Vital Energy: Permian Acquisitions Are How You Increase Cash Flow Quickly

Summary

- Vital Energy made a series of significant acquisitions to increase cash flow, with the cost still relatively cheap compared to pre-oil price crash figures.

- The acquisition continues (even accelerates) a transition from a reserve-based strategy, which may result in more shares outstanding but greater free cash flow.

- The use of common stock in the transaction is decreasing financial leverage which increases the safety of the investment.

- The gas weighted acreage provides speculative upside possibilities as the export capability of the industry rises.

- If the acquisition market dries up, there are plenty of very profitable free cash flow generating well locations to continue financial improvement.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

bjdlzx

Vital Energy (NYSE:VTLE) took a huge step to increase cash flow with the latest acquisition announcement. The cost of the acquisition still looks cheap compared to historical figures before the 2015 oil price crash as well as before COVID. However, that cost also is rising even if it's still firmly "in the cheap zone." Therefore, the transition to more free cash flow from a reserve-based strategy (that often-involved negative cash flow and asset sales to keep debt down) is likely to involve more shareholder dilution as is shown in the current announcement. Still this management got an early start on this strategy. Therefore, the transition is not likely to cost shareholders as much here in terms of number of shares issued as it will elsewhere to get where management is going.

Acquisition Announcement

The company announced three transactions.

Vital Energy Summary Of Acquisitions (Vital Energy Announcement Presentation September 2023)

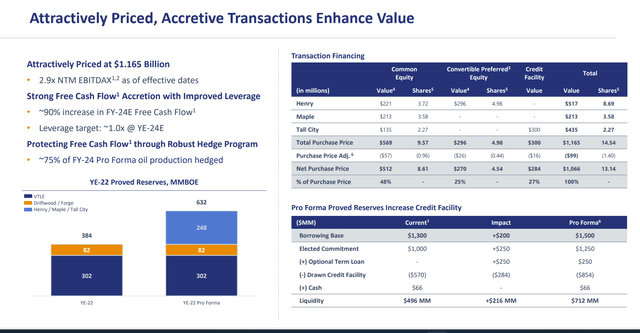

The more common stock a company uses, then the more likely the transaction will be safer for shareholders. Loading up with debt on a transaction like this can easily prove fatal given the low visibility and volatility of the industry.

More importantly, stock (or equity) does not have to be repaid. That "insures" (as much as possible for upstream) that free cash flow will grow as the stock part does not require the expenses of debt servicing.

As a side note, the company is already offering an additional 2.75 million common shares before overallotments which in theory (for all practical purposes) increases the equity component shown above even though that announcement is separate. For shareholders, that's likely to reduce the accretive nature of the transaction. But the extra cash will decrease implied financial leverage and increase the safety of the series of transactions from a financial standpoint. It also will free up the bank line more when combined with the concurrent offering of debt securities. It may even lead to a faster improvement in the debt ratings of the company which would decrease future borrowing interest expense.

As can be seen in the slide above, the value of common stock used in the transaction has been climbing. Note that common equity and preferred equity are about three quarters of the transaction value. But for common shareholders, the 48% figure is the number to use because unlike banks, for shareholders preferred equity is ahead of the common stock.

The immediately accretive part is important. Far more important is that much of this acreage cash flows as good or better than the legacy natural gas weighted acreage. Therefore, cash flow should increase which each well drilled even if the company does not grow production. That means if the acquisition market "dries up" this management can still increase future free cash flow. In many ways that is like hedging your bets as to how to proceed.

The Acreage

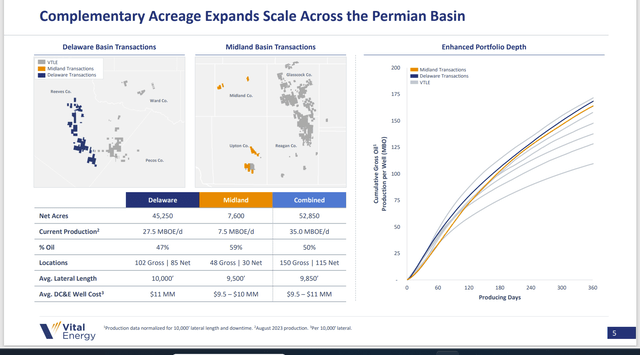

The gross price divided by the acreage acquired comes out to very roughly the $20,000 per acre. This is considerably less than the $65,000 per acre that the high production percentage (of oil) acreage generally sells for. But in return for that lower price, management likely will have access to some of that growing export capacity coming online within the next two years.

Given the profitability of these wells compared to the legacy acreage, the company can grow profits simply by replacing declining gassy production with more profitable oil weighted production from these wells. Growing production would simply raise the rate of free cash flow growth in the long run.

The Permian is probably the most oversupplied (or at least one of the most) part of the natural gas business in the United States and probably North America. Therefore, most companies in this area often receive some of the worst pricing in the industry because the drilling decision is often based upon the amount of oil that the well produces. Gas revenues are considered "extra."

Vital Energy Acquisition Acreage Production Profile Compared to Existing Acreage (Vital Energy Acquisition Presentation September 2023)

I would guess that the Howard County acreage probably is still the most profitable acreage for the company. However, expansion into Howard County in the future will face a lot of competition as Howard County has now been "discovered" by much of the industry. Therefore, expansion options at reasonable prices are likely limited. This industry, just like Mr. Market, tends to go overboard with pricing when competition intensifies. Therefore, it's to the credit of management that they're looking for better deals elsewhere.

As shown above the production combined with the percentage of oil produced is likely to prove very profitable for the company. Management is wisely hedging into the future. All any investor has to do is look at how long high prices lasted in 2022 to realize that a sure thing now to repay acquisitions is probably preferrable to risking more exposure to volatile oil and gas prices.

Not mentioned by management is that some of the acquired acreage shown above is obviously bolt-on to their acquired acreage as well as to company acreage. Larger acreage positions that are contiguous are often both more profitable and more marketable (should the need arise). Some of this is shown on other slides in the presentation. This management has in the past swapped small acreage positions to increase other acreage positions to further the advantage of "bolt-on" acquisitions.

The larger position also allows this management to acquire small subpar holdings (as this management does from time to time) that are "bolt-on" to increase the value of acreage held. Management has in the past paid as little as $2,000 an acre because some of those subpar holdings are so small that there is literally "no market" for them. Being willing to put together small acreage positions into larger acreage positions is an "extra mile" that's a hallmark of this management going the extra mile when a lot of managements that I follow simply cannot be bothered.

Risks

- Bigger acquisitions have a higher failure rate. Management is minimizing this risk by having done a lot of smaller acquisitions in the past and by staying with acreage it knows best.

- Anytime you acquire something you have the risk of overpaying. Right now that does not look like a real possibility, but it's possible for any acquisition to disappoint in ways not foreseen before management can actually operate the acquisition.

- Commodity prices may not cooperate with management forward assumptions and management may not sufficiently hedge to protect against unforeseen adverse events.

- Service costs can balloon beyond acquisition expectations to cause some drilling locations to become unprofitable.

- Last, another basin can become lower cost leaving the company in a less competitive position.

- Management used preferred convertible stock for the first time. That will imply a slightly higher risk for the common shares than the debt market would indicate because that preferred is between the common and the debt.

- There's a separate sale of stock that could cause pricing weakness that might lead to some buyer remorse. It usually does not happen but it could happen with the large number of shares eventually to be issues. The accretive nature of the whole transaction should offset this concern.

What The Acquisitions Change

This company sent the old management packing because that management relied on a reserve-based strategy that resulted in regularly large negative cash flows with periodic asset sales to reduce debt. That did allow continuing development. But the strategy also fell out of favor with the stock market and the debt market.

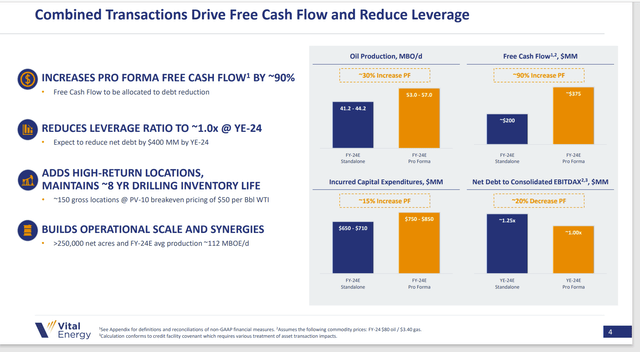

Currently, the market is allowing growth by acquisition and the debt market is cooperating with this strategy. Management has accelerated the growth of free cash flow with the 90% projected increase shown above. Strengthening commodity prices above the pricing assumptions used for this acquisition could accelerate the process more. The additional stock sale may indicate that the debt market is getting impatient with the pace of free cash flow growth.

Keep in mind that with rising commodity prices, the negotiations and the reserve report took place under considerably more conservative industry conditions. Nothing makes management look like a genius like rising commodity prices. In fact, making a big acquisition like this with rising commodity prices often allows hedging to preserve at least some of these prices should prices fall later. That can "guarantee" a successful acquisition regardless of what happens later.

The other upside of this acquisition is that these more profitable well locations will gradually replace declining production from less profitable or legacy gas weighted production. The company receives a big profitability boost from the acquisition and then slowly adds to that benefit over time.

In summary this is a big acceleration of a strategy that the company began years ago. It could be at least partly because sales prices are rising from some abysmal prices the company was able to take advantage of in the beginning. Therefore, the end of this route to quicker profitability and more free cash flow may be slowly closing. That makes the ability to drill for more free cash flow extremely important.

Also note that the sale of stock announcement mentioned early may mean debt market impatience with the pace of change of free cash flow. This company, like many repaid a fair amount of debt in 2022 with those high oil prices. Now it needs to demonstrate to the debt market that it can do the same at lower prices. Materially changing the production mix through a large acquisition to more profitable locations can do just that. Combine that with rising commodity prices and management could look really smart here.

The Net Result

This series of acquisitions assumes WTI $80 net oil. While no company will hedge 100% of production as a safety measure, this acquired production can be hedged to safeguard that assumption for at least a year. That would put the company well on the road to paying for this acquisition in the form of suitable profits for at least the first year no matter the level of commodity prices.

Vital Energy Summary Of Financial Benefits Of Acquisition (Vital Energy Acquisition Presentation September 2023)

Management can of course often hedge longer if desired. But the key is that a minimal return for some time to come can be obtained to assure at least a good start on the acquisition.

What makes the outlook look better than the worst-case scenario is a lack of speculative money pouring into the industry combined with a lot of insiders like this company taking advantage of the buyers' market. Now prices are rising so this option could close down in the future at some point. But for now, growing free cash flow through acquisitions is the preferred way to go. This management turned a negative cash flow (reserved based) situation into positive free cash flow combined with a sinking corporate breakeven point.

This company is going to be a far more robust competitor in the future.

The other consideration is that leverage is decreasing considerably as a result of this transaction. That is probably due to all the equity used in the transaction. Note that common shareholders do not quite get all the benefits because the preferred equity really counts as debt for common shareholders due to the superior claim on assets (until it converts). Therefore, for common shareholders the leverage will be a little bit higher.

Management also is sticking to areas it knows relatively well to reduce the risk of the acquisition failing. This management has been making acquisitions almost since it arrived. Therefore, the good track record so far helps to assure the success of the transactions.

The last consideration is that available well drilling sites are much more profitable than the legacy gas weighted acreage. The market has had considerable trepidation about lack of cash flow positive acreage. But management has done considerable work to reduce that type of risk.

As the cost of these acquisitions continue to rise, then the pathway toward profitability with this strategy will close. But this management has a backup plan in that there are a lot of locations (to drill) that will free cash flow now. That was not the case with the gas weighted legacy acreage. Therefore, the transition to market suitable debt ratios and free cash flow can continue under a wide variety of industry conditions.

There's also speculative upside in that as the North American capacity to export natural gas expands, the North American natural gas market may well join the much stronger world natural gas pricing market. This may make the legacy acreage far more valuable than it is now.

This issue is likely a strong buy consideration as management continues the progress toward market acceptable free cash flow and debt market acceptable debt ratios. Companies like this can remain bargains longer than many investors can be patient. However, management is definitely heading in the right direction. All that is needed now is to cross that threshold into market acceptability.

I analyze oil and gas companies like Vital Energy and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VITAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)