Qorvo, Now Potentially Another Apple Surrogate With Its Massive Win

Summary

- Qorvo has become another surrogate for Apple, with a significant portion of its revenue and product penetration coming from Apple products.

- Qorvo's September guidance showed a huge jump in revenue, indicating a major possible change in the company's position within the Apple ecosystem.

- The new product from Apple that Qorvo is supplying likely has a high average selling price, leading to potential major gains for Qorvo.

- The company likely won the mmWave 5G component from Qualcomm.

miralex/E+ via Getty Images

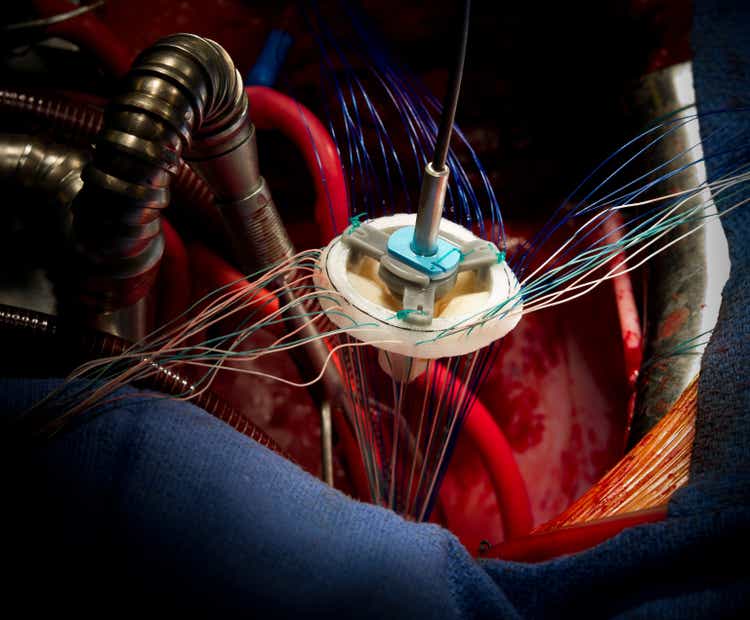

With Qorvo's (NASDAQ:QRVO) last report, it officially joined as another Apple (AAPL) surrogate. Companies become surrogates for larger companies when their percentage of revenue and product penetration equals enough to accurately predict the performance of the primary. Qorvo always carried a level of penetration into Apple products, iPads, iPhones with differing parts, trackers, WIFI products and interfaces. But though Apple was its largest single customer, it only represented slightly more than 30% of the total revenue. Then, with the September guidance, management reported a huge jump quarter over quarter even after commenting about Android weakness, Qorvo's previous largest market. Something changed: it isn't small. Understanding the change, its position within the new unstated company, becomes important for both Apple and Qorvo investors. It is important to remember that Apple no longer offers next quarter or yearly guidance, but companies such as Qorvo do. With this in mind, Apple's coming performance maybe reasonably construed. In the past, we wrote articles primarily outlining this company's superior technology. More recently, we pointed out the major shortfall with its collapsing Android business. But for now, wash your hands and arms thoroughly, dawn the gowns and head with us into the operating room. We believe your time will be well spent.

It Begins with the Quarterly Report Plus Some

First, let's take a simple look at the quarter, including past quarterly revenue comparisons. Qorvo reported:

- Revenue of $650M in-line.

- Non-GAAP income of $0.34.

- Guided $1B approximately $400M higher quarter over quarter with quarter earnings near $2.00.

To help investors understand the significance of the guidance, a table follows:

| Revenue | Sept. 23 | June 23 | March 23 | Dec. 22 | Sept. 22 | June 22 |

| Quarterly | $1B* | $650M | $630M | $740M | $1.15B | $1.04B |

*Guided.

Notice that prior to the major drop in Android business with its inventory correction, Qorvo's June to September revenue remained relatively flat. The company held large percentage positions in Android that, even with the Apple spike and Android fall in September, still resulted in little revenue difference. Then came the massive guidance, even with this management comment, "We expect continued reduction in channel inventories in the September quarter, and we see Android channel inventories normalizing by calendar year end."

Remember, with Apple as the only player with size, management stated,

"In the September quarter, our outlook primarily reflects new products ramping at our largest customer. Later in the year, we expect Android revenues to reflect a healthier channel in Qorvo's shipments that are more closely aligned with end-market demand."

I think this largest customer comment pins down the new customer. But investors should know what the new product is. It must have a huge ASP.

Answers From the Past

A few quarters ago, management signaled the very real possibility for a massive gain with Apple and possibly Samsung. Last November, this back and forth between Gary Mobley of Wells Fargo and Bob Bruggeworth, Qorvo's CEO, now gains significant meaning with Mobley asking,

"On the cellular side. So, you just hinted on this. I think Qualcomm is already conceded the idea that, they might not be in iPhone 16 and subsequent versions to that. And so you hinted that maybe you can take back the Envelope Tracker, which they currently supply as part of their cellular solution... But what about some of the millimeter wave opportunity there, as they're designed out?

Bruggeworth answered on the millimeter wave question,

"But what I do feel good about is that, we have -- we've got feedback from several customers that the process technology, the designs we have, the millimeter wave are the best out there and can actually have about half to a quarter of the current consumption that's currently out there. So, all just have to wait and see what architectures are chosen by any of our customers. But I feel very good."

Although, this could change, up through the iPhone 14, only in the U.S. were phones sold supporting this wave. Continuing in adding detail, one report stated: "The BoM of the mmWave 5G variant of the iPhone 14 Pro Max costs about $474, while the BoM for the sub-6GHz model adds up to about $454." With slightly less than half of iPhones containing the functionality, during a year of 225 million sold units, the supplier of millimeter wave might expect as high as $2B in revenue (0.45 times 225 times $20). From our following of Cirrus Logic (CRUS), Apple tends to purchase roughly 60 million units of iPhone parts in the September quarter, with approximately 70% supporting newly released phones. Some simple math confirms the source and ASP for the major gain, 60 million times 0.70 times 0.45 times $20 equals over $350 million, a similar value with the increase in guidance. We understand the approximate nature of the analysis and that it is possible for Qorvo's trackers to also be included. We also understand that Qorvo might not provide all of the $20 content, but what is also clear that for whatever part(s) it does supply, the ASP is significant, something well above $10. A teardown likely toward the end of September will confirm more accurately new wins.

Also, it is important to note that during recent conversations, management clearly included significant new wins with Samsung. We suspect that with the return in Android volumes, this meaningfulness will become more evident.

Adding Up the New Qorvo

The evidence for coming changes with Qorvo's revenue are rather massive. Apple tends to order on the magnitude of 75-80 million iPhone units in December quarters, 15-20 million more than the September quarter. Added revenue for that quarter might equal an additional $200+ million. Going forward, Qorvo revenue stands to increase significantly. Quarterly revenue in the more normal Android unit sales environment averaged approximately $1.1 billion, or $450 million more than the June quarter. The long-term direction for Qorvo in its full stride equals $2.0B from Apple per year, and an additional $1.8B from Android returning plus the dismal run rate of $2.4B totaling near $7B. At 52% margins, the peak it generated, operating income is likely to equal $3.5B or approximately the same as past revenues. The strong heartbeat from this new surrogate brings smiles to the observers.

Risks

Risk always exists. Again, the economies of the world aren't robust. Unit volumes could dip significantly in the short run. With any Apple supplier, components may be lost. Qorvo has lost a win or two in the past. But the compelling story is more than one-fold:

- It is about returning Android units over time.

- It is about a major potential win at Apple.

- It is about other growth not discussed in this article.

The stock price remains relatively low in the $90s, with guided earnings now near $2 per quarter. The added ASP seems compelling for both revenue support and eventually massive growth. We rate the stock a buy in the $90's, at a P/E in the 11 range, and have a strong buy in the $80's. The superior technology heartbeat is strong.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)