Lakeland: Can This Stock Go Higher Post-Earnings?

Summary

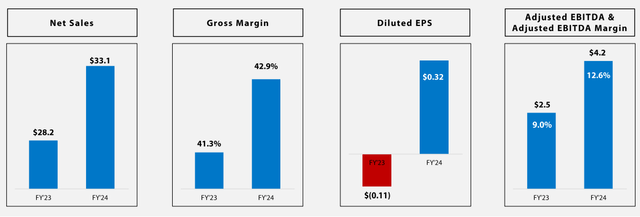

- Lakeland Industries reported strong Q2-2024 earnings, with EPS of $0.32 and revenue of $33.07 million, beating street estimates.

- The company experienced strong revenue growth driven by fire services, with a 17.3% increase in sales and a 202% growth in the fire services line.

- Lakeland stock is trading at a discount of 6.94x compared to 17.17x for peers based on forward EV/EBITDA multiple.

Michael Stifter/iStock via Getty Images

Background

I wrote the article "Lakeland: Trading At A Discount Despite Improving Financials" on 3rd Sep, 2023 based on an investment thesis that Lakeland has the potential for upside. I have evaluated the projected growth of the addressable market for Lakeland and concluded that it is poised to outperform due to sustainable long-term revenue growth, adjusted EBITDA margin enhancement, better management of cost structure and reasonable valuation. The stock is up ~7% compared to a negative S&P change of 0.75% since the previous analysis was published. The company reported its Q2-2024 earnings last week. In this article, we will evaluate the possibility of further increases in stock based on the latest earnings or Post-Earnings Analysis.

Lakeland Industries (NASDAQ:LAKE) manufactures and sells safety garments and accessories for the industrial protective clothing market primarily in North America, China, India, and Brazil.

Street Expectation Review

Lakeland Industries reported second quarter EPS of $0.32, $0.09 better than the analyst estimate of $0.23. Revenue for the quarter came in at $33.07 million, $2.67 million better than the street estimated.

Strong Revenue Growth Driven By Fire Services

Earning Presentation, Q2-2024

The sales increased to $33.1 million in Q2-2024, an increase of 17.3% Y/Y driven by robust growth of 202% or $6 million in the fire services line by focusing more into a higher value and strategic product categories. The growth in the fire product category was further supported by the Eagle acquisition with $3.4 million in fire service sales. In addition, its sales are increasing in key geographic markets outside of the U.S. Furthermore, the woven product line is also showing momentum driven by the industrial market. However, the ongoing weakness in Asia, particularly China is still showing signs of distress as the impact of COVID-19 lockdowns waned early in 2023. In H1-2024, sales in Russia were 3.3% with sales in Ukraine were not significant. This will reduce any risk from the ongoing Russian-Ukraine War. However, the rising inflationary trend has impacted both revenues and costs globally, and which may continue in the future. According to management, the revenue growth will be in the range of mid-high single digits in core markets for the 2025-2027 target. Moreover, this growth will be higher than the market by 200bps-300bps per year, showing the resilience of the Lakeland business model.

Continuous Improvement Of Operational Efficiency And Profitability

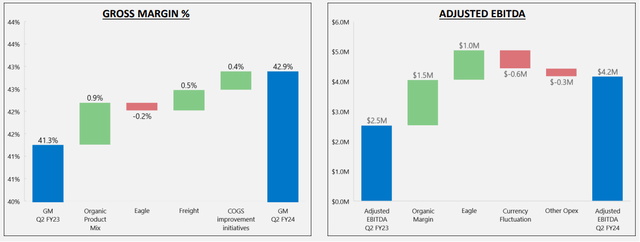

I believe improvement in margin can be better understood from the margin bridge compared to previous year's margin.

Earnings Presentation, Q2-2024

In terms of gross profit margin, Lakeland has shown strong improvement in margin with an increase of 160 bps Y/Y to 42.9% due to an improved product mix through focus on strategic product lines, reduced manufacturing costs through increased throughput and reduction in freight costs. Moreover, management has a three-to-five year target for gross profit margin in the range of 40% to 45% and 42.9% is well within the range.

Lakeland's improved gross margin, product mix, improvement in the higher value product line and Eagle acquisition are reflected in the adjusted EBITDA margin, which has increased to 12.6% from 9.0%. However, it was partially offset by the negative impact of currency fluctuations and other operating expenses. This increase in operating expenses was due to an increase in selling expenses, travel and trade show expenses and administrative expenses. In terms of percentage of sales, the operating expenses were reduced to 31.6% in Q2-2024 from a 34.8% on a Y/Y basis due to increased revenue. The management has projected a long term target for adjusted EBITDA margin in the high teens.

In summary, Lakeland has better projected revenue growth driven by a strategic product line, better management of cost structure and the EBITDA margins are projected to be within the long term target. All these factors are positive stock catalysts for investors.

Post-Earnings: Lakeland Is Still Trading At Discount

| Peers | EV/EBITDA (Forward) |

| Lakeland Industries (NASDAQ:LAKE) | 6.94x |

| DuPont de Nemours (NYSE:DD) | 12.93x |

| MSA Safety (NYSE:MSA) | 17.65x |

| Honeywell International (NASDAQ:HON) | 14.73x |

| Kimberly-Clark (NYSE:KMB) | 13.17x |

| Median Multiple | 13.17x |

Based on the above peers analysis post-earnings, we can conclude that Lakeland is trading at a discount of 6.94x compared to 17.17x for peers. With strong revenue growth, EBITDA margin enhancement and consistent cash generation, Lakeland has a potential to trade at premium multiples and provide investment opportunities for investors.

My Recommendation: Buy Rating (Medium - Long Term)

I recommend a Buy rating for Lakeland based on the following factors:

- Strong revenue growth driven by focusing more into a higher value and strategic product categories

- Operational efficiency due to an improved product mix through focus on strategic product lines, reduced manufacturing costs through increased throughput and reduction in freight costs

- Valuation seems reasonable compared to peers based on an EV/EBITDA multiple

- However, investors have to watch closely the impact of foreign currency changes on revenue growth. In addition, the investor should keep a close eye on management guidance related to revenue and margins for the long-term target of 2025-2027.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.