Canadian Tire: Why It May Be A Good Trade

Summary

- Canadian Tire stock has retreated 16% from its recent high, potentially due to concerns about an upcoming recession.

- The stock's credit rating is BBB, which is not ideal in a higher interest rate environment.

- Canadian Tire is an iconic brand with diverse retail divisions, but its recent financial results have been impacted by increased expenses.

- It also offers a safe 4.5% dividend that provides a return while holding the stock.

AWSeebaran

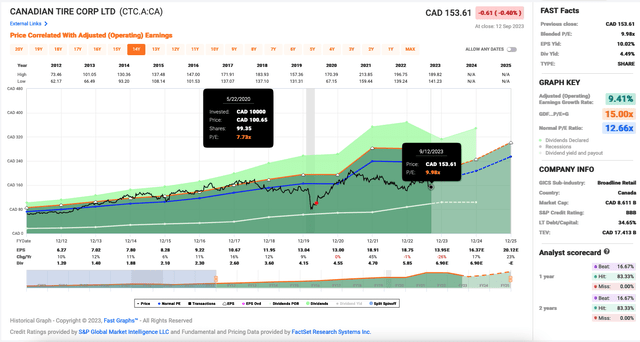

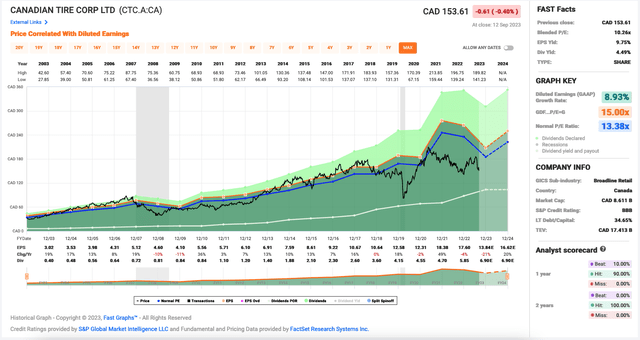

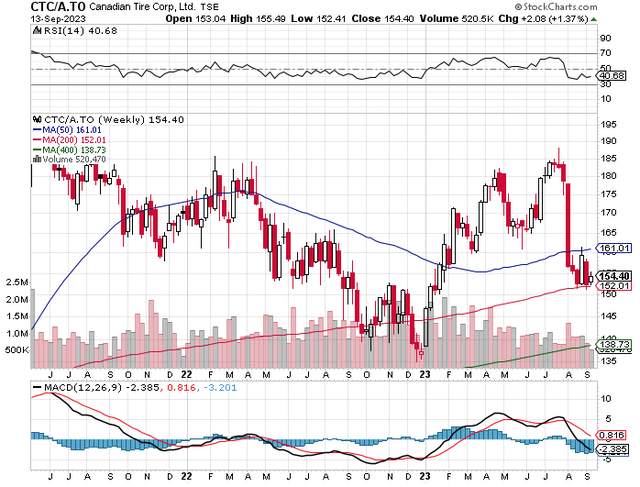

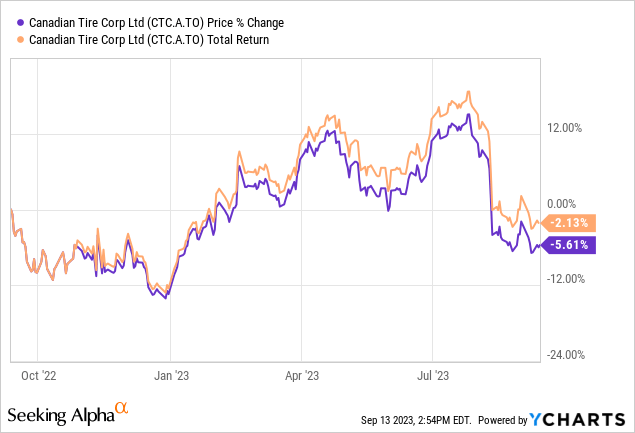

The investing community seems to be ignoring Canadian Tire (OTCPK:CDNTF) (TSX:CTC.A:CA) for now as the last Seeking Alpha coverage on it was more than four months ago. The stock has just retreated north of 16% from a recent high of about $185 set in July. In the last 12 months, the stock is down about 5% with total returns being -2% thanks to the cushion from its dividend.

What's Weighing on the Stock?

Expected Upcoming Recession

An upcoming recession could be what's weighing on the stock. With economists anticipating a recession by 2024 in Canada, investors are probably correct to watch cautiously on the sidelines, as the stock likely won't go much higher in the near term.

Because it offers durable goods, the consumer discretionary stock usually falls meaningfully in a recession. When Canadians are strapped for cash, they would focus on the essentials like groceries. In the Q2 report, even Greg Hicks, the Canadian Tire president and CEO, stated, "As inflation persisted and rate hikes continued, consumer demand for discretionary goods softened, particularly in the latter half of the quarter, and Canadians shifted to more essentials within our multi-category assortment."

In the last two recessions (during the global financial crisis of 2008-09 and the pandemic in 2020), from peak to trough, the stock fell more than 40%. What's notable is that it did bottom at some point during the recessions and subsequently made a comeback while paying safe dividends. So, it could be worthwhile to target to buy low and sell high while collecting the dividend in between.

For instance, if you had eyed the stock and bought it cautiously after it has bounced and made a bit of a consolidation in during the 2020 pandemic crash, you would have made respectable annualized returns of north of 17% holding it till now, as shown in the buy and sell points in the above graph.

(The company reports in Canadian dollars, so the figures in this article are in CAD$ unless otherwise noted.)

Credit Rating

Since 2022, the Bank of Canada has raised the benchmark interest rate rapidly to 5.0% to curb the relatively high inflation. The stock's credit rating is not the best in today's higher interest rate environment, which increases the cost of capital for the company and is a dampener on economic growth. Specifically, Canadian Tire has a S&P credit rating of BBB for its long-term debt.

To get a sense of the interest rates that Canadian Tire is exposed to, it just pushed out $600 million worth of unsecured medium term notes, including $400 million due September 2030 at a rate of 5.372% and $200 million at a floating rate due September 2026.

The Business

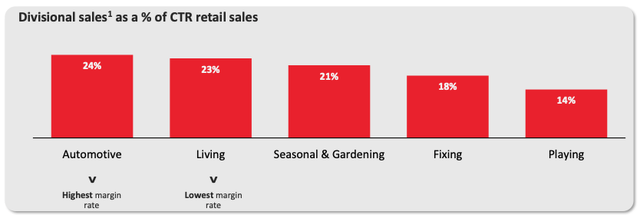

Canadian Tire is an iconic brand that was founded in 1922. It has picked up other retail brands along the way. Other than Canadian Tire, its umbrella of brands include Mark's (for casual and industrial wear), Pro Hockey Life (a hockey specialty store), SportChek, Hockey Experts, Sports Experts, and Atmosphere, etc. Specifically, its retail business has 5 divisions with leading sales coming from its higher-margin Automotive division, as shown in the graph below.

The omni-channel merchandise retailer has 1,700 retail and gasoline outlets that are supported by its Financial Services division. It also has a stake in CT REIT (CRT.UN:CA). In 2022, Canadian Tire's revenue diversification was almost 90% Retail, almost 8% Financial Services, and close to 3% CT REIT.

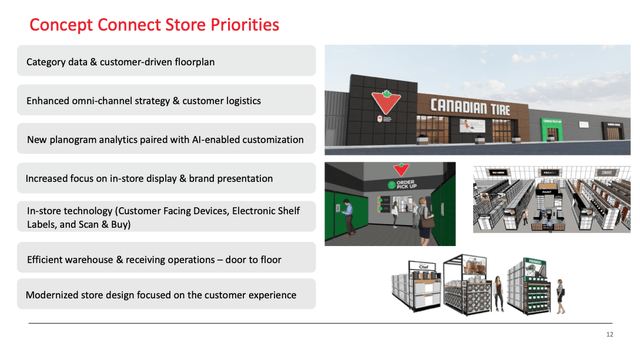

Since the announcement in 2022, the retailer has been revamping its Canadian Tire Retail stores to make them more contemporary. So far, it has refreshed more than 10% of the stores to improve customer experience and help drive incremental sales. Areas of improvement are highlighted in the slide below.

Year to date, it has invested $238 million in operating capital investments and completed 22 of these store improvement concepts.

Recent Results

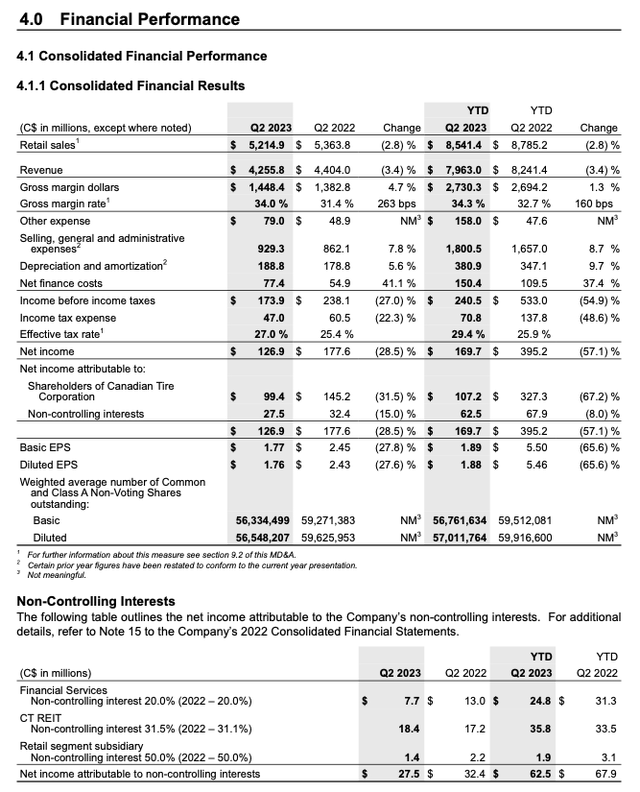

Its eCommerce sales hit $1.1 billion over the last 12 months. Year to date, its retail sales fell 2.8% to $8,541.4 million. The gross margin rose 1.3% to $2,730.3 million with the help of the gross margin rate expanding 1.6% to 34.3%. Sales stayed resilient in today's macro environment.

Unfortunately, expenses jumped. Selling, general and administrative expenses added $206 million to its costs. Higher finance costs added $40.9 million. The effective tax rate of 29.4% was also 3.5% higher year over year. Ultimately, the GAAP earnings dropped 57% to $169.7 million with the diluted earnings per share ("EPS") falling almost 66% to $1.88.

Risks

All investments come with risk. Here are some risks Canadian Tire are exposed to.

As mentioned earlier, with a credit rating of BBB for its long-term debt, Canadian Tire is subject to interest rate risk. Higher interest rates increase its borrowing costs and make its debt a greater burden and dampens its growth potential.

Since the start of the year, Canadian Tire has completed the multi-year rollout of its digital platform across all banners. This means that, in a sense, it's competing with other companies that are selling similar products online. According to Similarweb, some of Canadian Tire's top online competitors include Walmart (WMT), Rona that's owned by Lowe's (LOW), and Amazon (AMZN).

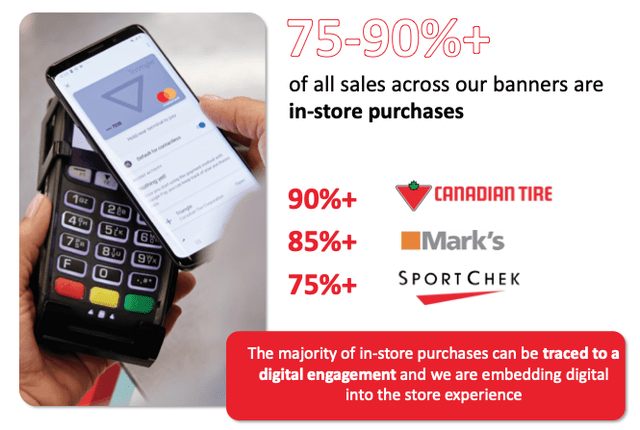

That said, Canadian Tire did mention that about 75-90% of its sales are in-store purchases. As noted in the slide below, its digital platform is meant to enhance or support sales for its brick-and-mortar stores. So, at the end of the day, predicting customer demand and consumer preferences, and selecting the right products to sell is critical.

Because Canadian Tire sources its products from different countries, it is exposed to foreign currency volatility. In 2022, China was its top sourcing country, followed by Canada, the United States, Bangladesh, Vietnam, Cambodia, Mexico, Malaysia, Taiwan, and Israel. When the Canadian dollar is weak against these foreign currencies, particularly, the Chinese Yuan and the U.S. dollar, it will be a hit on the retailer's bottom line.

Relatively high inflation is also another risk factor. It's harder to pass higher inflationary costs to consumers for durable goods that are discretionary purchases. It means that in many cases, Canadian Tire has to eat up that cost.

Growth Catalysts

Canadian Tire targets to refresh 50% of the square footage in its network, which could encourage foot traffic and the consumer shopping experience. Since most of its sales are in-store purchases, this investment can potentially drive sales growth.

Its business tends to do well post-recessions. As well, it tends to generate stable growth in other economic conditions (other than doing poorly in recessions). So, assuming Canada does fall into a recession by 2024, investors can expect the stock to do better sometime after that.

Moreover, during recessions, the Bank of Canada tends to reduce the policy interest rate to encourage economic growth. The reduction of interest rates would be a growth catalysts for businesses, including Canadian Tire.

Valuation and Dividend Safety

Despite it sells non-essential merchandise, Canadian Tire's earnings have been in a growth trend and largely stable, especially if you ignore the massive rise in earnings in 2021 post-pandemic.

In the last 10 years, the stock delivered annualized returns of about 8%, which is not stellar. However, today, at $154.62 per share at writing, it trades at a forward P/E of about 11.1 based on adjusted EPS. This is a decent multiple to buy shares assuming a subsequent economic expansion. However, investors might need to wait for this to occur after a recession.

In the meantime, Canadian Tire pays a safe dividend. It has maintained or increased its dividend for at least 20 consecutive years with 5-, 10-, 15-, and 20-year dividend growth rates of 17.6%, 17.2%, 15.0%, and 14.4%, respectively. At writing, it offers a dividend yield of close to 4.5%. Its sustainable trailing-12-month payout ratio was 44% of net income.

Investor Takeaway

In the past 10 years, Canadian Tire increased its adjusted EPS by almost 11.6% per year. Being more cautious, let's assume Canadian Tire grows its earnings by about 8%. Then, based on its reasonable valuation today, it should be able to deliver total returns of more or less 12%, assuming no valuation expansion over the next five years.

That said, in the near to medium term, if Canada does run into a mild recession, the stock could be range bound, which could make it a decent candidate for trading on potential pops from any good news. The technical chart below shows a ceiling in the $180 range.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article consists of my opinions and is for informational purposes only. Please do your own research and due diligence and consult a financial advisor and or tax professional if necessary before making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.