Kinross Gold: A Good Merger Target In 2024

Summary

- Kinross Gold Corporation released its second quarter 2023 results, reporting revenues of $1,092.3 million and a net income of $151.0 million.

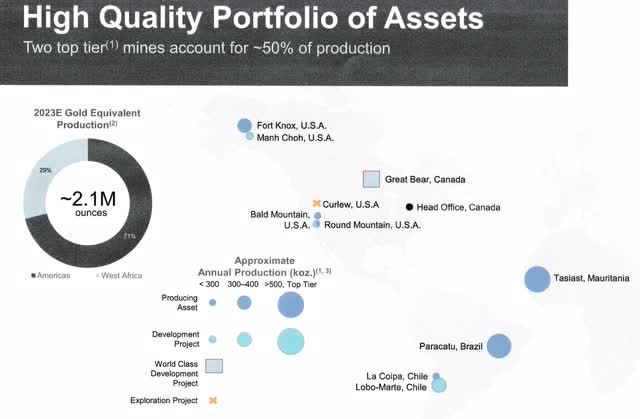

- The company owns six producing mines and two advanced projects, including the Great Bear project in Canada and the Manh Choh project in Alaska.

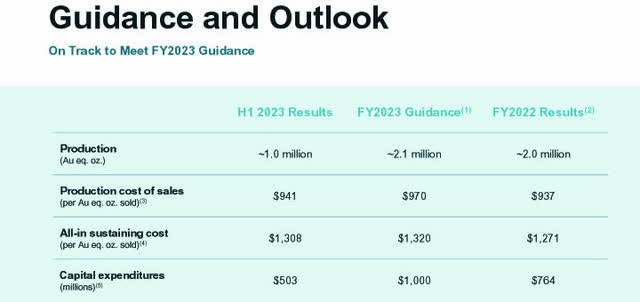

- Kinross Gold expects to produce approximately 2.1 million Au eq. Oz. in 2023 and has outperformed other gold companies on the stock market.

- I recommend buying Kinross Gold Corporation shares between $4.70 and $4.55 with possible lower support at $4.25.

Moussa81

Part I - Introduction

Toronto-based Kinross Gold Corporation (NYSE:KGC) released its second quarter 2023 results on August 2, 2023.

Note: I have followed KGC quarterly since 2015. This new article is a quarterly update of my article published on May 22, 2023.

Kinross Gold owns a high-quality assets portfolio:

KGC owns six producing mines and two advanced projects: The Great Bear in Canada, with engineering 70% complete, and the smaller Manh Choh project in Alaska, two projects with near-term production potential.

KGC A look at the Assets (KGC preceding Presentation)

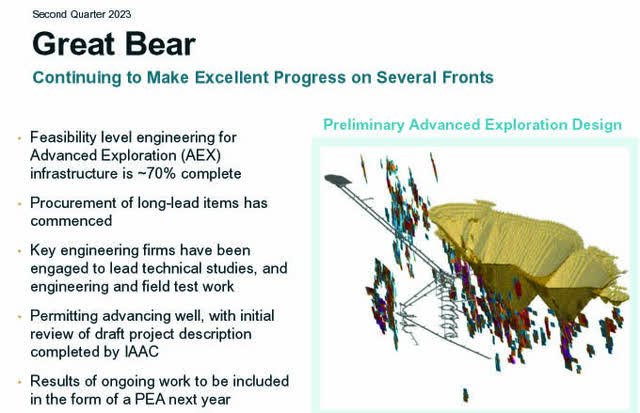

1 - The Great Bear in Great Lake, Canada's advanced exploration infrastructure with ~70% completed, is an excellent project with expected production in 2029.

The Deep Holes demonstrate the potential for the extension of High-Grade Underground.

KGC Great Bear Project (KGC Presentation)

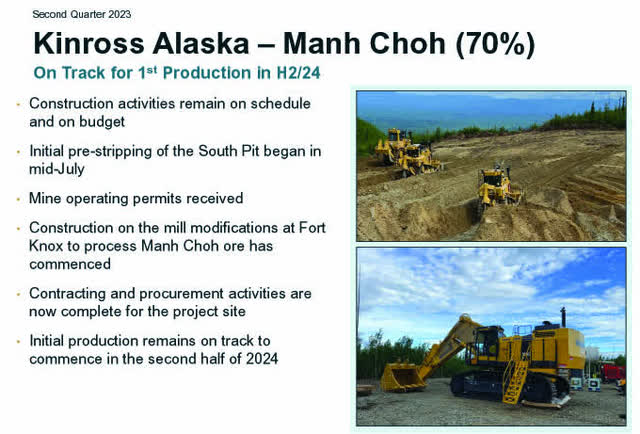

2 - The 70%-owned Manh Choh Project in Alaska. On track for first production in H2 2024.

The project is expected to increase the Company's production profile in Alaska by approximately 640K attributable to Au eq. Oz. over the life of mine at lower costs. Initial production from Manh Choh is expected in the second half of 2024.

The Manh Choh ore will be processed at the mill at Fort Knox, which is modified to process the new ore.

KGC Manh Choh Project Update (KGC Presentation)

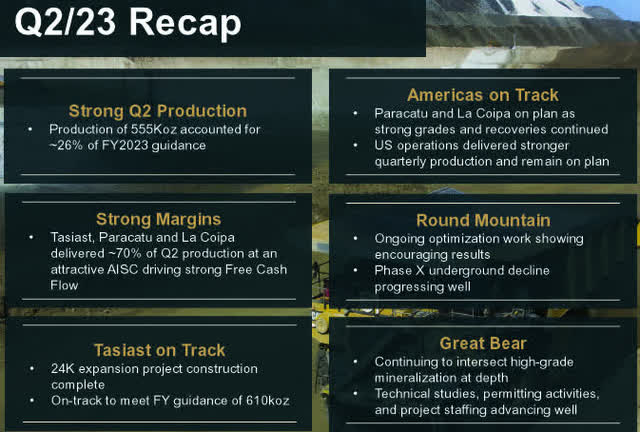

3 - 2Q23 result snapshot

For the second quarter of 2023, revenues were $1,092.3 million, with a net income of $151.0 million, or $0.12 per diluted share. The Adjusted net earnings were $167.6 million or $0.14. The company now expects to produce about 2.1 Moz in 2023.

KGC 2Q23 Recap (KGC Presentation)

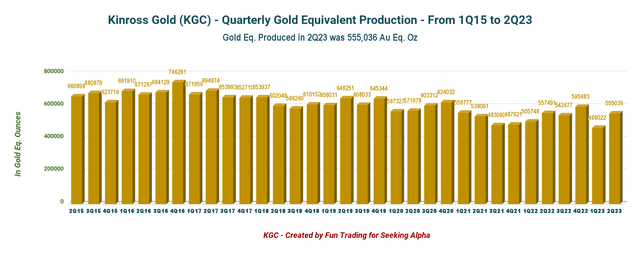

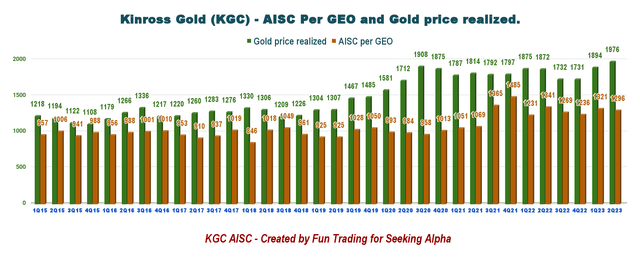

Production in 2Q23 was 555,036 gold equivalent ounces (Au eq. oz.), a 22.3% year-over-year increase, and sales of 552,969 Au eq. Oz. The gold price realized was $1,976 per ounce sold, and AISC was $1,296 per ounce.

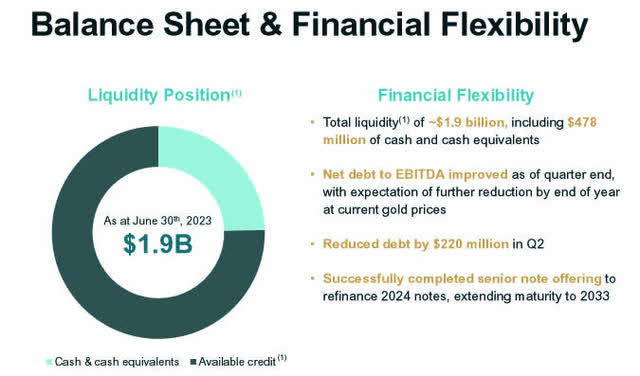

Cash and cash equivalents were $478.4 million, and total liquidity was approximately $1.9 billion at June 30, 2023.

Kinross' Board of Directors declared a quarterly dividend of $0.03 per common share for 2Q23.

The Company expects its 2023 production to be approximately 2.1 million Au eq. Oz.

KGC 2023 Guidance (KGC Presentation)

J. Paul Rollinson, President and CEO, said in the conference call:

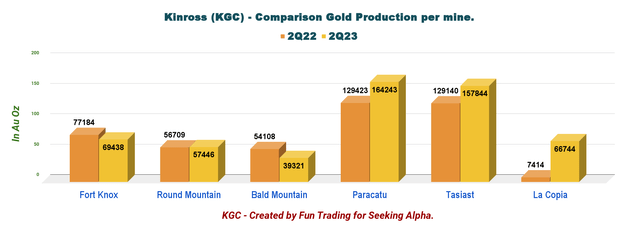

We had a great second quarter contributing to a strong first half of the year, positioning us well to meet our full year guidance. Tasiast, Paracatu and La Coipa delivered excellent results, representing approximately 70% of our production in the quarter with an AISC of approximately $1,000 per ounce driving strong free cash flow.

This excellent balance sheet and growth potential make Kinross Gold a worthy acquisition contender in early 2024. The trio Agnico Eagle, Barrick Gold, and Newmont Corp. could be interested in an all-share deal. Especially NEM, which has experienced a significant drop in gold production.

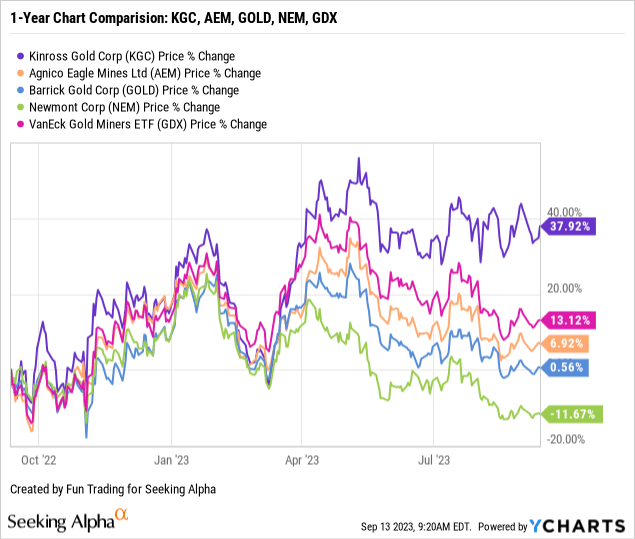

4 - Stock performance

Kinross has outperformed Barrick Gold (GOLD), Newmont Corp. (NEM), and Agnico Eagle (AEM) on a one-year basis. KGC is now up 38% on a one-year basis.

Part II - Kinross Gold - Financials History 2Q23 - The Raw Numbers

| Kinross Gold | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Total Revenues in $ Million | 821.5 | 856.5 | 1,076.2 | 929.3 | 1,092.3 |

| Net Income in $ Million | -40.3 | 64.9 | -106.0 | 90.2 | 151.0 |

| EBITDA $ Million | 241.0 | 301.4 | 156.0 | 369.6 | 466.6 |

| EPS Diluted in $/share | -0.03 | 0.05 | -0.08 | 0.07 | 0.12 |

| Operating Cash Flow in $ Million | 207.9 | 171.6 | 474.3 | 259.0 | 528.6 |

| Capital Expenditure in $ Million | 155.0 | 217.8 | 323.8 | 259.5 | 290.4 |

| Free Cash Flow in $ Million | 52.9 | -46.2 | 150.5 | -0.50 | 238.20 |

| Total Cash $ Million | 719.1 | 488.4 | 418.1 | 471.0 | 478.4 |

| Long-Term Debt in $ Million | 2,610 | 2,512 | 2,593 | 2,694 | 2,475 |

| Shares Outstanding (diluted) in Million | 1,299 | 1,300 | 1,258 | 1,225 | 1,238 |

| Quarterly Dividend $/share | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

Data Source: Company release and Fun Trading.

Note: Historical data from 2015 are available for subscribers only.

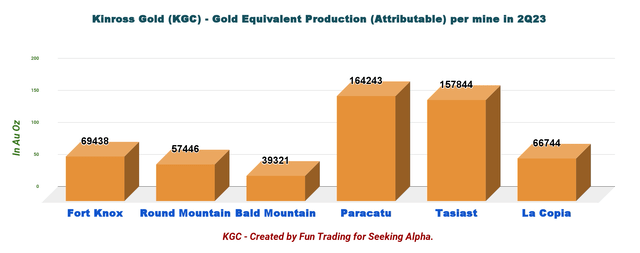

1 - Gold Production Details For The Second Quarter 2023

1.1 Total attributable gold equivalent production

KGC Quarterly Gold Equivalent Production History (Fun Trading)

Kinross Gold equivalent produced 555,036 attributable GEO in 2Q23 compared with 453,978 GEO in 2Q22. Kinross Gold sold 552,969 GEOs in 2Q23.

KGC Quarterly Production per Mine 2Q22 versus 2Q23 (Fun Trading)

The 22% year-over-year increase was primarily attributable to higher production at La Coipa and higher grades and recoveries at Paracatu and Tasiast.

KGC Quarterly Production per Mine 2Q23 (Fun Trading) KGC Quarterly Gold Price and AISC History (Fun Trading)

The chart below shows that the AISC is now $1,296 per GEO, down from $1,341 per ounce last year.

1.2 Tasiast 24K project completed.

Note: The Tasiast gold mine is a gold deposit located in central western Mauritania, near the coast. The operating license was granted to Tasiast Mauritanie Limited S.A. ("TMLSA"), a Canadian group Kinross Gold Corporation subsidiary. Mining activities began in 2007.

Tasiast carries risks. Mauritania already experienced a coup in 2008. I consider the risk in this part of the World elevated, as we experienced in Mali, Gabon, Niger, Tchad, etc. However, it is factored into the stock price now.

The Tasiast 24k project is completed. The result is a record production in 2Q23 of 157,844 Gold ounces.

By year-end, the company is on track to achieve design throughput rates of 24K TPD. Tasiast solar project and the 610K Oz targeted for 2023 remain on track.

KGC Tasiast 24k project completed (KGC Presentation)

2 - Kinross Gold: Financial Analysis

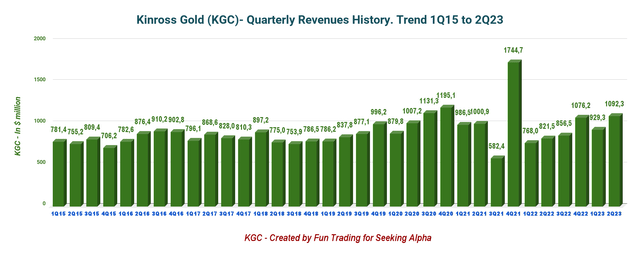

2.1 - Revenues were $1,092.3 million in 2Q23

KGC Quarterly Revenue History (Fun Trading)

Note: Previous quarters were restated.

KGC posted an income of $151.0 million or $0.12 per diluted share in the second quarter of 2023, compared to a loss of $40.30 million or $0.03 per diluted share in the same quarter last year.

The adjusted net earnings were $167.6 million or $0.14 per share for 2Q23.

Revenues from continuing operations in 2Q23 were up 33% year-over-year to $1,092.3 million.

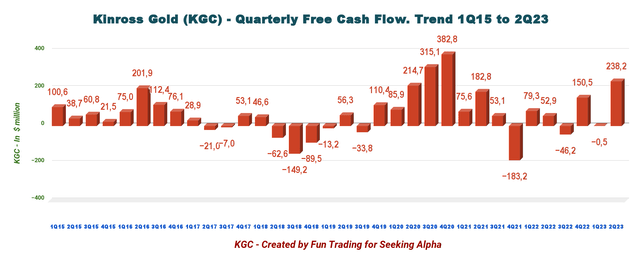

2.2 - Free Cash Flow was $238.2 million in 2Q23

KGC Quarterly Free Cash Flow History (Fun Trading)

Note: Generic free cash flow is the cash from operations minus CapEx.

Trailing 12-month free cash flow was $342.0 million. The Company had a free cash flow of $238.20 million in 2Q23.

The Company pays a quarterly dividend of $0.03 per share or a yield of 2.44%.

2.3 - Net debt and liquidity

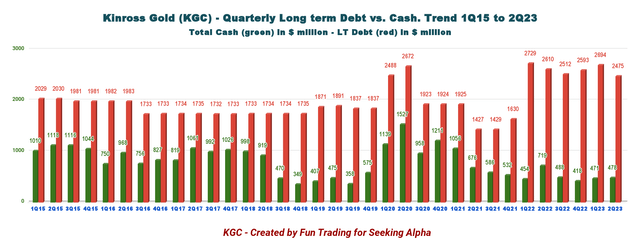

The net Debt dropped sequentially to $2,475.4 million in 2Q23, down slightly from 2Q22 ($2,610.2 million).

The Company had cash and cash equivalents/short-term investment of $478.40 million, with total liquidity of approximately $1.9 billion, on June 30, 2023.

KGC Quarterly Cash versus Debt History (Fun Trading) KGC Balance Sheet (KGC Presentation)

Part III - Technical Analysis and Commentary

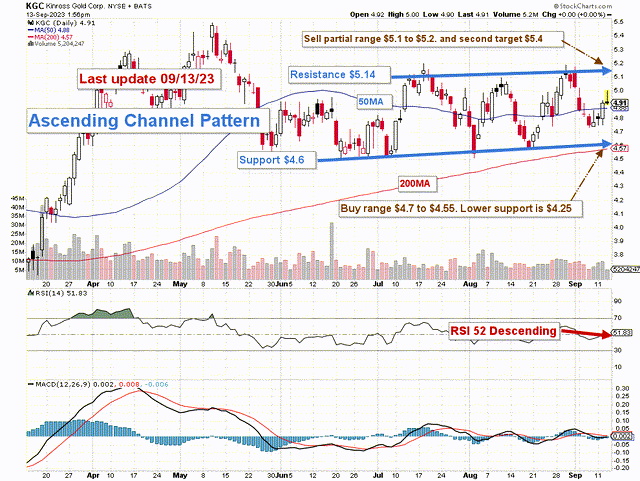

KGC TA Chart Short-Term (Fun Trading StockCharts)

Note: The chart is adjusted for the dividend.

KGC forms an ascending channel pattern with resistance at $5.14 and support at $4.60.

Ascending channel patterns or rising channels are short-term bullish in that a stock moves higher within an ascending channel, but these patterns often form within longer-term downtrends as continuation patterns. The ascending channel pattern is often followed by lower prices, but only after a downside penetration of the lower trend line.

I recommend trading short-term LIFO at about 50% and keeping a core long-term position for a final target of $7+.

I suggest selling about 50% of your position between $5.10 and $5.20 with possible upper resistance at $5.40 and buying KGC between $4.70 and $4.55 with possible lower support at $4.25.

Trading LIFO lets you keep your old position, which is generally underwater in the KGC case, and trade your most recent position for gain without selling your long position at an unnecessary loss. You never sell LIFO for a loss but for a profit between 3% and 10%, depending on your strategy and cash available.

Repeating this exercise can provide a solid income that helps you de-risk your long-term position.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KGC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I trade KGC short-term and own a long-term position.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)