Five Point Holdings: A Cheap Investment With A Hard Catalyst

Summary

- Five Point Holdings is an undervalued and misunderstood California land developer.

- The company owns three major communities in California with significant real estate available for development.

- The market is overly concerned with the company's ability to pay down and refinance the 2025 Note.

Demolition Of San Francisco"s Candlestick Park Enters Final Phase Justin Sullivan/Getty Images News

The Setup

Five Point Holdings (NYSE:FPH) is a small California land developer misunderstood by the market. From 2009-2021, Five Point was under a previous leadership team that ran a bloated cost structure. According to Redfin, 82.4% of homeowners have an interest rate below 5%, 62% below 4%, and 23.5% below 3%. With mortgage rates ranging from 7-8%, the likelihood of one moving is low, given the dramatic increase in interest costs associated with a new mortgage. Combine this factor with the recent estimates from Freddie Mac, which estimate the country is short about 3.8 million housing units for rent and sale. New builds should see sustained demand as buyers have almost no alternative, leading to continued demand for land over the next several years, benefiting Five Point. We recommend buying this depressed stock.

Business Description

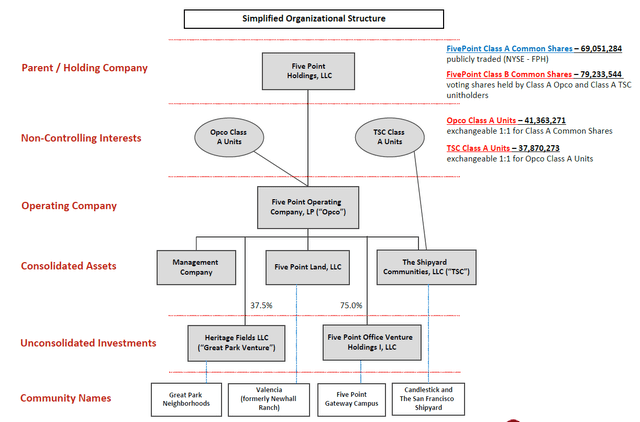

Five Point is a landowner and developer in California. They own three communities: Valencia, Great Park, and the San Fransisco Shipyard & Candlestick Park. In addition, the company owns a 75% interest in a commercial real estate site known as the Gateway Commercial Venture. These properties represent a significant portion of the real estate available for development in three major markets in California—Los Angeles County, San Francisco County, and Orange County. The ownership structure of FPH is complex and likely one of the reasons the discount persists. Five Point owns 100% of Candlestick, the San Francisco Shipyard, 100% of Valencia, 37.5% of Great Park, and 75% of the Commercial Park.

FPH generates almost all its revenues and profits by selling land to developers. The payment structure is typically based on a margin (around 37%) plus an incentive payment based on the home's sale price. For example, if it costs FPH $100,000 to develop a lot, they would sell it to Lennar or another developer for $137,000. Lennar would then build and sell a home. If Lennar profited $100,000 on the house, FPH may receive 5%. Five Point and Builders are in a partnership arrangement to maximize each lot's value. In addition to the single-family lots, Five Point owns over 20m sq. Ft of commercial space, some of which they are actively marketing. The main drawbacks of land development are a capital-intensive business, sizeable initial cash outlays, lumpy cash flow stream, and sensitivity to the economic environment.

Five Point Holdings Org. Structure (FPH IR)

Valencia - Los Angeles, CA

Statistics - 15,000 acres, 11.5m sq ft of planned commercial space, 10,000 acres of open space, 50 miles of trails, 275 acres of parks, 7 new schools, 21,500 planned homes with 2,200 affordable units.

Valencia is the largest of the three communities and began selling homesites in 2019. Since the initial opening, Five Point has sold ~1,866 homesites; however, none since the fourth quarter of 2021. Five Point acquired this land in 2009. Currently, the company is marketing 50 acres of prime commercial real estate. You can click the following here to see the sites.

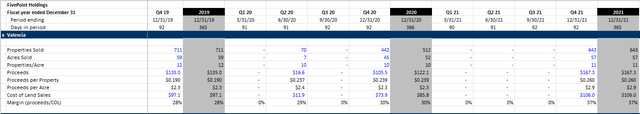

Valencia Historicals (FPH 10-K & 10-Q)

The spreadsheet depicts the sales of Valencia homesites to date. Typically, one values the land on a per-property or acre basis. In 2019, Valencia sold 711 properties on 59 acres for $135m or $190k per lot or $2.3m per acre. The most recent sale in Q4 21 was 643 lots on 57 acres for $167.3m or $260k per lot and $2.9m per acre. Land values should track home values, making it unsurprising that land value increased since 2019.

Great Park - Irvine, CA

Property Statistics - 2,100 acres, 4.9m sq. ft of planned commercial space, 200 acres of parks and trails, 3 new schools, 10,500 planned homes with 1,050 affordable units.

Five Point owns a 37.5% interest in the Great Park Venture. As part of the original land acquisition, the previous owners of Great Park, known as "Legacy Interest," were entitled to receive priority distributions up to an aggregate amount of $565.0 million, of which $524.3 million had been distributed as of July 14, 2023. Legacy Interest holders were entitled to the first $476m of distributions. Great Park Ventures holds cash on its Balance Sheet to fund future development. When the entity deems they have excess cash, it distributes the excess cash. The first $476m of distributions went to Legacy holders. Legacy Interest holders will receive approximately 10% of future distributions until the remaining balance is fully paid. Five Point and other partners will receive the remaining 90%. As of June 30, 2023, Legacy Interest holders have a maximum entitlement of $40.7 million in distributions. In Q2 2023, FPH received a distribution of $81.8 million.

Great Park operates as a self-funding development. FPH and other partners will not contribute capital to develop the remaining undeveloped land. Instead, financing the development using $141 million in cash on hand and proceeds from existing lot sales. It's important to note that this cash balance is not included in Five Points' balance sheet.

On the Q2 2023 call, management stated, "after these residential and commercial sales, the Great Park Venture will have about 295 acres remaining, depending on the pace of sales, we'd expect to be through remaining inventory at Great Park in 5 to 8 years." Since Great Park is nearing its end, little reinvestment is needed to develop future sites. As cash comes in, distributions to FPH and other partners should ensue shortly thereafter. Do not expect a dividend or buyback. Cash will be used to reduce debt or reinvested back into Valencia or San Francisco. In Q2, Great Park sold 798 properties across 84 acres for $357.8m or $448k per property and $4.3m per acre.

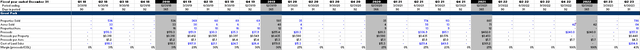

Great Park Historical Sales (FPH 10-K & 10-Q)

Candlestick & The San Francisco Shipyard - San Francisco, CA

Statistics - 700 acres, 5m sq ft of planned commercial space, 1.25m sq ft for entertainment/culture/hotel, 340 acres of open space, 10,700 planned homes with 3,400 affordable units.

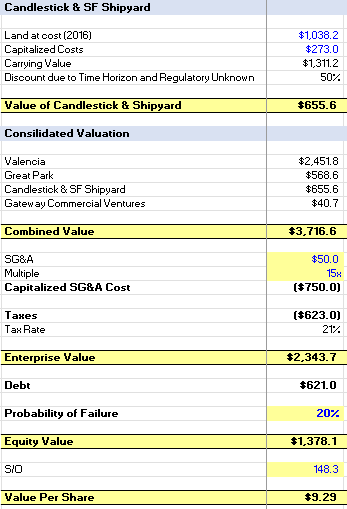

This community has faced significant challenges. Currently, the U.S. Navy still owns 408 acres of the Shipyard, formerly Hunter's Point, and these parcels will not be transferred to Five Point until the U.S. Navy completes its finding of suitability to transfer. The site is contaminated due to past activities and is undergoing remediation. You can find more information about the allegations and ongoing issues here. Until the hazardous waste is entirely removed, Five Point cannot commence development on the site. They are working on creating a standalone project for Candlestick while they wait for the Navy to complete remediation. No sales have occurred. The land recorded on FPH's Balance Sheet is land at a cost of $1.04B (value based on land at a cost in 2016) and capitalized costs of $273m for a total carrying value of $1.3B

Thesis

Who'd like to own a complex organizational structure, long-term disappointing stock where the previous owners went bankrupt in 2009, CALPERs taking a $1B writedown, and a stock down 80% since its IPO in 2017? Few. In August 2021, Emile Haddad stepped down from his role as CEO, replaced by interim Stuart Miller, whom Dan Hedigan replaced in February 2022. In addition, most of Emile's existing staff were let go.

The business direction, cost structure, and focus are now in the right hands. Had Mr. Hedigan been CEO since 2017, I believe FPH shareholders would be in a far different position. I've spoken to Dan and the new management team, and during the hour-long discussion, management said exactly what we were looking to hear. It was a breadth of fresh air given the painful shareholder experience thus far. Due to the bloated cost structure of the previous management team, I think Five Point would have gone bankrupt in 2024-2025 when their note matures. The cost structure was immediately right-sized under Dan's leadership. In Q1 22, headcount was reduced by ~29%., resulting in annual SG&A declining from $77m in 2021 to a run rate of $52m in 2023.

One of the issues with Land developers is the capital intensity of the business. Large cash outflows to develop land and subsequent reinvestment to develop other parcels after initial sales means cash flows to investors are typically backloaded. Additionally, cash continually leaves the business when land sales are not occurring. One strategy other developers and Dan proposed was to develop the Commercial land to continually generate rental income, using this cash to fund the development of the single-family land parcels. Rental income provides supplemental income to land sales. The only way for Five Point to fund the initial land development was through an equity raise and debt issuance.

However, Five Point's hand is forced with $625m of 7.875% notes outstanding and a debt market relatively close to a business like this. Management must substantially reduce the balance before maturity. These notes were not issued in a traditional public debt offering; they were offered only to select institutions. While the debt is technically publicly traded, almost no trading volume exists. The fair value of the notes at the end of Q2 was $566m. While the debt is trading at a discount, and they have the cash to reduce the balance, the lack of trading volume means the company cannot repurchase the discounted bonds. The current YTM of the bonds is 13.4%. Five Point clearly could not support this type of interest rate. The good news is management is aware and taking proactive measures to generate near-term cash. As noted above, they are currently marketing 35 acres of commercial land, which should be sold by the end of the year. The company generated positive cash flows in the first half of the year and guided to positive FCF in the second half.

The general thesis is not whether the stock is undervalued relative to the value of the land. It almost certainly is. The primary question is whether current equity holders benefit or whether there is a restructuring in the future. The company has until November 2025 to figure out the debt situation. Given the current stock valuation, an equity offering is not an option. To refinance the note, the company must get to roughly $300m of net debt. Paying off half while refinancing the other. They have $193m of cash on hand, some of which must be used to develop land further. Through land sales, both commercial and residential, and cash distributions from Great Park, the possibility of reducing and refinancing the note has become a more likely scenario relative to just a year ago. Two years ago, it looked like this company was headed for bankruptcy, and the debt yielded 18%.

Valuation

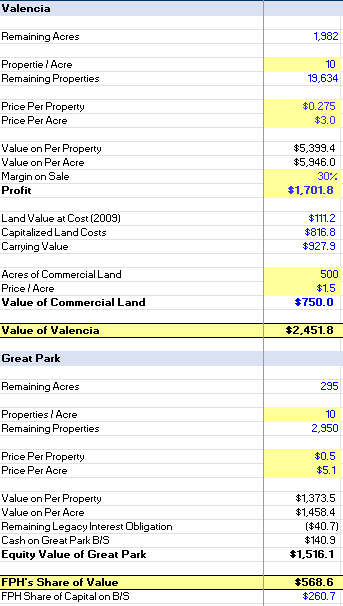

I valued the properties utilizing historical sales and margin profile. Below are my valuations and assumptions by the community. Note that these are my best estimates and err on the conservative side.

Note that depending upon when the company acquired the land, Valencia in 2009 and Candlestick in 2016, the carrying value is likely dramatically lower than today's actual value. You can imagine how acquiring land back in the financial crisis is worth more today.

In the case of San Francisco, while the carrying value is $1.3B and was acquired in 2016, I utilized a far lower value due to the inherent uncertainty surrounding this property. Even management does not have a sense as to when this property could be developed and monetized. Since this is the case, I tried to take a relatively draconian picture of this community. In addition, given the uncertainty surrounding the macro picture, the timing of future monetization, and upcoming debt maturity, there is a possibility that the company cannot refinance or payoff the note, resulting in bankruptcy, which I put at a 20% possibility.

After considering all these factors, I believe the business's fair value is around $9.29.

FPH Valuation (FPH IR & Dominick D'Angelo's estimates) FPH Valuation (FPH IR & Dominick D'Angelo estimates)

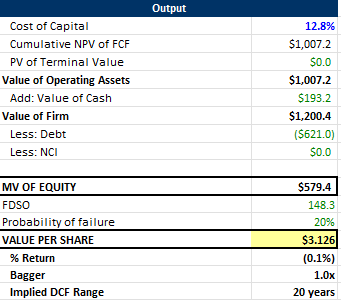

In addition to valuing the stock per property and acre basis, I did a DCF, assuming all of the land is sold within the next 30 years.

This valuation presented a much different picture, producing a value of $3.13. While far different from the previous valuation, this result would still mean holders would generate the company's cost of capital of 12.8% per year, not a bad result. In addition, I used the firm's current cost of debt of 13.4%. Assuming the company reduces its debt load in a few years, the firm's cost of capital should decline, and the probability of failure will also decline.

DCF Output (Dominick D'Angelo Estimates)

The 2025 note maturity is a hard catalyst for investors to monitor. If they refinance it and pay it down, the stock will dramatically rerate as the possibility of this event occurs. With a 10% cost of capital and 0% probability of default, the value of the business increases from $3.13 to $5.97, not factoring in the cash generated between now and then.

However, if you believe the market environment for new-build sales will dramatically worsen and the demand for land will fall over the next two years, you likely think the probability of default is higher, and you should not own this stock. I believe management is fully aware of the situation and is taking necessary steps to reduce the debt load.

Q2 Results

While any quarter is not of much significance due to the lumpiness of the business, Q2 had a few notable highlights to call out. First were the positive first-half results, where the company generated $61.4m of FCF compared to the original expectation of -$56m to -$24m.

Second, the company guided to $50m-$70m of net income and to generate positive cash flows in the second half of the year, expecting to end the year with a $250-$300m cash balance. One thing to be wary of with this business is that transactions often are not moved up but are often delayed. The actual results could spill into the first half of 2024.

Finally, the 798 homesites and 84 acres of land sold at Great Park for $358m. While the price per property/acre was lower than expected, the $81.8m of cash distributions Five Point received is far more critical.

Risks

Throughout this article, I harped on the primary risk several times: the November 2025 $625m note maturity. Additional risks include the rise in interest rates affecting the company twofold. One, when they refinance the debt, the interest rate will be higher than the current rate, and second, the affordability of homes will further decline. With 82% of homeowners locked into a sub-5 % rate, the secondary home inventory is unlikely to increase dramatically. New builds should continue to see sustained demand as it is the only viable way for prospective buyers to guarantee a home.

One of the problems of this investment is that the company's cost of capital is higher than what land values appreciate. Delays will reduce the present value of the land. This risk is heavily magnified in the San Francisco community, given its $1.3B carrying value. To give a hypothetical, suppose today's value is $1.3B, and due to inflation and demand, the property's value increases 6% per year (note that going from raw land to buildable land results in a dramatic step up in value). If we had the option to sell all of the land for $1.3B or wait a year and sell it for $1.38B (1.3 * 1.06), we would sell it for $1.3B today because the present value of the $1.38B using the 12.8% cost of capital is $1.22B. This exercise does not apply solely to San Francisco but to every property. The step up in value from raw land to developed land does not make this 100 % apples-to-apples. However, every year, the company sits on developed but unsold land, and the PV of the land is lower than the year prior.

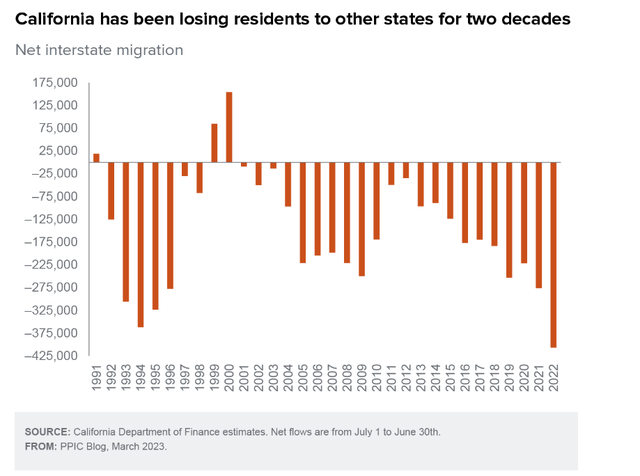

Third, the land is concentrated in California. Should migration trends continue or worsen, the demand for homes in California may decline, resulting in a decline in land demand.

California Migration Trends (California Department of Finance)

Finally, the complex ownership structure makes this investment challenging to understand what minority shareholders own.

Please note the lack of daily volume in the stock. It is thinly traded, with an average of 59,000 shares or ~$179,000.

Summary & Forward-Looking Items to Monitor

FPH is a small, off-the-beaten-path idea with a hard catalyst that should result in a rerating once the fear of default subsides. Five Point owns desirable land that should see sustained demand for years due to the lack of secondary inventory. Management is laser-focused on the tasks, and I believe the next few quarters will further ease leverage concerns. The stock is currently trading at a dramatic discount to the value of the land it owns.

Over the subsequent few quarters, investors should watch for the following:

- Sale of commercial land

- Positive cash flow generation

- Discussion surrounding the separation of Candlestick and the Shipyard could accelerate the market time.

- Land sales at Valencia

Model - FPH.xlsx

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FPH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.