Theft, Politics, And Consumer Weakness - What To Make Of Target?

Summary

- Target's quarterly earnings show consumer weakness, problems with theft, lower guidance, and investments in a more streamlined future.

- The retail industry is facing challenges including employee dissatisfaction, theft, and social/political pressures.

- Target is making efforts to improve its business by adjusting to consumer trends, enhancing the shopping experience, and improving supply chain efficiency.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Yossakorn Kaewwannarat/iStock via Getty Images

Introduction

I do not own Target (NYSE:TGT), as I prefer to own the companies that ship consumer goods, including railroads. However, I still like to cover it for a number of reasons:

- I have family members who own TGT stock.

- The company, which operates close to 2,000 stores, tells us a lot about the state of the consumer and other developments we need to know about.

- The retail landscape has become a minefield of political developments, increased shrink (a fancy word for theft), and employee dissatisfaction.

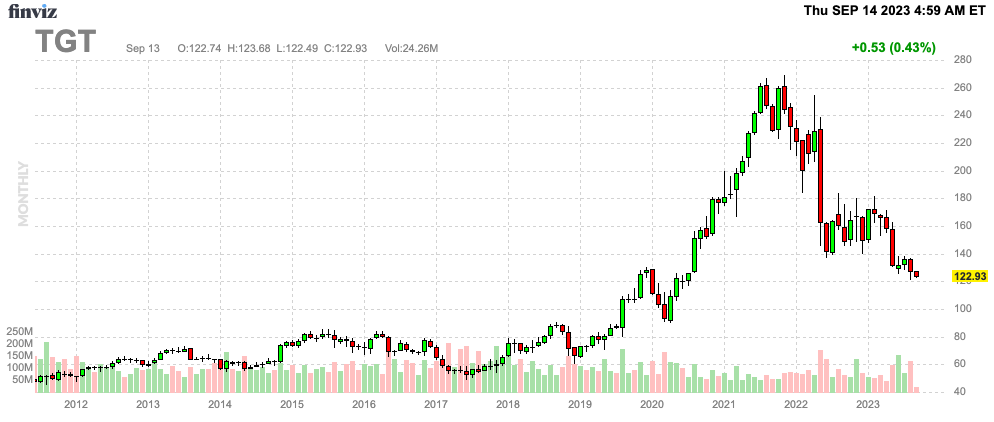

- Target is a dividend aristocrat with a 3.6% yield, trading more than 50% below its all-time high.

FINVIZ

So, there are plenty of reasons to take a closer look at this Minnesota-based retail giant.

In this article, we'll discuss its quarterly earnings, which showed consumer weakness, problems with theft, lower guidance, and investments in a more streamlined future.

We'll also discuss its valuation, which has become a lot more favorable.

So, without further ado, let's get to it!

Retail Has Become A Minefield

Earlier this month, I read a lengthy article on Bloomberg, which discussed how dissatisfied American retail workers are becoming.

On top of the usual problems like low pay, erratic schedules, and monotonous tasks, employees are now hit with new issues like increasing theft and social/political issues.

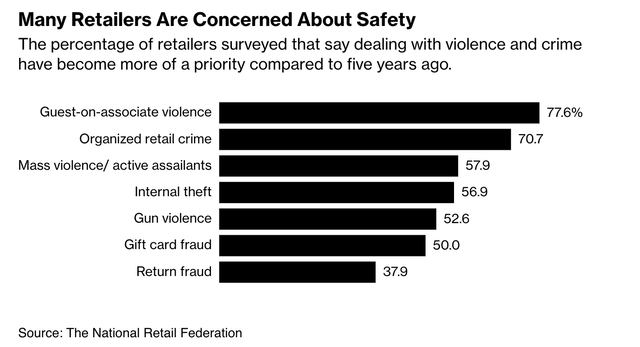

Bloomberg

One company was mentioned specifically: Target.

And in today’s era of political polarization, some have been caught in the crossfire of the culture war — most notably at Target Corp., which pulled some LGBTQ-themed merchandise from its shelves earlier this year after employees were subjected to what CEO Brian Cornell described to “Bloomberg” as threats from certain customers. “Violence in stores for political reasons is something that we didn’t really experience in the past,” says Stuart Appelbaum, president of the 100,000-member Retail, Wholesale and Department Store Union.

While I refrain from commenting on political issues, as I do not want to abuse my platform for political goals (also, my political opinion does not matter too much), I believe that we're in a period where retailers need to be careful. Bud Light, for example, made the grave error of using promotion at the worst possible time that didn't even remotely appeal to its customers.

It caused Target to completely rethink its strategy.

[...] we're focused on building assortments that are celebratory and joyous with wide-ranging relevance, seem mindful of timing, placement and presentation, meaning the segmentation and leveraging our digital experience and reconsidering the mix of owned brands, national brands and external partners within these assortments. - TGT 2Q23 Earnings Call

Having said that, there are bigger issues. I believe that marketing can be solved. One issue Target cannot influence is the health of the consumer, which isn't great.

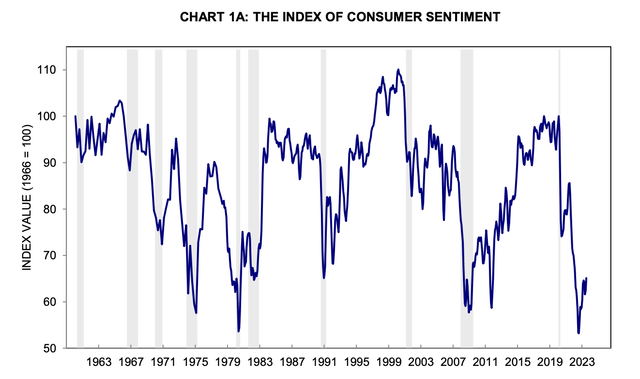

While consumer sentiment has bounced back, it continues to hover around the lows of the Great Financial Crisis. Even worse, gasoline prices are starting to increase again. The just-released inflation numbers showed a second consecutive month of rising year-on-year inflation. That will likely keep a lid on consumer sentiment.

University of Michigan

So far, consumer weakness has done a number on Target's sales.

For example, the second quarter saw a 5.4% decrease in comparable sales, driven by a divergence in sales trends between frequency and discretionary categories. Traffic was down 4.8%. Digital comparable sales were down even more at -10.5%.

Target

The company attributed this to various factors, including inflation affecting frequency categories like Food and beverage, increased spending on services, and the rollback of government support for consumers.

During its earnings call, the company also mentioned challenges related to the Pride assortment, which resulted in swift changes to protect the team (and revenue growth). The Pride assortment is the social/political issue I just briefly addressed.

On top of that, the company noted a rise in retail theft and organized retail crime, with safety incidents involving violence or threats on the rise.

During the first five months of this year, our stores saw a 120% increase in theft incidents involving violence or threats of violence.

[...] But so far, we've only seen indications that loss rates might soon be reaching a plateau, but have not yet seen evidence that loss rates will begin to come down. So the only reason for the expected change in year-over-year comparisons is the cadence of how shrink was recognized by quarter in the back half of last year, a period when loss rates increased rapidly, resulting in higher shrink accruals at year-end. - TGT 2Q23 Earnings Call

In other words, the only reason why theft may become more favorable is accounting measures and year-on-year comparisons. I believe that is not a recipe for success, especially because it seems that politicians couldn't care less about these issues.

Because of these issues, a lot of stores (not Target, but in general) have already closed in certain locations. For example, the San Francisco Bay Area is losing a lot of stores to these problems.

As a result of a mix of weak consumer sentiment (the biggest issue), social issues like its Pride incident, and rising theft, the company adjusted its guidance.

On the top line, the company is now planning for comparable sales in a wide range centered around a mid-single-digit decline for the remainder of the year, consistent with what the company experienced in July and the second quarter overall.

With this change in the top line, we also adjusted our bottom line guidance and now expect full year GAAP and adjusted EPS in the $7 to $8 range compared with our prior range of $7.75 to $8.75. - TGT 2Q23 Earnings Call

Having said all of this, I'm doing things a bit differently. I'm going to show you the valuation before I get to another important part.

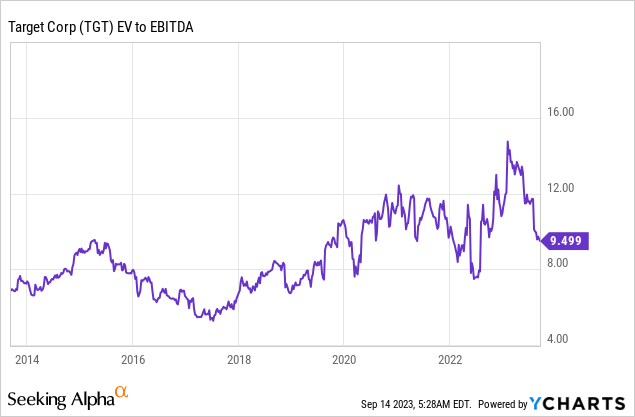

Valuation

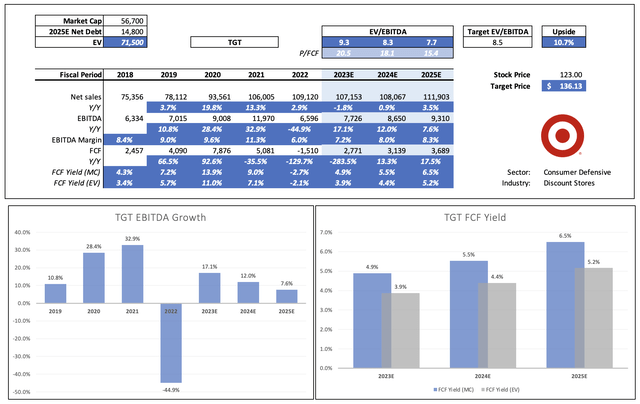

Over the past ten years, TGT's valuation has been volatile. After the pandemic, the valuation rose to 12x EBITDA. It rose even further when its financials started to weaken. Now, the valuation is back to 9.5x LTM EBITDA. The longer-term median is close to 8.5x EBITDA.

When I apply an 8.5x multiple to the company's longer-term EBITDA outlook (from analysts, it's not guidance), we get a fair value of $136 per share, which is 10% above the current price. That's not a lot after the stock got hammered over the past two years.

The current consensus price target is $151.

The problem is that the company's EBITDA took a pretty big hit after the pandemic. Growth rates are expected to quickly decline again to 7.4% by 2025. That's not a bad growth number, but it keeps a lid on longer-term EBITDA growth. Although I expect that macroeconomic challenges will change these numbers over time, I doubt we'll see many upgrades, given the downtrend of economic growth.

Leo Nelissen (Based on analyst estimates)

The good news is that the company is expected to consistently generate more than $3 billion in annual EBITDA after this year. This implies a greater than 5% free cash flow yield. This protects the current 3.6% dividend yield.

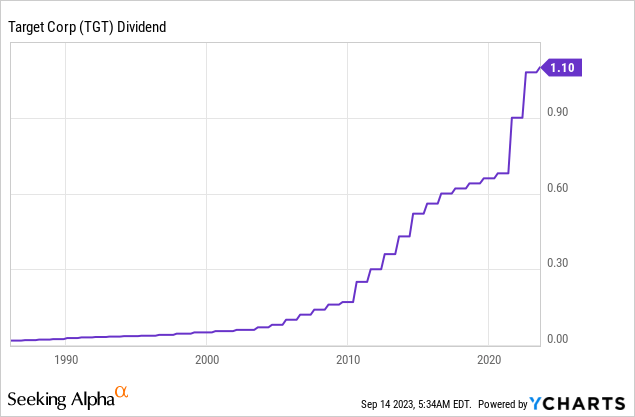

Its dividend has been hiked for more than 50 consecutive years, making the company a dividend king.

With regard to dividend growth, the 5-year dividend CAGR is 11.7%, which was mainly fueled by the pricing power that came with the pandemic. On June 15, the company hiked by just 1.9%.

The dividend is also protected by its balance sheet. The company is expected to lower its net leverage ratio to 1.8x in 2024. It has an A-rated balance sheet.

Having said that, it's not all bad.

Target is making good progress in adjusting its business to this challenging environment and capturing new opportunities in the future.

Target Is Improving Its Business

Target cannot improve customer health. However, it can adjust itself to consumer trends and improve the shopping experience.

For example, during its 2Q23 earnings call, the company mentioned Target Circle Week's success and the expansion of shop-in-shops with Ulta Beauty (ULTA).

The introduction of Starbucks and convenient returns through Drive-Up also received positive feedback.

The company also highlighted its success in securing exclusive products tied to movie licenses, capturing significant market share.

[...] to invest heavily in our in-store experience, which starts with new stores and remodels that incorporate our latest and greatest offerings, including Apple, Levi's and Disney experiences as well as the additional Ulta Beauty at Target locations. And just like we remodel our stores to reflect our latest thinking and guest feedback into the shopping experience, will begin rolling out a remodel of our digital experience this quarter. - TGT 2Q23 Earnings Call

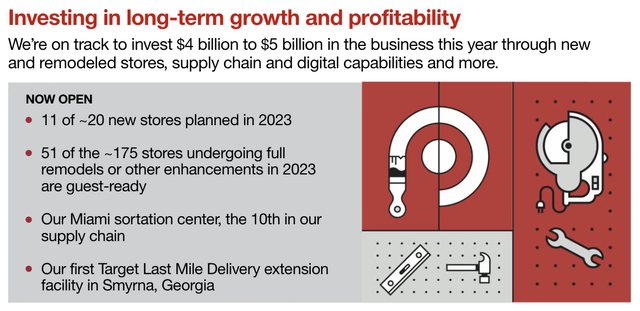

On top of that, the company's new sortation centers were highlighted as key contributors to its success. These facilities, located downstream from stores, focus on improving last-mile delivery efficiency.

Approximately 70% of packages processed by these centers stay in the local market, leading to shorter delivery times, with an average click-to-deliver time almost 1.5 days shorter than the network average.

Target

Target plans to open more sortation centers in the coming years, projecting a substantial increase in package processing.

Also, with regard to the aforementioned staffing issues, the company invested in training programs and implemented rapid response processes to ensure consistent execution and improve critical guest outcomes.

This also included pricing accuracy, efficient digital order fulfillment, and timely implementation of seasonal programs. According to the company, the results showed broad-based improvements in performance metrics.

Furthermore, Target maintained tight control over inventories, which were 17% lower than the previous year. This control was a result of the company's cautious planning approach, responsive team, and agile global supply chains.

In prior years, managing inventories was a very tough task, as the pandemic came with a wave of new demand after lockdowns ended. Inventories were not prepared. Then, companies ordered too much inventory, leaving them with massive markdowns when consumer demand slowed. It's one of the biggest reasons why TGT's stock price started to weaken in 2021.

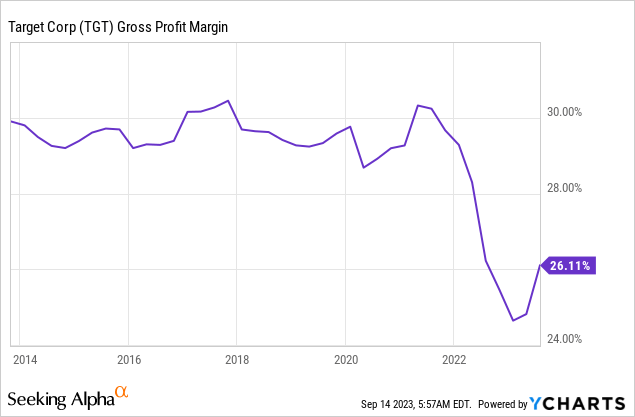

Despite leaner inventories, they improved in-stock levels significantly. The company's gross margin performance in 2Q23 was good (given the circumstances), reflecting benefits from lower markdowns, reduced inventory-related costs, and lower freight expenses.

The chart below shows the development of gross margins.

Digital fulfillment and supply chain efficiency also contributed positively, partly offset by a 90 basis point headwind from inventory shrink.

Going forward, analysts expect the company to somewhat normalize EBITDA margins to 8.3% by 2025 (see my valuation table above).

Overall, these developments are good. I have little doubt that TGT will remain one of the go-to stores. Its dividend yield has become attractive, and its stock price has priced in a lot of weakness.

Although I do not believe that TGT is a no-brainer long-term investment, I think the risk/reward is starting to get attractive.

However, investors need to be aware that the stock could see more downside in case of worsening economic growth. I would not rule out 10% to 15% more downside if re-accelerating inflation keeps a lid on consumer confidence.

So, please keep that in mind when making long-term investment decisions.

Takeaway

Recent issues like employee dissatisfaction, theft, and social/political pressures have added complexity to the retail landscape. Target, in particular, has had to adapt its strategies in response.

Consumer weakness has impacted sales, and the company adjusted its guidance accordingly.

However, Target's strong dividend track record, focus on improving the shopping experience, and efficient supply chain management are positive signs.

While not a no-brainer long-term investment, TGT presents an attractive risk/reward profile.

However, be mindful of potential downside risks, particularly if economic growth falters.

Although I give the stock a Buy rating, it's more of a speculative buy rating.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)