Realty Income: Strong Buy After Bellagio Deal

Summary

- Realty Income Corporation is trading at its lowest valuation in three and a half years, presenting an opportunity for passive income investors.

- The trust recently announced its acquisition of equity interests in the Bellagio property in Las Vegas, expanding its operational scope.

- Concerns over interest rates are unwarranted as Realty Income has minimal exposure to floating-rate debt and inflation is moderating.

Alexander Shapovalov/iStock via Getty Images

Realty Income Corporation (NYSE:O) is trading at its lowest valuation in three and a half years, potentially offering passive income investors a unique opportunity to double down on this monthly-paying retail REIT.

Realty Income is not only trading near 52-week lows, but the trust also recently announced that it was acquiring common and preferred equity interests in Bellagio, the famed Las Vegas property.

Realty Income's most recent down-fall is likely due to concerns over interest rates, which I consider to be unwarranted as the trust only has relatively small exposure to floating-rate debt.

With inflation moderating substantially in the last six months, I think that Realty Income offers investors the best value in more than 3 years. As a consequence, I am doubling-down on the trust and think that the risk/reward has drastically improved, particularly for long-term oriented passive income investors.

My Rating History

My last published article on Realty Income was Realty Income: This Strong 4.7% Yield Won't Let You Down. I articulated my thesis and named as reasons to buy Realty Income the portfolio's strong diversification, good dividend coverage and a moderate valuation.

With inflation trending down (lowering the risk of further rate hikes) and a much more compelling valuation following the Bellagio deal, I think that Realty Income makes an exceptionally strong value proposition at 52-week lows.

Falling Inflation Rates Should Ease Concerns Over Realty Income's Floating-Rate Debt

Realty Income is a well-managed retail REIT with a portfolio of 13,118 properties, reflecting 255.5 million square feet of leasable space in the United States and Europe.

Real estate tends to be a good investment in times of inflation because lease contracts typically contain provisions that tie lease rate hikes to consumer price indices. With that being said, rate hikes also scare investors as trusts with floating-rate debt on their balance sheet face the possibility of higher interest rate payments.

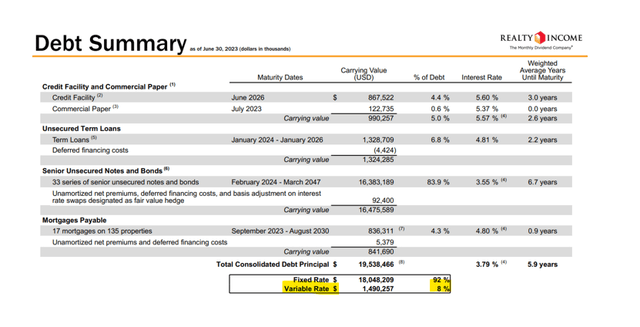

Realty Income has an investment grade rated balance sheet and staggered debt maturities. Though the trust has a considerable amount of debt, $19.5 billion, only about 8% of this debt is linked to variable rates. Put simply, passive income investors really have no reason to be concerned about the trust's balance sheet or the impact of higher interest rates.

This is particularly true because inflation is easing and trending down, giving the central bank less justification for additional rate hikes.

Evolving Strategic Road Map And Bellagio Deal

Realty Income started out as a retail commercial investment trust that leased its properties to large scale national retailers such as Walgreens, Dollar General or 7-11. With that said, though, the REIT's portfolio strategy has evolved, largely because Realty Income acquired a boatload of properties in the past and is starting to diversify into other investment areas, such as industrial properties or experiential properties like casinos.

In the last week of August, Realty Income announced that it would invest $950 million to acquire common and preferred equity interests in the Bellagio property on the Las Vegas strip. By expanding its operational scope, Realty Income is set to develop a multi-line REIT business that produces cash flow outside its core area of retail properties.

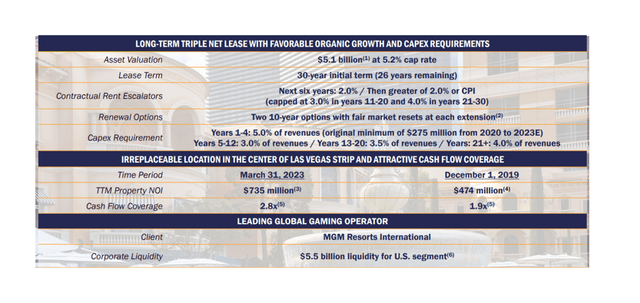

The Bellagio transaction is based on a 30-year lease with contractual rent escalators (inflation hedges). The property produced $735 million in net operating income and will provide Realty Income with a new revenue source from one of Las Vegas' most iconic casino properties.

The deal also lays out terms for substantial capex requirements for the casino operator, which should ensure that the property will remain in good condition and continue to attract a steady stream of visitors. Both parties agreed that MGM Resorts International (MGM) will have to invest 5% of its revenues into the property between 2020 and 2024.

Bellagio Investment Overview (Realty Income)

Besides acquiring a trophy asset in a severely supply-limited market, the deal is strategically significant for Realty Income, in particular because it enhances the diversification profile of the retail trust.

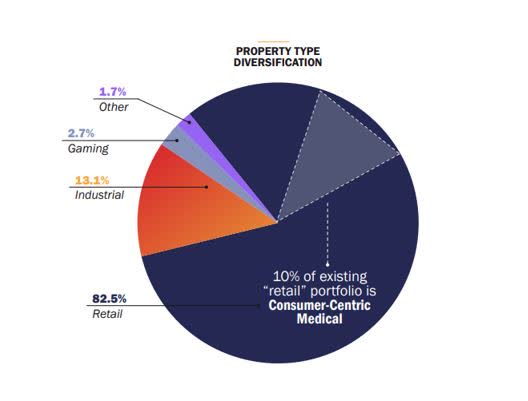

At the end of 2Q-23, more than 80% of Realty Income's investments were concentrated in retail properties, while other segments, such as industrial and gaming, accounted for substantially smaller investment percentages.

The Bellagio transaction could make Realty Income less dependent on the retail business and open up a path for similar transactions on a sale-and-lease-back basis in the casino industry. With more casino operators unloading their prime real estate assets, Realty Income could become a formidable force in the gaming market moving forward and thus gradually broaden its investment scope.

Property Type Diversification (Realty Income)

What I Am Thinking Of The Deal

Higher diversification is a good thing for trusts and their retiree investor bases that rely on steady and well-protected income. Taking into account the trust's deeper diversification in terms of property types, future portfolio income should therefore have less risk, making an even stronger case for owning Realty Income in a passive income portfolio.

Most importantly, the deal could lead to future deals in the industry, potentially establishing Realty Income as the go-to source for trophy real estate sale-and-leaseback transactions.

Stable Dividend Coverage Ratio Indicates That Investors Don't Have To Worry About Getting Paid

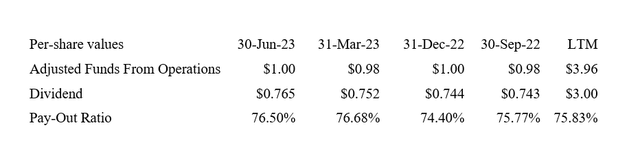

Realty Income's real estate portfolio produced $1.00 per share in adjusted funds from operations in the second quarter, reflecting an increase of 3% YoY.

The retail real estate investment trust paid out $0.765 per share in total in the second quarter which implies a dividend pay-out ratio of 76.5%. The dividend is rock solid, in my view.

Dividend (Author Created Table Using Trust Information)

Realty Income Trading At 52-Week Lows, Compelling Valuation Multiple

Realty Income is seeing $3.94 to $4.03 per share in adjusted funds from operations for 2023 which, at a present price of $55.39, translates into a funds from operations multiple of 13.9x.

For context, National Retail Properties Inc. (NNN) guided for $3.20 to $3.25 per share in adjusted funds from operations in 2023, implying a 11.8x AFFO multiple. While National Retail Properties may be cheaper on an AFFO basis, Realty Income nonetheless represents solid value for passive income investors, in my view.

Realty Income, earlier this year, sold at more than 16x AFFO, and I considered shares to be cheap then already, given the quality of the value proposition. At 52-week lows, given the stability of dividend payments that passive income investors have grown to appreciate, I must conclude that Realty Income represents enormously good value for passive income investors at the current price point and I am doubling-down on the trust right now.

Why Realty Income Might Make New Lows

I don't think Realty Income will trade at 52-week lows for long, as the trust's reputation as a reliable dividend payer is significant. Nonetheless, there are developments that might hurt Realty Income's prospects such as a recession, falling rents or rising rates.

Over the long term, however, Realty Income has a solid operating history, a main reason why I think that the trust offers passive income investors a unique investment opportunity right now.

My Conclusion

Realty Income presently represents the best value for passive income investors in three and a half years, in my view and investors should look past the noise that is depressing the trust's market price.

Part of the concerns about Realty Income relate to floating-rate debt as well as the Bellagio transaction, both of which I see as positives. The trust's floating-rate exposure is quite small and with inflation retreating, the odds for new rate hikes are rather small, in my view.

Plus, with the Bellagio transaction, Realty Income is adding another long-term net lease contract to its portfolio and expands the scope of its real estate investment portfolio.

As a long-term investor adamant about growing my passive income streams, Realty Income is a Strong Buy following the Bellagio deal.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)