IEUR: Pinching On Financials, Indebted Industrials

Summary

- IEUR provides exposure to quality equities in Europe, with a diversified portfolio of over 1,000 holdings.

- Industrials, financials, and healthcare account for about half of the allocations in IEUR, with potential risks in industrials and financials due to industry pressures and interest rate hikes.

- While the European rate situation may converge with the US policy for FX benefits, the valuation of IEUR at almost a 14x P/E is not particularly compelling considering benchmarks.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

FrankRamspott

The iShares Core MSCI Europe ETF (NYSEARCA:IEUR) covers quality equities in Europe, representing a pretty fair basket of the European economy by sector. The IEUR is diversified with more than 1,000 holdings, so broad level comments on the key sectors of industrials and financials can help us conclude that the valuation of the market in Europe is broadly about fair, especially as pressures begin to show on industry and financials.

IEUR Comments

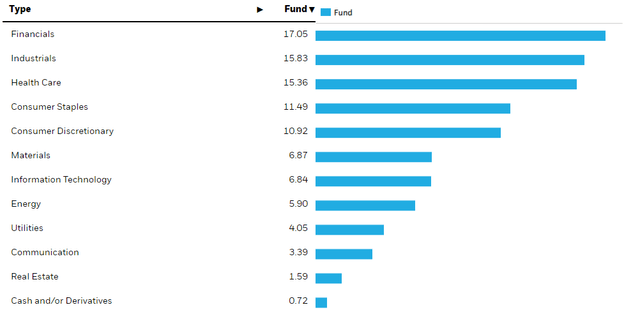

Let's begin with the sector distribution.

Industrials, financials and healthcare account for about half of the allocations in EUR.

- Industrials - the concern here is that proximity (especially of Germany which drives the industrial exposure) to the effects of the Ukraine war and general dependency in the past on Russian integration creates a substantial delta that puts the European economic situation below the US. Industrials are some of the first to adjust activity and get rational when things start to get a bit difficult. This is evidenced in lower gas demand for European industry, despite a meaningful come-down in price. Cyclical exposures and also indebtedness inherent to industrial assets creates some risk here of meaningful profit crimps.

- Financials - the long story short is that interest rate hikes are now being passed on to savers. We saw in our coverage that European banking had been benefiting from higher NIMs up until now. That is expected to start changing, and it will crimp profits a little.

- Healthcare - this is a decent exposure. Driven recently by Novo Nordisk (NVO) which is actually the largest allocation in IEUR, this exposure is broadly resilient especially as any potentially negative effects from COVID-19 like lower diagnostic rates or declines in diagnostic industry revenue have been lapped.

Beyond these exposures are consumer staples, companies like Nestle (OTCPK:NSRGY) which is a 2.84% allocation overall for the IEUR, which should be pretty resilient and have already demonstrated resilience. Then there's also consumer discretionary, represented by automotive which could be trickier due to the markets being exposed to leverage-based demand - possibly a negative increment once the pent-up demand is exhausted. There is not that much confidence in European automotive at the moment.

Bottom Line

The CPI remains a little high in Europe, and further rate hikes are expected to come with the European rate situation likely to converge further onto the US policy. This is good for the EUR, and may present an interesting FX play for US investors, but at almost a 14x PE, we don't think the valuation is especially compelling for IEUR. The implied earnings yield, while still ahead of benchmark rates, could be higher to demand a margin of safety considering that some major exposures like financials and industrials could start seeing negative increments, potentially pretty hefty ones in industrial if we are to believe that the effects of the rate hikes on the economy are still lagging behind, which is not unreasonable and actually consistent with history. We just want lower multiples in the current high-rate environment for all our stocks.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.