Dycom Industries: Great Play On 5G Growth, But Not At This Price

Summary

- Dycom Industries is a specialty contractor that primarily works with telecom companies to build their 5G infrastructure.

- The company is well positioned for the growth of 5G, and it is a way to gain exposure without owning the big telecoms.

- While the stock is a good option for those interested in 5G growth, it is currently overvalued and will experience a reversion to the mean in earnings and ROIC.

xijian

Dycom Industries (NYSE:DY) is a specialty contractor that mostly works with telecom companies to help plan, implement, and service their infrastructure. They were founded in the late 60’s and have been publicly traded since the mid 80’s.

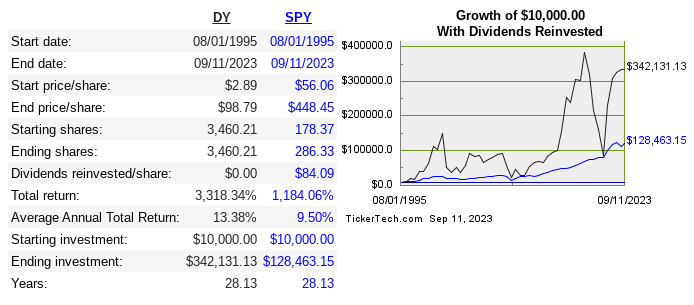

Let’s look at the long term share performance:

dividendchannel

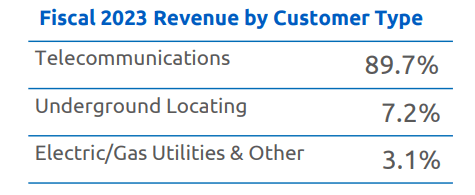

Next is their revenue breakdown:

DY investor presentation

As we see, most of their revenue comes from helping telecom companies build their 5G infrastructure. The stock is almost a pure play on the development of 5G growth. Next, let's look at their return figures compared to their peers:

Company | 10-Year Revenue CAGR | Median 10-Year ROE | Median 10-Year ROIC | EPS 10-Year CAGR | FCF/Share 10-Year CAGR |

DY | 12.2% | 8.7% | 4.6% | 15.3% | n/a |

10.3% | 18.9% | 13.1% | 10.9% | 10.6% | |

11.2% | 9.1% | 7.1% | 8.7% | 19% |

The company has around 3% insider ownership, and the CEO has had a very long tenure, being at that position since 1999.

Capital Allocation

The company has never paid a dividend and doesn't need to. Net share count has only been reduced slightly over the long term, lately there has been a bit more emphasis on repurchases. They do acquire other business fairly regularly, including a very recent purchase of Bigham Cable Construction, a company with around $140 mil USD in sales. Let's look further at how the capital has been allocated over the past decade, in USD millions:

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Ebit | 77 | 87 | 152 | 247 | 275 | 117 | 118 | 122 | 82 | 211 |

FCF | 42 | -5 | 39 | 75 | 55 | -41 | -63 | 324 | 152 | -36 |

Acquisitions | 330 | 17 | 32 | 156 | 26 | 21 | ||||

Repurchases | 15 | 10 | 87 | 170 | 63 | 2 | 100 | 106 | 48 | |

Debt repayment | 717 | 992 | 935 | 2,695 | 1,371 | 662 | 986 | 2,349 | 272 | 17 |

SBC | 10 | 13 | 14 | 17 | 21 | 20 | 10 | 13 | 10 | 18 |

Latest Earnings

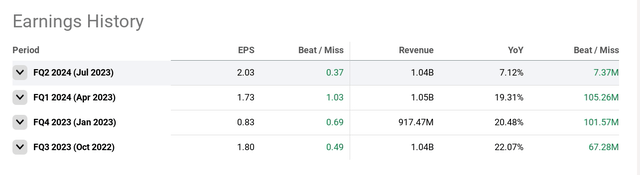

While I don't like seeing a company miss earnings consecutively, in the shorter term I look at them as potential opportunities to buy the dip, sometimes more than a dip. They didn't have as big a beat in FQ2, but they are consistently beating expectations lately:

This shouldn't be ignored as it provides an example of the quality of this company. Their margins and returns on capital are fairly low historically, but they are in the right industry at the right time, and are executing well without drowning the company in debt or dilution.

Their latest acquisition will take a little time to really show up in the EPS, so I expect wider beats for the next few quarters.

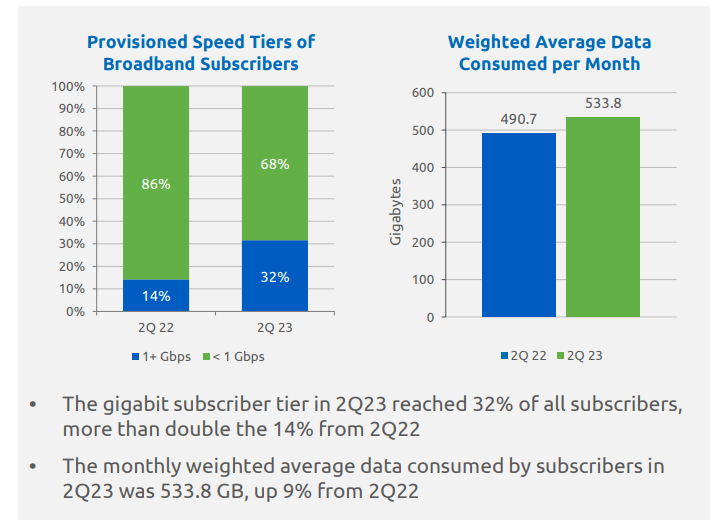

Risk

While margins at all levels are low with this company, the growth of 5G is what will propel the growth of DY. The global 5G infrastructure market is projected to grow 35% CAGR till 2030. There isn’t much risk of getting this growth wrong, at worst it will be slower than projected, but the general growth isn’t prone to recession risk. The demand for more devices, with higher speeds, using more data, will stay strong no matter the condition of the overall economy.

DY investor presentation

There is very little risk from a secular point of view, which means the other risks are operational or valuation related.

As was noted earlier, capital allocation risk is low, but debt could theoretically get out of hand at some point. Long term debt is at $799 mil, while the cash balance is $83 million. I assign a low probability of debt growing excessively due to previous periods of fairly aggressive debt repayment. This leads us to valuation.

Valuation

If you look back at the long term share price performance, you’ll see it is a volatile stock with opportunities to either get burned or make a great return. The beta is 1.33 so it has been a fairly volatile stock.

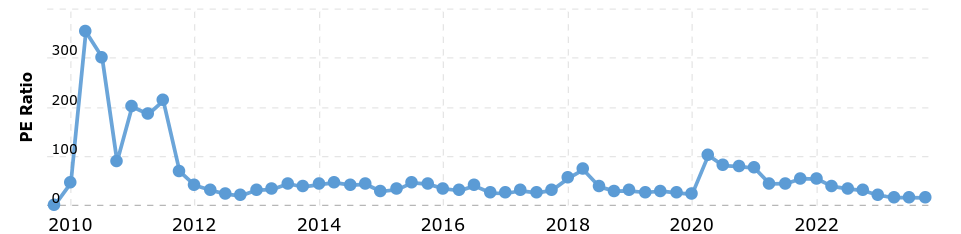

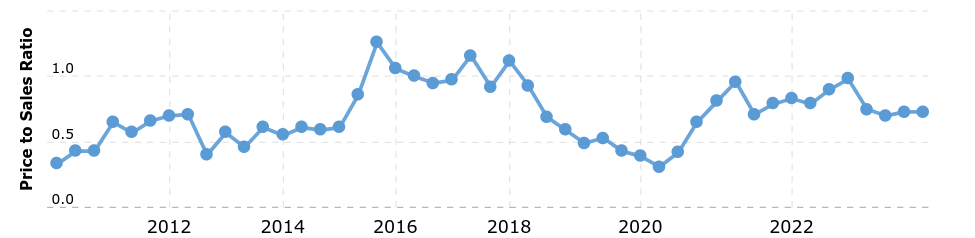

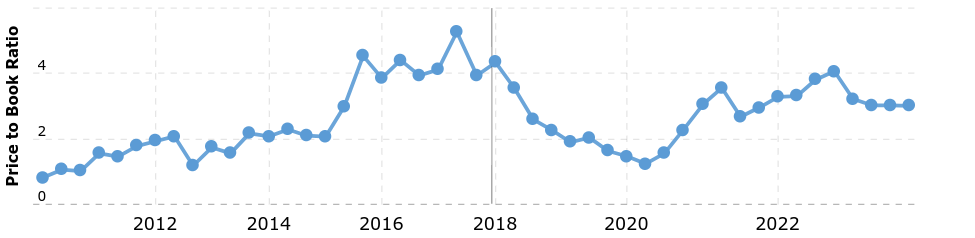

Let’s first look at the multiples comp versus peers, then a historical glance at these multiples:

Company | EV/Sales | EV/EBITDA | EV/FCF | P/B |

DY | 0.9 | 8.4 | -3527 | 3 |

MHH | 0.4 | 13.7 | 4.1 | 1.4 |

PWR | 1.8 | 23.8 | 46 | 5.2 |

macrotrends macrotrends macrotrends

In this case, I don’t think the multiples help us very much. DY’s peers aren’t exactly replicas as far as revenue breakdown, so the intrinsic valuation will be better.

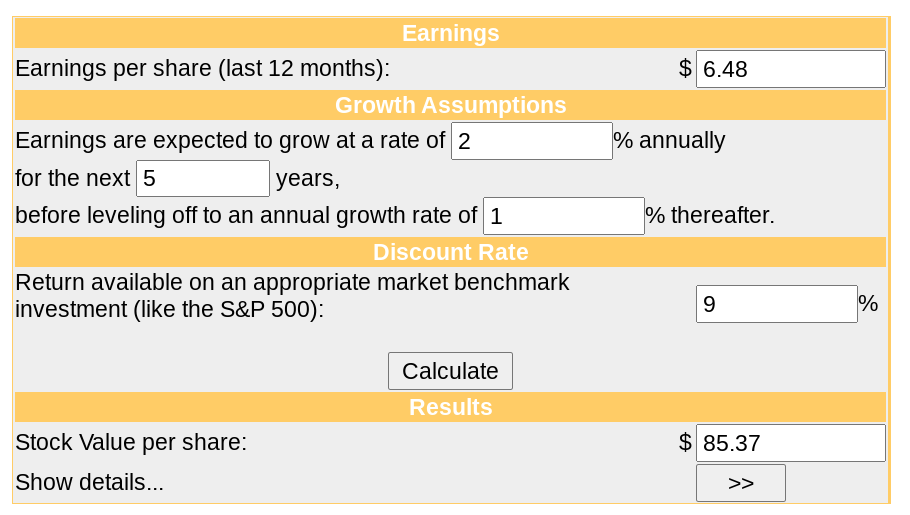

DY has hit record high TTM earnings, but I don’t expect this to be a new normal that we can reliably count on year after year. Don’t think that the growth of the overall 5G industry will translate into EPS growing at the same rate. More importantly, paying too much for this stock would wipe out most of your participation in the industry growth as an investor.

Below is the DCF model, based on a very conservative future earnings growth due to the current record profit.

moneychimp

Historically, the best times to buy this stock have been during the broader market downturns based on macro events: crashing of the tech bubble in early 2000s, the GFC, and the Covid bottom of 2020. As someone who looks for growth at a decent price, I like the idea of a stock that isn’t one of the big telecoms, yet can participate in the growth of 5G. The big telecoms are debt intensive and most of the return comes from dividends, making them more akin to bonds. The issue here is simply the valuation.

Conclusion

DY is one of the best pure play options for those who want to get it on the growth of 5G without buying one of the big telecoms. Earnings are at a record high and the underlying growth is definitely recession-resistant.

I view it as overpriced, and expect earnings and returns on capital to revert to the mean over the next few years. I’m also not excited about the low level of insider ownership considering the amount of SBC used, and the fact that the CEO has had a multi-decade tenure. This is a minor issue though, as the price is mostly what brings to give this stock a “hold” rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.