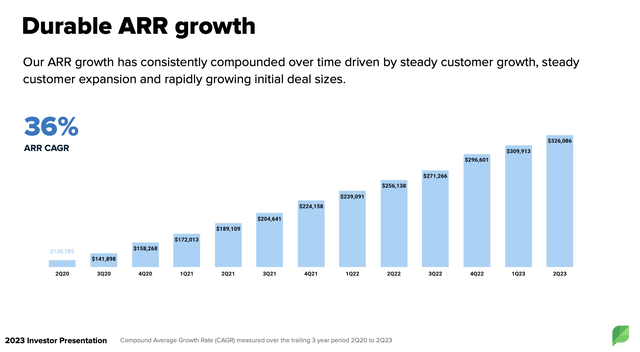

The company did continue to grow ARR, adding $16 million in net-new ARR to end the quarter with $326.1 million, up 27% y/y.

Sprout Social Q2 ARR growth (Sprout Social Q2 earnings deck)

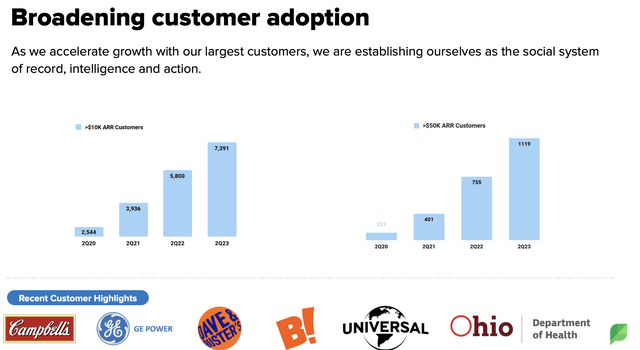

It also continues to rotate into larger customers, growing the count of clients generating over $50,000 in ARR to 1,119, up 48% y/y. Enterprise revenue also grew 50% y/y and now represents 43% of overall ARR.

Sprout Social Q2 customer trends (Sprout Social Q2 earnings deck)

Management is noticing a shift in its business between the smaller and larger segments. CEO Justyn Howard noted on the Q2 earnings call that patterns at the lower end have been unpredictable, but enterprise demand has held up better:

While we are seeing everything we want to see from our strategic shift late last year, structural improvements in our business and accelerated momentum up-market, the unpredictability at the very low end of our business has remained difficult to forecast in Q2. So we view this as a positive trade-off and have deliberately deprioritized and removed resources from this part of our business. We are ultimately committed to high competence projections [...]

Meanwhile, the upside of our strategic shift is becoming even more pronounced. We are beginning to see if structurally positive impact on net dollar retention of our core customers and our enterprise business further accelerated during Q2, yielding the highest new LTV for enterprise compared to all prior quarters. Enterprise grew nearly 50% year-over-year and represents a record 43% of total ARR. Enterprise new business was up more than 50% year-over-year and total net new ARR from this segment also grew greater than 50% year-over-year. Multiple factors are contributing to our success and this quarter premium module attach rates were very strong. Total premium module attach rates increased by 160 basis points from Q1 2023, nearly double the uptick we saw on average in 2022."

Pro forma operating income, meanwhile, swung to a positive 2% margin, versus a -3% margin in the year-ago quarter. This was driven by a 150bps boost in gross margin, driven by economies of scale, and a reduction in G&A expenses to 17% of revenue, down 3 points from the year-ago period.

Key takeaways

While I continue to believe that Sprout Social is a quality business for the long term, I think paying a ~6x forward revenue multiple amid decelerating growth and a recent acquisition that consumes most of Sprout Social's liquidity is risky, especially in a high interest rate environment. Lock in gains and steer clear for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.