Procter & Gamble: Where Consistency Meets Opportunity

Summary

- Procter & Gamble is well-positioned to deliver mid-to-high-single digit EPS growth through FY27. However, the current share price is too high to warrant a buy rating.

- PG's robust revenue diversification across developed and emerging markets provides stability and growth opportunities.

- The company's ability to adapt to evolving consumer preferences and its strong brand portfolio position it to outperform sector growth.

- PG's financial resilience is evident, with recent years seeing notable improvements in organic sales growth and core EPS growth. At the same time, I see little room for significant margin improvements.

- The company consistently rewards shareholders through dividends and share repurchases, supported by a healthy balance sheet and strong cash flow generation.

Mario Tama/Getty Images News

Investment thesis

I initiate my coverage of The Procter & Gamble Company (NYSE:PG) with a Hold rating following my in-depth research of the company and the underlying consumer staples industries. While the company may not have been a winner over the last decade in terms of financial performance, the company today is well-positioned to deliver market-matching results over the next few years.

Procter & Gamble emerges as a steadfast fortress for investors seeking stability and growth in a volatile economic landscape marked by high inflation and rising interest rates. As a globally renowned consumer goods conglomerate, PG boasts an extensive portfolio of essential products that transcend market cycles. PG's robust revenue diversification across developed and emerging markets provides a balanced foundation, with approximately 70% of sales originating from mature economies.

This diversification extends to PG's five operating segments, with no single segment contributing more than 35% of sales. PG's enduring growth potential is underpinned by its ability to adapt to evolving consumer preferences. With a significant presence in skincare, haircare, grooming, healthcare, and more, PG stands to benefit from industry growth trends. The company's market leadership and strong brand portfolio position it to outperform sector growth.

PG's financial resilience is evident, with recent years seeing notable improvements in organic sales growth and core EPS growth. The company consistently rewards shareholders through dividends and share repurchases, supported by a healthy balance sheet and strong cash flow generation.

While PG commands a premium valuation due to its quality and stability, current share prices appear slightly overvalued in the near term. However, its enduring characteristics justify a premium over peers. Procter & Gamble is a symbol of reliability amid economic uncertainties. Its ability to adapt, diversification, and shareholder-friendly approach make it an attractive long-term investment. While current valuations may warrant caution, PG's growth outlook and strong fundamentals suggest it remains a prudent choice for investors, especially at a more attractive entry point of around $143 per share.

In this article, I will take you through my analysis of the company and the underlying industry, as well as the latest developments and financial projections.

Procter & Gamble – A consumer staples giant

Inflation rates are stubbornly high still, interest rates keep rising, and the global economy is faltering. In these challenging times, investors often get reminded of the value offered by all-weather consumer goods companies, which offer products that are consumed and a necessity in the daily lives of most people around the world no matter the economic health or geopolitical issues.

One of the most recognized and high-regarded consumer staples companies (and one of the biggest) in the world is Procter & Gamble. Procter & Gamble (which I’ll refer to as PG) is a multinational consumer goods company established in 1837 and has grown to become one of the world's largest and most influential consumer goods companies, with a rich history of innovation and a strong presence in more than 180 countries.

The company operates in several important consumer markets like Beauty, Grooming, Home Care, Healthcare, and several others through well-known brands like Pampers, Dreft, Always, Gillette, Braun, Head and Shoulders, Old Spice, Oral B, Olay, to just name a few.

I am sure the company needs little introduction as it is very well known among investors, especially as one of the most sublime dividends-paying companies out there with a history of 66 consecutive years of dividend growth.

Procter & Gamble's enduring success is rooted in its ability to innovate and adapt to changing consumer preferences. With so many $1+ billion brands across different consumer markets, the company has shown the ability to adapt to fast-changing consumer preferences over its many decades of history.

An exceptionally well-diversified revenue stream

As a global consumer goods powerhouse, P&G continues to shape the industry with its iconic brands and dedication to improving lives worldwide. It is simply hard to avoid the company as a consumer due to its presence across markets and regions.

North America is still the largest market for the company as this region accounted for 50% of its sales in FY23, which I don’t think makes it overly dependent on this continent alone. The other 50% is derived from all other regions worldwide, with Europe taking up the largest part with 21% of sales.

This means the company derives around 70% of its sales from developed regions, with the remaining 30% coming from emerging and faster-growing regions. I believe this is a very nice balance between mature and stable markets and faster-growing regions that can drive growth for the company without giving it too much exposure to these generally more unstable economies.

Furthermore, this positive diversification trend continues when looking at its operating segments. Today, the company operates across five different operating segments, which are:

Beauty: This segment includes a diverse array of skincare and haircare products. The segment accounts for 18% of total sales and through multiple very strong brands, the company holds a market share of around 20% in the hair care industry, according to Business Quant. Furthermore, growth in these particular industries (skincare and haircare) is expected to remain very respectable with underlying market growth of around 6% expected through 2030.

Grooming: P&G is a global leader in the grooming industry, producing products such as razors, shaving creams, and deodorants under brands like Gillette and Old Spice. The segment accounts for only 8% of total sales but the company is still the global leader in the industry with a market share of around 60%, according to Business Quant. Furthermore, growth in the men’s grooming industry, for example, is expected to grow at a solid 8% CAGR through 2030.

Healthcare: P&G's healthcare segment encompasses products like toothpaste, dental care products (Oral-B), and over-the-counter medicines (Vicks, Pepto-Bismol). This segment accounts for 14% of total sales. As the healthcare industry is massive and complicated, it is hard to determine PG's market share or expected growth rate. However, with an aging population and an increasing focus on hygiene and dental care, this segment is well-positioned to keep reporting solid growth.

Fabric and Home Care: This segment offers fabric care, air freshener solutions, laundry detergents, dishwashing products, and cleaning solutions through brands like Ariel, Febreze, and Swiffer. This segment is the largest one and accounts for 35% of total sales, giving the company a market share of around 25% in this market, according to Business Quant. Furthermore, growth in the underlying industries should ensure this segment grows by low-to-mid-single digits through 2027, which sits somewhat below the expected growth for many other of PG’s segments.

Baby, Feminine, and Family Care: P&G produces baby care products (Pampers, Luvs), feminine care products (Always, Tampax), and family care products (Charmin, Bounty). The segment accounts for 25% of total sales and the company holds a market share of around 25% in the industry, according to Business Quant. Furthermore, underlying industries are expected to grow by mid-single digits, with the baby care industry expected to grow at a CAGR of 6.2% and the overall personal care market at 4.62%.

Looking at the overall picture, I quite like the company’s current diversification as the company is not overly exposed to any regions and has plenty of exposure to faster-growing economies. Yes, you could think it heavily relies on the US, but I think 50% exposure is within the limits, especially as the growth outlook for other regions is more promising.

Furthermore, the company is well diversified across several consumer end-markets, with no single segment accounting for over 35% of sales. The combination of great international and end-market diversification makes PG one of the best-diversified consumer staples companies, giving it exceptional resiliency under pretty much any circumstances.

A solid growth outlook across end markets and remarkable brand strength

Possibly even more important, looking at the underlying expected growth rates we can see that all segments are expected to show growth of low-to-mid-single digits, giving us an idea of what to expect from PG through the end of the decade in terms of sales growth.

Crucially, as PG also holds respectable market shares in all of these industries, often being the industry leader, and operates leading brands, it should be well-positioned to fully benefit from growth in these industries and could likely even outperform. Outperforming the underlying industry is precisely what management targets according to its 2022 investor day, likely resulting in long-term sales growth of between 4-6%. I believe this is a realistic scenario.

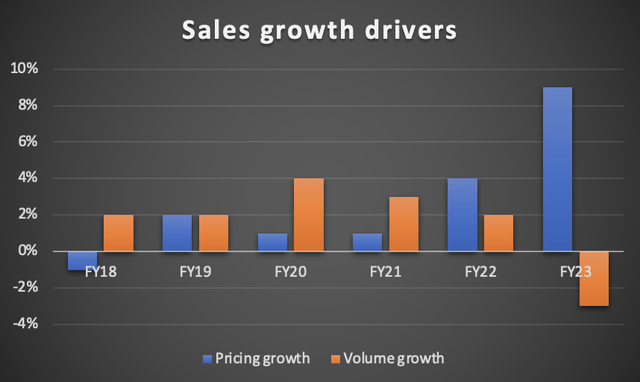

The majority of this growth will be driven by volume with pricing giving an additional boost. Luckily, PG has a strong portfolio of well-known brands and true household products, which are not easily replaced by consumers, giving the company incredible brand strength and pricing power, allowing it to drive growth through pricing, as illustrated in recent years if volumes tumble.

As a result, even if times get rough and the economy deteriorates or inflation booms, PG has shown the ability to offset any volume weakness or increases in input costs with stellar pricing power to keep margins stable and growth positive. This further contributes to the company’s incredible resilience and stability.

Following the decade-high inflation levels seen over the last two fiscal years, PG has shown pricing growth of 4 and 9 percentage points as volumes weakened and even turned negative in its fiscal FY23, which ended last quarter. This perfectly highlights the company’s pricing power as volumes were only slightly impacted. Still, importantly, we should expect growth to be driven by growing volumes over the next couple of years and growth driven by pricing to ease as inflation does the same.

By Author

Sales growth is looking good but there is little room for margin improvements

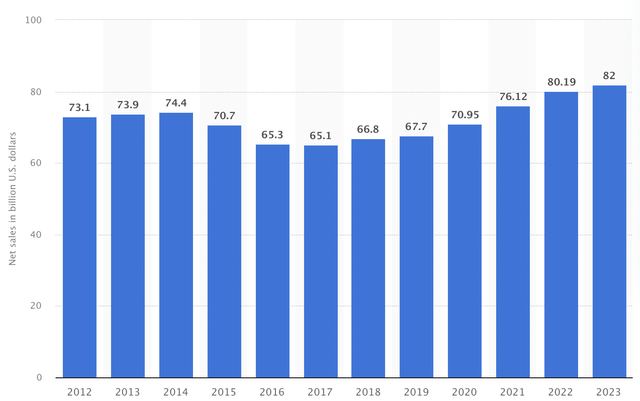

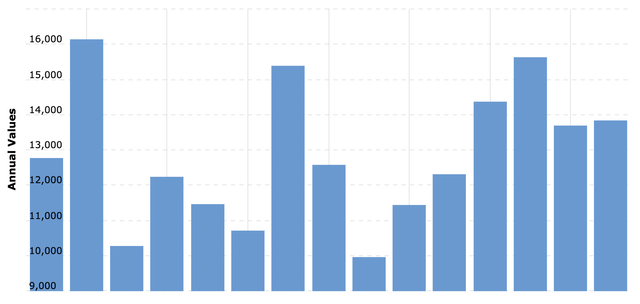

In terms of sales growth, earnings growth, or margin improvements, PG has definitely not been the place to be over the last decade and I would even call the financial performance rather disappointing over these years. Sales grew at a very meager CAGR of 1% and net earnings at a disappointing 3% CAGR. Nothing to cheer about for sure.

P&G revenue (Statista)

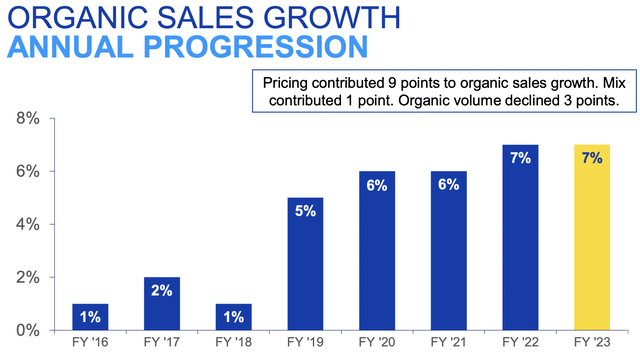

However, the graph above shows a significant improvement and turnaround over the last four to five years. The company has performed much better over the last few years, reporting organic sales growth at a CAGR of 6%, volume growth of 3%, and currency-neutral core EPS growth of 12%. Management has turned the declining sales trend around and has returned to reporting decent growth, partly driven by price increases in the last couple of years.

Looking at the most recent results, organic sales growth of 7% for FY23, which, as shown earlier on, was driven mainly by price increases as volume growth came in at a negative 3%. Still, this was the fifth consecutive year in which revenue growth sat above 5% after multiple years of disappointing growth.

FY23 performance (P&G)

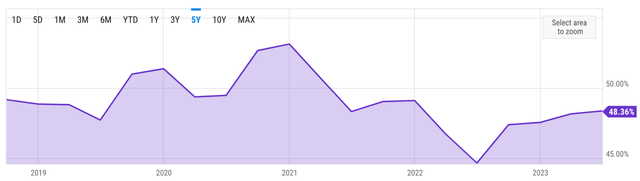

Looking at the bottom line, the picture is a bit mixed. PG is able to report a gross and operating margin that sits consistently and comfortably above the consumer staple average, which is a respectable achievement. However, margins have shown little improvement over recent years, and I am not expecting incremental margin improvements over the next couple of years either. The gross margin did show some structural improvement in the period 2018-2020, but exceptional circumstances largely drove the record high of 53% in 2020, most notably COVID-19. I am not expecting similar margins anytime soon again.

50-100 basis points of gross margin improvement is about all investors can wish for as the company is very mature and has shown little ability to incrementally boost margins from the current already solid level. For FY23, PG reported a gross margin of 47.8%, up 50 basis points YoY while the operating margin declined by 10 basis points to 22.1%. Both sat roughly in line with the 5-year average.

Gross margin development (Ycharts)

The company reported a net income margin of 18%, down 40 basis points. Still, this sits far above the sector average and is really strong for a consumer staples company. The company is incredibly high quality but has little room for potential improvements.

In FY23, EPS grew by just 2% due to some margin declines, but I expect PG to slightly grow margins in the long run (nothing too impressive, though) and further boost EPS by repurchasing shares. Therefore, I think it’s fair to assume EPS to outgrow sales growth by around 150-250 basis points, resulting in long-term EPS growth of between 5.5% and 8.5%.

The company excels in rewarding its shareholders through capital return

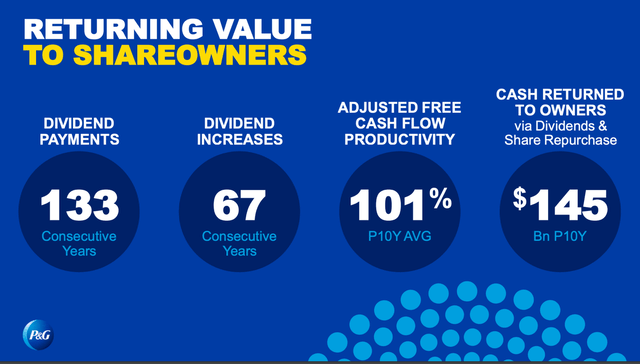

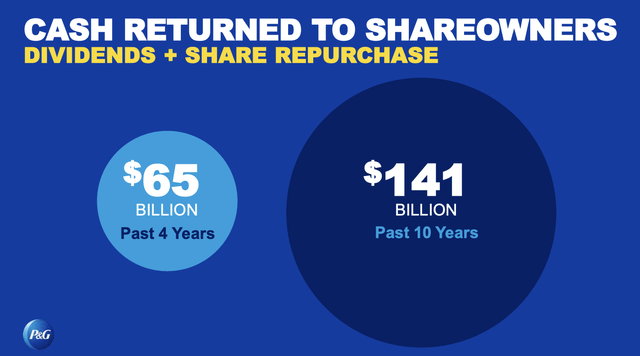

On the note of the company buying back its own shares, it is worth mentioning that it is very much shareholder-focused. This is highlighted by the two slides below.

P&G

P&G

In FY23 alone, PG returned $16 billion to shareholders through $9 billion in dividend obligations and an additional $7.4 billion in share repurchases, which was not fully covered by the $14 billion in FCF generated.

Shares currently yield 2.46%, which sits 3.5% below the 5-year average and to me is a very decent starting yield. Furthermore, with a payout ratio of just 62%, the dividend is well-covered and can be perceived as safe. While I prefer a payout ratio of below 50% to support meaningful dividend growth potential, PG’s sales stability and decent growth outlook give me confidence in the safety and growth potential of the dividend.

Furthermore, the company’s healthy balance sheet allows these kinds of returns as the company, as of the most recent quarter, reported a solid cash position of $8.25 billion against debt of $35.42 billion. Furthermore, the company knows how to generate significant cash flows as it has generated a total of almost $70 billion in free cash flow over the last five years and has been showing improvements as well. As the company continues to aim to return around 90% of its FCF to shareholders, I believe this should nicely cover a dividend growing at mid-single digits and continued share repurchases.

P&G annual FCF (Macrotrends)

Outlook and PG stock valuation

After reporting its 4Q23 results a couple of months ago, management now guides for FY24 organic sales growth in the range of 4% to 5%, in line with my long-term expectations, which I laid out before. Management believes its underlying markets will return to growth of around 4% and pricing to become less of a driver as volume growth turns positive again. These sales expectations should lead to EPS growth in the range of 6% to 9%.

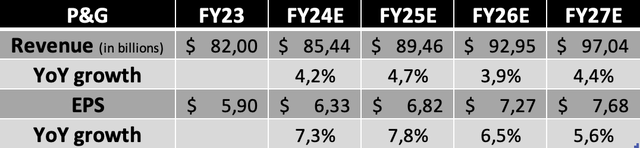

Based on this FY24 outlook, my long-term expectations, and further research, I arrive at the following financial projections until the company’s fiscal FY27.

Financial projections (By Author)

Moving to the valuation, it is essential to first note that high quality always comes at a price. PG shares are currently valued at 24.5x my FY24 EPS estimate, which means shares are currently valued slightly above the 5-year average valuation of 24.1x. Earlier, I pointed out that the dividend yield also currently sits slightly below the 5-year average, indicating that shares are slightly richly valued, even for PG standards.

In an increasingly more risk-on environment and as economic headwinds ease, this valuation for a company projected to grow sales at mid-single digits is quite rich. However, the incredible earnings quality and stability offered by the company warrant a significant premium over peers; therefore, I believe its 5-year average P/E multiple of 24x is fair.

Based on this belief and my FY25 EPS projection, I calculate a target price of $164, leaving a 24-month upside of just 6%. Going with an annual return of 7% (9.5% including dividends), I believe a current fair value share price sits around $143 per share, meaning shares are currently overvalued by around 7%.

Conclusion

Procter & Gamble stands as a beacon of stability and resilience in the face of economic challenges. With its diversified revenue streams, strong brand portfolio, and impressive track record of dividend growth, PG has proven its mettle in adapting to changing consumer preferences. Despite a decade of modest financial performance, recent years have witnessed a remarkable turnaround, with a focus on organic growth and robust pricing power.

PG's commitment to rewarding shareholders through dividends and share buybacks underscores its shareholder-friendly approach. While its current valuation might seem slightly rich, its enduring quality and stability warrant a premium.

Looking ahead, PG's growth outlook remains promising, with expectations of mid-single-digit sales growth and solid EPS growth. However, shares are currently slightly overvalued with a target price of $164 and a fair value estimate of around $143.

Therefore, I rate shares a hold and recommend investors to hold onto the shares or keep them on their shortlist while waiting for a better entry point of closer to $143 per share.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

I never plan to sell. I sleep very well nights collecting safe & reliable dividend payments from this dividend king.