Evolution Petroleum: Increasing Commodity Prices And A Strong Sell-Off Make This Stock A Buy

Summary

- Evolution Petroleum Corporation's FY2023 results were below expectations, causing the stock to lose 16% in after-hours trading.

- The company focuses on onshore natural gas assets in the United States and has a non-operating business model.

- Despite the disappointing results, EPM is still considered a worthwhile investment due to its sound balance sheet and potential for future growth.

- Production costs are $21/boe.

Funtay

A couple of days ago, Evolution Petroleum Corporation (NYSE:EPM) released its results for FY2023. Results were worse than what analysts expected with the stock losing 18% in the trading day after announcement.

In this article, I will provide a description of Evolution Petroleum (this is indeed my first article about the company) and I will analyze the FY2023 results. Despite the results being below expectations, I believe that Evolution Petroleum is worth a BUY recommendation. Indeed, from a financial point of view the company is solid (no debt at all) and the current oil/gas prices are constantly increasing thus supporting future free cash flows.

If you are interested in other oil and gas investment idea, you can take a look at my previous articles about Coterra Energy and Reconnaissance Energy.

About the Company

Evolution Corporation was founded in 2003 and, one year later, in 2004, it went public with an IPO. Today, Evolution Corporation is an oil and gas player focused on onshore natural gas assets in the United States: the main strategy consists of investing in already producing assets with long-life and low-decline proved developed reserves. Particularly, the company invests in assets that are expected to require modest maintenance, in order to keep CapEx at minimum levels, and that are located in places with close market access to minimize the offtake cost.

Evolution's asset portfolio is composed of the following assets:

- Delhi Field: non-operated interests in the Delhi Holt-Bryant Unit, a CO2-enhanced oil recovery project across 3200 net acres

- Hamilton Dome Field: non-operated interests in the Hamilton Dome, a secondary recovery field that uses water injectors to pressurize the reservoir, located in Hot Springs County

- Jonah Field: non-operated working interests in 595 producing wells on about 950 net acres in Sublette County, Wyoming.

- Williston Basin: non-operated working interests in 73 producing wells located on approximately 45,000 net acres in the Golden Valley, and McKenzie Counties in North Dakota.

- Barnett Shale: non-operated working interests in the famous Barnett Shale in an area of about 21,000 net acres.

As one can see from the portfolio, Evolution's business model is based on non-operations of the assets that allow for a simpler company structure and a leaner operations team. In addition, being a non-operator allows Evolution to have lower G&A since many functions are not required and it also makes scalability easier since new assets - even in new geographical locations - can be added to the portfolio without the need of moving employees.

On the contrary, not being an operator means having less control over the assets and, therefore, investing in assets with excellent operators becomes mandatory to ensure both profitability and safety.

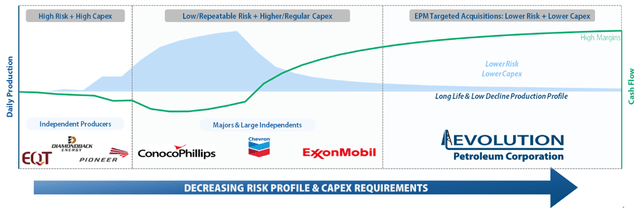

The following chart provides a clear graphic representation of Evolution strategy: Evolution invests in oil/gas fields once they are in decline phase since, in that way, they have to invest far less capex to develop the field rather than when the field is in development or in mature phase. Moreover, Evolution mostly invests in US onshore gas fields that are famous for having long decline curves that can produce for many years with limited capex and maintenance.

Stock Performance

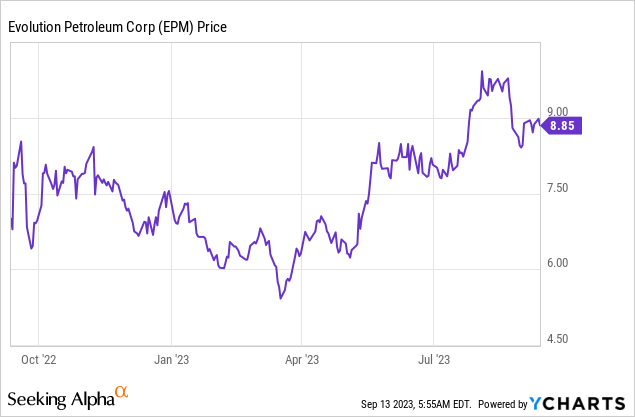

Evolution is currently trading at $8.85/share, equivalent to a market capitalization of $288 M. Since the beginning of the year, the stock has gained 17% while, in the last 52-week period, the stock gained 34%. Looking at the chart, one can notice that there was a significant decline in March/April 2023 with the stock reaching the 52-week minimum ($5.4/share) before starting an upward rally up to $9.9/share on August 3rd. Now Evolution is trading at about an 11% discount to that maximum value while it is at a 64% premium to the 52-week minimum.

FY2023 results

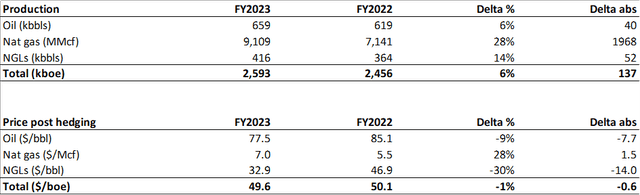

Total revenues for FY2023 increased by 18% year-on-year from $109 M to $128 M. The increase in revenues was not homogenous across all products: oil and NGLs sales decreased by 3% and 20% respectively while sales of NatGas increased by 63% y-o-y. The main driver of this behavior can be found in the price of the product sold rather than in the volumes. As can be seen from the table below, production volumes increased across all products, with NatGas volumes increasing 28% year-on-year due to new acres being added. Gas revenues also benefitted from the increase of price post-hedging that, on average, during FY2023 was $7/Mcf. For what concerns oil and NGLs, despite volumes increased (+6% and +14%), the decrease in pricing was stronger and led to lower revenues.

Looking at costs, total OpEx increased 31% year-on-year from $63 M to $83 M mostly due to a $11 M increase in lease operating costs generated by new acreage in the Jonah Field and the Williston Basin. For the same reason, even D&A increased by $6 M. Finally, G&A was ca. $3 M higher due to salaries for the addition of new personnel.

Considering that sales and OpEx increased by about $20 M each, net income only slightly increased to $35 M (up 8% from $33 M one year earlier).

Cash flow and capital structure

Cash flow from operations was stable at y-o-y at $51 M. Cash flow from investing activities was negative at -$7 M since the company added some new oil and gas properties. Cash flow from financing was negative as well at -$42 M with $16 M spent for dividends, $4 M for stock repurchases and $21 M used to repay all outstanding debt.

Indeed, at the end of FY2023, Evolution Petroleum has no outstanding financial debt and sits on a cash position of $11 M.

Hydrocarbon Reserves

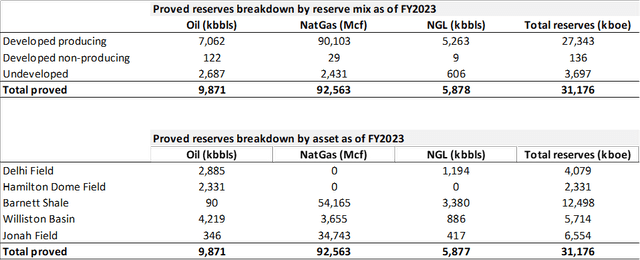

According to data disclosed by the company, at the end of June 2023, proved reserves amount to 32 Mboe with 27 Mboe that are classified as "developed producing" (88% of the total). In terms of product type, 49% of proved reserves are NatGas, while 32% is oil and 19% NGLs. The Barnett Shale - accounting for 40% of total proved - is the largest field and is mostly gas-based (72%). The Jonah Field accounts for 21% of the reserves while the Williston Basin for 18%. The remaining fields, Delhi and Hamilton Dome, account for 20% of the reserves and have no gas but only oil and NGLs.

Outlook

Evolution's FY2023 results were affected by a lower oil price than in 2022. In July, August and September (i.e.: Evolution's Q1-2024) the WTI has been averaging higher levels and, therefore, I would expect higher revenues when they announce Q1-2024. In addition, the oil market is expected to grow in the next years with IEA forecasting a 1 Mbbl/d of additional oil demand in 2024.

In this context of rising commodity prices, Evolution will be able to increase its profitability and free cash flow generation, in particular, if we consider that - not being an operator - its production cost is $21/boe.

Risks

The main risk to which Evolution is exposed is represented by the commodity price volatility. The main driver of Evolution's revenues is oil/gas price and, in case of a substantial decline in pricing, revenues might be negatively affected. According to the Company's 10K, Evolution only barely hedges its production, selling its production to off-takers at market prices. Therefore, if you invest in Evolution, you should be aware that a drop in commodity price might significantly affect the share value and your investment.

Valuation

Developing a proper DCF model for Evolution would not be too much reliable since the company is likely to add new acreage in the next year and it is almost impossible to forecast when and how much new land they will buy.

However, we can have a look at trading multiples. Evolution is currently trading at 6.59x EV/EBITDA, about 11% higher than the sector median while the price to cash flows is 3.82x, about 13% lower than the sector median. Despite EV/EBITDA being higher than peers, I believe that the recent strong sell-off and the increasing oil/gas price justify the premium.

Conclusion

Overall, I believe that Evolution Petroleum is a small independent O&G player with a clear strategy and the ability to execute it properly. The company has no debt and a sound balance sheet, it is profitable and has a significant free cash flow generation.

The increasing oil and gas prices will support further FCF growth in the next quarter. In conclusion, I believe that Evolution Petroleum is a stock worth buying.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.