Rio Tinto's ESG Performance Matters To Their Shareholders

Summary

- Rio Tinto's ESG performance will impact its financial performance as companies prioritize environmentally friendly products.

- The steel industry's transition to greener methods, such as using recycled steel scrap, is important for reducing emissions.

- European automakers will demand low-carbon steel due to new climate legislation, creating opportunities for companies like Rio Tinto.

Leonhard Simon/Getty Images News Rio Tinto's logo (Rio Tinto)

Investment Thesis

It has been a year since we shared with the SA community our views on Rio Tinto (NYSE:RIO)

As we stated in the title of our June article, we were of the belief that investors could take comfort in Rio's margin of safety.

In autumn, we highlighted how important it is what happens in China in another article.

One important point we tried to make in that article was:

China's real estate sector, which is struggling, has accounted for as much as one-third of the nation's GDP and roughly one-third of the steel produced. There is a need for some government support and intervention to stabilize the real estate market in China. Until this is done, it is unlikely that we will see any major positive shift in demand over the next few months."

It is the real estate developers which is the largest problem. Some will make it, but some of them will disappear. Home buyers, servicing their mortgages, are not the biggest problem. When China's two largest banks, ICBC and BOC, recently reported their FH 2023 results, they actually reported lower Non-Performing Loans. Interest rates in China have already started to fall, and these two banks have already started to lower their mortgage rates.

It will take some time for the "animal spirit" in China to be reawakened. And when it happens, steel consumption will continue to grow.

In the meantime, we want to focus on RIO's ESG performance, as we believe this too will have an impact on how they will do financially.

Greener steel

The whole world is getting clear signs about climate change.

Europe just experienced the highest air temperatures this summer. China had the worst flood in 140 years. The list of events goes on and on. The costs to society are going to be in the trillions of dollars.

Most leaders attending the latest G-20 session in Delhi agreed that now is the time to take action.

With that backdrop, companies will "double down" on ESG-related activities and many consumers will choose to purchase products that are made, used, and have an end-of-life that is the most environmentally friendly.

There are basically two ways to make steel. The first is through blast furnaces, which use iron ore and coking coal. As we know, RIO is one of the largest producers of iron ore.

Then you have the second way, which is to reuse recycled steel scrap. In terms of the environmental impact of this method, it is somewhat better. In 2021, about 21.9% of crude steel output in China came from recycled steel scrap. That was double what it was six years earlier. If we compare this with the U.S., we see that 47% came from steel scrap in 2019. This could increase, but it comes with its own set of challenges. Having a sufficient supply of scrap iron is one, and a sufficient supply of reliable electricity is another. Both are insufficient in many parts of China.

When we look at the scope 1 pollution of the whole steel industry, IEA reported in July 2023 that they produced 1.41 tons of CO2 for every ton of steel produced. It has been stable since 2010. The world produced 1.88 billion tons of steel in 2022, according to the World Steel Association. That is 2.65 billion tons of CO2 released into the air in just one year.

In addition, comes air pollution from scopes 2 and 3. Seaborne trade of iron ore is about 1.5 billion tons per year. A standard bulk carrier can ship about 200,000 tons of iron ore during each voyage. That is 7,500 bulk carrier shipments.

One company that can reduce companies like RIO's scope 3 emissions, is Himalaya Shipping (HSHP) which can run on LNG as a fuel. We covered them here.

For the steel industry to reach net-zero emission by 2050 they need to accelerate the reduction of emissions considerably.

Some development is taking place using new technology with direct reduction of hydrogen.

RIO is not sitting idle and just "waiting to see what will happen".

Through their subsidiary, Rio Tinto Iron Ore Company of Canada, they have signed a multi-year agreement to sell a part of their low-carbon hot briquetted iron pellets to H2 Green Steel of Sweden which is developing the world's first large-scale production of low-cargo iron and steel in Boden, Sweden. It is expected to start operation in 2025.

By using green hydrogen in an electric arc furnace, instead of the traditional blast furnace method using coal, the emission is expected to be reduced by 95%.

Other projects that can help steel mills to go green are also in progress.

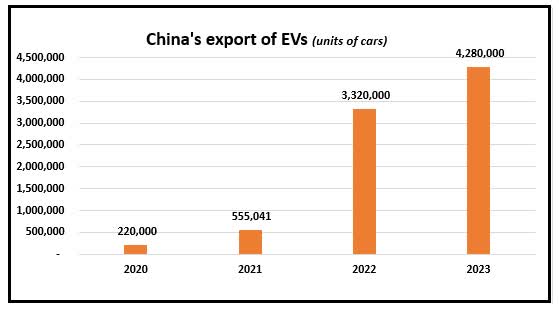

This is important, because customers, like the auto industry, are pushing ahead with marketing and selling cars that not only are cleaner to use, but cleaner to produce. More customers care.

According to a report from McKinsey, steel contributes 30 to 40% of a vehicle's material emissions. With the transition to EVs, the portion of steel in cars is growing. Cars are supposed to get lighter, but they are in fact getting larger and heavier every year.

In January 2026, a new climate legislation takes full effect in the European Union. It is called the EU Carbon Border Adjustment Mechanism. It will impose taxes on imports of steel and other high-carbon materials based on the volume of emissions from production. If steelmakers fail to decarbonize, they will face a steep disadvantage in the EU market. Therefore, the European automakers will want to procure low-carbon steel.

It is already happening in the aluminum industry. Norsk Hydro, which we recently covered here in SA, signed long-term contracts with Mercedes Benz (OTCPK:MBGAF) to supply "green aluminum".

On the topic of the auto industry, Chinese companies, in the context of where RIO's large part of iron ore goes, are gaining market share in Europe when it comes to EVs.

China's growth of export of EVs (Data from China Custom Authority. Graph by author)

Greener steel will come, although most likely slower from China than the EU and the US.

Companies, like RIO, can either be a part of the problem or choose to be a part of the solution. We believe that, ultimately, those who are proactive in this transition will become the winners.

Fortunately, RIO is proactive in this field with the plan to invest an estimated $7.5 billion between 2022 and 2030 to deliver on its decarbonization plan.

The mining industry is a risky business

In our article of June last year, we touched on the fact that there are many risks associated with developing new mines. For some reason, our creator put many of the valuable resources in countries with poor or no due process and a fair judiciary system. This is often combined with no democracy and a high level of corruption, plus a long list of human rights violations.

There is always a long lead time from when a company gives the green light to invest in a green field plot of land and before a single ton of commodity can be offered for sale in the market.

Billions of dollars need to be invested, too.

On that topic, we have been eagerly awaiting the development in Simandou, Guinea, which was described in our article last year. To illustrate how long time a project like this will take, we can inform you that RIO has had the license there since 1997.

Simandou mine project in West Africa (Rio Tinto)

The latest is that the government of Guinea is in agreement with the consortium's proposal. What is left is to negotiate negotiations between the partners to finalize the investment agreements and related shareholders agreements that underpin the co-development.

This might take more time, as we believe the Chinese government has domestic financial issues that might get higher priority at this moment.

Margin of Safety

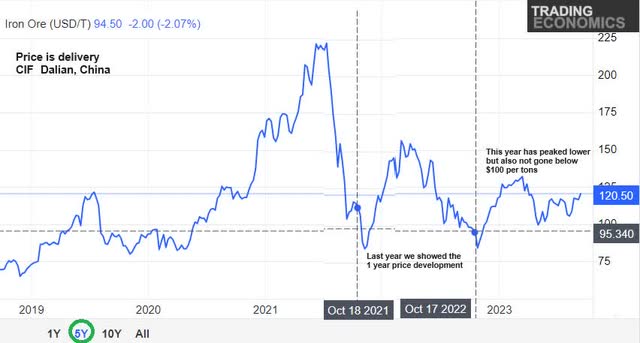

Last year, we shared our graph showing the decline in the iron ore prices between October 2021 and 2022.

The price of Iron Ore delivered to North China (Trade Economics. Comments on graph by author)

This year, despite all the negative news out of China, the price of iron ore delivered to Dalian in North China has been trading in the $100 to $125 range.

The FOB price for their iron ore from the Pilbara mine in Western Australia was $21.20 and the cost to ship it to North China is approximately $8.50.

That leaves them with a very good margin of safety.

It is important to understand that at that kind of level, RIO is comfortably producing a good stream of free cash flow. However, the free cash flow did drop 47% Y-o-Y in FH 2023 to $3.77 billion.

Their low net debt of just $4.3 billion is also a big plus with the increased cost of borrowing. That is another reason we are of the opinion that RIO has a large margin of safety.

Conclusion

Other analysts here in SA have covered RIO's FH 2023 results. As we just mentioned, the free cash flow did drop considerably on the back of lower commodity prices in FH 2023 when compared to FH 2022.

We are confident that demand for steel, aluminum, and copper, being RIO's three main commodities, will rebound as the world's energy transformation will require replacements of old outdated assets.

Our Buy stance on RIO remains.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)