MercadoLibre: Operational Excellence Justifying Premium Valuation

Summary

- MercadoLibre's most recent results demonstrate robust growth, efficient cost management, and impressive profitability, driven by solid e-commerce performance, particularly in Mexico and Brazil.

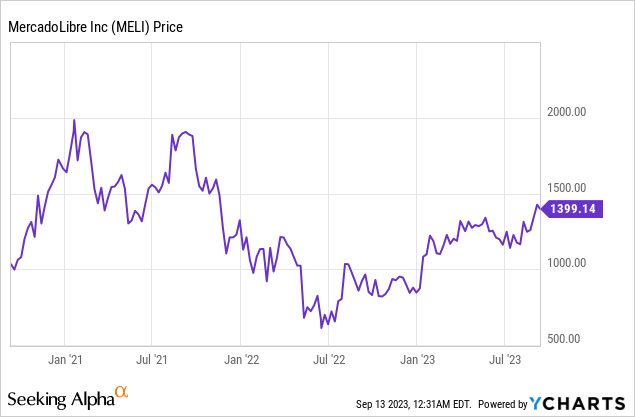

- The company's expanding presence in Latin America's e-commerce market, coupled with its focus on platform monetization, has led to significant stock appreciation, though it remains below its historical peak.

- While concerns include credit market delinquencies and short-term defaults, MercadoLibre's solid long-term performance, diversification, and growth potential make it an attractive choice for long-term investors.

Leila Melhado

MercadoLibre (NASDAQ:MELI) is an Argentine company operating in Latin America's e-commerce and fintech sectors. It currently holds a market leadership position in the e-commerce business in the key countries within its operational scope. Over its nearly 25-year history, MercadoLibre has demonstrated its ability to create an ecosystem of complementary and synergistic businesses. This approach has allowed the company to deliver a superior level of service compared to its peers in Latin America, particularly in logistics. The company primarily focuses on three countries contributing over 90% of its consolidated revenue: Argentina, Brazil, and Mexico.

Based on its most recent financial results, MercadoLibre's sustained momentum reinforces the belief that its proactive strategy effectively strengthens Latin America's e-commerce market. A rapid increase in platform monetization characterizes this market. Notably, the company's shares have already appreciated more than 60% as of September this year, demonstrating strong growth across its regions. However, they still trade approximately 30% below their historical peak two years ago.

It's worth noting that the company has frequently emphasized its commitment to investing in growth to strengthen its consolidation agenda. This growth focus could lead to sequentially lower year-over-year margin expansion in the coming quarters.

The robust profitability gains can be attributed to a combination of factors, including gross margin improvements, favorable operating leverage dynamics, and reduced provisions. MercadoLibre's continued earnings momentum underpins our confidence in its strategy to solidify its presence in the Latin American e-commerce landscape while enhancing platform monetization.

Because of its high-quality nature, MercadoLibre's shares typically warrant premium valuations. Although the shares are not currently undervalued, I believe there is a more favorable risk-reward profile when considering them as a long-term investment.

Latest Results: jaw-dropping bottom-line performance

In the second quarter of the year, MercadoLibre delivered impressive financial results characterized by robust revenue growth, efficient cost management, and a remarkable surge in profitability. The company reported consolidated net revenue of $3.4 billion, marking a 31.5% year-over-year increase, primarily driven by the e-commerce sector, which saw substantial growth of 37.9% year-over-year, led by solid performances in Mexico and Brazil.

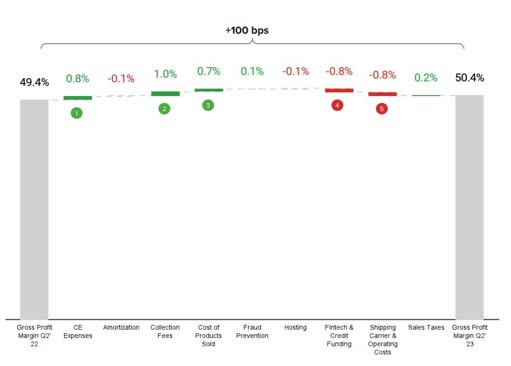

However, it's worth noting the rise in the cost of goods sold (COGS), totaling $1.7 billion, reflecting investments in fulfillment capabilities and funding costs. Despite this, MercadoLibre achieved a gross margin of 50.4%, outpacing revenue growth. Operational expenses, including SG&A and R&D, were managed efficiently, increasing profitability.

MercadoLibre's IR

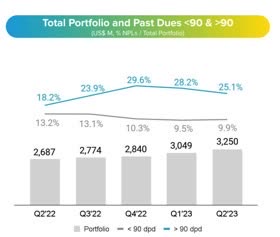

Provision expenses, particularly Provision for Doubtful Debts (PDD), slowed down as the credit operation gradually recovered. Nevertheless, concerns persist regarding the 90-day Non-Performing Loans (NPL) metric and its potential impact on future costs.

MercadoLibre achieved an impressive EBIT margin of 11.2%, driven by gross margin gains and prudent expense management. However, primarily influenced by Argentina's economic situation, foreign exchange losses partially offset these gains.

Despite these challenges, the company reported a remarkable 113% year-over-year profit growth, reaching $262 million. MercadoLibre's Q2 results reflect its strong growth trajectory, cost-efficiency measures, and operational excellence, positioning it as a leading player in Latin American e-commerce.

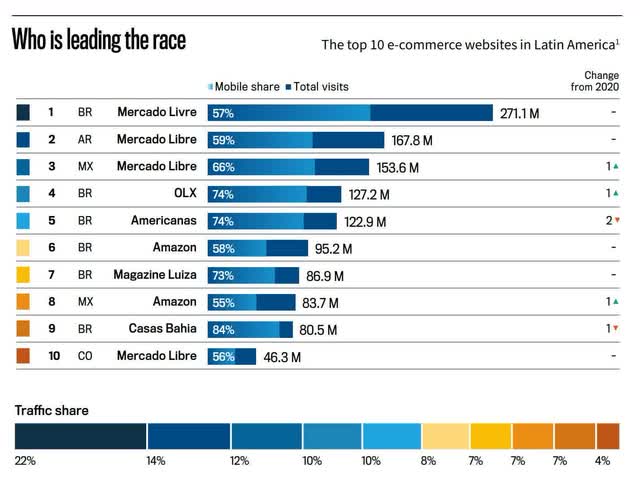

Dominance in Latin America's e-commerce

MercadoLibre holds the top in the Brazilian e-commerce market, commanding approximately 33% of visit volumes across its website and app. It managed to gain market share from Americanas, a Brazilian retailer that faced bankruptcy at the end of 2022. Sea Limited's (SE) Shopee ranks second with a solid 20%+ market share, maintaining its position steadily. Shein has steadily risen, capturing more than 15% of the market.

From: Atlantic's latest LATAM State of Digital 2023 Report

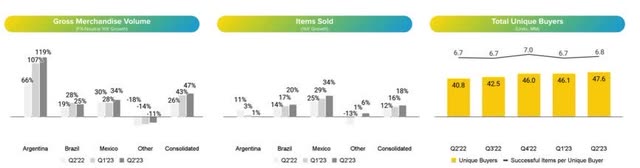

MercadoLibre has displayed impressive growth in its Gross Merchandise Volume (GMV), with a remarkable increase of 22.9% compared to the previous year, totaling $10.5 billion. This robust e-commerce performance underscores the company's continued expansion in its operational vertical.

Mercado Livre has solidified its dominant position in the e-commerce landscape in Brazil, capitalizing on opportunities to gain market share that emerged earlier in the year. This has resulted in an outstanding 59% growth in 1P GMV (first half) in local currency, contributing significantly to the positive performance of the local operation.

Mexico has emerged as MercadoLibre's second-largest operation in terms of GMV, surpassing Argentina. The Mexican operation is experiencing rapid growth, with local GMV accelerating by 52.0% year-over-year. Additionally, the Mexican operation has recorded the most significant increase in items sold and the most substantial growth in new buyers in two years.

However, the macroeconomic situation in Argentina continues to impact the performance of the local operation, primarily due to the country's inflation affecting GMV. Growth in items sold and absolute values is limited, with a modest increase of 1% in GMV in local currency.

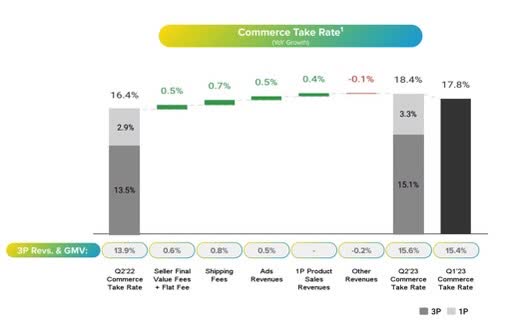

Despite the economic challenges, MercadoLibre has achieved a remarkable 38% growth in e-commerce revenue. This growth was driven by a 23% increase in total GMV and a +200 basis points acceleration in the e-commerce take-rate, which reached 18.4%. This take-rate acceleration was attributed to higher penetration of ad revenue, revised marketplace rates, and increased penetration of first-party (1P) sales.

MercadoLibre fintech performance, increasing revenues

MercadoLibre's Fintech division experienced a 45 basis points decrease in its take-rate compared to the previous year, reaching 3.52%. This decline can be attributed to more moderate growth in the credit business and lower commission rates in other areas. Nevertheless, fintech revenue grew 24% year-over-year, reaching $1.5 billion despite this reduction. Given the current macroeconomic conditions and the pursuit of sustainability in the credit business, this growth slowdown is prudent.

In summary, MercadoLibre's Fintech division faced a decrease in its commission rate but still achieved solid revenue growth.

Mercado Pago's expressive growth in transaction volume

Mercado Pago, MercadoLibre's payment platform, delivered an impressive performance with a 39.3% increase in Transaction Volume (TPV) for the quarter, reaching $42.0 billion. This growth can be attributed to targeting small and medium-sized businesses (SMBs), which contributed to the substantial increases in Off-platform TPV, increasing 128.7% year-over-year, and digital accounts TPV, rising 58.2% year-over-year.

The acquiring sector also witnessed solid growth, totaling US$27.2 billion. This sustainable strategy addresses market demands while maintaining a healthy competitive landscape.

Credit market performance with delinquency Concerns

The Credit Market continued to exhibit robust growth, with the credit portfolio totaling $3.2 billion, marking a substantial increase of 21.0% compared to the previous year. This growth was primarily driven by the expansion of the consumer segment in Mexico and the gradual expansion of credit card operations in Brazil.

The highlight was the notable acceleration in credit card operations, with a sequential growth rate of 12.8%. However, a cautionary note arises regarding delinquencies of less than 90 days, which experienced a reversal for the first time in 12 months, reaching 9.9%. This can be attributed to a seasonal mismatch and the increased involvement of the In-store Merchant segment, which carries higher risk due to the lack of user behavior history.

MercadoLibre's IR

Delinquency remains a concern, mainly as the company accelerates its credit card operations. It is crucial to balance growth and the portfolio's quality to ensure the sustainability of credit operations. Mismatches between these two factors can result in high costs in the future, especially as overdue installments progress through the portfolio.

Although there was no significant mismatch in Q2 2023, predicting the precise impact of new cohorts is challenging due to the portfolio's short maturity, and these cohorts are still relatively young. Despite the dynamics raising concerns, the situation is currently under control.

The bottom line

In my analysis, MercadoLibre consistently delivers exceptional operational performance, justifying its valuation. With an EV/EBIT multiple of 39.7x for 2023E and 25.7x in 2024E, we believe that MercadoLibre's track record of excellence justifies the premium in its shares, characterizing them as still relatively discounted.

MELI's consensus EPS estimates. (Seeking Alpha)

Looking further ahead, the outlook is for MercadoLibre to grow EPS by 75% by 2025, making its shares trade at a P/E ratio of 39x, a valuation very close to Amazon's (AMZN) estimated P/E ratio of 33x in 2025.

Some companies may appear expensive but continue to grow in value, and MercadoLibre seems to be following this trend. This is precisely why I believe that MercadoLibre should increase its EPS, as projections indicate, and potentially do so at a much faster rate.

MercadoLibre holds a prominent position in the e-commerce markets of Brazil and Argentina, further solidified by its significant presence in Mexico. The company consistently expands its market share in Brazil and Mexico, reaffirming its dominant status and showcasing its potential for sustained growth.

This is particularly noteworthy considering the current situation in the Brazilian e-commerce landscape, where major players like Americanas are effectively sidelined. Via Varejo (Casas Bahia) faces severe liquidity risks that could lead to bankruptcy. Such circumstances are expected to fortify MercadoLibre's consolidation in the Brazilian market.

Moreover, despite having approximately three times less traffic than MercadoLibre in Latin America, Amazon is not far from becoming a significant player, similar to its presence in North America. One of the reasons for Amazon's relatively minor market share in Latin America is its delayed entry into the region's economic landscape. The Brazilian business environment also presents unique challenges, a key factor contributing to this dynamic.

If we analyze MercadoLibre by region, it has achieved over 30% growth in all the areas where it operates. One compelling metric to note is the take rate, the percentage of sales that translates into revenue for the company. In 2010, 13 years ago, the take rate was 6%; now it stands at 18.4%, with indications that it will soon reach 20%.

MercadoLibre's IR

Why is MercadoLibre able to increase this metric? They consistently enhance their services by offering sellers more functionality through various initiatives.

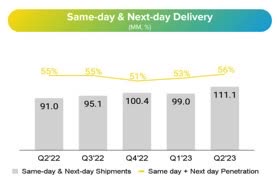

One such initiative is Fulfillment, where MercadoLibre excels in efficient delivery. Anyone who has used the platform knows how quickly the company delivers, significantly impacting customer loyalty and putting it ahead of the competition. To provide context, 80% of deliveries in Argentina, Brazil, and Mexico are completed within 48 hours.

MercadoLibre's IR

Despite having a higher commission rate than its main competitors in Latin America, the company has made substantial investments in logistics, approximately $1.8 billion since 2019. This makes advertisers willing to pay more because they understand they will convert more sales through the platform.

Another reason I favor the company is that it's more than "just" a marketplace. Over the past four years, MercadoLibre has made significant investments in digital banking to lend money in exchange for interest, accounting for around 45% of total net revenues.

In the fintech sector, despite a contraction in the take rate, which was expected due to softer growth in the credit portfolio and competitive dynamics in the acquiring market, this reflects prudent credit origination and competitive ambitions in Mercado Pago.

While short-term defaults are a concern, the situation appears to be under control. The focus on the NPL above 90 days indicator is positive. Still, the increase in NPL below 90 days warrants attention and is probably the biggest concern around MercadoLibre's bullish thesis in the short term.

In the long term, MercadoLibre's recent solid performance, sustained leadership in Latin America, and revenue diversification make it an excellent long-term portfolio holding.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MELI, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.