USHY: The Time To Worry Is Now

Summary

- Credit spreads are abnormally tight, indicating a potential risk of a credit event in the bond market.

- The iShares Broad USD High Yield Corporate Bond ETF may not be the best choice for investors due to the potential credit event.

- USHY offers a higher yield compared to other high yield bond ETFs, but carries significant risks. Investors should carefully consider these risks before investing.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

staticnak1983/E+ via Getty Images

Failure to accord credit to anyone for what he may have done is a great weakness in any man. - William Howard Taft

The time to worry about credit spreads is when they're abnormally tight as they are right now. As I've noted continuously, I believe the risk of a credit event is high whereby there's a sudden and aggressive repricing of default risk internally within the bond market. Most bear markets end with credit spreads blowing out - something we haven't seen yet despite the fastest rate hike cycle in history. Because of lags, the impacts of those rate hikes should start to be felt right around now in the cycle, and that's precisely why junk debt is in my view difficult to invest in at these levels.

There are a number of junk debt ETFs out there. Let's focus on the iShares Broad USD High Yield Corporate Bond ETF (BATS:USHY) which is a popular investment vehicle amongst investors seeking to diversify their portfolios with high-yield, USD-denominated corporate bonds. Designed by BlackRock, it tracks the investment outcomes of an index comprised of U.S. dollar-denominated, high yield corporate bonds. However, given the potential risk of a credit event, one might question whether this ETF is the best choice for investors right now.

The Structure of USHY

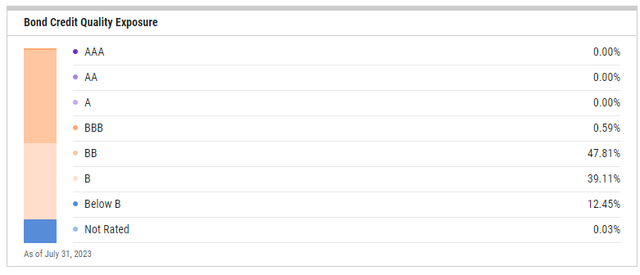

USHY offers broad exposure to the high yield bond market. It has a low cost, making it an attractive option for those seeking to enhance their portfolio's income and performance potential. However, credit quality is poor on average here broadly. This matters because you actually want low quality bonds towards the tail end of a bear market for equities as they mimic equity behavior at extremes. You don't want exposure towards the tail end of a bull move in risk-on assets.

This is the point I'm trying to stress loudly. Credit spreads have been remarkably tight while bankruptcy filings have factually been increasing in a way suggesting we are on the verge of a recession. This should make sense given how aggressively the Fed hiked rates. But when we look at spreads historically, we can see that it has periodic spikes on crises leading up to a recession. That means if you believe a recession can happen starting next year, credit spreads should start to widen right about now.

Comparing USHY to Peers

When comparing USHY to its peers, one can see that it offers a higher yield than many other high yield bond ETFs, with a 30-Day SEC Yield of 8.53%. For example, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) is at 8.09% and the iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) is at 8.22%. Both offer lower 30-Day SEC Yields than USHY. However, these ETFs also have different durations and sector exposures, which can influence their risk profiles.

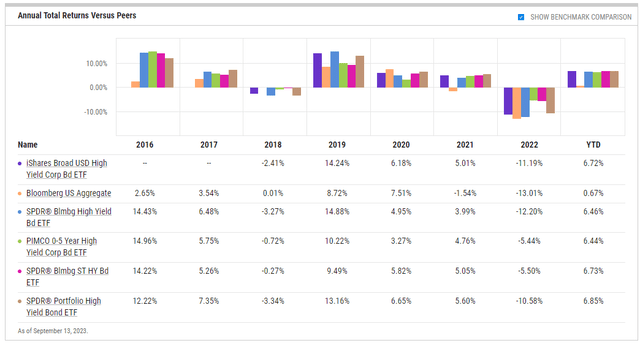

When we look broadly at comps, we can see the fund has performed roughly in line with other junk debt ETFs.

The Bottom Line

While the iShares Broad USD High Yield Corporate Bond ETF (USHY) offers broad exposure to the high yield bond market and a relatively high yield, it also carries significant risks. The possibility of a credit event suggests that this might not be the best time to invest in this ETF. Investors should carefully consider these risks and their own investment objectives before deciding whether to invest in USHY. I believe a substantial opportunity will come in high yield bonds on an inevitable sell-off overreaction. You just need to wait for that to happen.

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors, and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.