Amarin's Financial Tug-Of-War: Vascepa Vs. Generics

Summary

- Amarin's Q2 2023 earnings declined 15% YoY, citing increased competition and pricing pressures, despite cost-cutting and restructuring.

- Company maintains liquidity, explores European and global markets as potential growth areas amid U.S. competition.

- Investment recommendation is "Hold," as Amarin manages financial stability but lacks a convincing strategy against declining Vascepa revenues.

Paperkites/iStock via Getty Images

Introduction

Amarin (NASDAQ:AMRN) is a pharmaceutical company specializing in cardiovascular health therapies. Its flagship product, Vascepa, approved by the U.S. FDA and other global agencies, targets high triglyceride levels to reduce cardiovascular risk. Initially launched in 2013, Vascepa has received expanded approvals for use in high-risk statin-treated patients. Recently, the company underwent an organizational restructuring, cutting its workforce by 30% to pivot towards a new strategic focus, aiming to streamline operations and save $40 million annually. Vascepa faces competition from generics but remains a key player in its market.

The following article delves into Amarin's financial performance and strategic shifts. Amid declining revenues and rising competition, the company's cost-cutting and global expansion offer a mixed outlook. "Hold" advised for investors.

Q2 Earnings Report

Looking at Amarin's most recent earnings report, total net revenue for Q2 2023 was $80.2M, down 15% YoY due to increased competition and pricing pressure. Net product revenue declined 31% to $65.2M. Licensing and royalty revenue was $15M, which includes $11.1M of non-cash payment. Expenses were generally lower: cost of goods sold was $37.5M, SG&A expenses fell to $51M, and R&D costs were $5.6M. The company incurred a $10M restructuring expense. Amarin reported $313M of cash/investments on hand and lowered its 2023 operating expense guidance to $240M-$250M, affirming the adequacy of current assets for ongoing operations. Management attributes changes mainly to cost-reduction plans and restructuring.

Net Cash & Liquidity

Turning to Amarin's balance sheet, the company has cash and cash equivalents amounting to $233M, short-term investments at $79.9M, and long-term investments at $0.067M. Summing these up, the company has about $313M in liquid assets. For the six months ending June 30, 2023, Amarin had a net cash provided by operating activities of $0.196M, indicating it adds roughly $0.033M per month to its resources. A cautionary note: these figures are based on past data and might not be indicative of future performance. Moreover, ongoing declines in revenue could jeopardize profitability.

Amarin exhibits relatively sound liquidity with its ample cash reserves and investments. The company has total current liabilities amounting to $270.9M and long-term liabilities of $20M. With a positive operating net cash, the chances of the company securing additional financing appear favorable if needed. These are my personal observations, and other analysts might interpret the data differently.

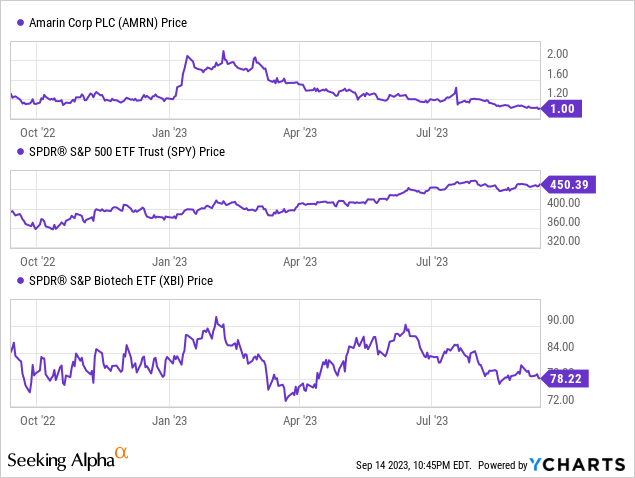

Capital Structure, Growth, & Momentum

According to Seeking Alpha data, Amarin's capital structure is intriguing with a relatively minimal level of debt in contrast to a large cash reserve, resulting in an enterprise value of $100.22M despite a market cap of over $400M. Growth prospects are bleak, with FY2023 and FY2024 revenues expected to decline by 24.41% and 23.29%, respectively. This downtrend raises questions about future earnings, especially given the company's recent restructuring and the competitive landscape. Stock momentum has been negative over multiple timeframes, underperforming the S&P 500.

Amarin Balances U.S. Risks with European Promise

While Amarin's aggressive cost-saving measures in the U.S. have been effective, they might hint at a focus on maintaining profitability at the expense of growth, suggesting a product facing challenges or entering maturity. Despite facing an increasing number of generic versions in the U.S., which could force more aggressive pricing or marketing strategies, Vascepa holds promise in the European market. Europe's longer market protection period and healthcare focus on specialists offer a more targeted, potentially cost-effective promotional strategy, which could serve as a lifeline.

Moreover, Vascepa's global expansion, including into China and MENA regions, serves as a hedge against U.S. market losses. However, each new market comes with its own set of regulatory and reimbursement challenges, adding layers of operational complexity. Amarin's reliance on third-party data for prescription numbers also introduces a layer of risk into its strategic planning.

Finally, the strong European patent portfolio extending potentially until 2039 provides some long-term revenue potential. However, intellectual property risks remain a concern, especially in light of past U.S. court rulings that invalidated several of Vascepa's patents. Overall, Vascepa faces a competitive U.S. landscape but finds balance in its opportunities in Europe and other global markets. The company will need to exercise effective market segmentation and agile operational adjustments to navigate these complexities.

My Analysis & Recommendation

In conclusion, Amarin is undoubtedly doing an admirable job in staying financially stable through cost-cutting measures and restructuring. However, the central issue remains: Vascepa's revenues are on a downswing, and there's a notable lack of visibility beyond this core product. Despite the company's restructuring and cost-saving initiatives, these moves could signify not a leaner, more agile Amarin, but a company fighting to maintain relevance in a highly competitive market.

Investors need to keep an eye on a couple of crucial elements in the coming weeks and months. First, Amarin's entry into the European market and potential expansion into China and MENA regions could be a crucial turning point. These expansions come with their own regulatory and reimbursement headaches, and missteps here could be costly. Second, pay close attention to the company's ability to diversify its product line or to make Vascepa more competitive against generics. A failure to do so could put long-term earnings in jeopardy.

Based on the current circumstances, my investment recommendation would be a "Hold." The company is navigating turbulent waters with some skill but hasn't yet demonstrated a strategy that convincingly tackles declining revenues and increasing competition for Vascepa. Until there's more clarity on these fronts, it would be prudent to hold off on increasing positions in Amarin.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

from big pharma expounding upon the wonders of their various products, but little if anything from AMRN on a medication that arguably rivals statins in terms of risk reduction.Sad!