Conagra Brands: The Parts Are Worth More Than The Whole

Summary

- Conagra Brands's operating and financial performance have both stagnated in recent years, weighing on share prices.

- The company's portfolio of brands is highly desirable, including names like Hunt's, Slim Jim, Marie Callender's, and more.

- CAG's potential could be unlocked through strategic transactions, such as divestitures or sales of assets, which could offer substantial upside to shareholders.

Jacob Wackerhausen/iStock via Getty Images

Background

Conagra Brands (NYSE:CAG) is a large-cap consumer defensive company which makes packaged food products. With popular brands such as Angie's, Marie Callender's, Reddi-wip, and Slim Jim, Conagra's assets are widely recognized by consumers across the country.

But regardless of its national recognition, the company has stagnated over the past decade. Margins remain tight, profitability is weak, and growth severely lags behind peers. From nearly $1 billion of operating income in FY 2023, the company generated just $10.6 million in cash.

The company has not materially expanded since the pandemic occurred, and there's no clear path forward for Conagra to jumpstart growth. Despite a modest 10% rise in net sales over the past 3 years, net income has actually declined by almost 48%.

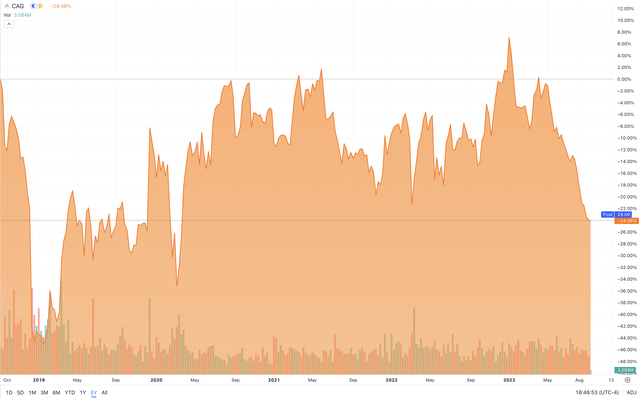

Even when factoring in dividends, CAG's stock price has declined by roughly -24% over the past 3 years, and is down by -11% over the past 5 years.

CAG Stock Price (Seeking Alpha)

Although the company's portfolio of brands is expansive, results have nonetheless been disappointing. This is why I believe that Conagra's tremendous potential could be unlocked through strategic transactions. While the fundamentals are not as good as I'd like them to be, the company has become increasingly attractive as share prices have fallen.

These depressed valuations have positioned the company to profit from a divestiture or sale of assets. Such moves could result in substantial upside to current shareholders, as Conagra's brands could offer great value to a variety of operators within different niches.

In this article, I'll explain why the parts (i.e., the individual brands) may be worth more than the whole (i.e., Conagra, as it stands today). I believe that the best path forward for shareholders is if the company were to sell some of the brands within its current portfolio. Conagra's assets could be quite valuable to the right buyers in different markets, which I will explore later.

For these reasons, my outlook for Conagra's stock is currently a Hold. I would caution against initiating a position at this time, but I would also suggest waiting to offload an existing position until value can be realized through tactical M&A deals.

History & Strategy

Conagra was founded in 1919 by Alva Kinney as Nebraska Consolidated Mills. While each of their brands has its own unique origin story, Conagra assembled the bulk of its holdings during the 1990s, purchasing Hunt's, Orville Redenbacher's, Swiss Miss, Hebrew National, etc.

In the 2000s, the company continued to adjust its portfolio, divesting its meat, seafood, and cheese brands while acquiring others in the popcorn and frozen food categories.

In 2010, Conagra established a "Recipe for Growth" strategy which included:

An expansion of the private label segment

Growth in the core business and adjacencies

International expansion

So it might not have been a huge surprise when 3 years later, the company acquired Ralcorp Holdings for $6.8 billion, as it sought to enter the private-label food business. Part of the rationale was that Ralcorp's offerings were highly complementary to (i.e., they had little overlap with) Conagra's existing products. By combining the two businesses, Conagra would create a food behemoth that spanned a wider range of price points, channels, and categories.

Unfortunately, the Ralcorp deal did not deliver the kind of growth that Conagra had expected. Instead, the failed acquisition drew the interest of activist investor Jana Partners. Jana soon built a 7% stake and gained two seats on Conagra's board.

As the company faced difficulties in the private-label business, it eventually sold most of its Ralcorp assets to TreeHouse Foods for $2.7 billion, implying a loss of nearly $4 billion on the transaction. While share prices did rise through this period, the company eventually reached a plateau around 2015-2016.

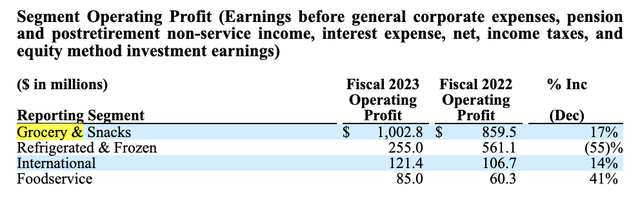

According to the company's latest 10K, the vast majority of its operating profit comes from the Grocery & Snacks division, while the Refrigerated & Frozen category declined sharply last year.

Synergies

Because the company has such a deep portfolio of assets, most consumers are already familiar with the company's brands. However, very few actually know about Conagra itself.

CAG Portfolio Brands (Conagra)

The essence of Conagra's growth strategy over the past 30+ years has been the acquisition. The key to success for a deal-heavy approach is to achieve synergies by properly selecting and executing transactions.

That's why I'd like to explore some of the synergies which could be realized for a business like Conagra's. I believe that two critical questions must be asked in this light, "What value is Conagra providing by holding all these brands under one roof?" and "What synergies are they realizing, and failing to realize, under their current structure?"

One type of synergy which they could attempt to realize is brand consolidation. By associating popular products with one another, the company could foster positive sentiment about its entire offering as a whole. The theory goes: if you're already buying Conagra ABC's Product, then you'll be more willing to try Conagra's XYZ Product if you knew both were made by the same company. This can be achieved directly (by labeling everything under one brand) or indirectly (by running cross-promotional campaigns).

The key issue with this approach is that Conagra's portfolio is simply too bloated. Consumers are unlikely to associate brands which are spread across very different categories and offer very different value propositions. Slim Jim's meat sticks are a cheap, convenient impulse buy, while Hunt's offers a line of canned tomato products. The appeal of one may not translate over to the other.

In fact, this kind of association could lower the appeal of some of their products. If you knew that Slim Jim's were being made in the same place as Annie's, you might actually think less of Annie's (since it's supposed to be a higher-tier product). This approach is clearly off the table given Conagra's portfolio, which is probably why the company has never bothered to pursue it.

Another type of synergy, cost reductions, could come from centralized production. By sourcing or processing all goods in fewer locations, there could be less overhead, maintenance, etc. and greater economies of scale.

But once again, Conagra's suite of products is simply too broad. There are very few commodities which are commonly used across multiple Conagra products. Whipped cream, meat sticks, tomato sauce, pickles, and popcorn all require fundamentally different input goods. Since the source materials are different, there's almost no room for this kind of vertical integration along the value chain. So production synergies are also off the table for Conagra.

A third kind of synergy could come from distribution, and the company has certainly done well in this area. If you're already delivering one set of products to a grocery store, it doesn't cost much more to add in a bunch of other products to your shipment. This is perhaps Conagra's biggest strength and it's what has underpinned its strategy for the past 20-30 years.

The last type of synergy I would mention comes from SG&A. Theoretically, the overall expense of running similar operations can be reduced by consolidating all business under one roof. As an example, the productivity of back-office employees can be increased since there's more work to go around (thereby utilizing some of their spare capacity). The same applies for marketing, operations, supplier negotiations, etc.

The company's track record in this area is remarkably poor. As a result of Conagra's larger acquisitions (i.e., Ralcorp, Pinnacle), the company has needed to go through several restructuring projects to achieve SG&A synergies. For nearly 10 years now, the company has stagnated while spending enormous resources on restructuring after restructuring.

A Lost Decade

The most recent plan is the 2019 Conagra Restructuring Plan, which has cost nearly $186 million so far. Management stated that the plan was intended to reduce SG&A expenses and optimize the company's supply chain network, but additional information is hard to come by.

The previous plan was the 2018 Pinnacle Integration Restructuring Plan, which was announced in connection with Conagra's acquisition of Pinnacle Foods for $8 billion. As of 2023, the company has estimated that total expenses associated with the Pinnacle Plan will be around $341 million.

And while the 2018 plan was being announced, the company was still undergoing its 2013 Supply Chain and Administrative Efficiency Plan (the "SCAE Plan"). The company no longer reports on costs from this plan, but in 2018 (five years after this plan was launched) the SCAE Plan was estimated to have cost $472 million.

So after spending nearly $1 billion on restructurings (excluding the value potentially destroyed in some of these large transactions), one would wonder what the impact has been on Conagra's performance?

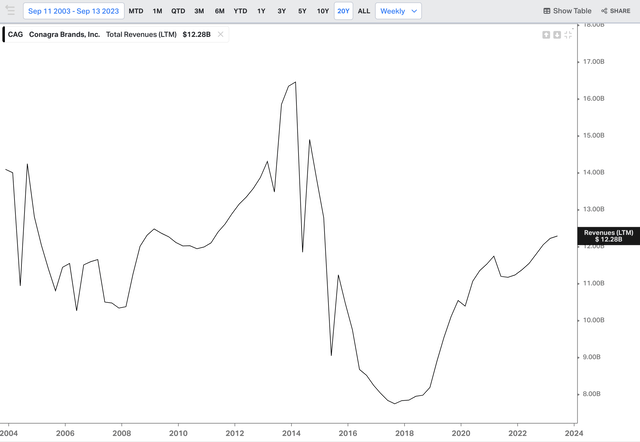

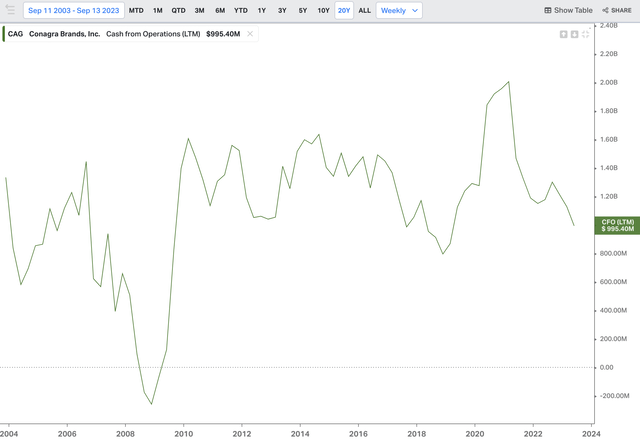

The harsh reality is that 10 years have gone by, but Conagra has gone nowhere. Here is a quick snapshot of the company's financial performance:

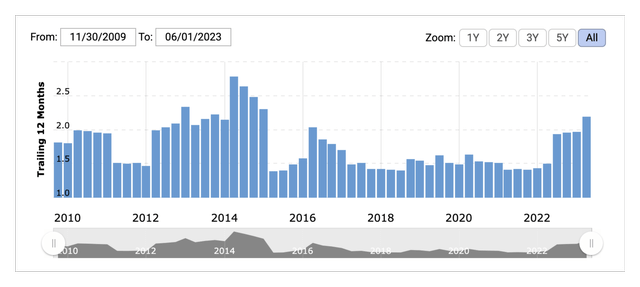

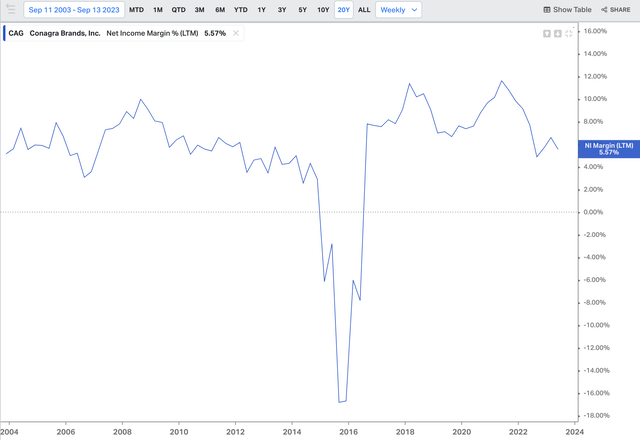

CAG Total Revenue (Koyfin) CAG Cash Flow from Operations (Koyfin) CAG SG&A (Macrotrends) CAG Net Income Margin (Koyfin)

In summary, the key metrics here remain relatively unchanged:

Total revenue remains below its peak in 2014

Operating cash flow is actually lower than where it was 10 years ago

SG&A remains elevated, and has risen over recent quarters

Net income margins are stuck in the 5-6% range

All said and done, my big-picture takeaway is that operating performance has been weak. Given the failure of these various restructuring projects to rein in SG&A expenses, management's vision appears unpromising.

Throughout its history, the company has made numerous divestitures as it has redirected attention from one category to another, so management is not totally against realizing value through sales of assets. However, it may take a push from an activist investor (like Jana) or some other shareholder in order to catalyze such a change in strategy.

Competition

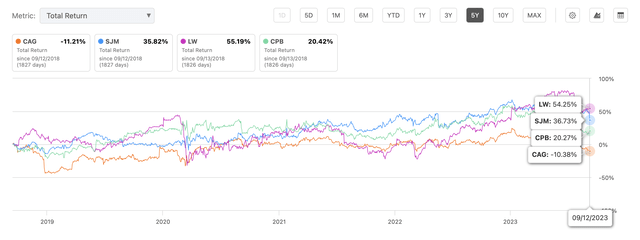

Some of Conagra's peers in the processed food space include J. M. Smucker (NYSE: SJM), Lamb Weston (NYSE: LW), and Campbell Soup (NYSE: CPB). None of those peers are exactly comparable to Conagra on their own, since they each tend to focus on just one niche category within the broader food industry. However, comparing Conagra to its peers is still useful for assessing the company's relative value:

Company | P/E (TTM) | EV / EBITDA (TTM) | Price / Book (TTM) |

CAG | 20.1x | 10.3x | 1.6x |

SJM | 13.7x | 10.0x | 1.9x |

LW | 14.1x | 16.2x | 10.1x |

CPB | 14.9x | 9.6x | 3.5x |

CAG 5-Year Peer Stock Comparison (Seeking Alpha)

In essence, Conagra is right in the middle of the pack in terms of valuation, but its share prices have underperformed as of late.

Strategic Brand Value

Unfortunately, the company does not provide specific data for each brand, so there's no easy way to estimate the standalone value of each name. However, by identifying other players who would might be interested in some of these brands, we can gain a better understanding of their strategic value if they were to be sold off:

Slim Jim:

Potential acquirers could include Jack Link's, Hormel (NYSE: HRL) and Tyson (NYSE: TSN).

Jack Link's is Slim Jim's closest competitor in the meat stick and jerky market, with nearly identical sales figures for both leading brands. Selling off Slim Jim would provide immense value to Jack Link's by eliminating their biggest threat (albeit one which is down market).

Hormel and Tyson are both involved in food processing. Either could use Slim Jim as an entry point into the meat snacking industry, enabling them to integrate vertically.

Hunt's:

Potential acquirers could include Kraft Heinz (NASDAQ: KHC) and Del Monte (NYSE: FDP).

Kraft Heinz has immense experience with tomatoes, given their leading brand of ketchup condiments. Hunt's portfolio of tomato products (mostly canned) would enable Heinz to cover the entire field of tomato products. I would expect brand synergies to be extremely high from this deal.

On the other hand, Del Monte is already an established player with canned food. Their portfolio is already quite broad, covering many different fruits and vegetables. What Hunt's would offer to them is an established position specifically within canned tomato goods, which is among the most expansive and popular categories within canned foods.

Orville Redenbacher's:

Potential acquirers include PepsiCo (NASDAQ: PEP) and Kellogg (NYSE: K).

PepsiCo could leverage Orville to pair their soft drinks with a recognizable brand of popcorn for cross-promotional purposes. Orville would also diversify Pepsi's assortment of snack offerings, which are offered under Frito-Lay.

Although it's widely known for its cereals, Kellogg has a solid portfolio of snacks such as Pringles, CheezIt, and Pop-Tarts. Gaining Orville's brand would enable the company to further expand its presence in the evening snack space. Additional savings could come from consolidating the production of corn-based products (like Orville's popcorn and Kellogg's lines of corn flake cereals).

In all these cases, savings from distribution would likely be maintained, since these companies already offer products in similar retail fronts (i.e., grocery stores, convenience stores). However, much of the value could come from unlocking some of the synergies mentioned previously. Brand consolidation and centralized production would be clear value-adds in many cases, and new acquirers could potentially improve upon Conagra's performance in managing SG&A expenses.

Governance

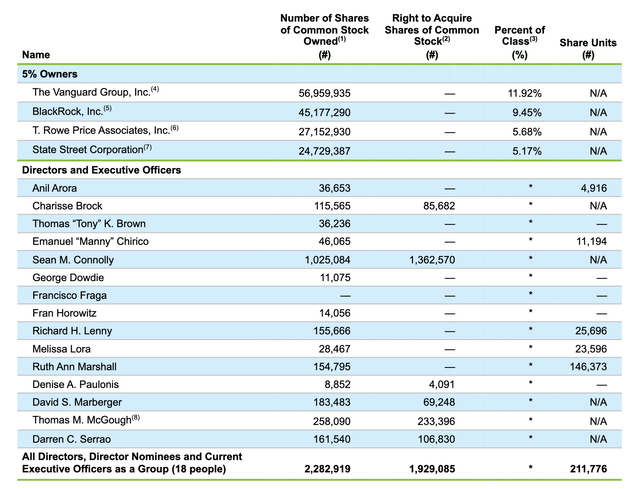

According to Wall Street Zen, Conagra's ownership is 84% Institutional, 8% Insider, and 8% Retail. Some of the largest shareholders include Vanguard, BlackRock, and State Street, and it appears that Jana still holds a 4% stake (although that information could not be found on Jana's most recent 13F filing).

In this year's proxy statement (the AGM on September 14th), one important item is Proposal 6, which would grant shareholders the right to call for special shareholder meetings. Only (a group of) shareholders owning at least 10% of the outstanding equity would be able to exercise this right, to prevent misuse. Proxy advisors like ISS and Glass Lewis generally recommend voting in favor of these shareholder rights, which provide greater accountability over boards of directors.

The CEO of the company is Sean M. Connolly, who joined Conagra in March 2015. Share prices have essentially stagnated over his tenure, with a cumulative gain of 7% over approximately 8 years. This result is disappointing and could justify a change in leadership if it continues to persist much longer in my opinion.

In terms of refreshment, the board has done a fairly good job of bringing in new perspectives, with an average tenure of 5.9 years. However, 3 directors currently have tenures beyond 10 years, which is excessive. Directors who sit on the same board for too long may lose their independence, as they form closer relationships to management over time.

In terms of stock ownership, the company's directors and executive officers each hold a significant amount of Conagra's shares. Excluding the CEO (who also receives equity as part of his executive compensation), the average director and executive owns nearly $2.7 million worth of common stock in the company.

Conagra Ownership Breakdown (2023 Proxy Statement)

The company follows several good governance practices, such as:

Having an independent board chair

Eliminating classified directors

Only having one class of stock with equal voting rights

No poison pill

Shareholder action by written consent

Overall, I'd say that the board has the right structure in place to effectively oversee management, although the company's performance over the past decade should certainly be a cause for concern.

Conclusion

Conagra is a unique company, which could have tremendous potential if it were to put its brands in the right hands. There are few peers which have such an expansive and widely-recognized portfolio within the food industry, yet Conagra may need to further refine its focus if it is to improve on growth and profitability.

The company's valuation is not yet cheap enough to entice investors to jump in, so I would maintain a Hold rating for now. If catalysts emerge (like a change in tune from management, or the resurgence of activist interest), then the company would be poised for an upgrade.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.