Recursion Pharmaceuticals: Leveraging AI To Decode Biology And Discover Novel Therapeutics

Summary

- Recursion Pharmaceuticals is a clinical-stage biotechnology company that uses AI and experimental biology to discover new treatments for diseases.

- The company has a technology platform called Recursion OS, which includes a collection of images, a search engine, a cloud-based supercomputer, and software tools.

- Recursion Pharmaceuticals has a diverse pipeline of over 40 programs in various stages of development, with lead candidates targeting rare genetic disorders and common complications of diseases.

- I do much more than just articles at Vasuda Healthcare Analytics: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

iLexx

Recursion Pharmaceuticals (NASDAQ:RXRX) was a new buy in the portfolio last week. This is a clinical-stage biotechnology company that combines experimental biology, bioinformatics, and artificial intelligence, AI to create a platform for drug discovery. The company aims to decode complex biology and find new treatments for various diseases that can be modeled at the cellular level.

Company History

The company was founded in 2013 by Chris Gibson, PhD, and Blake Borgeson, PhD, who met as graduate students at the University of Utah. They were inspired by the idea of using high-throughput screening and machine learning to identify novel drug candidates for rare genetic diseases. They started the company in a basement lab with a single microscope and a laptop.

Since then, the company has grown to become a leading TechBio company with over 300 employees, a state-of-the-art laboratory, and one of the most powerful supercomputers in the world. The company has also expanded its scope beyond rare diseases to include oncology, immunology, infectious diseases, and aging.

Technology Platform

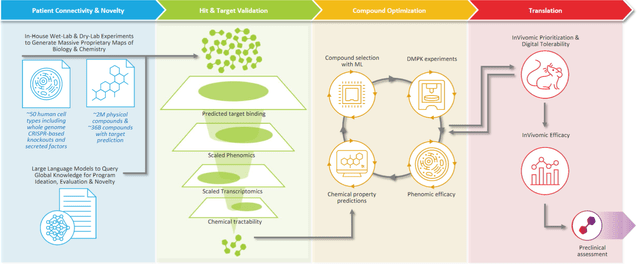

The core of Recursion Pharmaceuticals' technology platform is the Recursion OS, which integrates diverse technologies that continuously expand one of the world's largest proprietary biological and chemical datasets. The Recursion OS consists of four components:

- Recursion Map: A collection of over 100 billion images of human cells treated with various compounds and perturbations, annotated with deep phenotypic features extracted by computer vision and machine learning algorithms.

- Recursion Query: A search engine that allows researchers to query the Recursion Map for potential drug candidates, targets, mechanisms of action, biomarkers, and disease models.

- Recursion Compute: A cloud-based supercomputer that enables scalable and parallelized data processing, analysis, and modeling using advanced AI techniques such as deep learning, reinforcement learning, and generative adversarial networks.

- Recursion Studio: A suite of software tools that facilitates data visualization, exploration, annotation, and collaboration among scientists.

The Recursion OS enables the company to create virtuous learning cycles around its datasets and generate novel insights into biology and chemistry. By applying AI to decode complex biological patterns, Recursion Pharmaceuticals can discover new drug candidates faster and more efficiently than traditional methods.

Recursion OS Platform (Investor Presentation)

Drug R&D Pipeline

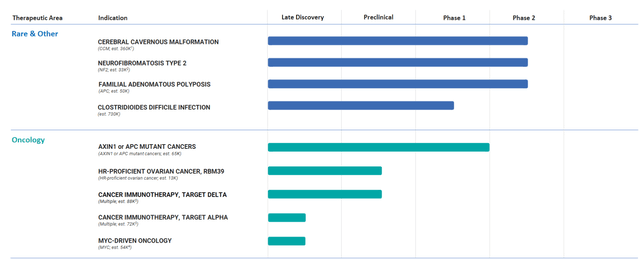

The company has one of the largest, broadest, and deepest pipelines of any technology-enabled drug discovery company. It has over 40 programs in various stages of development, spanning multiple therapeutic areas and modalities. The company's lead clinical candidates are:

- REC-4881: A small molecule inhibitor of MAPKAPK2 (MK2) for the treatment of cerebral cavernous malformation, CCM, a rare vascular disorder that causes brain hemorrhages. REC-4881 is currently in Phase 2a clinical trial with data expected in 2024.

- REC-163964: A small molecule activator of NRF2 for the treatment of neurofibromatosis type 2 (NF2), a rare genetic disorder that causes benign tumors in the nervous system. REC-163964 is currently in Phase 1/2a clinical trial with data expected in 2024.

- REC-2282: A small molecule inhibitor of ALK2 for the treatment of fibrodysplasia ossificans progressiva (FOP), a rare genetic disorder that causes bone formation in soft tissues. REC-2282 is currently in Phase 1 clinical trial with data expected in 2023.

- REC-994: A small molecule antioxidant for the treatment of diabetic macular edema (DME), a common complication of diabetes that causes vision loss. REC-994 is currently in Phase 1b/2a clinical trial with data expected in 2023.

R&D Pipeline (Investor Presentation)

Partnerships

In addition to its internal pipeline, the company has established several strategic partnerships with industry-leading companies to leverage its platform for drug discovery and development. Some of the notable partnerships are:

- Roche/Genentech: A multi-year collaboration to discover and develop novel treatments for oncology and neuroscience indications using Recursion's platform. The deal includes an upfront payment of $50 million, potential milestone payments of up to $3.7 billion, and royalties on future sales.

- Bayer: A joint venture to create a new company called Casebia Therapeutics, which will focus on developing gene therapies for hemophilia using Recursion's platform. The deal includes an upfront payment of $50 million, potential milestone payments of up to $1.5 billion, and royalties on future sales.

- Takeda: A collaboration to discover novel treatments for rare immune-mediated diseases using Recursion's platform. The deal includes an upfront payment of $25 million, potential milestone payments of up to $760 million, and royalties on future sales.

- Nvidia: A collaboration and $50 million investment from Nvidia to accelerate the development of foundation models in AI-enabled drug discovery using Recursion's platform and Nvidia's software and hardware solutions. Partnership with Nvidia will help to integrate and optimize MatchMaker (acquired via Cyclica) for massive-scale GPU-based computation on BioHive-1 and DGX Cloud.

Management Team

The company is led by a team of experienced and visionary leaders with backgrounds in science, technology, and business. The key members of the management team are:

- Chris Gibson, PhD: Co-founder and Chief Executive Officer. Dr. Gibson has a PhD in Bioengineering from the University of Utah and a BS in Biochemistry from the University of Texas at Austin. He has over 10 years of experience in drug discovery and biotechnology. He serves on the Board of BeeHive.

- Tina Larson: President and Chief Operating Officer. Ms. Larson has a BS in Chemical Engineering from Colorado State University and an MBA from the University of California, Berkeley. She has over 25 years of experience in biopharmaceutical operations, engineering, and quality at Genentech, Roche, and Achaogen.

- Michael Secora, PhD: Chief Financial Officer. Dr. Secora has a PhD in Physics from Harvard University and a BA in Physics from Princeton University. He has over 10 years of experience in finance, strategy, and investing, including Managing Director and Head of Capital Markets and Venture at Laurion Capital Management.

- Shafique Virani, MD: Chief Corporate Development Officer. Dr. Virani has an MD from Harvard Medical School and a BA in Biochemistry from Harvard College. He has over 15 years of experience in biopharmaceutical business development, strategy, and commercialization, including CEO of Navire Pharma and CoA Therapeutics (each a subsidiary of BridgeBio Pharma). He also served as CEO in residence at Bridge Bio Pharma and VP/Global head of Neuroscience, ophthalmology and rare disease at Genentech/Roche.

Financials and Valuation

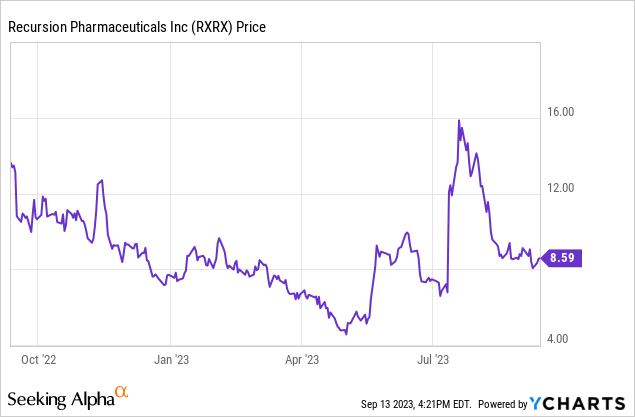

Recursion Pharmaceuticals went public in April 2021, raising $436 million in its initial public offering (IPO) at a price of $18 per share. Due to the early stage of the pipeline at IPO, The stock price is currently trading >50% below the IPO price. However, the recent Nvidia partnership has attracted investor attention to the stock.

As of June 30, 2023, the company had $406 million in cash and cash equivalents, $1.2 million in long-term debt, $50 million in revenue (last 12 months), and -$0.4 earnings per share, EPS. The company expects its cash runway to extend into 2025 considering the operating cash use was $240 million in the last 4 quarters.

Institutional investors holding the stock include Ark Investment Management, Fidelity, etc.

The key U.S. target markets for the pipeline candidates (in Phase 2 or higher) are: cerebral cavernous malformation (360K), neurofibromatosis type 2 (33K), familial adenomatous polyposis (50K), and AXIN1 or APC mutant cancers (65K). The total addressable U.S. target market size from these key indications is: 508K patients/year. At a conservative average orphan disease price of $150K/patient/year, these fully owned indications represent $76 billion/year of revenue opportunity just in the U.S. The current enterprise value of the company is $1.58 billion, which makes the company look undervalued (biotech companies usually trade at an average EV/sales ratio of 6-7).

The Wall Street analysts' mean price target for the stock is $17 or 85% upside potential in the 1-year timeframe. The price target from a Berenberg Bank analyst (who has the highest success rate of 55% on ratings on the stock in the past 1 year) is a Street-high target of $35 four weeks ago or 284% upside potential.

The stock jumped >75% 3 weeks ago on the news of the Nvidia partnership, subsequently traded down to fill most of the open gap, and is moving up again. The stock is at an excellent Buy level with a 2-3 years timeframe.

Near-term catalysts:

- Q3, 2023: REC-3964 Phase 1 safety data in C. Difficile

- H1, 2024: REC-994 Phase 2 CCM data

- H2, 2024: REC-2282 Phase 2 NF2 safety and prelim. efficacy data

Risks in the above investment include underwhelming data from the pipeline candidates, unknown side effects, cancellation of current partnerships, etc. which may cause the stock to fall. Investing in developmental-stage biotech/pharma/techbio companies is risky and may not be suitable for all investors. The above note represents my own opinion and is not professional investment advice. Please conduct your own research and due diligence before making any investment decisions.

Premium service reviews

"The best I have ever seen in the biotech space..."

"Great service with in-depth research on biotech stocks."

"If you want to invest in biotech following events (catalysts), this is the right service for you."

This article was written by

Money Manager. Registered Investment Advisor.

M.B.B.S., M.D., MBA Finance (NYU-Stern).

Founder of Vasuda Healthcare Analytics, a catalyst-driven biotechnology/pharmaceuticals-focused service. Ranked 5-star on Tipranks. SumZero contributor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RXRX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)