IEA Really Messed Up This Time

Summary

- IEA's assumptions for global oil demand in 2024 have been revised downward, leading to a significant decrease in demand projections.

- IEA did that by revising lower 2022 base demand, which directly resulted in lower demand projections for 2023 and 2024.

- The IEA's assumption change contradicts actual data and may lead to lower oil inventories and higher oil prices.

- Looking for a helping hand in the market? Members of HFI Research get exclusive ideas and guidance to navigate any climate. Learn More »

thitimon toyai/iStock via Getty Images

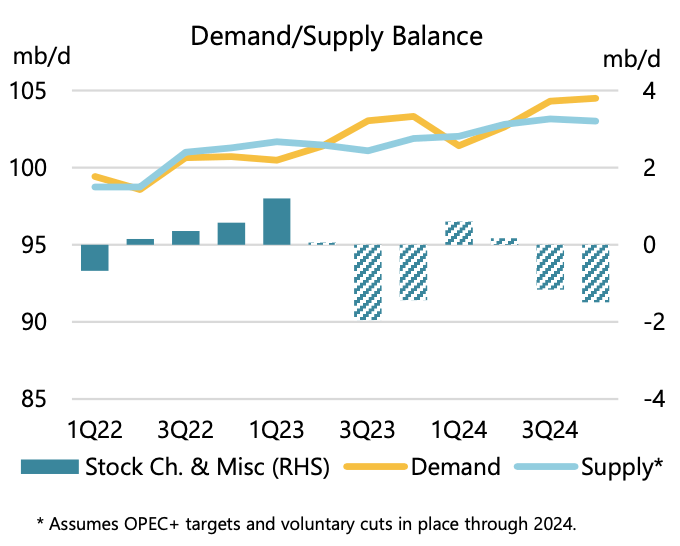

I knew something was wrong when I complimented the IEA in the July oil market report. At the time, IEA had published this chart for its latest oil supply & demand balance for 2024:

IEA

At the time, we read through the assumptions and came away thinking that this was the most balanced the IEA had ever been. It pointed out that China was a key tailwind for global oil demand and non-OECD will be the driver while OECD will lag.

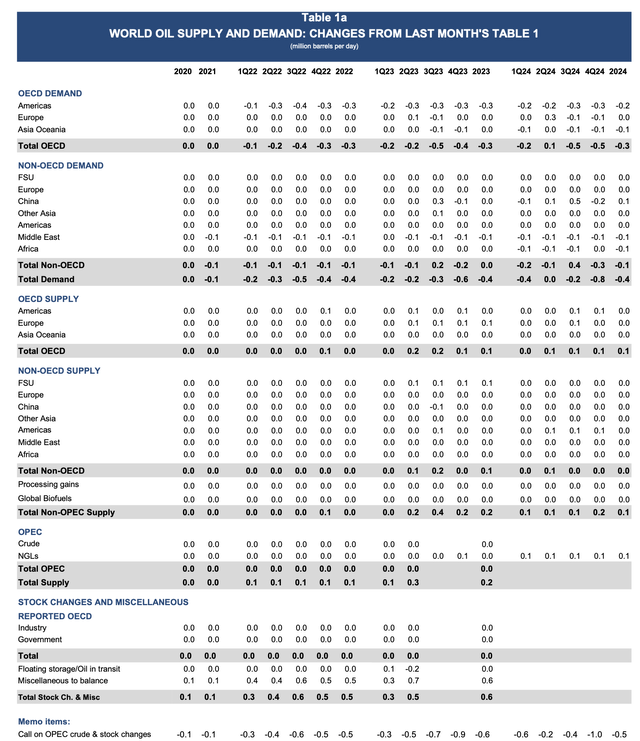

These were all very fair assumptions until this month's report came out. In fairness to the IEA, anyone with access to the report can look at the month-over-month change to see the assumption changes. It is on page 56 for anyone interested.

While the chart looks overwhelming, I will summarize it for you:

- IEA revised lower 2022 base demand by 400k b/d, which automatically revises down 2023 demand by 400k b/d and 2024 by 400k b/d.

This is an important point to understand. When you model global oil supply & demand balances, the Q4 figure is especially important because it carries over into Q1 of the following year. So in this case, you will see Q4 2023 demand assumptions revised down by 600k b/d. This will have a meaningful effect on balances in Q4 2024, which is down 800k b/d y-o-y.

People who are not looking at the fine print would not have noticed this startlingly downward revision.

To make matters worse, IEA increased miscellaneous to balance by 500k b/d for 2022. This automatically pushes the global oil balance from a deficit to a surplus. The combination of 400k b/d downward demand revision + 500k b/d of miscellaneous balance pushes 2022 balances to +500k b/d.

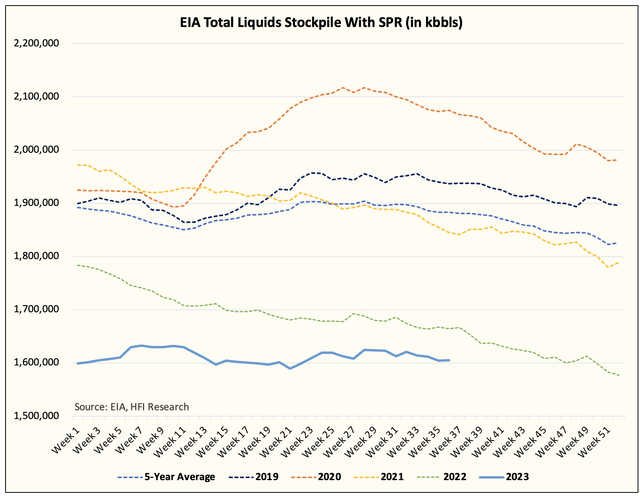

This assumption change makes about as much sense as the flat Earth theory. In 2022, US total liquids with SPR saw a draw of 300 million bbls. According to IEA's theory, global liquids should have seen a build of 182.5 million bbls.

So excluding the US, global liquids should have built 482.5 million bbls.

Does that pass the sniff test for you? Yeah, I thought so.

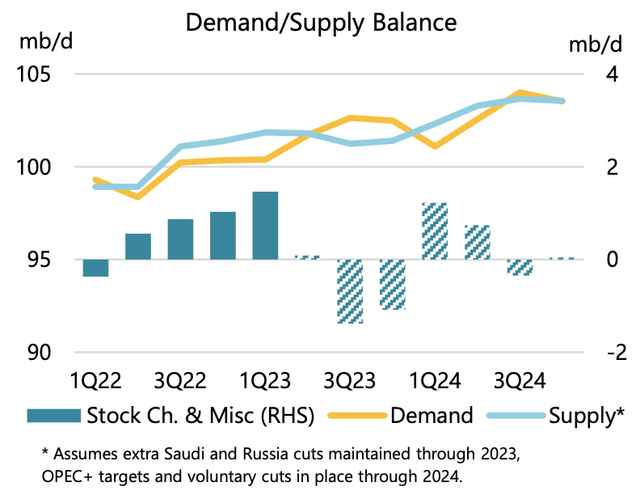

What's the end result? This:

Now there's another way to look at the problem we are presenting. If you are the Saudis and you look at this outrageous report the IEA just produced, what do you think you should do with your voluntary cut going into 2024?

Do you think the Saudis would just sit idle while IEA predicts a massive build in Q1 and Q2 of 2024? No, of course not. Perhaps the politically fueled IEA has triggered the catalyst we needed for the Saudis to extend the voluntary cut for H1 2024. Whatever the case, IEA's assumption for H1 2024 won't materialize.

There's so much more…

In my years of following the oil market, I have never seen such a dramatic change in the following year's assumption as the one I saw today. To implicitly change a historical year's balance by 900k b/d is one thing, but to do it in the face of facts is just something else entirely. And because of the downward demand revision, it changes the entirety of the assumptions for this year and the following year.

What is the purpose of this assumption change? Global oil market deficit is already starting and with the Saudis now more incentivized to keep the cut throughout H1 2024, IEA has all but sowed the seeds for even lower oil inventories and even higher oil prices. What they should have done instead is urge a potential supply crisis on the horizon, and falsely prompt SPR responses again like it did back in March 2022. Instead, they are poking the bear and prompting an entirely different response.

Just because the IEA says there is a surplus doesn't make it so, and by being untruthful in its reporting, it is only going to make matters worse. IEA screwed up royally.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, "Low commodity prices cure low commodity prices." Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!

This article was written by

#1 Energy Research Service on Seeking Alpha

----------

HFI Research specializes in contrarian investment analysis. We help you to find clarity in a world of uncertainty. We take contrarian thinking very seriously and believe that the only way to obtain a real edge in the market is to possess a contrarian investment thesis. We share our investment analysis with premium subscribers through daily and weekly reports.

----------

HFI Research Premium currently includes:

Oil Market Fundamentals - Our daily oil market report that discusses the current oil market fundamentals and the incoming price trend.

Natural Gas Fundamentals - Our daily natural gas market report that details current trader positioning, fundamentals, weather, and the incoming trade set-up.

Real-Time Trade Notifications - We actively trade oil and natural gas ETNs. In addition, we also issue real-time trade notifications on individual stocks.

Weekly EIA Crude Storage Forecasts - Every Saturday, we give the EIA crude storage estimate for the incoming week's report.

Weekly US Oil Production Forecasts - A weekly tracker for real-time US oil production so subscribers can understand what's happening to US shale growth.

What Research Reports We Read - A weekly report that covers all the research reports we read for the week, so subscribers can understand the market consensus and contrarian viewpoints better.

What Changed This Week - Our flagship weekly report.

For more info, please message us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)