GoldMining: Looking Cheap Following Recent Selloff (Rating Upgrade)

Summary

- The company has around $127.5 million in cash and equity holdings, and I think the La Mina project alone could be worth over $80 million.

- The market capitalizations of U.S. GoldMining and Gold Royalty have slumped over the past few months, and I think they could rebound as gold is still above $1,900 per ounce.

- GoldMining has a decent cash position and I think that an equity offering is likely at least a year away.

- Microcap Review members get exclusive access to our real-world portfolio. See all our investments here »

Lemon_tm

Introduction

I’ve written a total of three articles on SA about gold miner GoldMining (NYSE:GLDG) (TSX:GOLD:CA), the latest of which was in November when I said that there was a lack of progress on project sales and spin-outs and that the company was starting to look like a value trap.

Well, GoldMining completed a $20 million IPO of its US arm U.S. GoldMining (USGO) in April and the balance sheet looked strong at the end of Q2 FY23 with C$26 million ($19.2 million) in cash and cash equivalents. GoldMining has around $127.5 million in cash and equity holdings and with the market capitalization recently dipping below $150 million, I feel comfortable upgrading my rating on the stock to speculative buy. Let’s review.

Overview of the recent developments

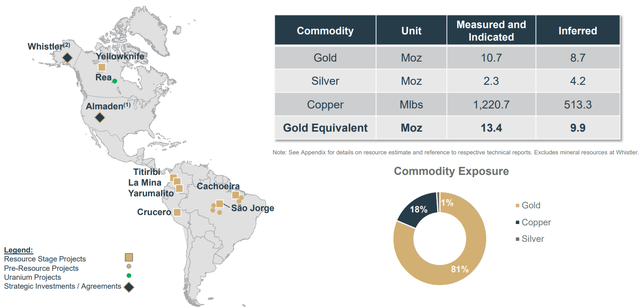

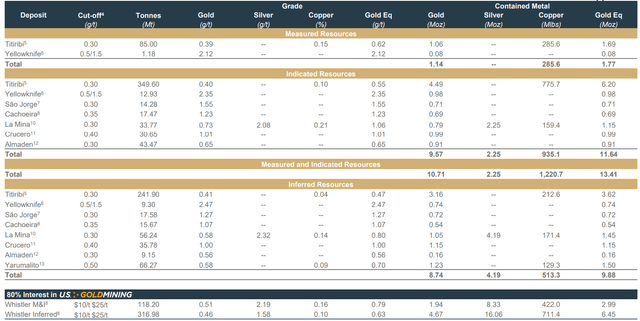

If you aren't familiar with the company or my earlier coverage, here's a brief description of the business. GoldMining owns a portfolio of 15 projects in North and South America - 14 gold properties as well as one uranium project. The gold projects have combined measured and indicated (M&I) resources of 16.4 million ounces of gold equivalent, but many of them are small. Only Titiribi, Whistler, La Mina, and Yellowknife have over a million ounces of gold equivalent in the measured and indicated category, with Titiribi alone accounting for almost half of the company’s M&I resources with 7.89 million ounces of gold equivalent.

GoldMining

The table above doesn’t include the 2.99 million ounces of gold equivalent M&I resources of the Whistler gold-copper project, which is owned by U.S. GoldMining. The latter was listed in a $20 million IPO on NASDAQ on April 24 and GoldMining currently holds almost 80% in it.

GoldMining

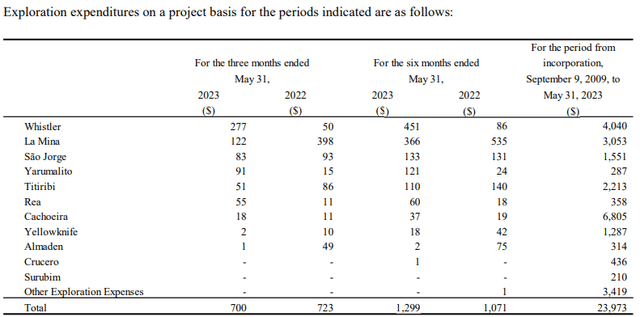

GoldMining doesn’t spend much on exploration, and its strategy of unlocking the value of its projects is through spin-outs and disposals. In March 2021, the company completed an $90 million IPO of its royalty arm Gold Royalty (GROY). In June 2022, GoldMining optioned its Almaden property to NevGold (NAU:CA; NAUFF) for up to C$16.5 million ($12.2 million). The idea behind this strategy is to keep a strong balance sheet and create value for shareholders with minimal stock dilution. Excluding Whistler, exploration expenditures came in at just C$0.85 million ($0.62 million) for the first half of FY23.

GoldMining

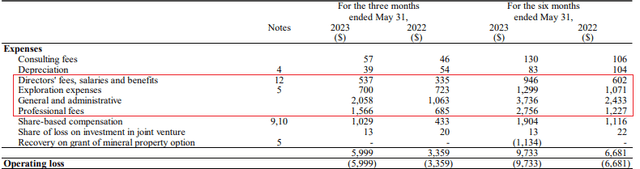

Yet, it’s worth noting that the cash burn is much higher than this as general and administrative expenses, professional fees, and directors’ fees, salaries and benefits came in at C$7.4 million ($5.5 million) for the same period, bringing the figure to C$8.3 million ($6.1 million) ex-Whistler. Considering that GoldMining had about C$26 million ($19.2 million) in cash and cash equivalents at the end of Q2 FY23, this gives it a runway of about 19 months as of May.

GoldMining

Now, taking a peek at the equity holdings, GoldMining owned a total of 9,622,491 U.S. GoldMining shares, 21,301,253 Gold Royalty shares, and 12,560,661 NevGold shares as of May 2023 according to its Q2 FY23 financial report. As of the time of writing, the U.S. GoldMining stake is worth $77.7 million, the Gold Royalty shares are valued at $28.1 million, while the interest in NevGold can fetch C$3.8 million ($2.8 million). Combined, we are looking at equity holdings of $108.6 million for GoldMining. The cash and equity holdings of the company thus stand at $127.5 million versus a market capitalization of $144.8 million as of the time of writing, meaning the market is valuing its gold and uranium projects at just $17.3 million. This is equal to only about $1.3 per ounce of gold equivalent of M&I resources, which I consider a low price to pay for a lottery ticket, considering most of these projects are likely to be either spun out or sold in the coming years. In addition, the share prices of U.S. GoldMining and Gold Royalty have declined significantly over the past few months despite gold prices hovering above $1,900 per ounce for the majority of the year. In my view, this sell-off seems unjustified and there is a decent chance that we will see a rebound in the share prices of the two companies over the next few months. The cash and equity holdings of GoldMining were worth about C$258 million ($190.1 million) in the middle of July when the company released its latest corporate presentation.

GoldMining

Looking at the next project to be spun-out, I think that the best candidate could be La Mina as it’s the most advanced project in GoldMining’s portfolio considering it’s the only one with a completed preliminary economic assessment (PEA). In my view, it’s a decent project with all-in sustaining costs (AISC) of $1,142 per ounce of gold net of by-product credits, while the after-tax net present value (NPV) stands at $274.5 million at $1,750 per ounce. Considering that development stage junior gold miners often trade at about 0.3-0.5x NPV, I think La Mina could be valued at above $80 million. An updated PEA was released in July, I think that a spin out could be coming in 2024.

Turning our attention to the downside risks, I think the major one is that the market capitalizations of U.S. GoldMining and Gold Royalty could continue sliding over the coming months, and the catalyst for this could be lower gold prices. Gold is often hailed as a hedge against inflation and with central banks around the world raising interest rates in a bid to tame inflation, the price of the yellow metal could come under pressure in the near future. In addition, operating expenses could keep growing, which would exhaust the cash reserves of GoldMining sooner than I’m expecting, and this could result in significant stock dilution. Also, it’s possible that I’m overly optimistic about the spin-out of La Mina in 2024. It could take several years for the next project spin-out or disposal to take place.

Investor takeaway

GoldMining has $127.5 million in cash and equity holdings, and I think that La Mina alone could be worth over $80 million. The company has a decent cash position and I think that an equity offering is likely at least a year away. In addition, the recent declines in the market valuations of U.S. GoldMining and Gold Royalty seem unjustified as gold is trading at above $1,900 per ounce as of the time of writing. However, there are several risks for the bull case, which is why my rating on the stock is a speculative buy. It could be best for risk-averse investors to avoid this one.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you like this article, consider joining Microcap Review. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys.

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.