Solana: Sell The Rumor, Buy The News?

Summary

- Solana has struggled to a larger degree than other cryptocurrencies since the collapse of FTX.

- A large driver of SOL's comparative weakness stems from soon to be liquidated FTX holding more than $1 billion in SOL tokens.

- Despite the FTX overhang and declining chain usage, the recent news of Visa utilizing Solana for USDC settlement is a significant milestone.

Dennis Diatel Photography/iStock Editorial via Getty Images

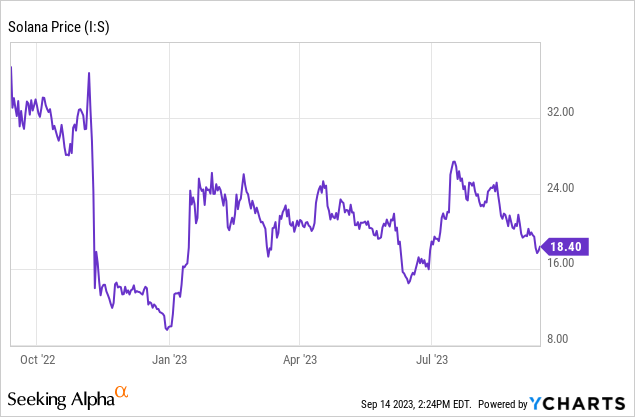

It's been a volatile 12 months for holders of Solana (SOL-USD). After getting absolutely massacred from an intraday high of $38.79 on November 5th, 2022 down to $12.09 just four days later, SOL continued to range between $12-15 through most of November and December before finding what could very possibly be a cycle bottom of $8 on December 29th.

Since then, SOL has served as one of the better trading vectors in crypto over the last 9 months, as it has seen traded between $15-25 dollars for much of 2023. Though I've covered SOL and even held it in my portfolio at times over the last couple of years, I've remained largely on the Solana sidelines since the FTX collapse.

Quick Summary

As it has been nearly a year since I last covered SOL for Seeking Alpha, for the benefit of my newer followers who may not be familiar with the idea, I'll provide a very brief background. Solana is a layer 1 public blockchain that gained notoriety in the back half of 2021. The allure of Solana as a smart contract blockchain network was because the chain had higher throughput, faster transactions, and much cheaper fees than the more popular Ethereum (ETH-USD) blockchain.

Since Solana was viable for much lower-value transactions, it was believed by many (myself included) that Solana was well positioned to take market share away from Ethereum in notable crypto areas like DeFi and NFTs. Since SOL served as the native asset and gas payment token of all transactions on the Solana blockchain, an increase in adoption of Solana figured to naturally drive the price of SOL higher provided demand growth outpaced token emissions. As an inflationary token without a supply cap, dilution was always a possible concern, and I personally viewed SOL as an asset that had to be staked.

FTX Overhang Ending?

After FTX blew up, SOL collapsed nearly 70% in a matter of a few days due to investment connections to FTX and Alameda Research. Through court filings, we later found out that FTX had over $1 billion in Solana. And as of the end of August 2023, those holdings were valued at just under $1.2 billion.

| FTX Top 5 Holdings | Holdings ($M) | Tokens (millions) | % of Supply |

| SOL | 1,162 | 55.756 | 13.65% |

| Bitcoin (BTC-USD) | 560 | 0.021 | 0.11% |

| ETH | 192 | 0.113 | 0.09% |

| Aptos (APT-USD) | 137 | 23.687 | 10.38% |

| Tether (USDT-USD) | 120 | 120.000 | 0.14% |

Source: CoinGecko

Given FTX's control of 13.7% of the SOL supply, there have been totally justifiable concerns about those SOL tokens hammering the price of the asset when the FTX coins are liquidated. Now that the court has given the liquidation team the green light to start unwinding, those concerns have been renewed. Upon closer look though, some of these fears may be unfounded.

| Unlocks | # of SOL | Unlock Schedule | Tokens per Unlock |

| 1 | 12,000,000 | Sep 2021 - Sep 2027 (Linear monthly) | 142,857 |

| 2 | 32,524,833 | Jan 2022 - Jan 2028 (Linear monthly) | 451,734 |

| 3 | 7,500,000 | Mar 1, 2025 (Full Unlock) | 7,500,000 |

| 4 | 61,853 | May 17, 2025 (Full Unlock) | 61,853 |

Source: CoinGecko

Coins often aren't available to be moved until they are vested. As it happens, many of the SOL coins in those FTX holdings are actually still locked and will be for some time. The true level of FTX SOL liquidations will be closer to 618k SOL per month, rather than one enormous sale of nearly 14% of the supply. But be advised there is a full block of 7.5 million SOL that can come into the market on March 1st, 2025.

Network Metrics

From a DeFi standpoint, Solana has experienced one of the larger collapses in TVL since late 2021. Measured in USD, Solana's TVL dropped 97% from a high of $10 billion in November 2021. However, when adjusting for the native asset price fluctuation, we can see the TVL measured in SOL is actually up to 16.6 million SOL from a January low of just 10.4 million SOL:

SOL TVL (DeFi Llama)

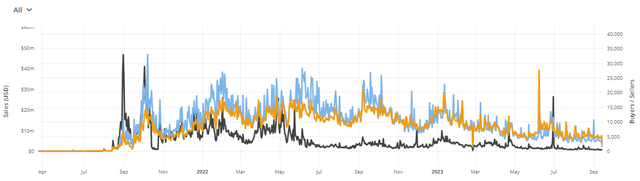

Still, at just $306 million in total value locked, Solana has already been passed by the recently launched Base blockchain developed by Coinbase (COIN). It hasn't been much better in the NFT department, where Solana's sales in August were down about 90% from the April 2022 high of $356 million:

Solana NFTs (CryptoSlam)

Even though sales have been down for months, the buyer and seller activity on Solana has weathered crypto winter fairly well compared to some of the competing "ETH killer" layer 1 chains.

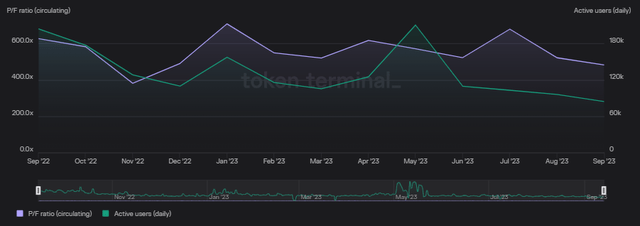

Solana (Token Terminal)

That said, monthly DAUs slipped below 100k in August for the first time in at least the last 12 months and at a 482x circulating P/S ratio, Solana isn't exactly cheap compared to chains like Ethereum, Arbitrum (ARB-USD) or Optimism (OP-USD). However, despite all of the down metrics, Solana's destiny may not actually be one of imminent doom.

The Visa Pilot

One of the more positive developments regarding the fundamental story for the network was the recent announcement that Visa (V) would be utilizing Circle's USDC Stablecoin (USDC-USD) on the Solana blockchain in a pilot program that includes Worldpay and Nuvei (NASDAQ:NVEI) for managing merchant settlements.

Following that news, SOL immediately spiked over $20, but has since retreated back below $18. From where I sit, this Visa news is actually a very important milestone for Solana, and it lends credence to the notion that the future is going to be a multi-chain world. In a multi-chain environment, fast, cheap transactions will likely attract the attention of merchants globally who pay significant fees to third party processing providers.

| Rank | Blockchain | 1d Change | 7d Change | 1m Change | USDC Circulating |

|---|---|---|---|---|---|

| 1 | Ethereum | 0.1% | 0.5% | 0.9% | $21.325b |

| 2 | Arbitrum | -0.7% | -0.6% | -25.7% | $658.5m |

| 3 | Solana | -1.0% | -1.1% | -8.7% | $626.29m |

| 4 | Polygon (MATIC-USD) | -1.5% | 2.9% | 5.0% | $611.98m |

| 5 | Avalanche (AVAX-USD) | 1.2% | 0.0% | -8.8% | $461.24m |

Source: DeFi Llama

Going forward, I think it makes some sense to pay attention to the circulating market cap of USDC on Solana and how that trend compares to other blockchains. Over the last month, Solana has experienced an 8.7% decline in circulating USDC on the network. This is inline with a chain like Avalanche but behind Polygon and Ethereum. At the third largest circulating cap of USDC on any one chain, I'd like to see Solana distance itself from Polygon and Avalanche and potentially even overtake Arbitrum as the second-largest blockchain for USDC supply for me to make Solana a significant holding in my crypto portfolio again.

Investor Takeaways

Solana is a blockchain that has almost become a joke to some in the crypto community. Among other things, there has been a history of network stoppages, concerns about centralization, and a general lack of interoperability with the rest of the smart contract ecosystem. Despite all that, the network itself is actually very impressive. I've experimented with Solana dApps. In my view, Solana offers a lot of things that other blockchains really can't match in the speed and ease of use departments.

The FTX liquidation has been a concern for a long time, and it's likely been keeping a ceiling on SOL's relief rally in 2023. But now that we have some guidance on how the FTX liquidation will be handled, I believe the widespread negativity concerning Solana may be close to priced in at this point. Barring a total collapse in the broad cryptocurrency market, I believe it's relatively safe to start responsibly scaling into a SOL position again in a high-risk portfolio for long term cryptocurrency exposure. I've started buying under $19 and will keep any additional purchases small while maintaining a close eye on the chain's USDC footprint for a larger signal.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, ETH-USD, MATIC-USD, AVAX-USD, SOL-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.