Huntington Bancshares: The Mispriced Regional Powerhouse

Summary

- Huntington Bancshares offers a unique post-crisis investment backed by robust net interest income, low non-performing assets, stable deposits, and solid capital ratios.

- The bank's share price is undervalued, presenting a potential capital gain of up to 50% and an elevated 5.5% dividend yield.

- Through strategic expansion and digital innovation, HBAN is enhancing customer engagement and operational efficiency.

- We believe the potential for capital gains, coupled with the dividend yield, more than compensates for the well-managed market, liquidity, and credit risks.

- Market recognition of HBAN's various strengths is anticipated to catalyze further upward price movement.

Editor's note: Seeking Alpha is proud to welcome Juri von Randow as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

HBAN: Unlocking Value While Rising from Crisis

sefa ozel

Investment Thesis

Huntington Bancshares (NASDAQ:HBAN) presents a compelling investment opportunity, especially in the current volatile, post-crisis market. The bank showcases strong fundamentals such as robust net interest income, low nonperforming assets, a stable customer deposit base, and solid regulatory capital ratios. These factors signal resilience and long-term stability. HBAN's stock is also trading at a significant discount due to market overreactions to the recent regional banking crisis.

With a track record of consistent growth—organically and through strategic acquisitions—HBAN has outperformed most of its peers, offering an optimistic outlook. A 50% upside potential, complemented by an attractive 5.5% dividend yield, should appeal to long-term investors. Key catalysts for the upside include market recognition of HBAN's mispriced valuation, its solid fundamentals, and the continuation of its growth strategies. This marks an opportune moment for investment.

Company Insights

In a volatile post-crisis market, looking closely at financial data and relevant external factors affecting a company is more important than ever. This way, we avoid participating in potential further share price declines and determine whether the sudden drop in value is due to changes in the company's fundamentals or simply an overreaction to the crisis.

We begin with a brief overview of the bank. Then, we identify outliers in HBAN's financials and conclude by arguing that investing in the bank offers significantly more upside potential than downside risk.

Overview

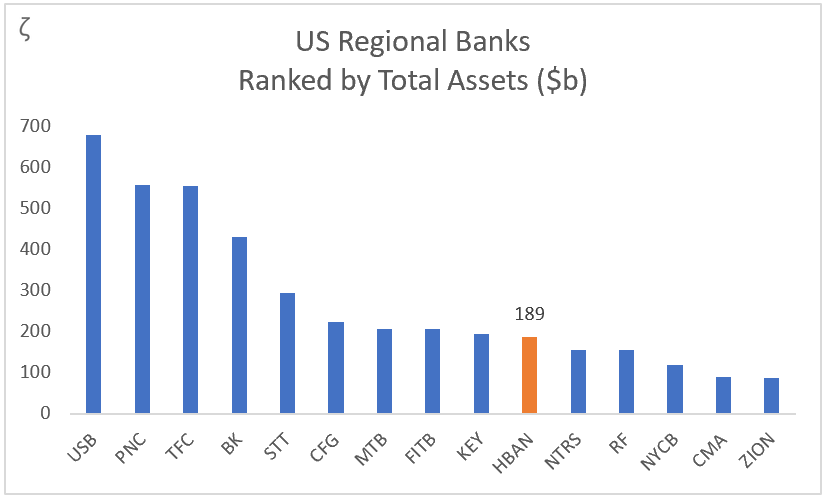

Huntington Bancshares ranks among the top 15 U.S. regional banks and is headquartered in Columbus, Ohio. With $189 billion in assets, Huntington National Bank and its affiliates operate over 1,000 branches across 11 Midwestern states, while some of their businesses extend into additional geographies.

MacroDozer, Seeking Alpha

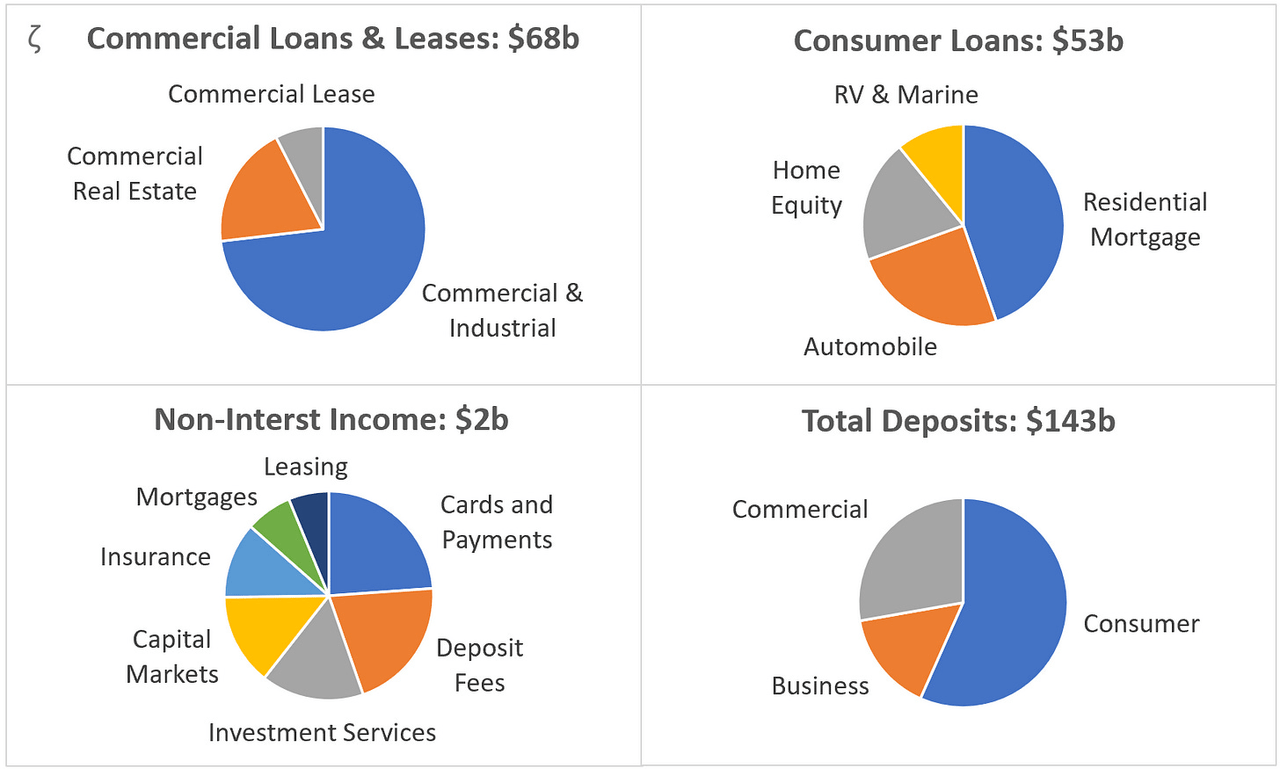

Founded in 1866, Huntington offers various banking, payment, wealth management, and risk management services. These services cater to a diverse clientele, including individuals, small and medium-sized businesses, corporations, and municipalities. Below is a breakdown of loans, leases, non-interest income, and deposits, organized by customer and business segment.

MacroDozer, Huntington Bancshares

The business strategy aims to establish the company as the country's premier people-centric and digitally-driven bank. Focused on long-term sustainable growth and efficiency, the bank offers a one-stop shop experience that differentiates it from competitors. Additionally, the strategy emphasizes digital innovation to provide user-friendly access and self-service options. Relationship building, strategic partnerships, disciplined financial management, and robust risk management are vital to ensure long-term stability and resilience.

Interest Income & Investments

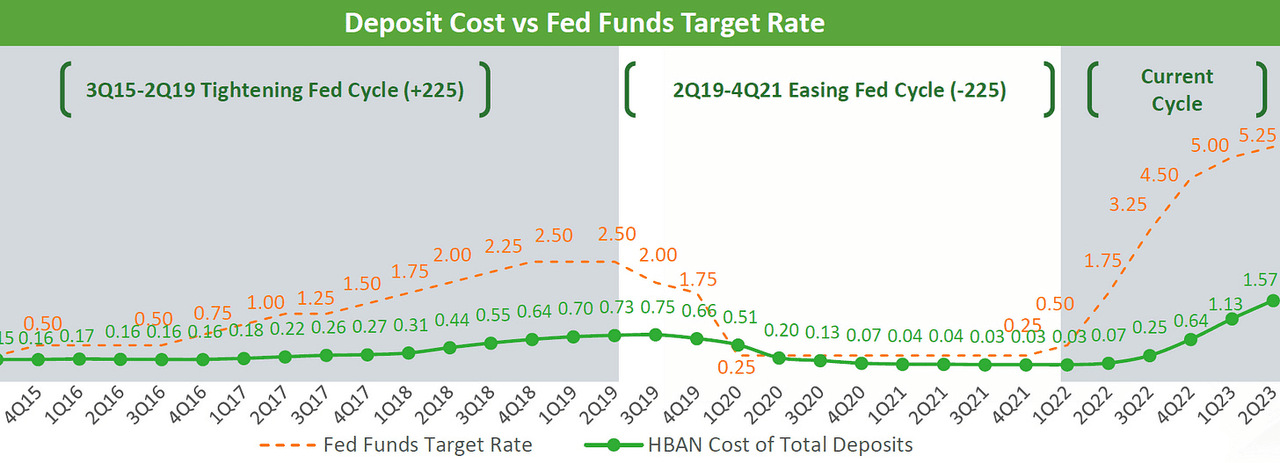

Let's delve into the financials, starting with interest income and investments. HBAN's net interest income, along with its investments—primarily in mortgage-backed securities—is significantly influenced by interest rates. The bank tends to do well when interest rates are high. When the Fed raises rates, as shown by the orange line in the chart below, HBAN quickly increases its loan and lease rates. These rates often rise faster and come with higher spreads than customer deposits, represented by the green line, the bank's primary funding source. A wider gap between these rates boosts the bank's income.

Huntington Bancshares

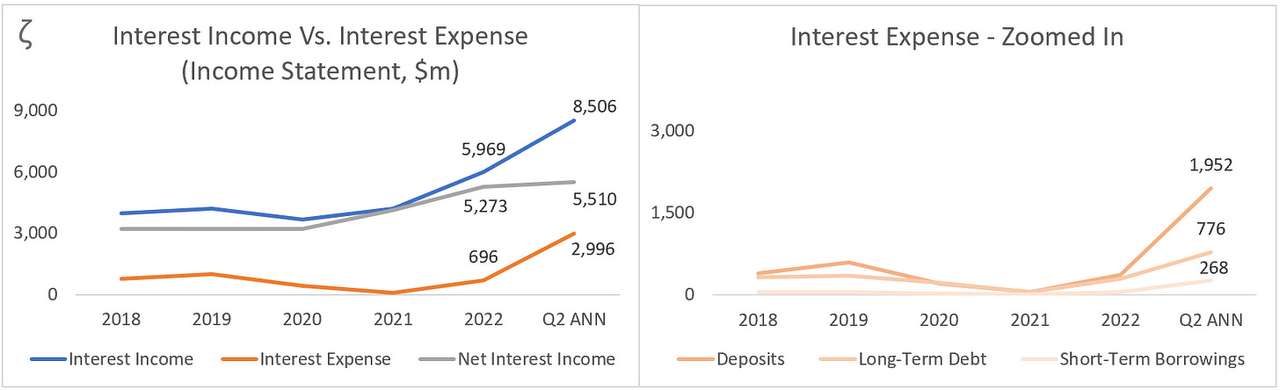

HBAN's net interest income has steadily risen since 2020, as indicated by the grey line in the chart below. While interest income (blue line) has spiked, interest expenses (orange line/s) have offset mainly this gain. This is primarily due to increased deposit costs. Following the recent rapid increases in interest rates, we anticipate a more stable and predictable environment, which holds greater importance for HBAN’s business than the actual levels of interest rates.

MacroDozer, Huntington Bancshares

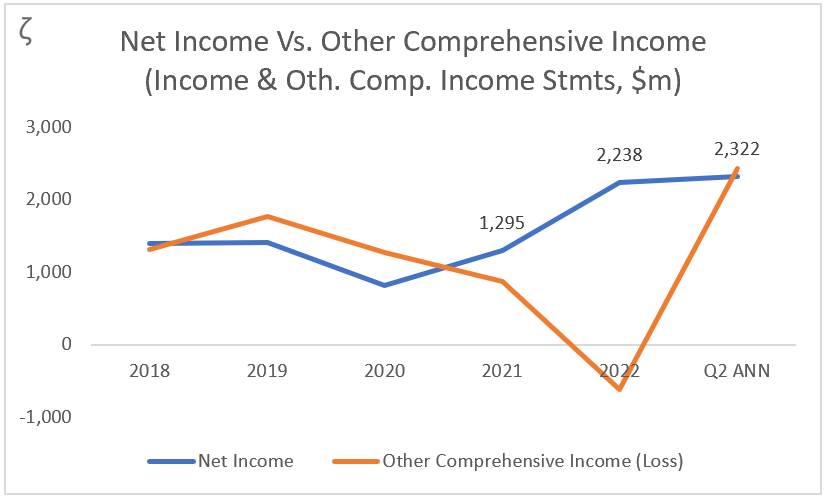

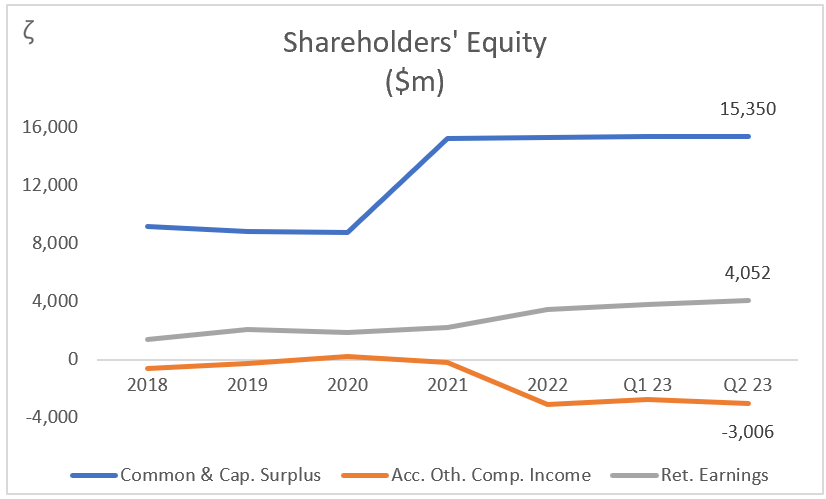

In 2022, even though net income significantly increased, an investment-related irregularity occurred in Other Comprehensive Income. This category includes income or losses not reflected in HBAN's primary results. In this context, HBAN experienced a sharp decline (see chart below). Unrealized losses totalling $2.8 billion were recorded for available-for-sale securities (AFS). For 2023, no major surprises are expected, and the year-end figure is anticipated to align with net income once again.

MacroDozer, Huntington Bancshares

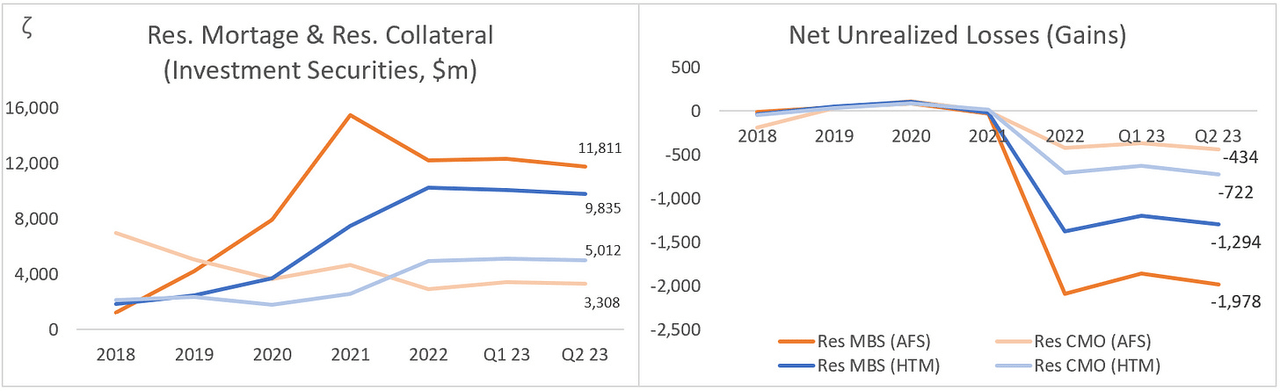

Most of these unrealized losses in 2022 originated from investments in residential mortgage-backed securities (Res MBS) and residential collateralized mortgage obligations (Res CMO). Both types of investments are essentially bundles of home loans bought as securities from other banks. Only securities categorized as available-for-sale (AFS) must be carried at fair value on the balance sheet, with value fluctuations recognized in Other Comprehensive Income.

The charts below highlight the AFS portions of these securities in orange. The blue lines represent the held-to-maturity (HTM) portions of those investments. These are accounted for using the amortized cost method instead of the fair value method. As a result, any hypothetical unrealized losses associated with these HTM assets are not recognized in Other Comprehensive Income and thus remain somewhat "hidden."

MacroDozer, Huntington Bancshares

Some investors have raised concerns about adequately accounting for the blue HTM portions. However, we believe there is a reason that specific securities qualify for the amortized cost method. They are typically of high quality—in the case of HBAN, only Federal Agency Securities—and are held to maturity.

We do not anticipate any further significant write-downs on AFS securities. On the contrary, they will recover over time and reach their total value as they approach maturity.

Loan & Lease Portfolio

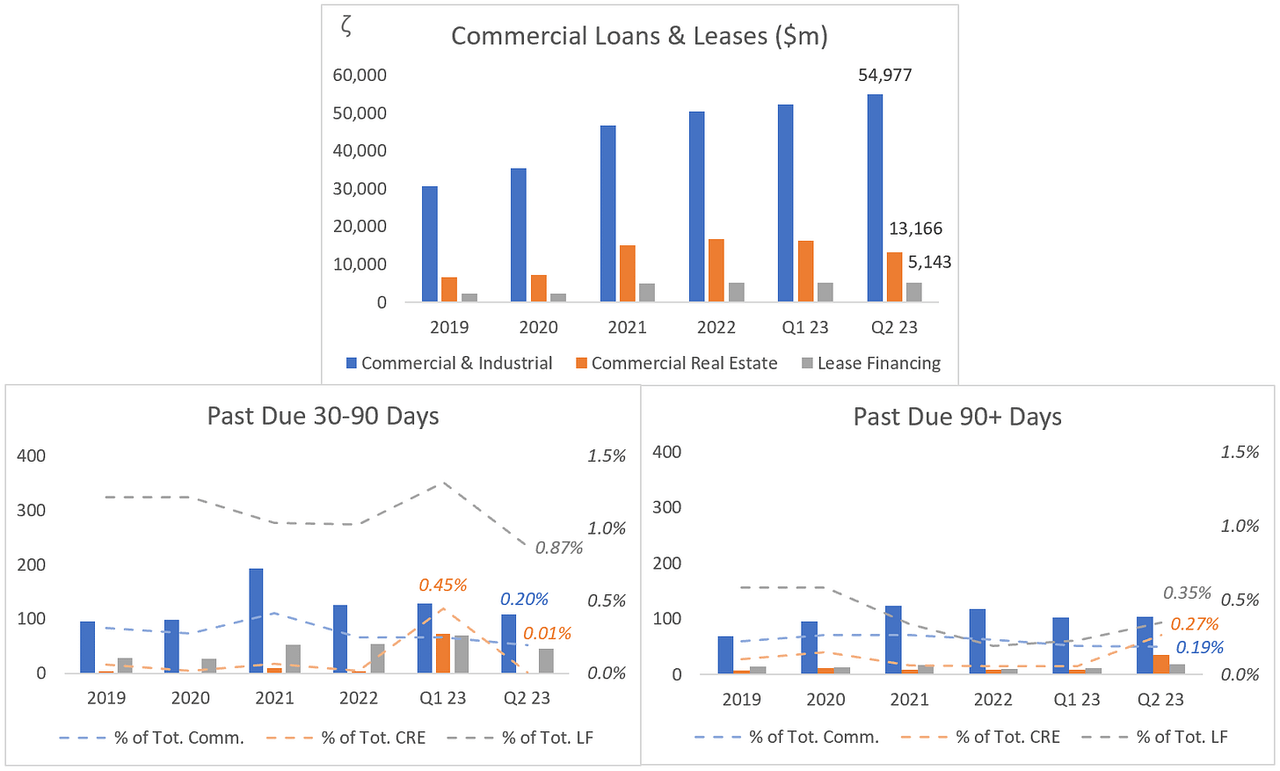

Total nonperforming assets, which consist of loans and leases that do not generate expected income and are generally more than 90 days past due, represent only 0.46% of HBAN's total loans and leases.

Examine the charts below to observe HBAN's commercial loan and lease portfolio trends. In Q1 2023, the orange bar representing commercial real estate (CRE) shows an increase to $73 million in the "Past Due 30-90 Days" category. This spike was a small outlier, representing only 0.45% of the already modest CRE portfolio. Significantly, this number was cut in half by Q2 2023, a development we view as positive.

MacroDozer, Huntington Bancshares

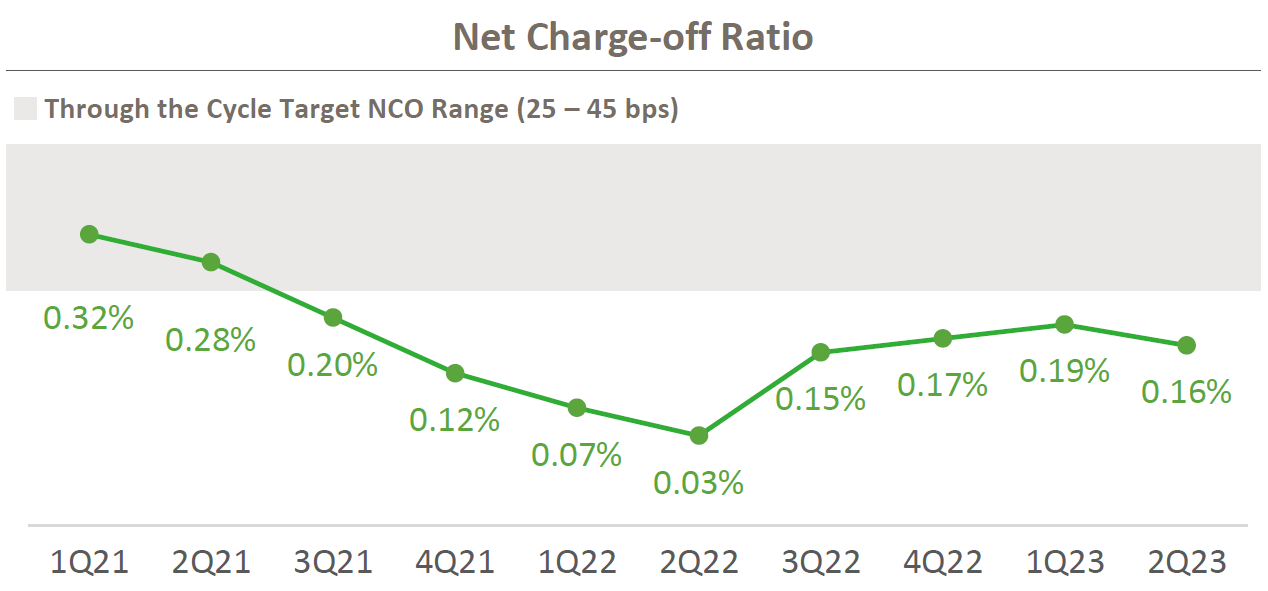

Net charge-offs, which refer to the complete write-off of loans and leases that HBAN considers uncollectible, account for an impressively low 0.16% of total loans and leases. Please refer to the quarter-by-quarter comparison below for more details.

Huntington Bancshares

Consumer loans and residential mortgages are healthy and diversified, with no significant outliers.

Customer Deposits

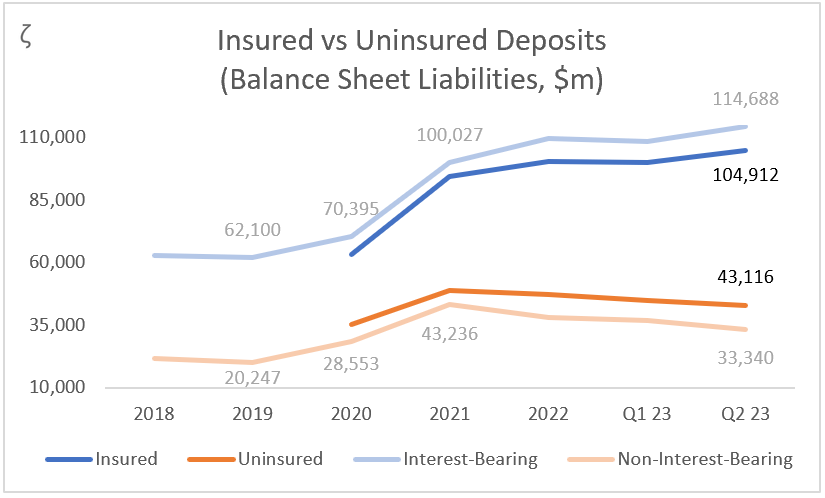

In 2020, the unprecedented surge in customer deposits during the pandemic was primarily due to liquidity infusions from the Federal Reserve and the government.

In 2021, a significant part of the increase in customer deposits came from HBAN's acquisition of TFC Financial. This acquisition added $27 billion in interest-bearing deposits and $12 billion in non-interest-bearing deposits to their balance.

MacroDozer, Huntington Bancshares

HBAN has not experienced a net outflow of customer deposits. Instead, there has been a shift from uninsured to insured deposits and non-interest-bearing to interest-bearing deposits.

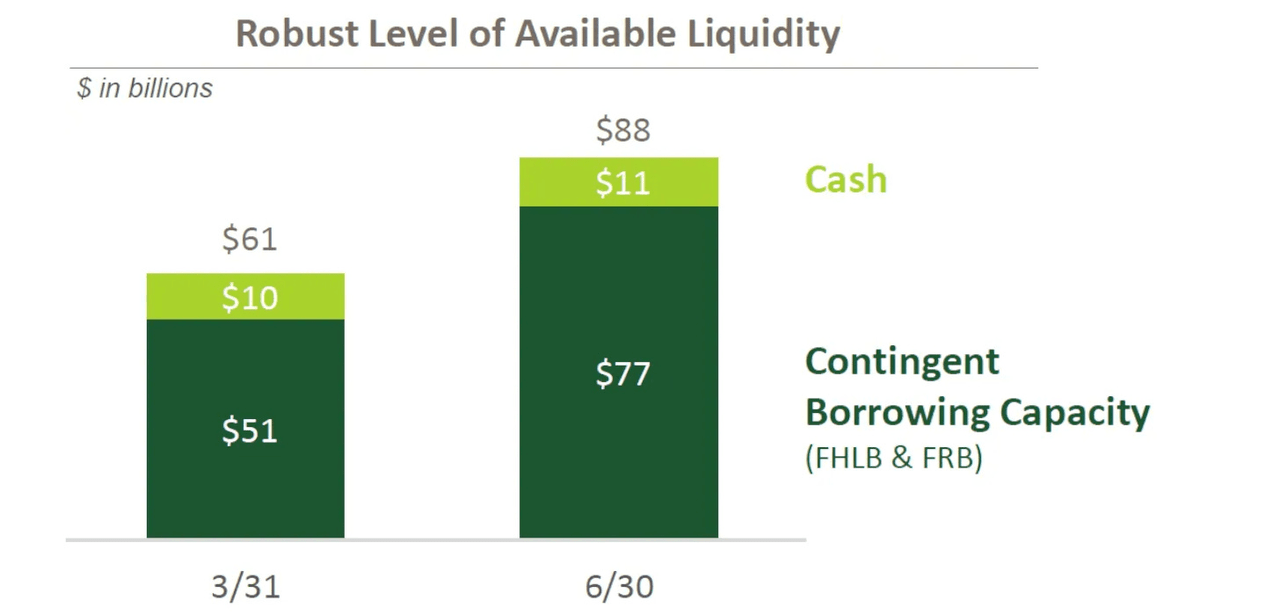

In a worst-case scenario where all uninsured depositors withdraw their $43 billion overnight, HBAN would still have twice as much cash as needed—$88 billion as of June 30, 2023—without selling any securities. HBAN does not fully disclose the breakdown of its contingent borrowing capacity. However, it generally comprises resources like the Discount Window, the newly introduced Bank Term Funding Program, and Repurchase Agreements, all facilitated by the Federal Reserve (FRB). It also includes Advances enabled by the Federal Home Loan Bank (FHLB).

Huntington Bancshares

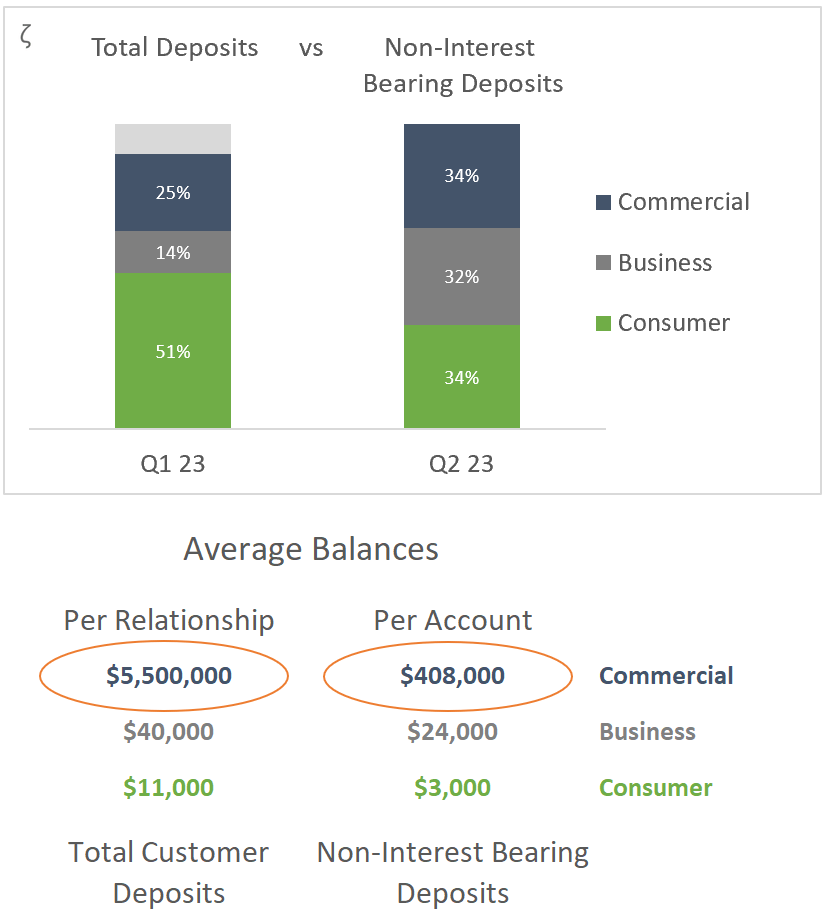

After reviewing the Q2 2023 earnings presentation, our concerns about deposit cluster risk and the potential for significant damage from a small number of customer withdrawals have been alleviated. The new data revealed an average deposit balance per account of $408,000 for non-interest-bearing commercial deposits, as shown on the right-hand side of the table below.

This is a significant decrease from the $5.5 million per relationship for total deposits reported in Q1 2023. While not all accounts will be eligible for FDIC insurance, this looks more manageable.

MacroDozer, Huntington Bancshares

Capital Management

HBAN's regulatory capital ratio (CET1) is a solid 9.82%. This strength is mainly because unrealized losses on securities measured at fair value are not included in the calculation. We are not overly concerned about this aspect, as these securities are expected to return to their original value at maturity. Therefore, the orange line in the equity graph below will eventually return to zero.

MacroDozer, Huntington Bancshares

Valuation & Opportunity

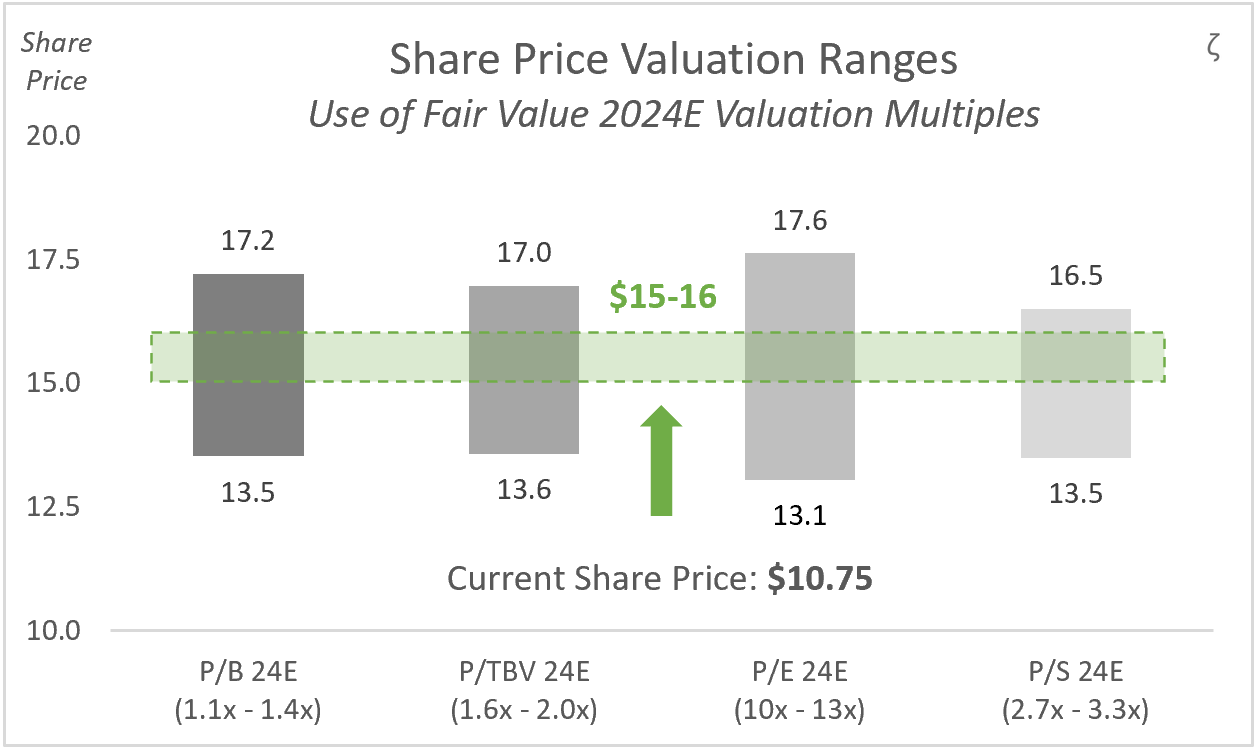

Our comprehensive valuation analysis of HBAN reveals that it is a promising investment choice within the regional banking sector. Based on a range of relative valuation metrics, HBAN is currently trading at relatively low levels compared to its own averages and the broader sector. This assessment holds despite HBAN's strong financials, top-tier dividend yield, and robust M&A track record, suggesting a potential for above-average growth in the years ahead.

The regional banking sector appears undervalued, with most regional banks, including HBAN, trading close to their long-term median lows. Considering these factors and our forward-looking estimates, we project a target share price range of $15-16 for HBAN, representing a substantial upside compared to today's share price.

Valuation

We utilized the four most commonly used relative valuation metrics and presented our findings primarily through scatter charts. These charts compare Price-to-Sales (P/S) with Price-to-Earnings (P/E) multiples, as well as Price-to-Book (P/B) with Price-to-Tangible Book Value (P/TBV) multiples.

Our analysis primarily relies on future estimates. However, we also examined historical time-series data to assess multiple contractions and expansions over time—compared to peers and on a stand-alone basis.

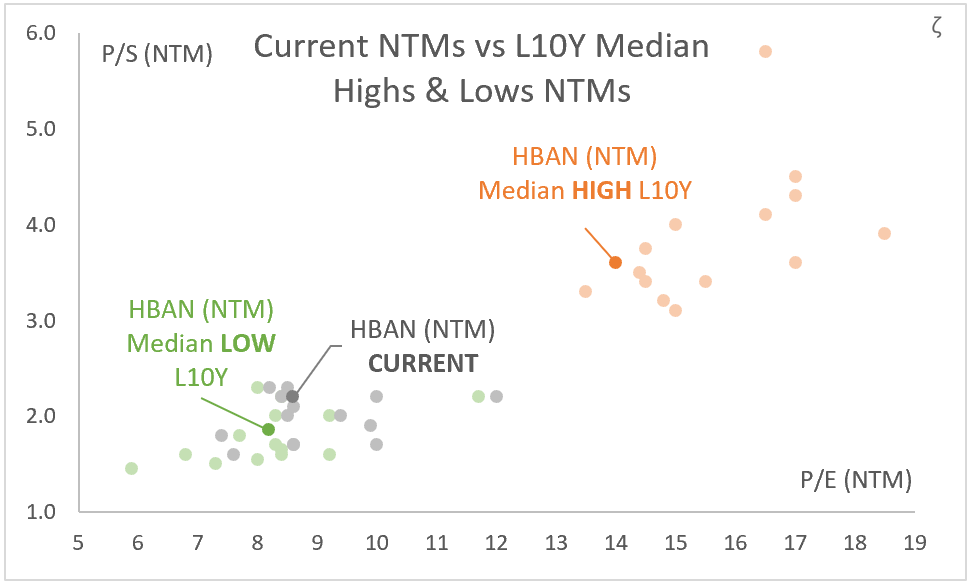

The chart below provides an overview of the Next Twelve Months (NTM) P/S and P/E multiple ranges for HBAN and its peers. This chart illustrates HBAN's current NTM trading position relative to its competitors, as the grey dots indicate. Additionally, the chart highlights the Last 10 Years (L10Y) NTM median highs and lows, represented by orange and green dots, respectively.

The critical observation is that all banks are trading very close to their L10Y median multiple lows.

MacroDozer, Koyfin

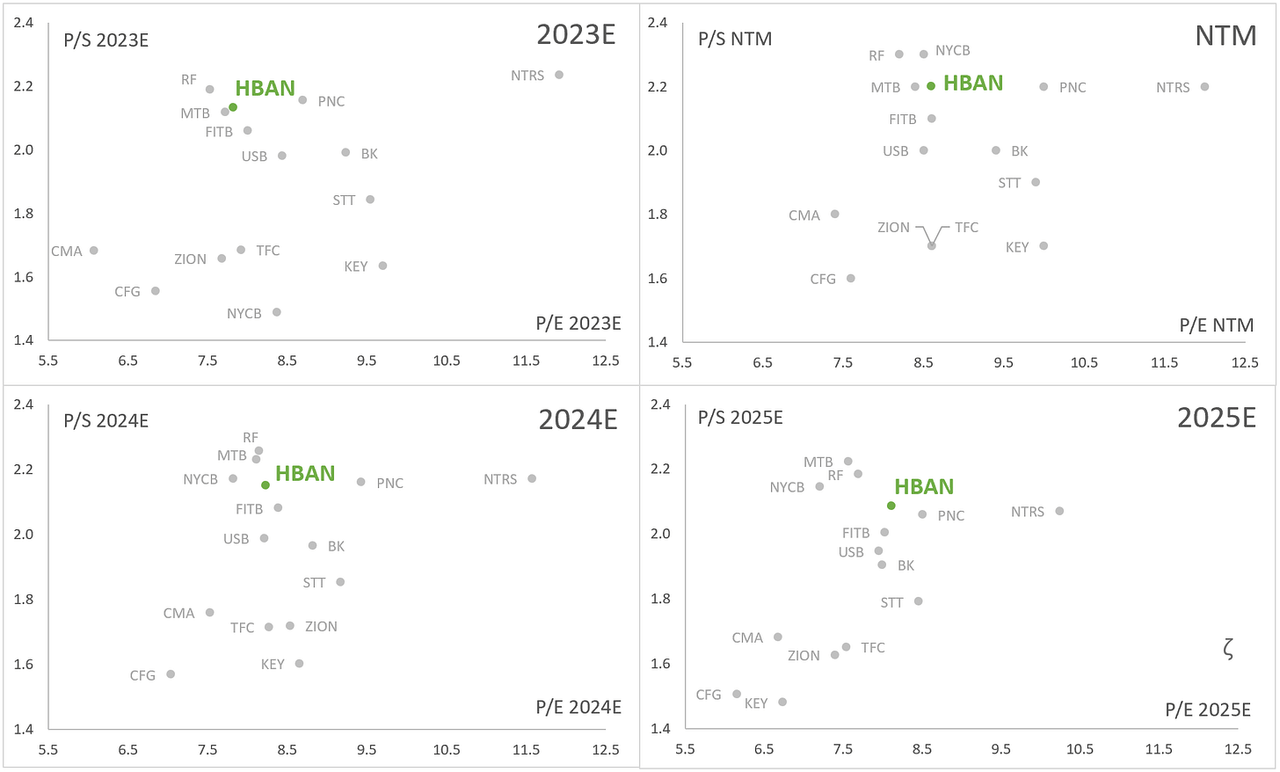

The subsequent set of charts focuses on forward sales and earnings multiple comparisons, beginning with estimates for 2023 and concluding with 2025. Across all time frames, HBAN is trading in the middle of the pack in terms of P/E and at the upper end for P/S.

MacroDozer, Koyfin

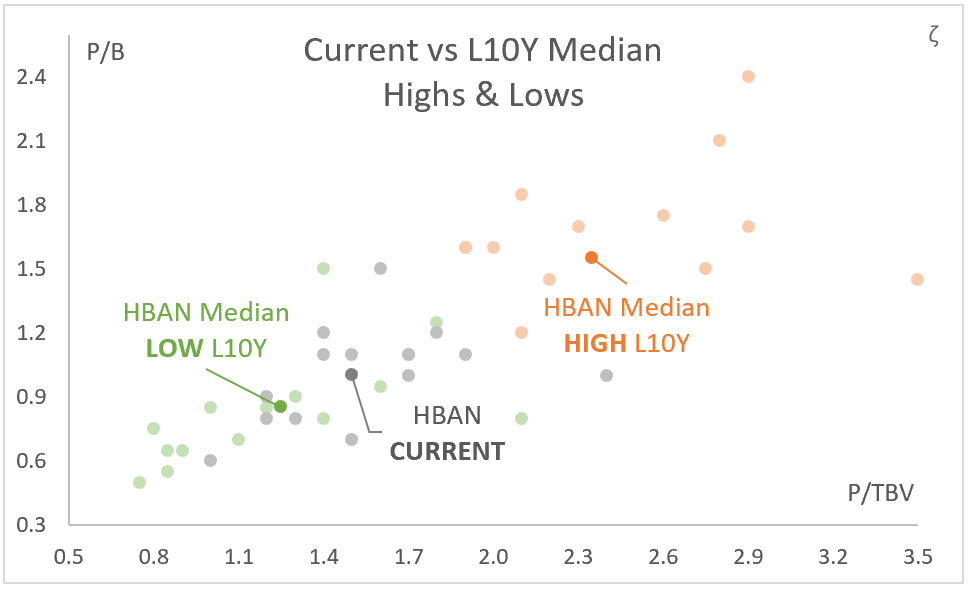

Moving on to book values, the following chart provides an overview of the P/B and P/TBV multiple ranges for HBAN and its peers. This chart shows HBAN's current trading position relative to its peers, denoted by grey dots. Similar to the first valuation overview chart above, it highlights the L10Y median highs and lows, again represented by orange and green dots.

MacroDozer, Koyfin

It is worth noting that most regional banks, including HBAN, have categorized nearly half of their investment securities as "available for sale" on their balance sheets. This categorization results in temporarily reduced equity or book values due to unrealized losses, which has the effect of inflating the tangible/book value multiples. Consequently, many of the current grey dots in the chart above should be closer to the lower left corner, mingling with the L10Y median lows.

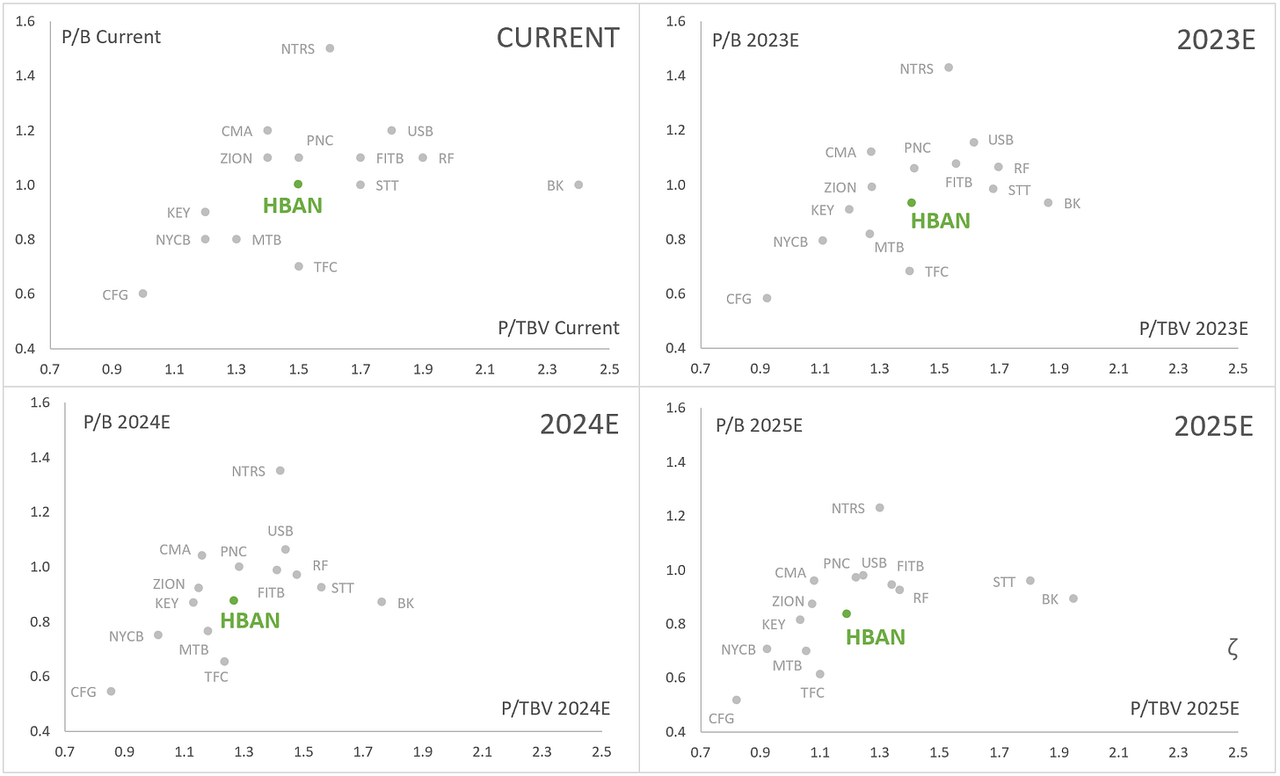

In the snapshot series that follows, as we project further into the future, the consensus equity/book value estimates return to their "old strengths," thereby reducing the value of the multiples. HBAN trades roughly at or slightly below its peer group's average for both P/B and P/TBV.

MacroDozer, Koyfin

While it may be tempting to argue that HBAN should trade at the upper end of the spectrum for each of the four metrics, particularly given its status as one of the most solid and high-quality banks among its peers, we feel more comfortable advocating for a broader narrative focused on multiple expansion. HBAN currently trades at a relatively low valuation in terms of its long-term averages and those of the entire sector. We believe the sector as a whole is mispriced.

Given these factors, we firmly believe HBAN is one of this sector's most secure and stable entities. Additionally, HBAN offers a top-tier dividend yield and has a history of robust and competent M&A activity, suggesting the potential for above-average growth in the coming years.

In our final valuation chart, we present what we consider to be a fair price range for HBAN shares. To arrive at this range, we utilized the forward metrics discussed earlier and evaluated how HBAN has been historically valued in relation to itself and its peers. Based on this analysis, we established a fair range for each projected multiple for 2024. We then applied those ranges to today's share price to determine a fair price range for each metric. Ultimately, we arrived at a share price target range of $15-16, representing more than a 50% upside to today’s share price.

MacroDozer

Growth

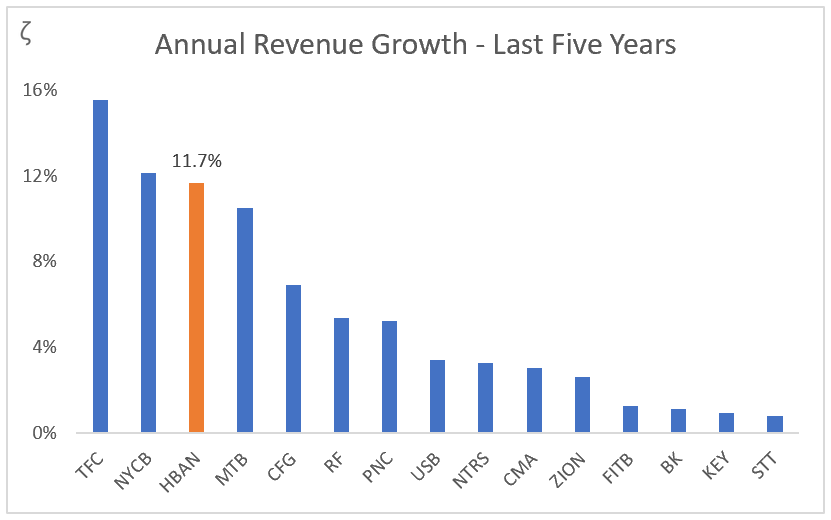

We take particular satisfaction from low valuation multiples, especially when actual growth is likely to exceed consensus estimates. Currently, only one analyst is providing long-term forecasts beyond a two-year horizon. The consensus is that HBAN will experience only limited growth for the following year.

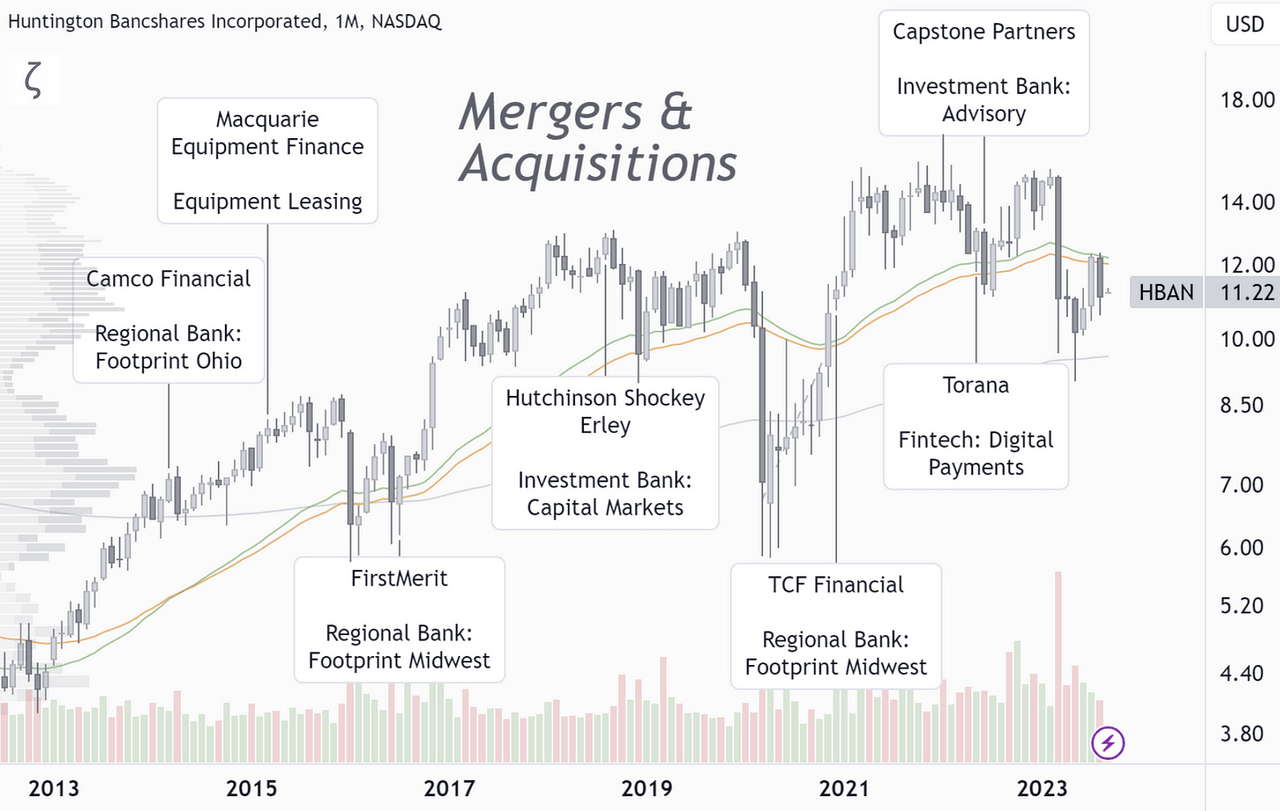

Given the current economic climate, this cautious outlook is understandable. However, it's worth noting that HBAN has a strong track record of acquiring smaller regional banks and diversifying into sectors such as Global Leasing, Investment Banking, and FinTech. As a result, HBAN has substantially outperformed most of its peers over the last five years.

See below for details on HBAN's significant M&A activity over the past decade and the bank's annual revenue growth over the last five years compared to its peers.

MacroDozer, TradingView, Huntington Bancshares

MacroDozer, Koyfin

Dividends

HBAN has showcased a strong dividend history, boasting over 30 years of continuous dividend payments, which is well above the sector median. The bank has maintained or increased its dividend payouts, signaling robust financial performance and a commitment to returning value to shareholders.

The current dividend yield of 5.5% is exceptional and ranks among the top 5 of its peers. The chart on the right illustrates the evolution of the dividend yield over the past decade; it currently sits at the upper end of its historical range.

MacroDozer, Koyfin

Risk-Reward

Our multi-metric valuation analysis indicates a 50% upside, presenting an attractive opportunity for those considering a long-term investment. In addition, the investment offers a premium dividend yield of 5.5% and the potential for above-average strategic growth in the years ahead.

However, several hypothetical developments could cause the stock to continue moving sideways or even introduce downside risk. For full awareness, we outline the four main risks below and HBAN's plans to mitigate them.

Market Risk: HBAN is vulnerable to market risk due to interest rate fluctuations. The company uses financial simulation models to handle various rate scenarios, including extreme changes. Derivatives further assist in risk management.

Liquidity Risk: HBAN confronts liquidity risk, particularly in a potential bank run scenario. To counter this, the company has diversified, easily accessible funding sources such as cash, securities, and stable core deposits. It also maintains contingency plans and can borrow from federal reserves.

Credit Risk: HBAN faces credit risk, exacerbated during economic downturns. The bank mitigates this through diversified lending, early risk detection, and internal stress tests. It also sets loan exposure limits in line with its moderate-to-low-risk profile.

Operational Risk: HBAN is subject to operational risks, including human error, system failure, and cybersecurity threats. Specialized internal committees oversee significant risks and suggest corrective measures. The bank also invests in advanced cybersecurity protocols.

Conclusion

Huntington Bancshares offers a compelling investment opportunity in the uncertain post-crisis landscape. The bank is poised for long-term viability with strong fundamentals like robust net interest income, low nonperforming assets, a stable deposit base, and solid capital ratios. The bank’s mispriced valuation and an upside potential of 50% are sweetened by a 5.5% dividend yield, making it an attractive proposition for investors.

Despite market volatility, HBAN's diversified strategy and focus on digital innovation and strategic expansion give it a competitive edge. The bank has adeptly managed various risks—market, liquidity, credit, and operational—reassuring investors and setting a course for future challenges. With a discounted valuation and strong fundamentals, HBAN is an ideal candidate for inclusion in a long-term portfolio.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HBAN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.