FUTY: Utilities Dashboard For September

Summary

- The utilities sector is close to its historical baseline in valuation and quality.

- Water utilities are slightly overvalued.

- FUTY: An alternative to XLU.

- 10 stocks cheaper than their peers in September 2023.

imantsu

This monthly article series shows a dashboard with aggregate industry metrics in utilities. It is also a top-down analysis of sector ETFs like Utilities Select Sector SPDR Fund ETF (XLU) and Fidelity MSCI Utilities Index ETF (NYSEARCA:FUTY), whose largest holdings are used to calculate these metrics.

Shortcut

The next two paragraphs in italics describe the dashboard methodology. They are necessary for new readers to understand the metrics. If you are used to this series or if you are short of time, you can skip them and go to the charts.

Base Metrics

I calculate the median value of five fundamental ratios for each industry: Earnings Yield ("EY"), Sales Yield ("SY"), Free Cash Flow Yield ("FY"), Return on Equity ("ROE"), Gross Margin ("GM"). The reference universe includes large companies in the U.S. stock market. The five base metrics are calculated on trailing 12 months. For all of them, higher is better. EY, SY, and FY are medians of the inverse of Price/Earnings, Price/Sales, and Price/Free Cash Flow. They are better for statistical studies than price-to-something ratios, which are unusable or non-available when the "something" is close to zero or negative (for example, companies with negative earnings). I also look at two momentum metrics for each group: The median monthly return (RetM) and the median annual return (RetY).

I prefer medians to averages because a median splits a set in a good half and a bad half. A capital-weighted average is skewed by extreme values and the largest companies. My metrics are designed for stock-picking rather than index investing.

Value and Quality Scores

I calculate historical baselines for all metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are calculated as the averages on a look-back period of 11 years. For example, the value of EYh for hardware in the table below is the 11-year average of the median Earnings Yield in hardware companies.

The Value Score ("VS") is defined as the average difference in % between two valuation ratios (EY, SY) and their baselines (EYh, SYh). FY is reported for consistency with other sector dashboards, but it is ignored in utilities' score to avoid some inconsistencies. The same way, the Quality Score ("QS") is the average difference between the two quality ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are in percentage points. VS may be interpreted as the percentage of undervaluation or overvaluation relative to the baseline (positive is good, negative is bad). This interpretation must be taken with caution: The baseline is an arbitrary reference, not a supposed fair value. The formula assumes that the two valuation ratios are of equal importance.

Current Data

The next table shows the metrics and scores as of the last trading day's closing. Columns stand for all the data named and defined above.

VS | QS | EY | SY | FY | ROE | GM | EYh | SYh | FYh | ROEh | GMh | RetM | RetY | |

Gas | -0.34 | -2.99 | 0.0534 | 0.5175 | -0.0443 | 8.53 | 37.75 | 0.0475 | 0.5955 | -0.0630 | 9.28 | 36.97 | -0.76% | -12.01% |

Water | -12.09 | -0.29 | 0.0348 | 0.1895 | -0.0597 | 9.31 | 57.40 | 0.0362 | 0.2378 | -0.0325 | 9.71 | 55.42 | -5.54% | -9.52% |

Electricity and Multi | 0.70 | -5.03 | 0.0525 | 0.4908 | -0.1267 | 8.70 | 39.10 | 0.0506 | 0.5026 | -0.0513 | 9.74 | 38.86 | -0.07% | -12.10% |

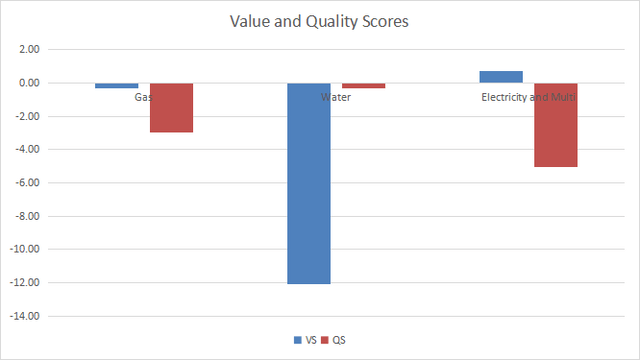

Value and Quality Chart

The next chart plots the Value and Quality Scores by industry. Higher is better.

Value and quality in utilities (Chart: author; data: Portfolio123)

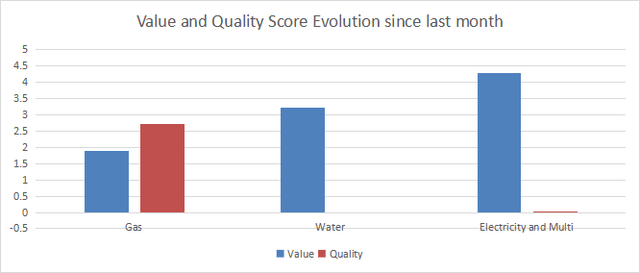

Evolution Since Last Month

The value score has slightly improved in all subsectors.

Variation in value and quality (Chart: author; data: Portfolio123)

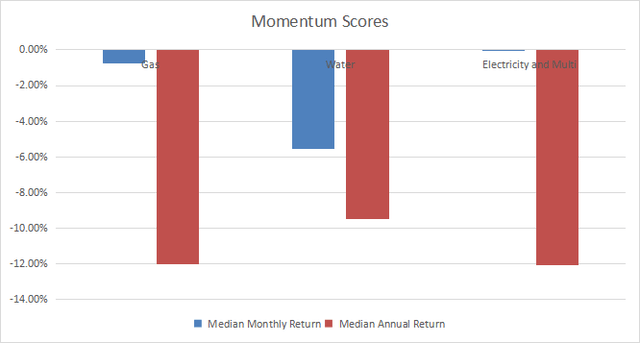

Momentum

The next chart plots momentum scores based on median returns.

Momentum in utilities (Chart: author; data: Portfolio123)

Interpretation

The sector as a whole was very close to 11-year averages in valuation when I published my broad market dashboard for September. Considered separately, gas and electricity/multi-utilities are on their historical baseline in valuation, and close below it in quality. Water utilities are overvalued by 12% and quality is neutral.

Fast Facts on FUTY

Fidelity MSCI Utilities Index ETF started investing operations on 10/21/2013 and tracks the MSCI USA IMI Utilities 25/50 Index. The expense ratio of 0.08% is a bit cheaper than for the sector benchmark ETF XLU (0.10%).

As of writing, the fund has 69 holdings. The next table lists the top 10 names with fundamental ratios and dividend yields. Their aggregate weight is 51.9%.

Ticker | Name | Weight | EPS Growth % TTM | P/E TTM | P/E fwd | Yield % |

NextEra Energy, Inc. | 13.01 | 209.31 | 16.94 | 21.91 | 2.73 | |

The Southern Co. | 7.12 | -0.42 | 24.63 | 19.30 | 4.03 | |

Duke Energy Corp. | 6.59 | -63.71 | 52.26 | 16.72 | 4.37 | |

Sempra | 4.25 | 121.85 | 18.22 | 16.01 | 3.31 | |

Dominion Energy, Inc. | 3.90 | 1.57 | 17.71 | 13.83 | 5.59 | |

American Electric Power Co., Inc. | 3.88 | -24.14 | 20.61 | 15.05 | 4.19 | |

Exelon Corp. | 3.84 | -21.31 | 19.29 | 17.43 | 3.50 | |

Constellation Energy Corp. | 3.28 | N/A | 45.83 | 22.06 | 1.03 | |

Xcel Energy Inc. | 3.03 | 4.85 | 18.42 | 17.34 | 3.58 | |

Consolidated Edison, Inc. | 2.97 | 52.35 | 13.16 | 18.68 | 3.54 |

Ratios: Portfolio123

FUTY has marginally underperformed XLU since 11/1/2013. The difference in annualized return, maximum drawdown, historical volatility, and risk-adjusted performance (Sharpe Ratio) is insignificant.

Total Return | Annual. Return | Drawdown | Sharpe Ratio | Volatility | |

FUTY | 122.52% | 8.44% | -36.44% | 0.56 | 14.74% |

XLU | 127.48% | 8.69% | -36.07% | 0.57 | 14.99% |

Valuation ratios also are very close:

FUTY | XLU | |

Price/trailing earnings | 18.67 | 19.03 |

Price/book | 1.9 | 1.94 |

Price/sales | 2.03 | 2.12 |

Price/cash flow | 9.49 | 10.16 |

In summary, FUTY is a good instrument with cheap fees for investors seeking a capital-weighted exposure in utilities. It has more holdings than XLU (currently 69 vs. 32), but past performance is almost identical. The two funds are equivalents for long-term investors. However, XLU is a better instrument for tactical allocation and trading, thanks to much higher trading volume. Both funds have a high exposure to the top holding NextEra Energy. Investors looking for a more balanced portfolio may prefer Invesco S&P 500 Equal Weight Utilities ETF (RSPU).

Dashboard List

I use the first table to calculate value and quality scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells us that a gas utilities company with an Earnings Yield above 0.0534 (or price/earnings below 18.73) is in the better half of the industry regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers, with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time. The list below was sent to subscribers several weeks ago based on data available at this time.

ONE Gas, Inc. | |

Hawaiian Electric Industries, Inc. | |

Northwest Natural Holding Co. | |

UNITIL Corp. | |

Spire Inc. | |

DTE Energy Co. | |

Entergy Corp. | |

New Jersey Resources Corp. | |

PG&E Corp. | |

PNM Resources, Inc. |

It is a rotational model with a statistical bias toward excess returns in the long term, not the result of an analysis of each stock.

Quantitative Risk & Value (QRV) features data-driven strategies in stocks and closed-end funds outperforming their benchmarks since inception. Get started with a two-week free trial now.

This article was written by

Step up your investing experience: try Quantitative Risk & Value for free now (limited offer).

I am an individual investor and an IT professional, not a finance professional. My writings are data analysis and opinions, not investment advice. They may contain inaccurate information, despite all the effort I put in them. Readers are responsible for all consequences of using information included in my work, and are encouraged to do their own research from various sources.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.