REACT Or Retreat: ProKidney's Phase 3 Focal Point

Summary

- ProKidney focuses on cell therapy for chronic kidney diseases, with REACT in Phase 3 trials and FDA's RMAT designation.

- Financially stable, with $446M in liquid assets and a 37-month cash runway, but experienced a net loss of $34.8M in Q2.

- Investment recommendation: "Hold" due to uncertainties in clinical trials, scalability, and cash burn rate.

SewcreamStudio/iStock via Getty Images

Introduction

ProKidney (NASDAQ:PROK) is a clinical-stage biotech company developing a cell therapy platform to treat chronic kidney diseases. Using a patient's own renal cells, the company's lead product, REACT, aims to restore or preserve kidney function, eliminating the need for immunosuppressive therapies common in kidney transplants. REACT is in Phase 3 trials for diabetic kidney disease and has received FDA's RMAT designation for its promising outcomes.

The following article analyzes ProKidney's financials, ongoing trials for its lead product REACT, and investment outlook. It recommends a "Hold" position due to uncertainties.

Q2 Earnings Report

Looking at ProKidney's most recent earnings report, cash on hand as of June 30, 2023, was $446M, down from $490M at the end of 2022. R&D expenses surged to $26.4M, primarily driven by a $5.9M increase in compensation costs and a $6.2M rise in clinical trial costs. G&A expenses also went up to $13.5M due to higher legal and insurance costs. The company reported a net loss of $34.8M, compared to $22.1M in the same quarter of 2022.

Cash Runway & Liquidity

Turning to ProKidney's balance sheet, as of June 30, 2023, the company has $243.6M in 'Cash and cash equivalents' and $202.6M in 'Marketable securities,' totaling $446.2M in liquid assets. The "Net cash used in operating activities" for the six months ending June 30, 2023, is $71.7M, giving an estimated monthly cash burn rate of approximately $12M. With this, the company has a cash runway of about 37.2 months. It is essential to note that these calculations are based on past data and may not accurately predict future financial performance.

ProKidney appears to have sufficient liquidity to fund operations for a considerable period. Regarding liabilities, the company's total current liabilities stand at $24.5M, and there's no mention of debt in the statements. Given its current liquidity position and manageable liabilities, securing additional financing, should it be required, seems feasible for the company. These are my personal observations, and other analysts might interpret the data differently.

Capital Structure, Growth, & Momentum

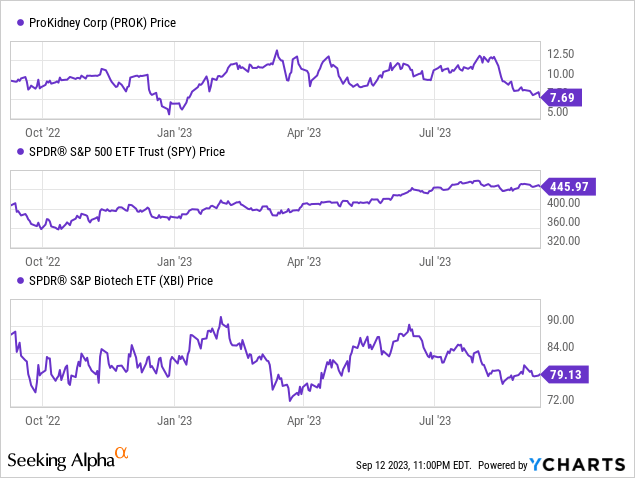

According to Seeking Alpha data, ProKidney's capital structure is relatively robust, featuring substantial cash reserves and minimal debt, underpinning its $1.91B market cap. The enterprise value stands at $1.85B. Growth-wise, the company is in a clinical-stage development phase; thus, no revenue is generated. The focus remains on REACT's trials for diabetic kidney disease, and its future earnings potential appears promising if FDA approvals are secured. However, analysts have not provided specific revenue projections. In terms of stock momentum, PROK has underperformed the S&P 500 significantly in the past year.

Clinical and Financial Horizons of ProKidney's REACT

REACT, a groundbreaking innovation from ProKidney, represents a personalized kidney therapy that originates from a patient's unique renal cells. The procedure entails cultivating these cells within a laboratory setting, transforming them into a hydrogel or cryopreserved form, and subsequently administering them for clinical application. This autologous method is designed to bolster kidney performance while minimizing the potential for rejection.

Logistically, ProKidney is positioning itself for the commercialization of REACT. They've recently closed on a 210,000 square-foot facility in Greensboro, N.C. and secured conditional tax and energy credits, which are tied to job creation and capital investment targets.

On the clinical front, there are two major Phase 3 trials in progress. ProACT 1 is enrolling 600 patients in the U.S., UK, and other high-risk countries, with initial interim data expected by 2024. ProACT 2, which targets the EU, Latin America, and Asia Pacific patient populations, has been updated to align with current medical guidelines. The study is slated to commence in late 2023, with preliminary findings due by the end of 2025.

As for the Phase 2 results, they warrant a deeper dive. 32% (7/22) of patients showed an improvement in their estimated Glomerular Filtration Rate (eGFR), a key indicator of kidney function. Even more intriguing is the hint that the efficacy of REACT may be tied to the expression of RET in the product, providing a possible biomarker for identifying "high responders" in future studies. Nevertheless, it's crucial to juxtapose these encouraging results with the safety data, where a notable frequency of Serious Adverse Events (SAEs) was observed within the cohort. While it's worth noting that none of these events were directly linked to REACT, the elevated occurrence, in my perspective, calls for a more comprehensive safety assessment.

My Analysis & Recommendation

In wrapping up, ProKidney presents a compelling case with its focus on chronic kidney disease treatment, particularly through its lead product, REACT. While the company has a strong cash position and appears financially equipped to meet both short-term and long-term obligations, caution is advised for several reasons.

Firstly, despite promising Phase 2 results, the small sample size means the findings might not be broadly applicable to a larger, more diverse patient population suffering from this chronic disease. This makes the upcoming Phase 3 trials crucial for both efficacy and safety validation.

Secondly, logistical challenges cannot be ignored. REACT employs a complex procedure of autologous cell therapy, which involves culturing a patient's own renal cells. Scaling this process efficiently will be an operational hurdle, not to mention the recently acquired 210,000 square-foot facility in Greensboro, which will add another layer of complexity to commercialization.

Investors should also keep a watchful eye on the company's cash burn rate. While the current runway appears comfortable, any delay in the trials or unforeseen expenses could significantly alter the company's financial calculus.

In terms of investment, I recommend a "Hold" position for now. Given the high risk and uncertainty associated with clinical-stage biotech companies, and considering that REACT is still undergoing critical Phase 3 trials, the stock is more speculative than proven. The promising financials do offer some cushion, but until more conclusive data from larger trials is available, maintaining a status quo investment strategy seems most prudent.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.