BioNTech: Renewed COVID Focus Might Spark Potential Share Price Boost

Summary

- Recent surges in COVID cases and public interest could drive revenue once again in the near future. However, this renewed attention is also likely to boost investment interest in companies.

- BioNTech has made significant strides in advancing its pipeline, including advancement with BNT316/ONC-392, a potential treatment for Non-Small Cell Lung cancer that posts a significant market opportunity.

- Cancer continues to affect a growing population. The BioNTech pipeline holds a variety of candidates addressing these different types, aiming to capture future market share in the multibillion-dollar field of oncology.

Thomas Lohnes

Introduction

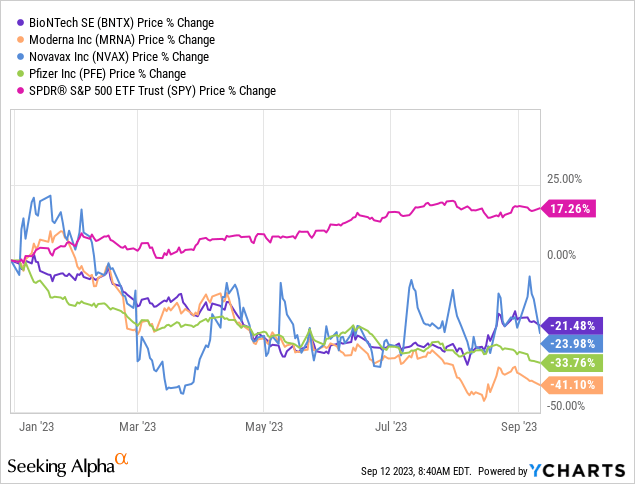

In my last article on BioNTech (NASDAQ:BNTX), I primarily focused on its valuation and suggested it might be a good buy ahead of its Q2 results. Since then, the stock has risen by approximately 10%. Nevertheless, BioNTech has experienced a YTD decline of over 20%, contrasting with the S&P 500's revival, which is up more than 18% YTD. BioNTech in particular, as one of the stars of the recent COVID years, which turned vaccine sales into substantial profits, is now facing pessimism from Wall Street and the markets. This pessimism primarily revolves around the expected decline in vaccine sales, overshadowing the company's robust cash foundation accumulated during its unprecedented streak of high COVID profits. This cash could now be directed towards funding promising research efforts, particularly in the highly demanded field of cancer drugs, where BioNTech holds a promising pipeline with early successes, satisfying a significant long-term market opportunity. However, for the time being, vaccine sales continue to contribute to the company's revenue and are expected to do so for the foreseeable future, given the anticipation of COVID remaining a seasonal occurrence, resulting in a likelihood that especially vulnerable groups might get themselves a shot on a regular basis to acquire protection against the occurring new variants of COVID. However, regardless of the uncertain development of COVID vaccine sales, I want to emphasize herein the company's potential in the field of oncology and why the recent spike in COVID cases might rather serve as an attention bring-back to the recently neglected shares of pharma and biotech stars such as BioNTech.

Unjustified Pessimism on Wall Street - Dependence on COVID Vaccine Sales

Pharmaceutical and biotech companies, such as BioNTech, have been among the poorest performers this year. Concerns about the Inflation Reduction Act and price-setting clauses for U.S. companies like Pfizer (PFE) are another reason for the prevailing pessimism.

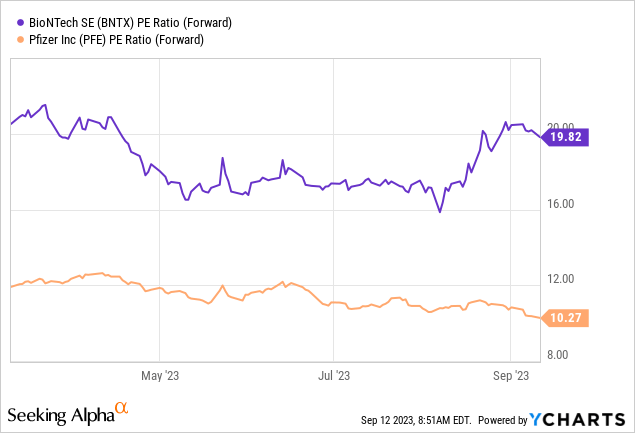

This poor performance has also resulted in lower valuation levels. For BioNTech, the German biotech company, the decline in its share price currently puts it at a forward P/E ratio of about 20.

Recent Results Developments

Upon reviewing BioNTech's recent Q2 results, the outlook appears more promising than some may believe. Despite the uncertainty surrounding COVID-19 vaccine sales due to unpredictable demand patterns, BioNTech has maintained its full-year revenue projection of €5 billion. This projection relies on sales during the upcoming fall and winter seasons. In Q2, the Comirnaty COVID vaccine contributed €168 million to the company's revenues, totaling €1.4 billion in the first half of 2023.

While COVID vaccine volumes are declining, BioNTech is exploring opportunities in the U.S. commercial market, where it partners with Pfizer, to charge higher prices.

BioNTech's financials for Q2 and the first half of 2023, however, also reveal the company's resilience and adaptability as it navigates the post-COVID era. The expected decline in COVID-19 vaccine sales has not resulted in a catastrophic collapse. The company's proactive measures, such as cost optimization and maintaining lean expense structures, are helping mitigate the impact.

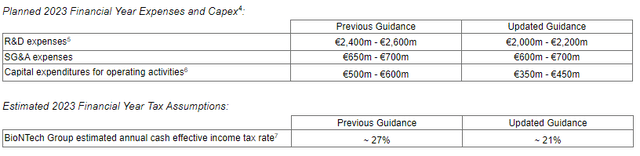

BNTX - Planned Expenses 23 (SEC - Form 6-K)

It's evident that the company is carefully monitoring its spending. BioNTech primarily records profit shares from Comirnaty and is responsible for direct sales only in Germany and Turkey, which is advantageous in terms of avoiding heavy expenses. The company is also controlling costs related to its oncology pipeline and production buildup, as we will discuss further.

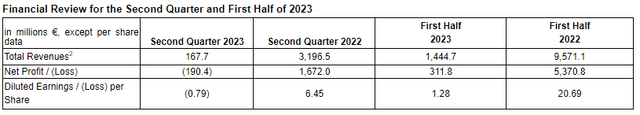

Here's a breakdown of the Q2 and H1 2023 numbers:

Q2 2023

- Total revenues: €167.7 million (compared to €3,196.5 million last year, reflecting write-offs by collaboration partner Pfizer).

- Cost of sales: €162.9 million (compared to €764.6 million last year, due to reduced COVID-19 vaccine sales).

- Research and development expenses: €373.4 million (slightly less than the previous year).

- General and administrative expenses: €122.7 million (up from €130.0 million).

BNTX - Q2/23 & H1 - Results (SEC - Form 6-K)

First Half of 2023

- Total revenues: €1,444.7 million (down from €9,571.1 million in 2022, reflecting declining COVID-19 vaccine sales).

- Cost of sales: €258.9 million (down from €2,058.7 million, reflecting declining COVID-19 vaccine sales).

- Research and development expenses: €707.4 million (slightly up from €685.4 million last year).

- General and administrative expenses: €242.1 million (up from €220.8 million).

Moreover, BioNTech is gearing up for the launch of the Omicron subvariant XBB.1.5-adapted monovalent COVID-19 vaccine, subject to regulatory approval, with deliveries expected to start in September. This underscores the company's ability to quickly adjust its existing products to satisfy the needs of individuals who seek protection against the ever-evolving virus, which will help the company continuously generate revenue from COVID-related vaccine sales even as COVID enters the state of a seasonal epidemic.

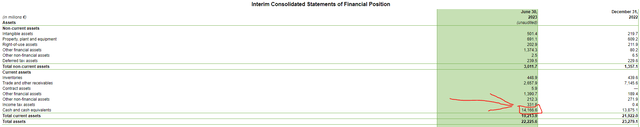

Notable, BioNTech reported a Cash position of $15 billion, which is currently more than 50% of BioNTech's 24 billion market cap. You could also point out that this equals a 50% discount pertaining to the current price per share.

BNTX - Cash Position - Q2/23 (SEC - Form 6-K)

Operational Review and Pipeline Update

BioNTech is dedicated to diversifying beyond COVID-19 vaccines and expanding into oncology. Several significant developments highlight BioNTech's progress in its pipeline and efforts beyond COVID-19.

The company has made significant strides in advancing its pipeline, including the initiation of a Phase 3 pivotal trial for BNT316/ONC-392, a next-generation anti-CTLA-4 monoclonal antibody candidate, in collaboration with OncoC4, Inc.

This candidate offers a potentially differentiated safety profile, enabling higher dosing and longer treatment durations. Numerous trials are planned across BioNTech's oncology portfolio, showcasing its strong commitment to this field.

This treatment of Non-Small Cell Lung Cancer (NSCLC), which is a certain type of lung cancer, has the potential to become a new option for patients, especially those with late-stage NSCLC who have an otherwise poor prognosis.

The Non-Small Cell Lung Cancer (NSCLC) Market is predicted to reach a value of $59.77 billion by the year 2030.

Recent Rise in COVID Cases & New Variant

Recent surges in COVID cases and public interest could drive revenue once again in the near future. Indicators such as hospitalizations, deaths, wastewater samples, and lab data show an increase in COVID activity, especially with the emergence of the EG.5 variant. However, I mainly view this renewed attention as a boost in investment interest in companies like BioNTech.

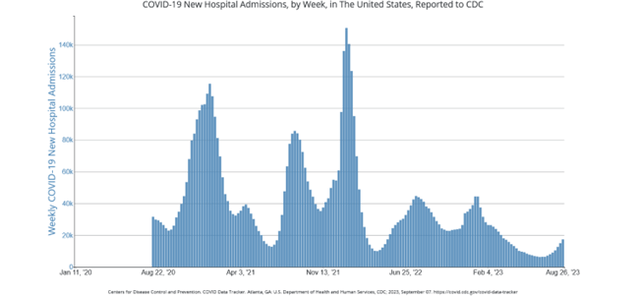

Across the United States, indicators of COVID-19 activity have been on the upswing, particularly as fall approaches. Hospitalizations are on the rise, deaths have experienced a slight uptick, and even wastewater samples and lab data are demonstrating increased viral presence. Hospitalizations are particularly telling, as they provide a reliable measure of the disease's severity. Recent data from the CDC reveals a nearly 16% increase in hospitalized COVID patients for the week ending August 26, 2023:

The EG.5 variant has gained prominence, accounting for a substantial proportion of COVID-19 cases. As of August 19, it represented 21.5% of cases, up roughly 2.9% from the previous week. The increased prevalence of EG.5, coupled with concerns about the upcoming respiratory illness season, has heightened public fear and driven more Google searches for COVID-19 information. This fear and renewed awareness are likely to catalyze a fresh round of vaccinations, especially among older populations.

Hospitalizations due to COVID-19 have surged, with a 15.7% increase in the week ending August 26, 2023. This surge is occurring despite shifts in hospital testing protocols, which now prioritize symptomatic individuals over universal testing. Emergency room visits with COVID diagnoses have also risen significantly since early July.

New Hospital Admissions, by Week, in the US, Reported to CDC (Centers for Disease Control and Prevention)

Wastewater samples offer another perspective, revealing an uptick in SARS-CoV-2 presence in communities. This aligns with the observed increase in COVID cases within these areas, underscoring the need for continued vigilance.

While deaths have risen slightly, it's important to note that the context has changed since earlier in the pandemic. Weekly death totals, which once remained under 600, have recently reached 636 by the week ending August 19, 2023. Moreover, the public's perception of COVID has shifted as well. Knowing multiple individuals are experiencing COVID symptoms or testing positive, coupled with the unavailability of COVID tests in retail stores, has contributed to heightened public awareness.

It's worth mentioning that while variants are in circulation, the BA.2.86 variant remains relatively rare, detected in only a few states. The current upsurge in cases and hospitalizations is more likely attributed to XBB subvariants, specifically EG.5 and FL.1.5.1. Furthermore, recent research suggests that individuals previously infected with XBB subvariants exhibit strong immunity against BA.2.86, allaying concerns about this variant's impact.

BioNTech, in collaboration with Pfizer, is positioned to address these evolving challenges. The companies have received a positive assessment from the European Medicines Agency (EMA) for their Omicron XBB.1.5-adapted monovalent COVID-19 vaccine, tailored to the latest subline of SARS-CoV-2. This updated vaccine is recommended for individuals as young as 6 months. Its approval by the European Commission will likely lead to swift distribution in EU member states. Regulatory submissions for this vaccine are also underway in other regions, including the U.S.

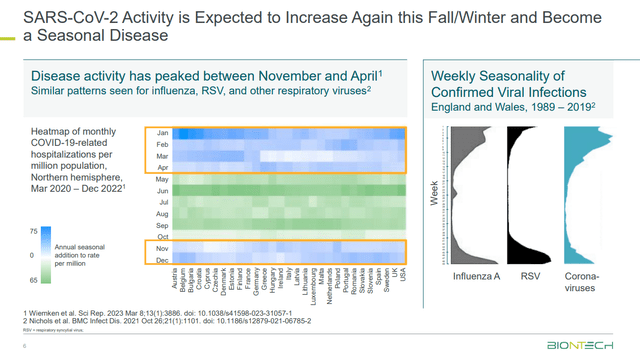

I see COVID-19 transitioning into an endemic phase, becoming part of the annual cold and flu season. This expectation, coupled with a focus on preventing severe illness rather than infections, presents BioNTech with opportunities to contribute to public health efforts while generating steady revenue.

BNTX - COVID-19 is expected to become a Seasonal Disease (BNTX - Investor Presentation)

The endemic state of the virus could lead to future seasonal sales of vaccines. However, in my opinion, it is not crucial for the company's future anyway, which is mainly focused on oncology. I believe the recent surge in COVID cases and attention can rather be seen as a chance for markets to reassess their pessimism regarding BioNTech, which might lead to rising share prices in the near future.

Catalysts Ahead - Pipeline and Oncology Market

While BioNTech's COVID-19 vaccines have dominated headlines and revenues, as I mentioned I believe it's essential to recognize that the company's future prospects extend far beyond the pandemic. One of the pivotal pillars of BioNTech's investment thesis lies in its ambitious strides within the oncology market, a domain that holds tremendous promise and demand.

Over the past three decades, the global incidence of cancer diagnoses among individuals under the age of 50 has surged by a staggering 80 percent. The prevalence of breast cancer, in particular, has been a notable concern, as reported by a study in "BMJ Oncology." Among the most significant increases in case numbers were observed in tracheal and prostate cancers.

As cancer continues to affect a growing population, the demand for new therapeutic options with fewer side effects remains paramount. The market size for oncology by 2032 is estimated to be around $470 billion in total revenue.

BioNTech has recognized both the need and the market opportunity and has positioned itself as a key player in the oncology field. The company boasts a robust pipeline of oncology projects targeting various cancer types, including prostate, lung, and ovarian cancer. Notable candidates in its oncology portfolio include BNT112 for metastatic prostate cancer, BNT116 for specific lung carcinoma types, and BNT316 for platinum-resistant ovarian cancer.

Beyond these projects, BioNTech has already ventured into critical collaborations and cutting-edge therapies. This for instance includes a pivotal Phase 3 trial for a CTLA-4 antibody in partnership with OncoC4, targeting non-small cell lung cancer. Additionally, BioNTech is advancing a Phase 1/2 trial for a CAR-T therapy targeting Claudin-6, a promising avenue in cancer treatment.

Conclusion

In conclusion, BioNTech, a biotech powerhouse that garnered recognition during the COVID-19 pandemic, has so far faced a challenging year in the stock market. The prevailing pessimism surrounding BioNTech primarily revolves around the expected decline in COVID vaccine sales, overshadowing the company's robust cash foundation and its oncology pipeline potential.

The recent spike in COVID cases and renewed public attention could serve as a catalyst for pessimistic markets to reassess their stance on BioNTech, recognizing its dual strengths in infectious diseases and oncology, resulting in an increase in BioNTech shares. The company's potential for future growth and its capacity to make a positive impact on public health remain clear to me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer: Equity Analysis Articles The information provided in this equity analysis article is for informational purposes only and should not be construed as financial or investment advice. The author of this article (hereinafter referred to as "the Author") is not a licensed financial advisor or registered investment advisor. The Author has prepared this article based on publicly available information, financial data, and their own research. While the Author strives to provide accurate and up-to-date information, they make no representations or warranties of any kind, express or implied, regarding the accuracy, completeness, or reliability of the information presented in this article. The Author disclaims any liability for any investment decisions made based on the information provided in this article. Conflict of Interest Disclosure: The Author has no conflict of interest in writing this equity analysis article. At the time of writing, the Author does not own any shares, derivatives, or any other financial interest in the equity of the company under analysis. Additionally, the Author has not received any compensation from any individual or entity for writing this article, other than Seeking Alpha. Forward-Looking Statements: This article may contain forward-looking statements and projections based on the Author's assumptions and beliefs. Such statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. The Author is not responsible for any reliance placed on such statements.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.