JFrog's Market Value: Already Richly Priced

Summary

- JFrog is a DevOps platform focused on ensuring secure and continuous software delivery.

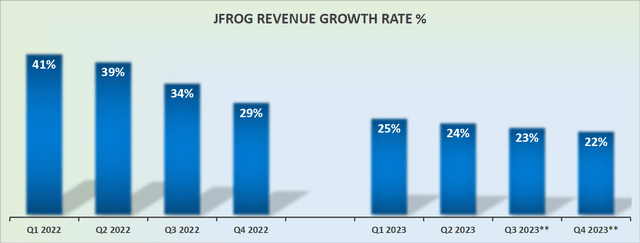

- The company's growth rates have slowed, stabilizing at around the mid-20s% CAGR.

- The stock's rich valuation, once we focus on its recent multiple expansion, keeps me cautious.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

hapabapa

Investment Thesis

JFrog (NASDAQ:FROG) is a DevOps platform that powers and controls the software supply chain, enabling organizations to continuously and securely deliver software updates across any system, a version-less software approach, if you will.

JFrog's value proposition revolves around providing a comprehensive DevOps platform that streamlines software development and delivery and promotes collaboration among development and operations teams. Their platform is flexible and highly scalable.

As we discuss JFrog, there are some positive aspects and some negative ones. The reason why I'm not particularly bullish on this stock is that I believe that the stock is already fairly priced. What this means in practice is that I suspect that the stock will continue to perform strongly, but I don't believe it makes sense for me to buy at this valuation.

JFrog's Near Prospects

JFrog's primary mission is to enable what they call "Liquid Software," which means continuously updated, version-less software. They offer a comprehensive DevOps platform that controls the entire software supply chain, allowing organizations to continuously and securely deliver software updates across different systems.

At the core of their value proposition is an end-to-end DevOps platform that serves as a critical bridge between software development and deployment. This platform streamlines workflows and fosters collaboration among teams.

Central to JFrog's offering is Artifactory, a universal package repository. Artifactory serves as a central hub for storing and, managing software packages of various types.

Security and compliance are paramount in modern software development, and JFrog addresses these concerns with solutions like Xray and Advanced Security. These tools scan software packages for vulnerabilities, license compliance, and quality issues. By identifying and mitigating potential security risks early, organizations can release software more confidently.

Flexibility is a crucial aspect of JFrog's platform. It can be deployed in a multi-cloud environment. This flexibility allows organizations to choose the deployment option that best suits their needs, avoiding vendor lock-in.

JFrog actively promotes DevOps and DevSecOps practices by bridging the gap between development and operations teams.

JFrog adopts a customer-centric approach. They offer various access points, including freemium offerings, free trials, and open-source versions of their products, enabling users to explore their platform before committing to subscriptions.

During its recent earnings call, JFrog described how its security offering will be a cornerstone of its strategic focus. Noting that JFrog Advanced Security stands out as a comprehensive solution, addressing various aspects of DevSecOps. This all-encompassing approach is designed to fortify the software supply chain by bundling important security capabilities into a consolidated solution, a significant departure from point solutions in the market.

That being said, JFrog is aware of the challenges posed by open-source components in modern software development. In an attempt to counter these risks, JFrog offers tools like JFrog XRAY and JFrog Curation. These tools automatically detect and prevent malicious packages and policy-violating software from infiltrating an organization.

Here's a quote from the earnings call echoing this assertion,

This solution automates the curation of open source software entering an organization before the development process begins. JFrog Curation automatically checks for malicious components and policy violating software and prevents them from ever entering the organization and compromising security of the software supply chain.

As you can see, JFrog Curation, in particular, allows for the centralized definition of security policies that can be enforced at a global scale across organizations, ensuring consistent and robust security practices.

With this framework in mind, let's discuss its outlook.

Revenue Growth Rates Decelerate

I'll cut to the chase. There are some positive and negative aspects facing this stock.

The first, the most obvious one, JFrog's growth rates are slowing down. The good news is that it appears to have stabilized at around the mid-20s.

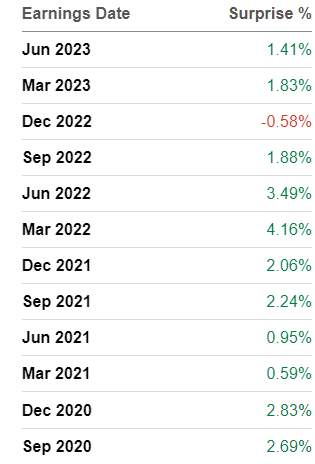

As a corollary to that, the business is making less than $0.5 billion in revenues. What's more, as you can see below, JFrog neatly guides for the next quarter and only marginally beats upon its guidance.

SA Premium

In other words, what we see above, in terms of guidance, is really what we get. This is a digital transformation and cloud migration story with respectable growth that emphasizes the balance between cost control and reinvesting in its teams. All this leads us to discuss its valuation.

FROG Stock Valuation -- ~80x 2024 Operating Profits

The problem I have with investing in JFrog is that I find its stock too richly priced. I get that it has an attractive narrative. And I also get that its customers are sticky.

But even if we presume that looking out to next calendar year, JFrog's bottom line profitability was to dramatically outpace its expected topline growth and grow by 30% CAGR to around $30 to $35 million, this would still leave the stock priced at more than 80x next year's non-GAAP operating profits.

Personally, I don't believe this affords me an attractive margin of safety. And whilst I acknowledge that such as trite consideration as a margin of safety shouldn't be considered when investing in a tech stock, after all, Amazon (AMZN), Tesla (TSLA), or Netflix (NFLX) were never cheap to start with, recall, not every business is the next Amazon or similar.

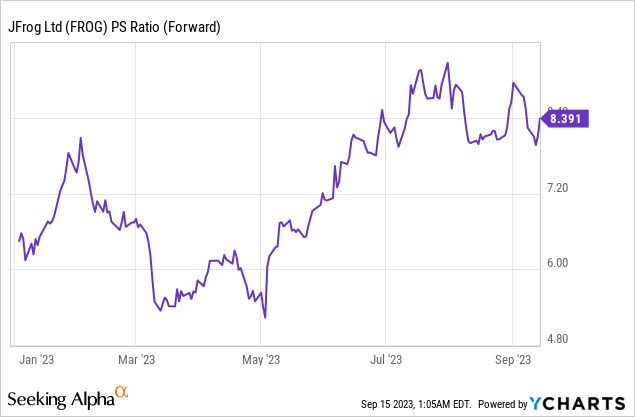

In my attempts not to jar with any reader (any more than I may have already), I'll ask that you consider this graphic that follows.

Since May, the stock has been moving higher on the back of a multiple expansion. And to presume that its multiple can continue to increase at such a rapid clip, over the next 12 months, is a tricky investment bar to cross.

The Bottom Line

In considering JFrog's position and potential, I find myself wavering. On one hand, they offer a robust DevOps platform emphasizing continuous, secure software delivery and have a solid customer-centric approach with enticing security offerings. However, their growth rates have slowed, and their current valuation seems quite steep, raising concerns about investment safety. With uncertainties surrounding their future multiple expansion, approaching JFrog's stock leaves me in a state of hesitation.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)