The Hackett Group Appears Fully Valued Here

Summary

- The Hackett Group, Inc. provides strategic advisory and technology consulting services to enterprises worldwide.

- The company is experiencing slower revenue growth, and clients may delay discretionary spending due to macroeconomic uncertainty and rising interest rates.

- The Hackett Group appears to be fully valued, so I remain Neutral [Hold].

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Hero Images Inc

A Quick Take On The Hackett Group

The Hackett Group, Inc. (NASDAQ:HCKT) provides a variety of strategic advisory and technology consulting services to enterprises worldwide.

I previously wrote about The Hackett Group with a Hold outlook.

The Hackett Group, Inc. is producing slower revenue growth than previous years and clients may continue to delay discretionary spending due to ongoing macroeconomic uncertainty and rising interest rates.

So, I remain Neutral [Hold] on HCKT in the near term.

The Hackett Group Overview And Market

Established in 1991 in Miami, Florida, Hackett aims to improve clients' operational outcomes by providing benchmarking, performance evaluations, business transformation assistance, and a variety of software deployment options.

The company is led by its founder, Chairman, and CEO Ted Fernandez, who formerly held the position of National Managing Partner at KPMG.

Hackett's key services include:

- Strategic Consulting

- Benchmarking Research

- Oracle & SAP Solutions

- OneStream Platform and Marketplace Solutions

- Business Transformation

- Market Intelligence Service

- Ancillary Services.

The company secures clients through direct sales and marketing initiatives as well as referrals from partners.

A 2021 report by 360 Market Updates found that the global digital transformation strategy consulting market was valued at $58.2 billion in 2019 and is projected to reach $143 billion by 2025.

This equates to an anticipated CAGR of 16.2% from 2020 to 2025.

The primary factors contributing to this expected growth include a significant shift from on-premise legacy systems to cloud-based structures with more complex architectures.

Additionally, the COVID-19 pandemic likely accelerated the need for modernizing enterprise systems, resulting in increased growth opportunities for digital transformation consulting firms.

Major competitive or other industry participants include:

Globant

EPAM

Slalom

Accenture

Deloitte Digital

McKinsey

BCG

Ideo

Cognizant Technology Solutions

Capgemini

Company in-house development efforts.

The Hackett Group’s Recent Financial Trends

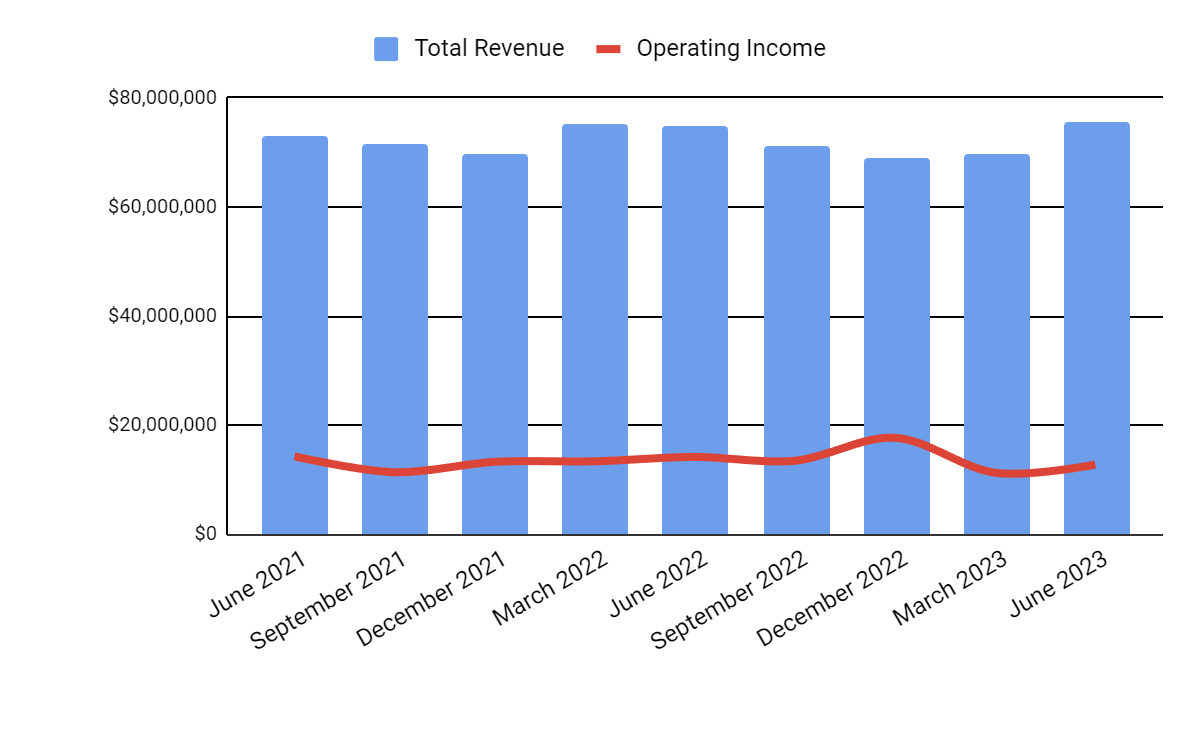

Total revenue by quarter has produced the following trajectory; Operating income by quarter has remained relatively stable in recent quarters.

Total Revenue and Operating Income (Seeking Alpha)

Gross profit margin by quarter has varied within a range; Selling and G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarters:

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

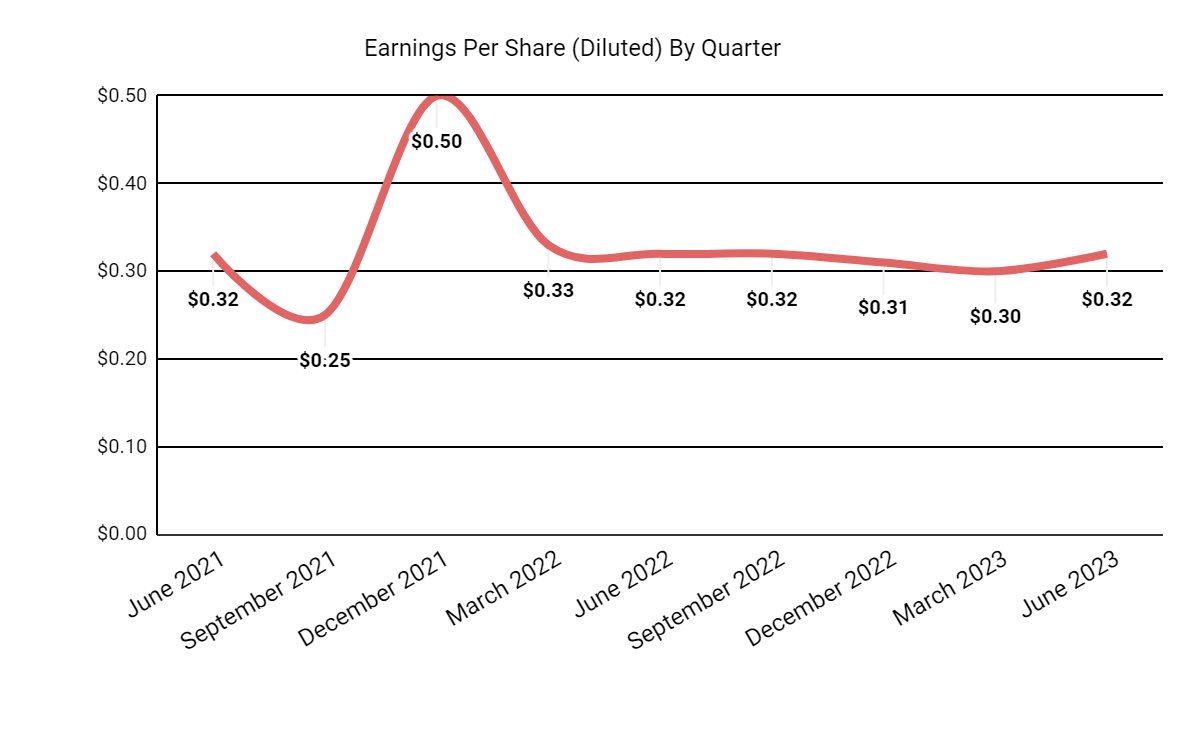

Earnings per share (Diluted) have remained generally stable in recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

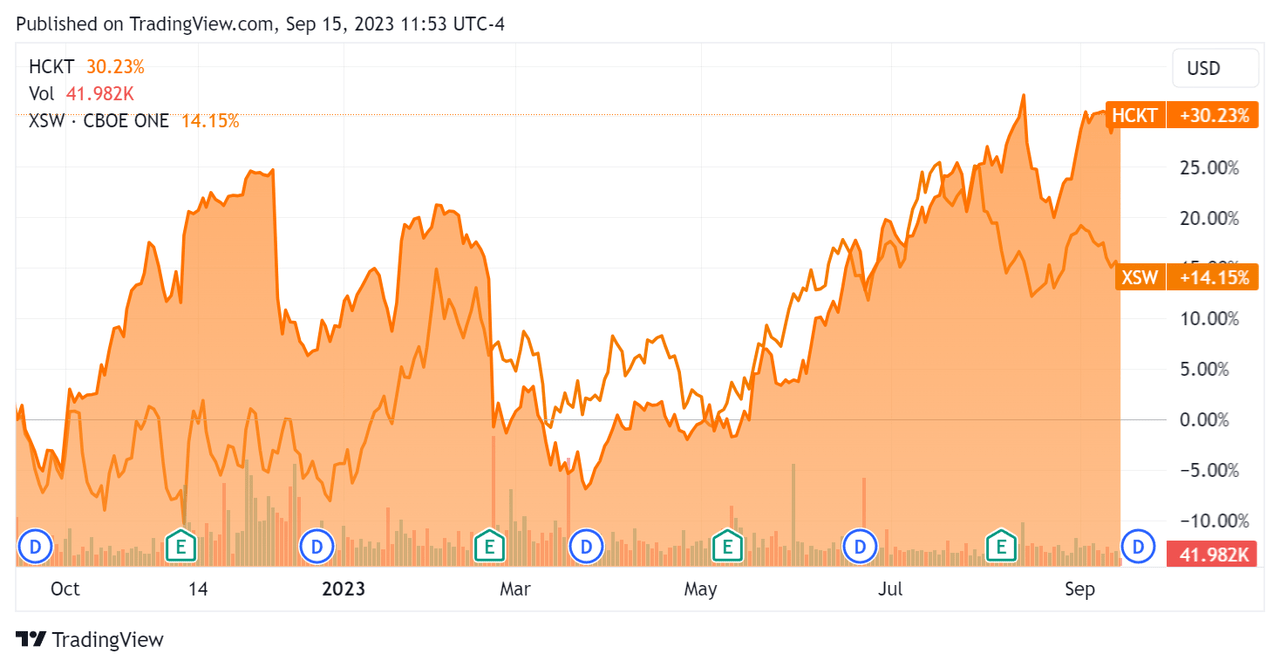

In the past 12 months, HCKT’s stock price has risen 30.23% vs. that of the SPDR S&P Software & Services ETF’s (XSW) 14.15%:

52-Week Stock Price Comparison (Seeking Alpha)

For balance sheet results, the firm ended the quarter with $15.8 million in cash and equivalents and $52.7 million in total debt, all of which was categorized as long-term.

Over the trailing twelve months, free cash flow was $34.8 million, during which capital expenditures were $4.5 million. The company paid $10.2 million in stock-based compensation in the last four quarters, about the same as in previous quarters.

Valuation And Other Metrics For The Hackett Group

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 2.4 |

Enterprise Value / EBITDA | 11.8 |

Price / Sales | 2.5 |

Revenue Growth Rate | -2.0% |

Net Income Margin | 13.0% |

EBITDA % | 20.5% |

Market Capitalization | $651,840,000 |

Enterprise Value | $691,060,000 |

Operating Cash Flow | $39,270,000 |

Earnings Per Share (Fully Diluted) | $1.25 |

(Source - Seeking Alpha.)

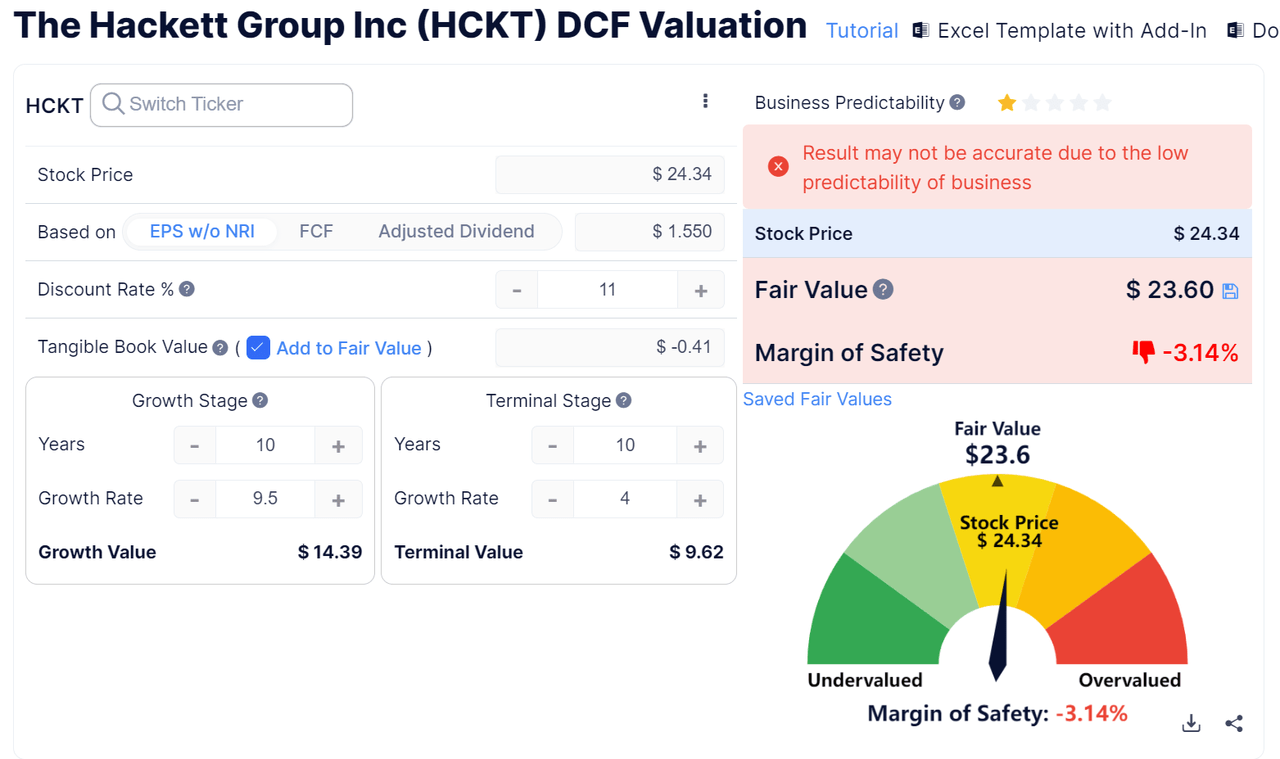

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow - HCKT (GuruFocus)

Based on the DCF, the firm’s shares would be valued at approximately $23.60 versus the current price of $24.34, indicating they are potentially currently fully valued.

Sentiment Analysis

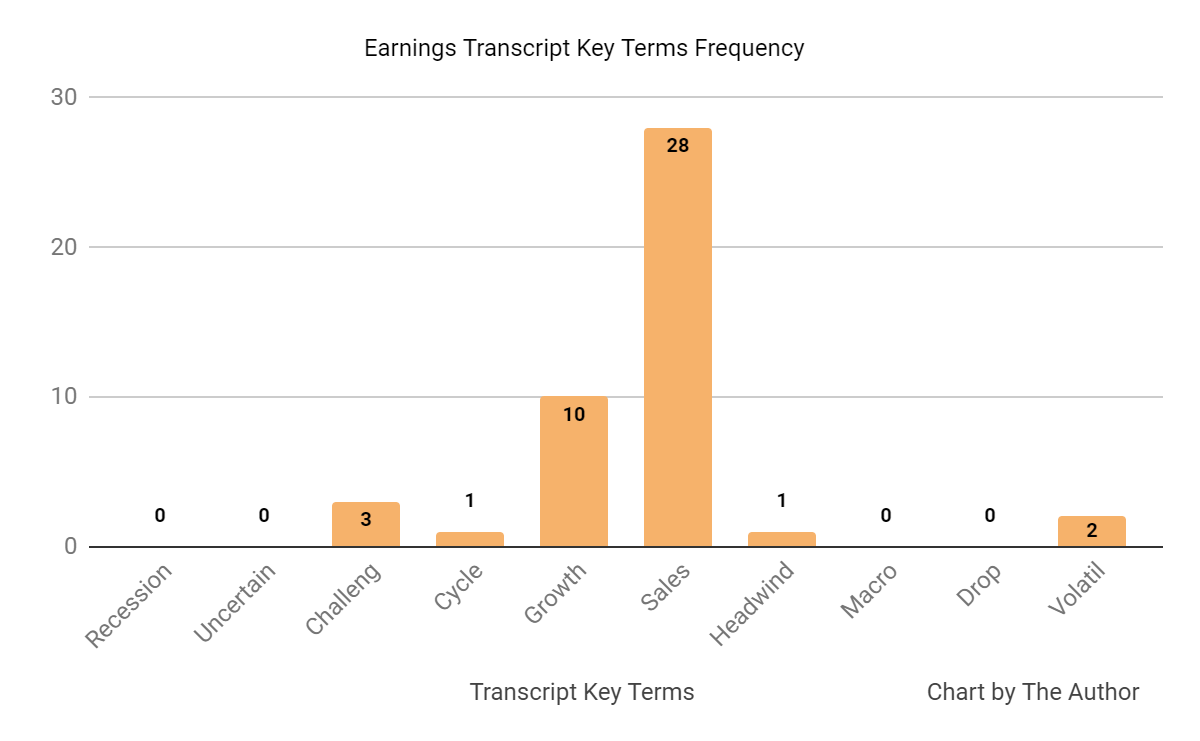

The chart below shows the frequency of certain keywords in management’s most recent earning conference call:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

The keyword frequency indicates some negative chatter and sentiment from management and analysts during the conference call.

Analysts questioned the firm about its AI strategy and the market intelligence report products.

Management responded that it is working on how to advise clients on the quickest ROI use of AI and the company is also determining if it wants to create its own large language model based on its proprietary IP.

Leadership said that its market intelligence reports have generated "favorable" engagement, both from clients willing to participate and from consumers of the reports.

However, management doesn’t see monetization derived from these report initiatives until 2024.

Commentary On The Hackett Group

In its last earnings call (Source - Seeking Alpha), covering Q2 2023’s results, management highlighted 8% sequential revenue growth despite a volatile macroeconomic environment and "extended client decision making."

While company results continue to be largely due to its Global Strategy and Business Transformation [GSBT] segment, the firm is seeing a turnaround in its Oracle Solutions segment.

Hackett continues to add consultant headcount at a steady pace, increasing sequentially to 1,148 from 1,128 in the prior quarter.

Management didn’t disclose any client, revenue or employee retention rate metrics for the quarter.

Total revenue for Q2 2023 rose slightly by 1.1% year-over-year while gross profit margin slid 0.3%.

Selling and G&A expenses as a percentage of revenue increased by 1.8% YoY and operating income fell by 9.9%.

The company's financial position is reasonably good, with some liquidity, more long-term debt but strong positive free cash flow.

Looking ahead, the consensus revenue estimate for 2023 is for a 2.4% growth rate over 2022.

If achieved, this would represent a decline in revenue growth rate versus 2022’s growth rate of 4.36% over 2021.

In the past twelve months, the firm's EV/EBITDA valuation multiple has risen from a 12-month low of just under 8x to its current level of 12x, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include improving discretionary project spending by clients.

However, the consulting industry has seen client behaviors continue to delay these types of projects in the face of an uncertain macro environment and rising interest rates.

Furthermore, my discounted cash flow calculation suggests the stock may be fully valued at its current level of around $24.00.

Accordingly, I remain Neutral [Hold] on The Hackett Group, Inc. for the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.