KIO: Invest With The Pros

Summary

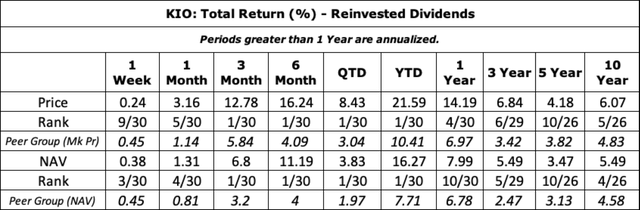

- KIO has a good long-term record and is doing exceptionally well so far in 2023, with a year-to-date total return of 21%.

- Its 12% distribution is more than covered by net investment income ("NII"), with capital gains providing additional coverage.

- Credit markets continue to over-compensate investors for recession fears and general pessimism, as they have for quite some time.

- Looking for more investing ideas like this one? Get them exclusively at Inside the Income Factory. Learn More »

Play With The Pros Klaus Vedfelt/DigitalVision via Getty Images

KIO: Investing With The KKR Professionals

Inside the Income Factory® members know that I like investing with experienced, professional money managers who invest millions of dollars for a living. But even the pros sometimes lose money, and us along with them. KKR Income Opportunities (NYSE:KIO) is a good example of a fund that is run by a highly regarded and experienced credit and investment shop, but has also had its ups and downs in terms of market pricing over the years, along with the high-yield credit market generally.

Being a big believer in high yield credit (loans, bonds, CLOs, BDCs, etc.) as a way to earn "equity-level returns" through steady cash yields, rather than with equity-level volatility, I have been attracted to credit funds run by the likes of KKR, Ares, Apollo, Barings/Mass Mutual, Prudential, Carlyle, Blackstone, Credit Suisse and others. So I hold a major position in KIO in my personal account, as well as in our Inside the Income Factory® model portfolio.

While I don't practice market timing in a technical sense, I do look at premiums, discounts and yields, as well as total return records, in deciding what to put new money into, and when. I have been a fan of KIO for some time, but my record on timing my purchases of the fund has been spotty.

In my personal account, I loaded up on KIO back in late 2020 and throughout 2021, which was poor timing. So I'm carrying a "paper loss," although I have no intention of selling and turning it into a real one, since the steady accumulation and compounding of KIO's 12% cash distribution continues to outdistance my initial paper loss on the investment.

Taking A Closer Look At KIO

KIO describes itself as an "income opportunities" fund, which suggests that it considers a range of corporate debt instruments to be potentially on its radar scope. In its words: "The Fund seeks to achieve its investment objectives by employing a dynamic strategy of investing in a targeted portfolio of loans and fixed-income instruments of U.S. and foreign issuers, and implementing hedging strategies in order to achieve attractive risk-adjusted returns."

What that means, in KIO's case, is essentially corporate loans and high-yield bonds, of which it recently held 51% high-yield bonds and 43% corporate loans. It also dabbles in CLO's (collateralized loan obligations) for 5% of its portfolio. That's not nearly as much CLO investment as some other funds do that describe themselves as being opportunistic, like Ares Dynamic Credit Allocation (ARDC) or XAI Octagon Floating Rate & Alternative Income (XFLT). This is not a criticism of KIO, but merely a distinction from other funds that are sometimes compared to it.

How well has KIO done?

What's important to me is:

- How did KIO do versus its peers? Since that helps us determine whether the fund's managers are real pros within their industry, since I want to be investing with the very best. I want to know that even during down-market periods, I have managers that have "been there and done that" before, and if anyone is likely to find value and avoid trouble in all kinds of markets, they will be the ones.

- So from that perspective, I am pleased to see that KIO was #5 out of 26 other funds in the high yield bond category over the past 10 years.

- Even better, I am heartened to see KIO #4 out of 30 in total return over the past 1 year period, and #1 out of 30 for 2023 year-to-date (on both market price total return as well as NAV total return!).

- Not only is the year-to-date ranking (#1) excellent, but the absolute total return percentages, 21% year-to-date on market price, and 16% on NAV, are impressive as well, which we will return to in a second as we examine distribution coverage.

How does KIO earn its total return?

Credit funds make their money the way most banks do, by collecting interest on their portfolios of loans, bonds or other credit instruments. I have often called this income - the cash that flows in day after day from their loan and bond portfolios, regardless of whether the market value of those portfolios has gone up or down - the funds' "business as usual" income.

Accountants and analysts call it, more formally, "net investment income" or "NII." It is defined as the net cash flow, minus fund expenses, from the interest and/or dividends that flow in routinely from a fund's investment portfolio. It does not include capital gains or losses. For credit and other high-yielding fixed income funds, the "river of cash" provided by the NII in today's current higher interest-rate environment can be 9-10% or more. So any capital gains the funds may achieve over and above their NII are essentially "icing on the cake."

This is in marked contrast to equity funds, where capital gains have to be the main part of "the cake" itself, rather than icing on the cake, if the funds want to earn a 9-10% equity return. Equities (like the S&P 500) generally only pay dividend yields of 1-2% (SPY, for example, yields 1.5%). For equity funds to earn and pay a 9-10% distribution, they have no choice but to achieve and harvest capital gains of another 7-8% on top of their 1.5 to 2% yields. They may not achieve that consistently every year, but they need to average that over time if they expect to match the average equity return over the long term.

In comparing equity investing to credit investing, I often refer to the capital gains that equity funds need to achieve as "heroic" income, since it requires fund managers to actually achieve gains and sell assets at a profit, in order to earn their target returns and pay their distributions. Credit funds merely have to "clip their coupons and cash their dividend checks" to generate their "business as usual" net investment income.

Fortunately, KIO has the best of both worlds in that it has a steady stream of "business as usual" net investment income from its loan and bond portfolio, which most recently (4/30/2023 semi-annual report, page 16) covered its distribution by 107%. But it had additional capital gains from its loan and bond portfolio that were the approximate equivalent of its NII, bringing its total return for the first six months of the year up to twice the amount of its NII. Since June 30, its total return has increased further and is currently 21% for slightly over 8 months.

The capital gains most likely reflect the steep discounts over the past year in the credit markets, as prices have tended to overestimate the likelihood of recession and default increases. So KIO and other credit investors could buy discounted but healthy loans and bonds in the secondary market, hold them to maturity while (1) collecting their stated coupons (which represented a higher yield than the stated coupon because so many of their loans and bonds had been purchased at a discount) and (2) then later collect the full par value at maturity, booking a capital gain for the difference between par and what they originally paid to buy the instrument. This is why credit markets (senior loans, HY bonds, CLOs, etc.) have so often done better for investors during volatile economic periods, because markets, encouraged by a media that loves to carry inflated "the sky is falling" types of stories, typically overcompensates investors for perceived credit risks (Link for more details).

This is good news for KIO investors, since we know our current distribution is fully covered by NII, but realize there may be extra income (i.e. realized capital gains) that will have to be paid out by the fund in order to meet its "90% of taxable income" distribution requirement; at least as long as KIO has loans and bonds on the books that it bought at discounts and will generate capital gains upon maturity.

Pricing, Yields and Risk

KIO currently pays a 12% distribution yield which, as we just explained, is fully covered by its NII. But the fund sells at a -6.8% discount to its net asset value, so KIO investors can buy each share for just 93.2% of its full value. KIO has actually sold at bigger discounts over the past year, with an average discount of about -10% and a low of as much as -14% early in the year. But the current discount is very close to what the average discount (-7%) has been for the past 5 years. I suspect the bigger discounts of the past year or so have reflected the pessimism in the credit markets when a recession seemed to be constantly just around the corner. Now considering that markets and the economy seem less pessimistic, as well as KIO's performance over the past year, I think a discount more in line with the fund's historical norms seems appropriate.

KIO's distribution yield on its NAV (i.e. its fully valued shares) is currently 11.2%. That's the yield shareholders would receive if they paid the full NAV per share. But since we can buy at the 6.8% discount, the actual yield on our investment is 12%, rather than the 11.2% it would be if we had to pay full price.

This may seem like a minor point to some investors, but in credit markets, just like other financial markets, generally the riskier the asset, the higher the yield (and vice versa). So to be able to hold a portfolio of "11% assets," in terms of risk, and get paid for holding "12% assets" because we bought in at a discount, represents a shift in the risk/reward balance in our favor as investors.

Who else is investing along with me?

Besides having successful professionals managing my funds, I have also emphasized ("From Slide Rules to Spreadsheets...") how I like to invest alongside professional institutional investors who manage tens of millions of dollars for a living. KIO definitely attracts that sort of investor, with 46% of its stock held by institutions, including: Morgan Stanley, Clough Investments, SIT Investments, Guggenheim, Vivaldi Capital, UBS, Advisors Asset Management, Invesco, Bank of America.

Obviously, investing with professionals doesn't guarantee success, but I think it lessens some of the downside risk of major surprises coming out of nowhere, since it means there are a lot of sharp eyes besides mine, keeping an eye on the investment.

I look forward to your questions and comments.

When I introduced the Income Factory ten years ago I was quickly labeled a heretic. Now, many of my 14,000+ followers, readers of The Income Factory® (McGraw-Hill, 2020), and members of Inside the Income Factory say they sleep better through market downturns as they "create their own growth" and free themselves from being fixated with market ups and downs.

Here are some comments:

- "Learned the hard way how exceptional the Income Factory is"

- "As close to investment management heaven as one can get."

- "Continues to be a killer bargain."

- "Slept better through the bear market"

Click here to learn more.

Thanks,

Steven Bavaria

This article was written by

Bavaria introduced the Income Factory® philosophy in his Seeking Alpha articles over the past 12 years, drawing on his fifty years experience in credit, investing, journalism and international banking. His earlier book "Too Greedy for Adam Smith: CEO Pay and the Demise of Capitalism" exposes the excesses in the CEO pay arena. Both books are available on Amazon.

Bavaria began his career at the Bank of Boston, handling international credit workouts that included managing a fleet of ships, chasing a Vatican-owned bank in Switzerland, and leading the turnaround of troubled branches in Australia and Panama.Then he did a stint as a journalist, writing about the financial markets for Investment Dealers Digest (IDD). There he wrote some of the first articles about novel securities, like CLOs, that have now become mainstream, and covered the early evolution of corporate loans to a public, tradable asset class.

Later he worked at Standard & Poor's, where he introduced credit ratings to the leveraged loan market, helping to open the loan asset class to pensions, mutual funds and specialized investment vehicles like CLOs.

Bavaria graduated from Georgetown University and New England School of Law. He lives in Ponte Vedra, Florida.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KIO, ARDC, XFLT, AIF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

PERSONAL DISCLAIMER: My articles published on Inside the Income Factory or elsewhere on Seeking Alpha, including comments, chat room and other messages, represent my own opinion based on personal knowledge and experience. I am not an investment “expert,” counselor or professional advisor, and while my articles may reflect substantially the strategies I employ in my own investing, there is no assurance that these strategies will be successful, either for me personally or for my readers. In other words, while I do my best, there is no warranty or guarantee that the ideas expressed are correct or accurate, and I urge all readers to take my opinions for what they are – “opinions” – and to do your own due diligence on, and check out personally, every investment idea, stock or fund that I may present, so you can make your own informed decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)