Addus HomeCare: More Challenges To Think About With CMS Proposals

Summary

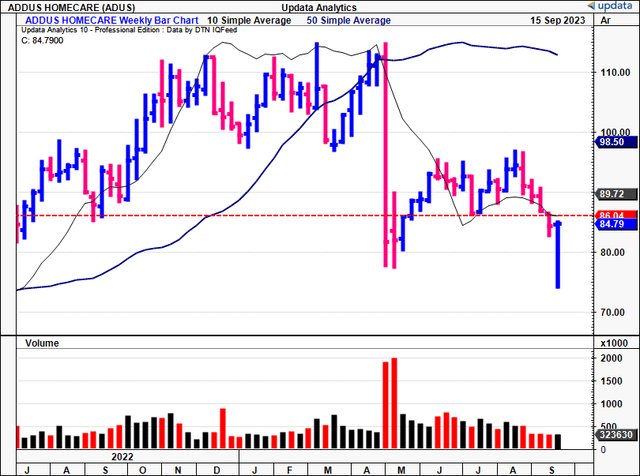

- Addus HomeCare Corporation's stock has sold off sharply and is now trading at 52-week lows.

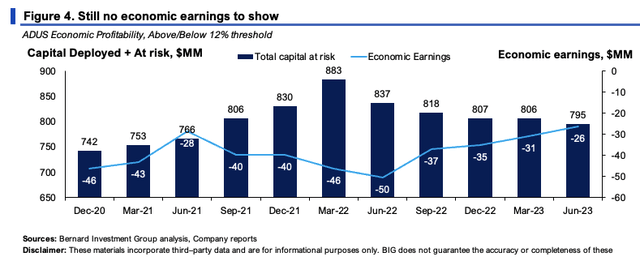

- The company is struggling to meet the opportunity cost of capital on its investments, corroborating its flat market values.

- Proposed regulatory changes, including mandatory staffing standards for nursing homes, could have a material impact on ADUS' operations.

- Net-net, reiterate hold.

naphtalina/iStock via Getty Images

Investment briefing

Since the last publication on Addus HomeCare Corporation (NASDAQ:ADUS) the stock has sold off sharply and now trades at 52-week lows. Recent proposals made by The CMS have weighed in heavily, and the company's soft economic performance is only adding fuel to the fire here in my opinion.

This report will unpack all of the latest investment findings for ADUS and link this back to the broader hold thesis. In short, the company is having a hard time meeting the opportunity cost of capital we require (12%) on its investments, leading to flat market values. Still, the company trades at high earnings multiples, but tight asset multiples, not the ideal setup. Net-net, I continue to rate ADUS a hold based on the factors presented here.

Figure 1.

Critical updates to investment facts-regulatory headwinds, earnings, technicals

1. Breakdown of proposed regulatory changes, what impact this could have to companies such as ADUS

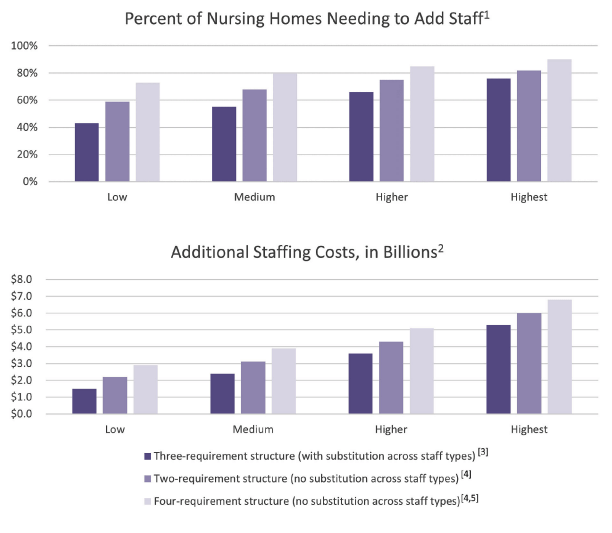

The Federal government has introduced a proposal to establish mandatory staffing standards for nursing homes across the U.S. The premise is to address care issues that were amplified by the pandemic's impact on long-term care facilities. Spearheaded by the CMS, the proposal aims to set a daily avg. nurse staffing level at 0.55 hours per nursing home resident, equivalent to 1 registered nurse for every 44 residents. The proposed changes could have a material impact to ADUS' operations going forward. Most of this impact would be seen at the cost level in my view, in labour + staffing. It would also have tax implications, and, there are also penalties for those who don't comply without valid reasoning. I must admit this is quite an interesting development because it would appear there are already staffing shortages in the aggregate sector, hence why we are at this point in the first place.

Unpacking the proposal in its core elements, the following is relevant:

- Current state and proposed changes-Comparatively, the current daily average care provided by nursing homes per resident rests at 0.66 hours/resident, translating to 1 registered nurse for every 36 residents. Thus, the proposed standard represents a decrease in the daily care currently given to each individual resident, instead distributing each employee's workload across more residents. But the other major change is that at least one registered nurse ("RN") would be required to be onsite at all times of the day/night, versus the current 8-hour requirement.

- Research-backed rationale for higher staffing levels-The proposal prompts discussions on the necessity of higher staffing requirements, supported by extensive research. Suppositions from The 2022 Nursing Home Staffing Study stated that maintaining total nurse staffing levels between 3.8 to 4.6 hours per resident day ("HPRD")-including 1.4 licensed nurse HPRD-is associated with a reduction in delayed or omitted clinical care. Additionally, the study found that a staffing level of 3.67 to 3.88 HPRD was linked to improved quality and safety in facilities, especially when compared to low-performing institutions. The proposed changes would correlate to an HPRD of 4.4 (0.55x8 = 4.4). One can only assume that CMS is using these guidelines as the bedrock for the proposal.

- Financial Implications-Transitioning from the current staffing levels to a proposed minimum staffing requirements is set to create a significant financial burden on the relevant aged care providers. The Nursing Home Staffing Study postulated that an increase to the highest minimum staffing requirement option could produce $278mm in Medicare savings over 3 years. At the same time, however, the change would likely to incur an estimated $3.8Bn rise in staffing costs-something which many in the industry state is unattainable.

Per the Department Of Health:

We are proposing to stagger the implementation dates of these requirements sufficiently to allow facilities the time needed to prepare and be in compliance with the new requirements. Specifically, we propose that the RN on site, 24 hours per day, for 7 days a week would take effect 2 years after publication of the final rule; and we propose that the individual minimum standards of 0.55 [hours per resident day] HPRD for RNs and 2.45 HPRD for NAs would take effect 3 years after publication of the final rule.

Under the proposal facilities in rural areas would be required to meet the proposed RN on site 24 hours per day, for 7 days a week, 3 years after publication of the final rule; and the proposed minimum standards of 0.55 HPRD for RNs and 2.45 HPRD for NAs would take effect 5 years after publication of the final rule.

If finalized, enforcement actions, also called remedies, would be taken against LTC facilities that are not in compliance with these Federal participation requirements. The remedies CMS may impose include, but are not be limited to, the termination of the provider agreement, denial of payment for all Medicare and/or Medicaid individuals by CMS, and/or civil money penalties".

Figure 2. From The 2022 Nursing Home Staffing Study-Estimated Percentage of Nursing Homes Needing To Add Staff and Estimated Additional Staffing Costs per Year to Meet Minimum Staffing Requirements

Source: The 2022 Nursing Home Staffing Study

Q2 FY'23 insights-revenues, cash collections up YoY

ADUS put up Q2 revenues of $260mm, up 9.7% YoY on adj. EBITDA of $28.3mm, a 12.7% increase from last year. Across the company's operating segments, personal care revenues made up 76.3% of the top line, hospice care stood at 19.3%, and home health revenues accounted for 4.4% of turnover. I'd note the latter figure includes revenues from its Apple Home Health acquisition, that completed in October last year. It pulled this to gross margin of 31.7%, ~20bps compression from last year. It printed OCF of $41.6mm, bringing the OCF number to $63.8mm for the YTD. Net-net, it produced earnings of $1.07/share, up 17.6% YoY.

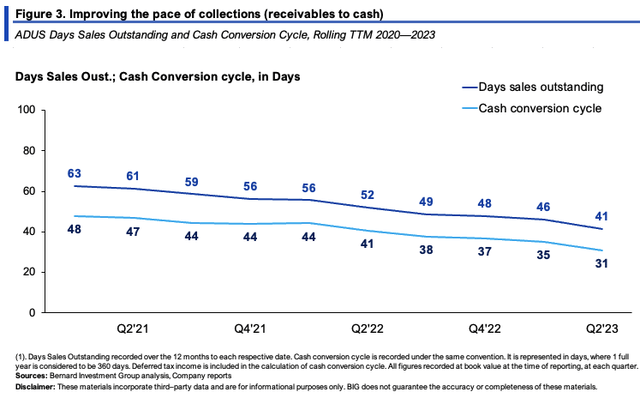

DSO reduced to 35.6 days at the end of Q2, down from 43.7 days at the end of Q2 in FY'22. On a TTM basis, the figures were down to 41 days, as seen in Figure 3. The reduction was influenced by more consistent cash collections, reducing the cash conversion cycle from 41 days to 31 days in the last 12 months. The Illinois Department of Aging reduced DSO to 22.3 days, which was significantly lower than the 43.7 days in Q1 this year. In my view, this was the major catalyst to see these numbers trend lower.

Still no change in economic profitability though. Figure 4 outlines ADUS' total capital at risk compared to the economic losses produced on this. Economic profits/losses are recorded as the difference between the NOPAT ADUS produced, minus the invested capital at a 12% capital charge. It represents the difference in what it needed to produce in NOPAT to create shareholder value, versus what it did produce. Naturally, a positive number is desirable. This certainly supports a hold rating in my view.

The technical picture

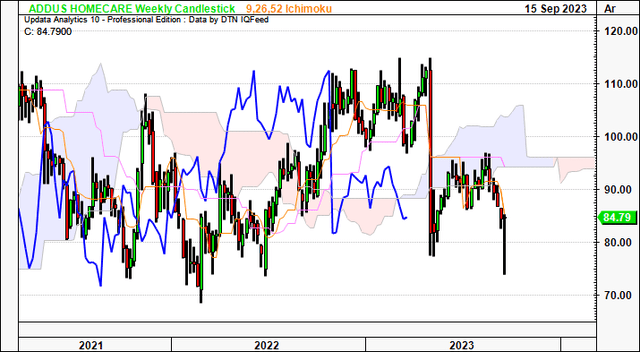

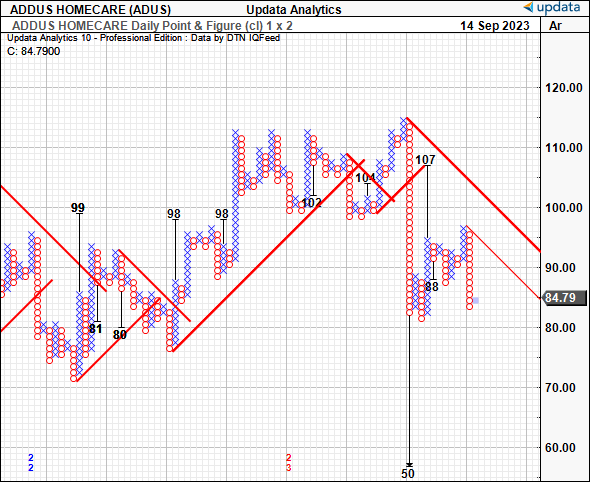

Technicals are equally unsupportive of a buy rating in my view. On the daily cloud chart in Figure 5, both price and lagging lines crossed the cloud in August. The recent price action has only deepened the gap. You'd need a spike above the $95.00 mark to suggest a bullish trend was on our hands. Right now, trend action suggests it could be a while before a long-term reversal.

Figure 5.

Same thing in the P&F study in Figure 6. We have downsides as low as $50, indicating the kind of sentiment in the stock. In fact the latest target is to $88, which ADUS has already taken out. So I'm not sure if $50/share is the right number, but the combination of targets shown tells me to look for a lower price, or, that ADUS could continue pushing sideways into congestion from here. Either way, I'm neutral on this setup.

Figure 6.

Data: Updata

Value drivers and forward expectations

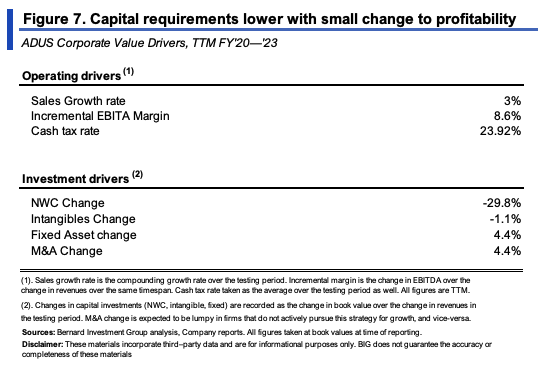

In the last 3 years, ADUS' sales have grown at a 3% rate, on ~8-9% operating margin. The margin has been stable, yet quite thin. More critically, with every $1 in new sales, it has reduced NWC by ~$0.30, whereas fixed asset intensity has increased at $0.044 on the dollar.

BIG Insights

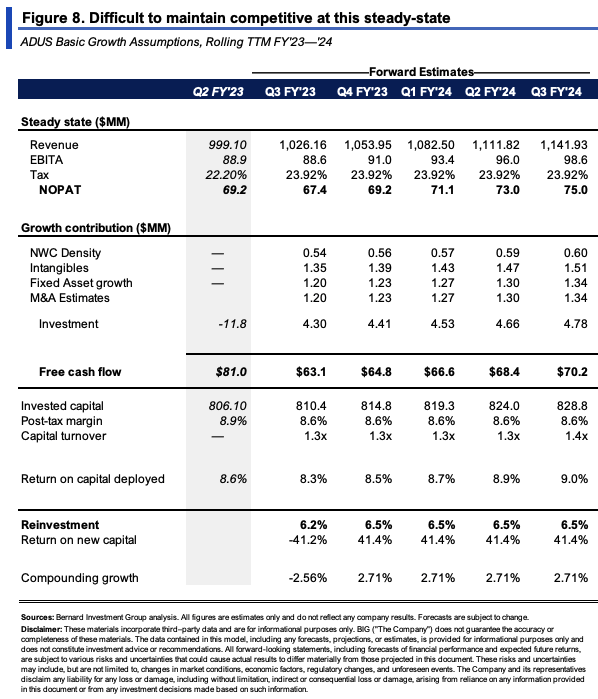

These provide critical assumptions about what ADUS can do going forward at this steady state. Figure 8 shows this, albeit with NWC growth changed to a rate of 2% of every new $1 in sales.

Critically, it would need ~$12-$20mm in investment each year to continue growing at a 3% rate. If it were to grow in this fashion, it's not unreasonable to foresee ADUS spinning off ~$70mm in FCF by FY'24. The issue here, is that it may only produce an earnings rate of ~8-9% on capital at these stipulations, with capital turns of 1.4x-not enough to offset <10% post-tax margins. I'd call for ADUS to compound its intrinsic value at just ~10% over the coming 12 months at this pace, which isn't the kind of re-rating I am after.

BIG Insights

Valuation and conclusion

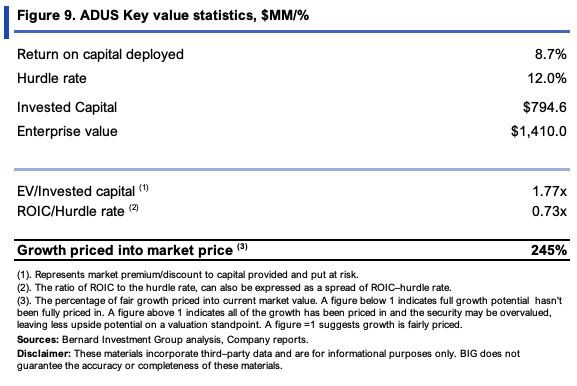

The stock still sells at 20x forward earnings and 15x forward EBIT. Not surprisingly, given (i) the persistent economic losses on capital deployed, and (ii) the respective CMS proposal outlined, the market has placed a small premium on the capital employed in ADUS' business, 1.77x in fact. At the trailing ROIC of 8.7%, that produced just $4.30/share on $49.70/share invested, there is little scope to see a mispricing in my opinion. It would appear the market may have even potentially overpriced ADUS at these multiples.

BIG Insights

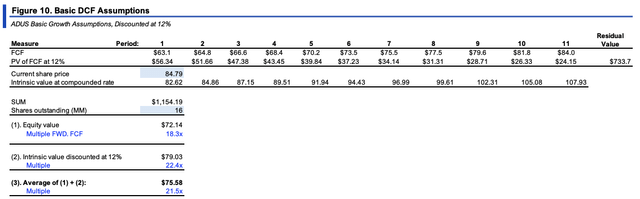

Projecting the steady-state numbers in Figure 8 out to FY'28, then discounting at our 12% hurdle rate, gets you to $72/share [Figure 10]. Compounding ADUS' intrinsic value at the rate of its ROIC and reinvestments spits out $79/share, and the average of the pair is $75/share. This valuation supports a neutral view.

In short, there are multiple challenges in rating ADUS a buy at the present time. In continuation with the last report, the company's business capital isn't pulling its economic weight, and there are added regulatory headwinds that could result in a further selloff in the sector. Based on the culmination of data presented here today, I reiterate ADUS as a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.