Entergy: Benefiting From Strong Texas Industrial Growth

Summary

- Entergy Corporation is well-positioned to benefit from the rapid population growth in Texas, one of the fastest-growing states in the US.

- The company is aggressively deploying renewable energy generation and promoting alternative fuels, despite operating in the hydrocarbon industry hub of Texas.

- ETR plans to invest $16 billion in expanding its infrastructure to meet the increasing demand for electricity, particularly from industrial expansion in Texas.

- Entergy has a considerably higher debt load than many of its peers, which could be a real risk in today's high interest-rate environment.

- The stock appears to be fairly valued relative to its peers, but it is cheaper than it was back in July.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

Justin Paget

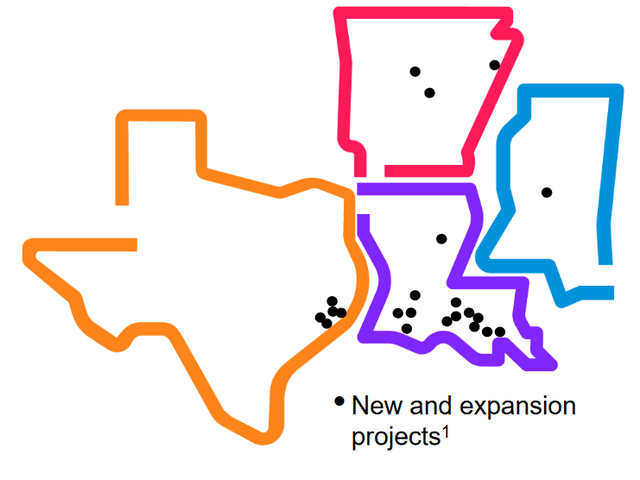

Entergy Corporation (NYSE:ETR) is a regulated electric utility that serves the states of Texas, Arkansas, Louisiana, and Mississippi:

This is an area of the country that has been growing at a fairly rapid pace, particularly Texas. In fact, Texas is one of the ten most rapidly growing states in the nation for a variety of reasons. Entergy is thus well-positioned to take advantage of this situation and benefit from a growing customer base in that state. However, this is not the only thing that this company has going for it, as Entergy Corporation is one of the most aggressive utilities when it comes to the deployment of renewable energy generation and the promotion of alternative fuels. This might not be what would be expected from a utility that operates in the Deep South, particularly in the state of Texas, considering that Texas is the focal point of the American hydrocarbon industry. However, the geography of Texas makes it very well suited for the use of both wind and solar power and the state has been taking advantage of that.

As I mentioned in my last article on Entergy, the company enjoys a remarkable amount of financial stability and resilience to economic shocks. This is something that could prove very advantageous right now considering the enormous amount of financial strain that many consumers are under as rapidly rising prices have caused real wages to decline and depleted the savings that were built up during the COVID-19 pandemic. Entergy is likely to be immune to any adverse impacts that this situation might have on consumer spending, which could make it a reasonable investment right now. The fact that the company currently trades at a very attractive valuation only enhances this thesis. Thus, let us investigate and see if this company could make sense for your portfolio today.

About Entergy Corporation And Growth Potential

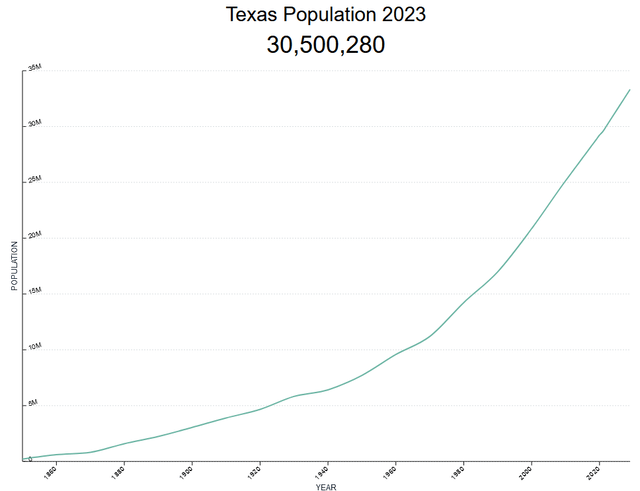

As mentioned in the introduction, Entergy is a regulated electric utility that serves the Deep South states of Texas, Louisiana, Arkansas, and Mississippi. This is an area that has been seeing significant population growth over the past few years, with Texas leading the pack. According to the U.S. Census Bureau, the population of Texas is growing at a 1.57% rate, which ranks it as one of the five fastest-growing states in the nation. As of right now, the state's population is estimated at approximately 30.5 million and it is projected to hit 33.3 million people by the end of the decade:

Arkansas is also growing, positing a current population growth rate of 0.57% year-over-year. Unfortunately, this strong growth is partially offset by Louisiana and Mississippi, which are experiencing population declines of 0.80% and 0.32% respectively. I explained why this population growth is a positive thing in my last article on this company:

The reason that this is important for Entergy is that population growth is one of the only ways that a utility can grow, and it is completely out of the utility's control. This is because Entergy is a monopoly that is restricted to operating in a specific region by law and it cannot expand by convincing customers outside of its service territory to switch providers. The fact, then, that Texas is one of the fastest growing states in terms of population provides a tailwind to the company's growth. The same is true of Arkansas, however, both Louisiana and Mississippi have been experiencing population declines since 2020. Overall, though, the trend is positive and Entergy's customer base is growing.

Thus, over time Entergy should have more people in its service area and thus more people paying their monthly utility bills. This should cause the company's revenues to increase, all else being equal. That will give the company more money to use to cover its fixed expenses and ultimately make its way down to profit and cash flow. Thus, the service area demographics are one factor in the company's favor.

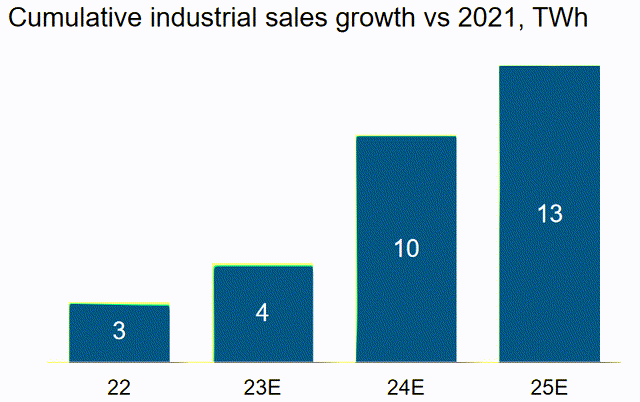

One of the reasons why Texas has been experiencing such strong population growth is because of industrial expansion in the area. We are seeing factories being constructed in Texas at a fairly rapid pace, for example. Tesla (TSLA) is a pretty good example of this, as the company constructed one of its "gigafactories" in Austin, Texas, and even moved its headquarters to the state. This company was hardly alone in this either, as there are several liquefied natural gas plants being constructed along the Gulf Coast along with supporting infrastructure to sustain this new construction. These are just a few examples of the economic growth in Texas that is attracting people to the state and growing its population. Entergy stands to benefit from this too because factories and other industry require a significant amount of electricity. Entergy notes that it currently sells approximately four terawatt hours of electricity to factories and other industrial facilities in its service territory. This is expected to increase to a whopping thirteen terawatt hours by 2025:

This is a 225% increase in two years. It should be fairly easy to see how that would have a beneficial impact on the company's revenues and cash flow. This does not, of course, include the fact that any employees of these industries who have to move into the company's service territory will begin using electricity in their homes. In addition, these industries are generally going to be providing jobs that pay sufficient wages to allow for some discretionary spending. Thus, we could see restaurants, retail stores, and other businesses pop up to provide entertainment and various consumer discretionary items to these people. All of these businesses will also consume electricity and pay regular bills to Entergy. Overall, this is a very good situation for the company to be in.

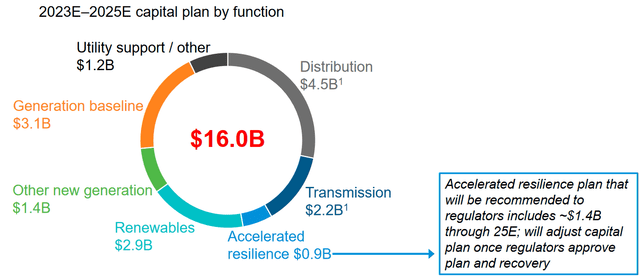

Naturally, though, the company will need to expand its infrastructure in order to accommodate this growing demand for electricity. After all, electric wires, power substations, generation facilities, and other infrastructure that the company might have only have a limited capacity that it can handle or deliver. The company will need to invest in new infrastructure in order to increase its capacity. Fortunately, Entergy is planning to do exactly that. The company recently unveiled a plan to invest approximately $16.0 billion into this area of its business over the 2023 to 2025 period:

This money will not be spent without appropriate payback for the company. After all, this capital spending will increase the company's rate base. I defined the rate base in my previous article on this company:

The rate base is the value of the company's assets upon which regulators allow the company to earn a specified rate of return. As this rate of return is a percentage, any increase in the rate base allows Entergy to adjust the prices that it charges its customers in order to earn more money.

This investment program is expected to increase the company's rate base from $35 billion today to approximately $42 billion at the end of 2025. This works out to a 6.26% compound annual growth rate over the three-year period. That does not necessarily mean that the company's earnings per share will grow at the same rate, although it will probably be reasonably close. There may be a discrepancy between the two figures though because Entergy Corporation will need to finance its growth program. Frequently, utilities will partially fund capital investment through the issuance of new common stock. This dilutes the existing shareholders and results in earnings per share growth being somewhat less than the company's rate base growth. Thus, in the absence of guidance from the company, we can probably assume that its earnings per share growth will be about 5% to 7% over the period. When combined with the current 4.47% yield, we get a total projected return of 10% to 12% annually, which is very reasonable for a conservative utility stock. This should be acceptable to most investors.

Revenue And Cash Flow Stability

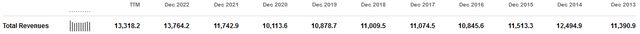

In the introduction to this article, I mentioned that Entergy enjoys remarkably stable revenues and cash flows regardless of the condition in the broader economy. We can see this quite clearly by looking at the company's revenues over the past several years. Here are the company's figures for each of the past ten full-year periods, as well as the twelve-month period that ended on June 30, 2023:

As we can immediately see, there is very little variation from year to year, despite the fact that the conditions in the economy experienced some steep swings over a few of these periods. In particular, the full-year 2020 period would include the COVID-19 lockdowns, which also included the shutdown of numerous businesses for several months. When we consider the number of businesses that were not operating during that period, including many factories and other large employers, we would expect to see a fairly significant decline in revenues. However, what we actually do see was very small compared to the prior-year period. In fact, it is pretty hard to believe that many offices, factories, retail stores, restaurants, and numerous other large consumers of electricity reduced their consumption at all.

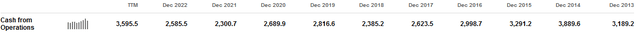

We see a very similar situation when we look at the company's operating cash flows over the same period. Here they are:

As was the case with revenue, we see very little fluctuation in the figures over time, although they are more volatile than revenues. That is to be expected though since events such as the timing of when the company paid certain bills, interest rate changes, and various other one-off events can have an effect on cash flows. The point though is that the company's financial performance should be largely unaffected by the financial health of the American consumer or the American economy. That point is basically made by looking at these figures.

I explained the reasons for this in my last article on Entergy Corporation:

The reason for this general cash flow stability is the nature of Entergy's business. The company provides a product that is generally considered to be a necessity for modern life. After all, how many people do not have electric service in their homes? Indeed, electric service is pretty much necessary for just about anything else that someone might have in their homes for entertainment or work. As such, most people will prioritize paying their electric bill ahead of making discretionary expenses during times when money gets tight. After all, nobody will want to go out for a meal or two in a restaurant with their last $100 and risk having their electricity turned off.

There are signs that the average American consumer has been getting weaker over the past few months. For example, LendingClub states that approximately 64% of Americans are currently living paycheck-to-paycheck. Vice President Kamala Harris recently stated that "most Americans are a single $400 expense away from bankruptcy," in a speech in Iowa back in July. This certainly does not sound like an environment that will be conducive to a high level of discretionary spending. In fact, the announcement earlier today that the inflation rate increased again will undoubtedly put even more pressure on the average person's ability to spend money. A company like Entergy should be able to navigate such an environment much better than a company that depends heavily on discretionary consumer spending for revenue. That is exactly the kind of company that we want to own in an environment like this.

Debt And Financial Structure

As I pointed out in the past, it is important to examine a company's financial structure as part of our investment research:

It is always important that we investigate the way that a company is financing its operations before we make an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is typically accomplished by issuing new debt and using the proceeds to repay the existing debt since very few companies have sufficient cash on hand to completely pay off their debt as it matures. As new debt is issued with an interest rate that corresponds to the market rate at the time of issuance, this can cause a company's interest expenses to go up following the rollover.

As of the time of writing, the effective federal funds rate is at 5.33%, which is considerably higher than it was the last time that we discussed Entergy Corporation. In fact, the federal funds rate is now at the same level that it was in early 2001 prior to the recession that followed the popping of the technology bubble. We literally have to go back to the early days of the George W. Bush Administration to find a time in which interest rates were comparable to today's levels. As such, it is a fairly safe assumption that any debt rollover today will cause a company's interest expenses to increase. I pointed this out in a recent article on one of Entergy's peers.

As of June 30, 2023, Entergy Corporation had a net debt of $26.0848 billion compared to $13.5870 billion of shareholders' equity. This gives the company a net debt-to-equity ratio of 1.92 today. This is only slightly higher than the 1.91 ratio that the company had at the end of the first quarter, so it appears to be trying to keep it somewhat stable. Here is how the company's ratio compares to that of its peers:

Company | Net Debt-to-Equity Ratio |

Entergy Corporation | 1.92 |

DTE Energy (DTE) | 1.89 |

Eversource Energy (ES) | 1.58 |

CMS Energy (CMS) | 1.91 |

Exelon Corporation (EXC) | 1.68 |

One thing that we notice here is that all of these companies saw their net debt-to-equity ratios increase since we last discussed Entergy Corporation. These are, after all, the same peers that we used for our comparison previously. Entergy saw the smallest quarter-over-quarter increase, with its ratio increasing by a scant 0.01, while all of its peers increased by much more than that. This could indicate a certain amount of financial discipline on Entergy's part, which is definitely good to see in today's interest rate environment. Unfortunately, Entergy still continues to rely more on debt to finance its operations than its peers. As such, its debt load could represent higher risks to shareholders than peers. This is something that we want to continue to watch, as we want to see Entergy reduce its net debt-to-equity ratio over time.

Dividend Analysis

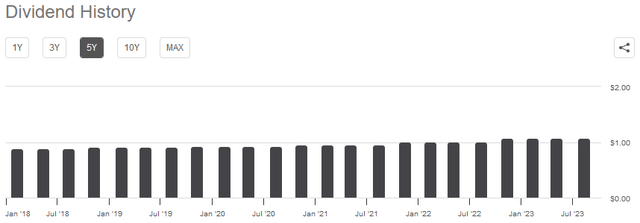

One of the biggest reasons why we purchase shares of utilities like Entergy Corporation is that they usually have a higher yield than most other things in the market. Entergy is certainly no exception to this, as its 4.47% dividend yield is substantially higher than the 1.46% yield of the S&P 500 Index (SPY). The company's dividend yield is also higher than the 2.66% yield of the U.S. Utility Index (IDU). Entergy also has a long history of increasing its dividend on an annual basis:

As I have pointed out before, a growing dividend is nice during inflationary periods because it helps maintain the purchasing power of the dividend in the face of inflation. In addition, a growing dividend will result in a stock's yield-on-cost being very high after a few years. That is something that could appeal to anyone who plans to hold a stock for an extended period of time.

As is always the case though, it is important that we ensure that a company can actually afford the dividends that it pays out. After all, we do not want to be the victims of a dividend cut, since that would reduce our incomes and almost certainly cause the company's share price to decline.

The usual way that we determine a company's ability to pay its dividends is by looking at its free cash flow. Over the twelve-month period that ended on June 30, 2023, Entergy reported a negative levered free cash flow of $1.3539 billion. That is obviously not enough to pay any dividends, yet Entergy still paid out $883.7 million to its shareholders over the period. At first glance, this is likely to be concerning as the company is unable to cover all of its financial obligations and expenses solely out of its internal cash generation capability.

However, it is quite common for a utility to cover its capital expenditures through the issuance of debt and equity. I mentioned this earlier in this article. The company will then pay its dividends out of operating cash flow. This is due to the very high expenses involved in constructing and maintaining utility-grade infrastructure over a wide geographic area. During the twelve-month period that ended on June 30, 2023, Entergy reported an operating cash flow of $3.5955 billion, which was easily enough to cover the $883.7 million that it paid out in dividends over the same period and leave the company with a substantial amount of money left over. Overall, the company should not have any difficulty maintaining its dividends at the current level and will probably increase the dividend payment when it announces its third quarter 2023 earnings results, just like it usually does.

Valuation

According to Zacks Investment Research, Entergy Corporation will grow its earnings per share at a 5.65% rate over the next three to five years. This is reasonably in line with what the company should be able to accomplish based on its rate base growth, so it seems like a good estimate. At this growth rate, Entergy has a price-to-earnings growth ratio of 2.53 at the current stock price.

Here is how that compares to the company's peers:

Company | PEG Ratio |

Entergy Corporation | 2.53 |

DTE Energy | 2.80 |

Eversource Energy | 2.51 |

CMS Energy | 2.31 |

Exelon Corporation | 2.73 |

This is interesting as a few of these companies have become considerably cheaper in the past few months since we last discussed this company. Entergy, DTE Energy, Eversource Energy, and CMS Energy are all cheaper than they were back in July. However, Exelon Corporation is much more expensive than it was before. For the most part, Entergy Corporation continues to look fairly valued relative to its peers, but the cheaper valuation might increase its appeal somewhat in the eyes of more value-oriented investors.

Conclusion

In conclusion, Entergy Corporation has a lot to offer an investor right now. Texas is currently experiencing more economic growth than many other parts of the United States, and Entergy is taking advantage of this. The consumption of electricity by the company's consumers continues to grow and the company's revenues are growing as a result. It is investing a considerable amount of money to construct the infrastructure needed to service all of this new demand, which should allow the company to deliver a 10% to 12% total average annual return over the next few years. That is slightly above what the company's peers are likely to deliver over the same period. Unfortunately, the company's leverage remains somewhat above the industry average, and this could be a risky situation in the current high interest rate environment. The company is not an especially big bargain at its current price either, although it is not particularly expensive. It could be worth picking up though, especially if you are willing to dollar cost average into the shares.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.