fuboTV: So You're Telling Me There's A Chance

Summary

- FUBO operates a cash incinerating vMVPD business that specifically curates to the sports viewer.

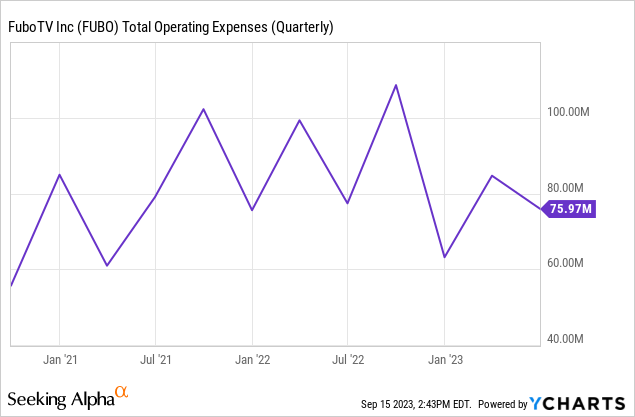

- Although the company still loses tens of millions of dollars per quarter, Fubo has trimmed opex and flipped gross profit margin from negative to positive.

- It's still a very risky name in my view, but given the low P/S and P/B multiples, I'm upgrading from "sell" to "hold."

gorodenkoff

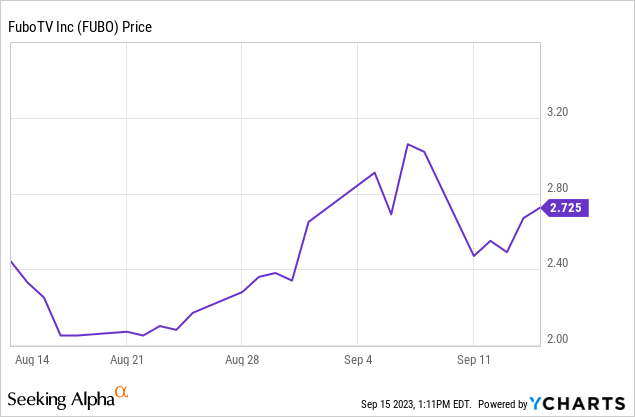

Now that a carriage deal has been reached between Disney (DIS) and Charter Communications (CHTR), one of the companies that was briefly benefitting from the dispute has almost completely retraced a 43% September gain from $2.34 to $3.35 per share.

It's been a wild month for fuboTV (NYSE:FUBO) shareholders. Now that the Disney/Charter dispute has been priced in and then priced out of FUBO, I think it's worth taking a fresh look at the fundamentals underlying fubo's business to determine if the stock makes some sense in the mid-$2 range. I've personally covered FuboTV for Seeking Alpha a few times in the past. My position on the company can best be summed up in this way from my last article:

Unfortunately, vMVPDs are just far too similar to the traditional MVPDs that they are believed to be disrupting. A key difference is most of the MVPD operators also sell the broadband access as part of the bundle. fuboTV doesn't have that luxury and is clearly running out of time. I have zero doubt fuboTV offers consumers a wonderful product. The problem is, if there isn't a market for that product at a price point that will allow the company to generate a profit from operations, the company has to find meaningful revenue from complementary models.

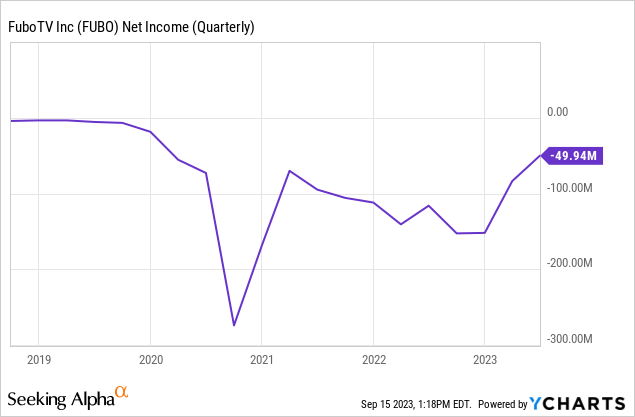

For a brief period, it looked like one of those complementary models the company planned to build out involved sports betting. However, that effort has since been put to rest. Despite that, Fubo's management has been able to reduce costs in recent quarters and Q2 was the company's best from a quarterly net loss standpoint in several years:

In this update, we'll look at Q2 performance, the balance sheet, and valuation.

Q2 Earnings

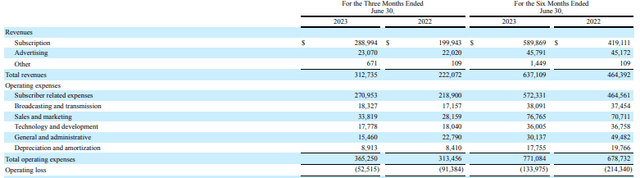

Top line revenue came in at $312.7 million - a year-over-year improvement of over 40%. Cost of revenue was $289.3 million, giving Fubo a gross profit margin of 7% for the quarter. Q2 was Fubo's third consecutive quarter of positive gross margin and by far the most profitable quarter of the three at $23.5 million.

Fubo was able to get total quarterly opex down to just $76 million, which was down slightly year over year and down about 10% sequentially. The overwhelming majority of that opex cut came from SG&A, which was down over 14% from Q1.

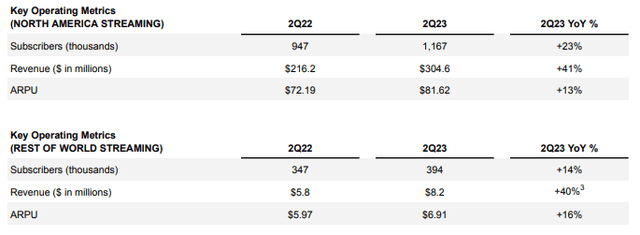

From an operational standpoint, Fubo grew subscribers by 23% year over year in the North American segment and by 14% in the rest of world segment. Arguably more positive though may be the 13% year-over-year jump in North American ARPU from $72.19 to $81.62. This seems to indicate a stickiness in the company's streaming service because at just 5% year-over-year growth, advertising was not a large source of Fubo's revenue improvement:

I'm going to flat out concede that I'm surprised Fubo has been able to continue growing subscribers this long, especially considering vMVPD peer SlingTV is losing subs. Fubo is guiding for 1.7 million worldwide subscribers in Q3. It'll be interesting to see if they hit that target. Given YouTube TV has taken over the NFL's Sunday Ticket offering, competition for the sports viewer may be a challenge for Fubo for the rest of the year. Having said that, there is no question Q2 was a better quarter for Fubo than we've seen in recent years.

However, the company did still lose over $52 million in the quarter. But despite the fact that Fubo is still losing a lot of money, the quarterly loss per share was more than cut in half sequentially from ($0.37) in Q1 to ($0.17) in Q2. The question then is how much longer can this continue?

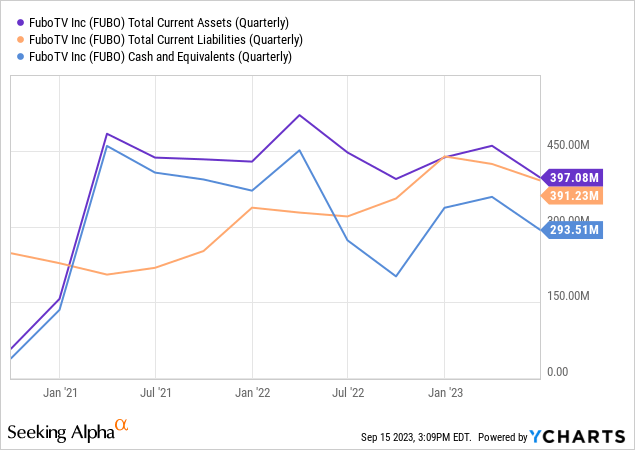

Balance Sheet

With over $293 million still in cash, the company can easily survive through 2024 at current cash burn levels. However, there is still quite a bit of debt on the balance sheet at $830.1 million and 47% of that debt is current.

The company has over $1.2 billion in total assets, but about half of that is "goodwill" and per the company's last 10-Q, there is a $148 million impairment charge. The company's reliance on goodwill and intangibles is something long-term investors should keep an eye on.

Valuation

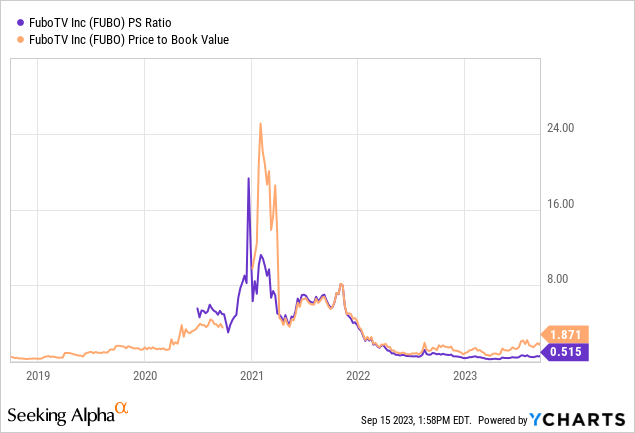

Fubo has a history of trading at pie in the sky multiples. Like other pure play streaming names, FUBO was a big beneficiary of COVID-era lockdowns. At its COVID valuation peaks, the stock was trading at roughly 20x sales and 25x book in late 2020 and early 2021:

Those multiples have corrected in a big way and FUBO now trades at a sizeable discount to sales.

FUBO (Seeking Alpha)

While it's important to mention the company is still unprofitable, it is arguably cheap compared to peers in the communication services sector if you are of the opinion that FuboTV will continue growing subscribers. If the company can continue its positive trajectory in cost-cutting and gross profit margin, I would expect a share price re-rating higher and valuation multiples more in line with peers as a base case.

Summary

I still have a lot of concerns with Fubo's fundamental model. As the broader media industry moves away from MVPDs and into a more direct-to-consumer product, Fubo is likely facing an uphill battle as a vMVPD provider that bundles content. Live sports, Fubo's core selling point, is a particularly expensive segment of bundled content and non-sports viewing MVPD subscribers have historically subsidized that programming for sports viewers. In my view, it could be difficult for Fubo leadership to navigate price increases that improve gross margin without exposing the company to possible subscriber churn as consumers increasingly become more price sensitive in an era of high inflation. Even sports fans likely have a limit.

All that said, I think there are definitely positives for long-term bulls. I have considerable doubts that those who have been riding all the way down from the $30's when I first covered the stock will ever be made whole unless they've continued to average down. But at a sub-$3 entry, there are worse ways to speculate in the public equity markets than longing FUBO at these levels. FUBO is trading at what I'd view as a reasonable book valuation and has a price to sales ratio well below 1.0. Given the improving operations and the valuation, I think an upgrade from "sell" to "hold" is warranted.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.