Procter & Gamble: Strong Pricing Power, But Expensive

Summary

- CPI increased to 3.7% YoY due to rising energy and gasoline prices, breaking its downtrend since October 2022, suggesting a higher for longer scenario.

- I plan to invest in defensive dividend-paying stocks, particularly in consumer staples and discretionary companies, to protect against inflation and high interest rates.

- Procter & Gamble is a well-positioned consumer staples company with strong pricing power, organic growth, and a shareholder-friendly capital policy. I rate PG as hold with a price target of $175 in three years.

- Looking for a helping hand in the market? Members of High Yield Landlord get exclusive ideas and guidance to navigate any climate. Learn More »

NicoElNino

Dear readers,

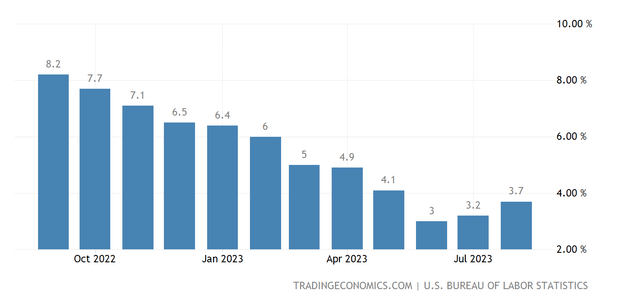

Earlier this week August CPI missed expectations, increasing to 3.7% YoY, as a result of energy and gasoline prices increasing sharply, by 5.6% and 10.6% MoM, respectively.

Higher energy prices, as well as sticky shelter inflation which continues to be reported at 7.3% YoY, despite real-time housing data showing no inflation, have contributed to CPI decisively breaking the downtrend it's been on since October 2022.

Trading economics, U.S. Bureau of Labor Statistics

If you've been following my research, you know that I'm currently bullish on a number of companies and that my base case calls for a decrease in interest rates sooner rather than later.

But that doesn't mean that my entire portfolio is positioned for a decrease in rates. That would be foolish and dangerous.

Earlier this week I published an article called 3 REITs For A Higher For Longer Scenario where I argued that investors should position themselves for multiple potential macroeconomic scenarios, including a higher for longer scenario. I also gave examples of three REITs that, despite common belief, are actually very well positioned for high interest rates and should outperform the market in such scenario.

In an effort to diversify and protect my own portfolio against the risk of sticky inflation and high interest rates for years to come, I've done a lot of research in sectors beyond REITs, Financials and Energy, which I usually invest in.

I was mainly looking for defensive dividend-paying stocks, with non-cyclical demand, low leverage and high ability to pass inflation on to the consumer. I found that consumer staples companies as well as some consumer discretionary companies such as fast-food restaurants satisfy this criteria rather well.

My thinking is that rather than holding a cash position of say 10-15% to be deployed in case of a market crash, I could buy defensive names today around a 3% dividend yield and "lock-in" an expected annual total return of somewhere between 7-10%.

If we get a soft landing, then these stocks will indeed do better than cash and if inflation stays high, the Fed pushes the economy into a recession and the market sells off, then these stocks which have a beta of 0.5-0.6x will for sure decline less than riskier technology stocks that I can then rotate into in anticipation of a higher total return than the 7-10%.

This is why I plan to start a series of articles on defensive companies from The Coca-Cola Company (KO), through McDonald's Corporation (MCD) and Starbucks Corporation (SBUX), to The Procter & Gamble Company (NYSE:PG) which I will start with today.

Procter & Gamble

Procter & Gamble is a global AA- rated consumer staples powerhouse which needs little introduction as it owns some of the most well-knows brands in beauty, grooming, home care and healthcare such as Gillette, Old Spice, Oral B, Pampers and many others.

I guarantee that you have at least a dozen products made by PG in your home and importantly, these are essential products to our everyday life. This means that we will buy them no matter what, which gives the companies making these products enormous pricing power, which is especially important in times of high inflation.

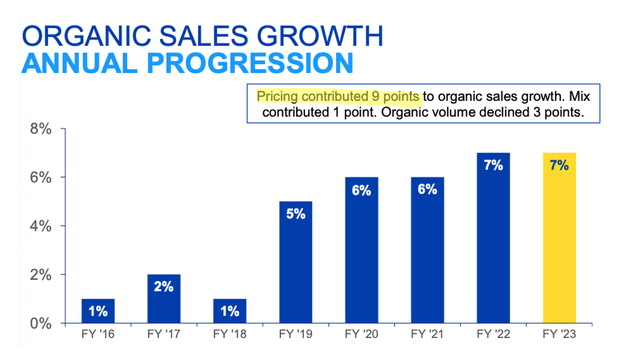

Recent results, reported by PG for their fiscal Q4 2023, confirm that indeed the company is able to pass inflation onto consumers. Organic growth has reached 7%, of which 9% was attributable to pricing and 1% to mix, while volume declined by 3%. Notably, the growth has been broad-based, across all of PG's segments.

Core earnings reached $5.90 per share, which is only 2% above last year numbers due to strong headwinds (of $1.38 per share) from higher material costs and FX. Keeping FX constant, core EPS increased by impressive 11% YoY.

As a result of strong results, the company has increased its dividend by 3% to $0.941 per quarter or a 2.4% dividend yield. In addition to paying out $9 Billion in dividends, the company also executed $7.4 Billion in share repurchases, confirming their shareholder friendly capital policy as evident from 66 years of consecutive dividend increases.

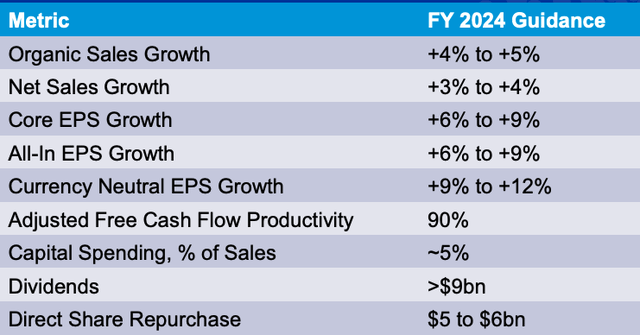

Going forward, management expects that pricing increases will slow and volumes will return closer to normalized levels, which should result in future market growth of about 4%. This assumption along with management's expectation to gradually capture market share worldwide leads to organic sales guidance of 4-5% for fiscal 2024.

In terms of earnings, guidance calls for fiscal 2024 EPS of $6.25-6.43 per share, which at mid-point represents annual growth of 7.5%. This still assumes a 3% headwind from FX so in neutral FX terms, guidance calls for EPS growth of 9-12% YoY.

In 2024, the expectation is for another $9 Billion in dividends and $5-6 Billion in share repurchases and beyond consensus calls for 6-8% core EPS growth until fiscal 2026.

Valuation

Procter & Gamble is a dividend king, which means that it pays one of the most reliable dividends out there, now at 2.4%.

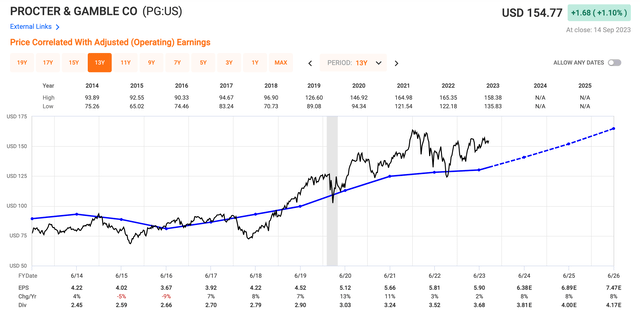

Such high quality barely ever comes cheap, and today is not an exception. At 25.8x 2023 earnings and 24.4x forward earnings, the stock trades at a premium to its 10-year average P/E of 23.8x.

So we're paying about an 8% premium today, relative to historical valuation.

With that said, I think we can reasonably expect the following:

- 2.4% dividend almost guaranteed to grow by 2-4% per year

- 6-8% core EPS growth for the next three years

- potential downside from re-rating to 23.8x earnings of 8%

Combined, this yields a price target of $175 three years from now, which corresponds to an expected annual return of about 6.5%.

That's somewhat below the 7-10% total return I'm after as part of my strategy, and it's also below the average market return. As a result, I rate PG a HOLD here at $155 per share and will continue looking for other defensive companies with higher potential upside.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

This article was written by

Disclaimer: I am not a financial advisor and none of the content I provide on this website is financial advice. Content is provided for illustrative and educational purposes only. Always do your own research before investing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.