The Case For Timber

Summary

- Timber is an essential resource and a genuine building block of human civilization.

- Its use in building construction and as a fuel source have made it integral to the functioning of our societies and world economy.

- Timber is a real asset, and investing in it typically involves ownership of the land on which the lumber-producing trees grow.

- S&P GTF Index constituents span the value chain of the timber ecosystem.

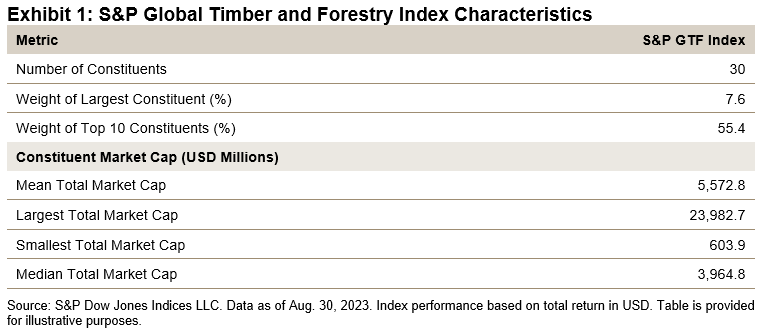

- The index constituents’ weights are based on each stock’s exposure score and its float market capitalization, subject to appropriate constraints to avoid concentration risk.

Frank Armstrong/iStock via Getty Images

By Srineel Jalagani

Timber is an essential resource and a genuine building block of human civilization. Its use in building construction and as a fuel source have made it integral to the functioning of our societies and world economy. On the flip side, our dependence on timber, combined with a lengthy regeneration time, means we are steadily using up this valuable resource. In the pre-industrialized world, forests covered more than 50% of habitable land.1 Today, our growing demand for this resource has reduced this coverage to less than 40%.

Trading of timber-linked products has seen massive growth in the past decade.2 This appetite for timber is expected to grow even more in the coming decade.3 Although residential demand remains the key driver for timber, other use cases like paper, packaging, plywood, etc., support demand diversity for timber.4

Investing in Timber

Timber is a real asset, and investing in it typically involves ownership of the land on which the lumber-producing trees grow. Timber, being a physical asset, provides your typical inflation protection component, but, unlike many other real assets, has the unique feature of biological growth during times of volatility and depressed demand.5 The option of flexible timing of harvests during low demand can smooth out some of the price volatility of timber investments. Estimates put nearly 60% of the forest lands in the U.S. as privately owned.6

Capital allocation to lumber producing forest lands has traditionally been within the realm of large institutional investors that directly own the forest lands and can use intermediaries (e.g., Timberland Investment Management Organizations (TIMOs)) to manage these lands. Expertise in forestry and land management, combined with relatively long hold-up periods and illiquidity, have been leading drivers for active management of these assets. However, Timberland REITs bring the same expertise in management of timberlands and are publicly traded, providing relative liquidity, real-time pricing and transparency for these long-dated assets. Additionally, ETFs also provide another avenue of access to timber and related investments via publicly traded instruments.

The push toward sustainability as an investment goal adds another dimension to timber’s value in a diversified portfolio. Efficient water/soil/resource management, ecosystem/biodiversity preservation and positive climate impact all contribute to favorable environmental and sustainability objectives. Forests act as a carbon sequestration mechanism, and when timber from these forests is used in construction, this can further reduce GHG emissions.7

Indexing Approach to Timber-Related Investments

The S&P Global Timber and Forestry (GTF) Index, launched in 2007, targets exposure to timber-related investments via public equity stocks across developed market listings and local listings from three emerging market countries (Brazil, South Korea and South Africa).

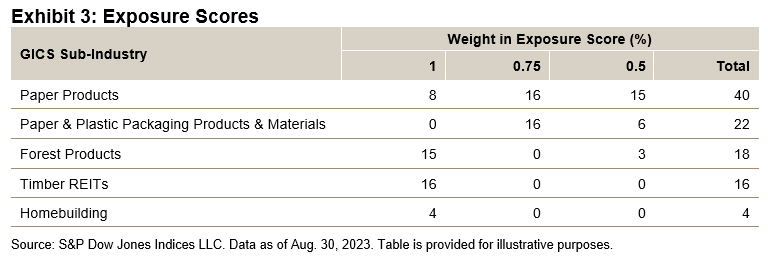

S&P GTF Index constituents span the value chain of the timber ecosystem. To capture a broad investable stock group with thematic relevance, the starting universe of stocks includes firms from Timber REITS under the GICS® classification,8 along with firms whose revenue comes from segments relevant to the forestry business (using the FactSet Revere Business Industry Classification System).

An exposure score framework is applied over this group of stocks to maintain the index’s thematic purity. Firms with higher exposure scores are generally seen as being closer to the core of the timber producing and processing ecosystem. Timber REITs and Timber Property Management stocks are given a higher exposure score, along with pulp mills that can be vertically integrated, when compared to Paper Mills and Packaging Products related companies that are more downstream. The index constituents’ weights are based on each stock’s exposure score and its float market capitalization, subject to appropriate constraints to avoid concentration risk.

Additionally, the index methodology excludes companies that are engaged in certain business activities (e.g., controversial weapons, tobacco products, etc.) and companies that are non-compliant with the United Nations Global Compact (UNGC) guidelines, and it screens companies for any reputational risk concerns.

As of Aug. 30, 2023, the index consists of 30 stocks, with 43% weight allocated to 11 pure-play companies, 16% weight in Timber REITs stocks and 27% weight to the companies with an exposure score of 1.

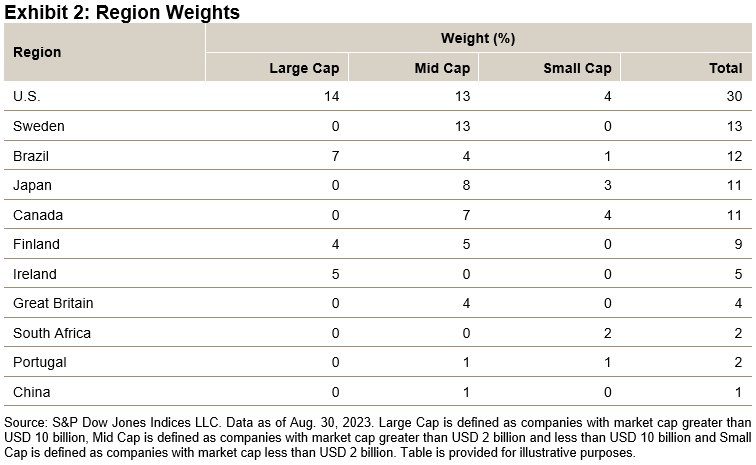

The index is tilted (56%) toward mid-cap stocks (see Exhibit 2), with the majority (over 40%) of the exposure coming from North American entities, followed by European firms (33%).

1 Visualizing the World's Loss of Forests Since the Ice-Age

4 Exploring the Link Between Lumber Prices and Timber Markets | Portfolio for the Future | CAIA

5 https://www.ipe.com/inflation-assets-timber/37666.article

6 Development and performance of timber REITs in the United States: a review and some prospects

8 For further information, please see the S&P Thematic Indices Methodology.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit Terms of Use.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by