CareTrust REIT: A Safer Alternative To Omega Healthcare Investors

Summary

- Although OHI has seen its share price grow over the last month, I discuss why I think CareTrust REIT is a safer alternative in the sector.

- CTRE has well-laddered debt maturities with no maturities until 2026 making them well-prepared for a higher for longer environment.

- The company has 9 years of dividend growth and I expect them to make the dividend champion's list this March.

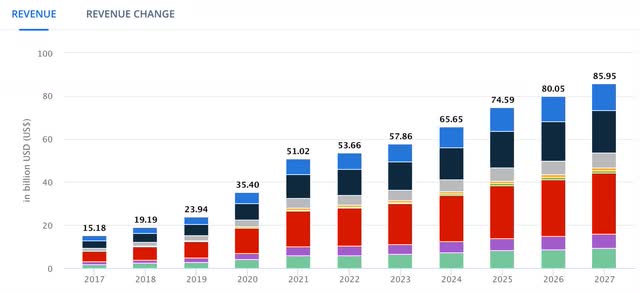

- The healthcare industry is expected to grow by 10.40% through 2027 making CTRE an attractive investment as it continues its growth with accretive acquisitions.

-Antonio-

Introduction

I know many investors are fans of Omega Healthcare Investors (OHI), mainly because it combines an investment grade balance sheet and a high-yield which is rare. With so much uncertainty in the economy and the talks of a recession heating up again, many are rotating out of lower yielding investments and flocking into safer, high-yielding alternatives for the time being. I can't say I blame them but I'm staying planted and averaging down on some of my favorite dividend-paying stocks. I'm also in constant search of others that are trading at attractive valuations that I deem safe.

There's a quote I live by and I've been thinking about it heavily since the fast rise of interest rates. Don't see things as problems but as opportunities, and when the market offers you discounts on safe, dividend-paying stocks, take advantage. While OHI has seen its price rise by over 3% in the last month, some of its peers haven't seen as much price movement. The healthcare business is considered a safe, growing sector due to the aging population and innovations in disease research. Let's get into why I think CareTrust REIT (NYSE:CTRE) is a safer investment right now than OHI.

Who Is CareTrust REIT?

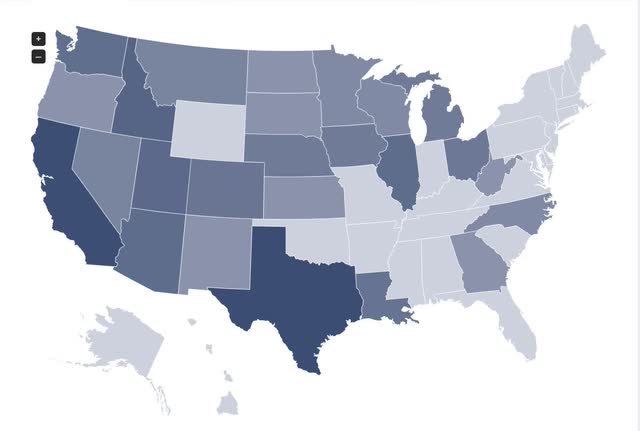

Because of its popularity, Omega Healthcare Investors seems like a much more attractive investment than CTRE. Like OHI, CTRE is also a healthcare REIT that focuses on skilled nursing and assisted & independent living facilities. Currently 72.4% of their rent comes from skilled nursing properties and ALF & ILF accounting for another 10%. Similar to OHI they have a high concentration of properties located in Texas. While Florida is the second largest for OHI, CTRE's second largest market is California.

They currently have 205 properties in their portfolio throughout 25 states. They operate 148 SNF's and 31 assisted living facilities. They're obviously not as large as OHI with a smaller market cap of $2.0 billion and a smaller portfolio.

OHI was founded in 1992 and has been around much longer than CTRE. So I can see why investors prefer OHI over CTRE as they have a much longer track record. CareTrust also has a much shorter & less impressive dividend track record with only 9 years of increases. But one thing I enjoy about smaller cap companies is their potential for growth. So although OHI has a much larger portfolio with 66 operators compared to 23 for CTRE, bigger isn't always better.

caretrustreit

Expected Growth In The Healthcare Industry

With the expected growth of the healthcare industry the REIT has a lot more room for growth over the next several years. The healthcare sector is expected to post an annual growth rate of double digits (10.40%) in 2023-2027, resulting in projected market volume of nearly $86 billion in 2027.

With their smaller portfolio CTRE stands to benefit from this. Besides minimal facilities in Louisiana, Georgia, and North Carolina, the company has plenty of room for growth especially in the growing Sunbelt region, as well as others.

Speaking of growth, during its Q2 earnings management announced they closed on eight transactions, seven acquisitions, and one mortgage loan. Additionally, they acquired 12 facilities and added six new operator relationships for $200 million and a blended yield of 8.4%. Seven of these were skilled nursing facilities. So the REIT is continuing on its path to growth within the expanding industry which will lead to shareholder accretion.

Statista

Steady Cash Flows & Dividend Growth

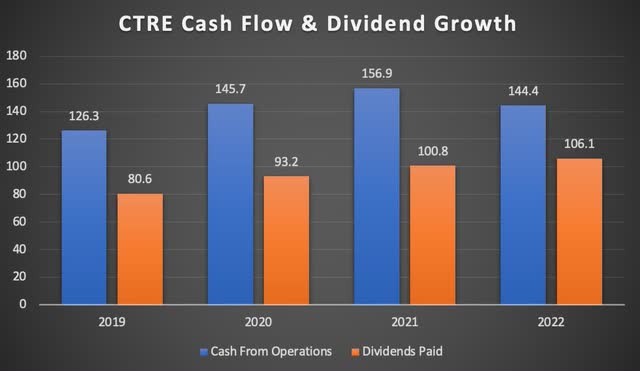

CTRE has grown its dividend for 9 years making it a dividend contender. I expect the REIT to make it to dividend champion status in the next 6 months when they announce a raise in March, something they have done historically since going public. One way a company continues raising its dividend is by steadily increasing its cash flows. Over the past 4 years CTRE has managed to grow its cash flows & dividend during the same period.

In 2022 cash from operations declined by 8.6%. This was due to the rapid rise in rates which ate into earnings and slowed FFO growth. Additionally, the company had one operator who accounted for 2.8% of rent with negative lease coverage. But even then, they still managed to increase their dividend. Furthermore, CTRE raised its dividend in 2020 by 11% while OHI maintained.

Author creation

Better Debt Maturities & Lease Expirations

Both healthcare REITs have strong balance sheets and well-laddered lease expirations. 98% of OHI's leases expire after 2024 with 14.2% expiring in 2027. CTRE has even less expiring in 2024 with just 0.8% with most expiring in year 2031.

And although CTRE has a lower credit rating at BB+ (junk grade), their well-laddered debt schedule makes them better prepared for the higher for longer environment promised by the FED as they can deploy capital more accretively. The stock was recently upgraded to outperform at RBC. The company has no debt maturities until 2026 and even then it's a small amount.

Furthermore, their Net Debt to Adjusted EBITDA is also lower at just 3.8x, below OHI's 5.1x, and below the company's stated range of 4 to 5 times. At this rate I wouldn't be surprised if CTRE was issued an investment grade rating in the coming years. The company is still fairly new having IPO'd less than 10 years ago.

CTRE investor presentation

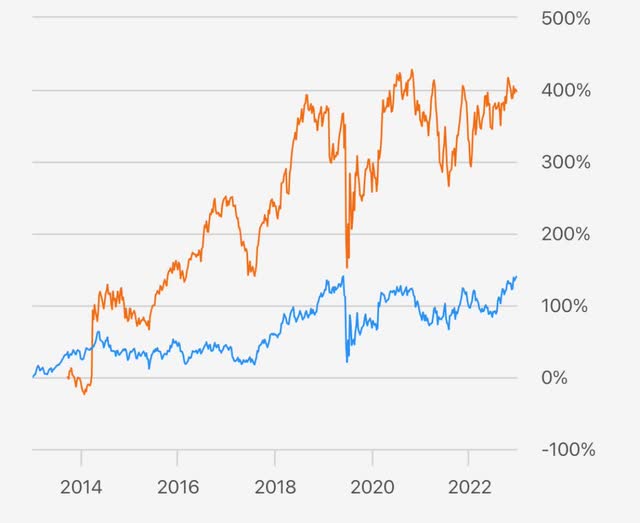

Superior Total Returns

Although the healthcare industry is expected to grow by 10% over the next 4 years, CTRE has beaten its most popular peer when it comes to total returns over a longer time period. Either way the healthcare sector has been good to investors in price & total returns over the last decade. Both REITs have positive returns although CTRE's is far superior at almost 217% compared to just 12.34% for the latter. Even though price return is important, as a long-term investor I like to see stocks with a positive total return to its shareholders. Over the same period CTRE has returned 397% to OHI's almost 140%. It is to be noted that CTRE's is just a tad shorter since the REIT went public in 2014.

Seeking Alpha

Valuation

Because the healthcare sector is considered more safe and stable, many have seen positive returns over the last month while popular REITs in the net lease sector have been battered over the same period. With the recession threat, this has also caused their prices to rise as historically healthcare has been a hedge against recessions. Reason being because although spending is tight, the demand for healthcare stays the same. This has caused many healthcare REITs and stocks to become fairly or even overvalued.

Its P/AFFO ratio is trading roughly in-line with its 5-year average. I used the Gordon Growth Model or Dividend Discount Model (DDM) to calculate an acceptable buy price. Due to the current macro environment I expect management to be a bit more conservative and raise the dividend this upcoming March by a half a penny, bringing the annual dividend to $1.14. CTRE's DG over the past 5 years has been 8% but again I'm being conservative here at 5%.

Keeping in-line with the S&P and using an expected return of 10%, I have an acceptable buy price of $22.80, slightly higher than analysts' price target of $22.17. This gives investors 10% to the price target, therefore making it a buy. If you're more of a contrarian and like a nice margin of safety the stock could see some share price weakness if the economy goes into a recession.

Risks & Opportunities Ahead

Similar to its peer OHI, CTRE faces some of the same risks, the biggest one being tenant defaults. As previously mentioned if we do indeed go into a recession, this could cause more financial hardship on operators, causing them to default on rent payments. The company has had trouble with some tenants paying rent, having to place them on a cash-basis status.

But where there's plenty of risks due to the economic uncertainty, there's also opportunities. As banks have tightened their lending standards due to the banking crisis earlier this year, this has created opportunities for many REITs and BDCs. Traditional competitors who used a highly leveraged model are on the sidelines because of the tight lending standards, thus causing sellers & brokers to prioritize REITs.

Closing Thoughts

Although OHI offers a higher yield and has an investment grade credit rating, CTRE offers investors more stable income over the medium and long-term. With a smaller market cap and portfolio, they have more room to grow and take advantage of the expected growth in the healthcare sector. The company has well-laddered lease expirations & a better debt maturity schedule, making them better prepared for a recession and high rate environment. Even though some of their tenants will face challenges if we do enter into an economic downturn, I think CTRE's management is well-prepared to navigate as seen by their track record. With a price target of $22.80 I rate CTRE a buy, and investors should add on any signs of share price weakness over the coming months.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CTRE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)