AIER's Everyday Price Index Sees Biggest Monthly Jump Since January

Summary

- In August 2023, the AIER Everyday Price Index rose 0.87 percent, lifting the index from 285.2 to 287.7.

- The month-to-month headline CPI number rose 0.6 percent versus 0.2 percent seen the previous month.

- With the release of the data, market-implied policy rates ticked up in the three- to six-month range, indicating higher expectations of another 25-basis point Fed Funds increase toward the end of 2023.

champc

By Peter C. Earle

In August 2023, the AIER Everyday Price Index (EPI) rose 0.87 percent, lifting the index from 285.2 to 287.7. This was the largest monthly percent increase since January 2023 (0.93 percent). Additionally, 287.7 is the highest recorded index value, besting the previous EPI high of 287.1 registered in June 2022.

AIER Everyday Price Index vs. US Consumer Price Index (NSA, 1987 = 100)

Source: Bloomberg Finance, LP

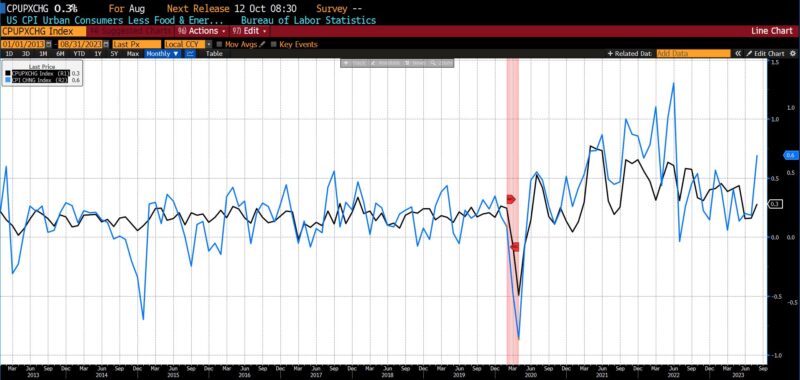

On September 13, the Bureau of Labor Statistics (BLS) released Consumer Price Index (CPI) data for August 2023. The month-to-month headline CPI number rose 0.6 percent versus 0.2 percent seen the previous month. The increase was in line with surveys and was the largest increase in 14 months. Core (excluding food and energy) month-to-month CPI rose 0.3 percent versus an expected rise of 0.2 percent.

The largest contributor to the increase in the monthly headline CPI was gasoline, which accounted for over 50 percent of the increase. Shelter, which has now risen for 40 consecutive months, also played a role in the August acceleration of US prices. In the core index, the month-to-month rise was accounted for by rents, motor vehicle insurance, medical, and personal care. Prices for used cars and trucks and recreation declined the most in August.

August 2023 US CPI headline & core, month-over-month (2013 – present)

Source: Bloomberg Finance, LP

August 2023 US CPI headline & core, year-over-year (2013 – present)

Source: Bloomberg Finance, LP

With the release of the data, market-implied policy rates ticked up in the three- to six-month range, indicating higher expectations of another 25-basis point Fed Funds increase toward the end of 2023. Despite some improvements since the apparent peak 13 months ago, consumers and businesses are still contending with 31 months of above-trend rising prices.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by