HCA Healthcare Is Beating The Industry

Summary

- HCA Healthcare has outperformed industry expectations with creative cost management and favorable contract renewals.

- The company's focus on improving profitability across the P&L has resulted in revenue growth and cost discipline.

- Q2 guidance suggests that HCA Healthcare will continue to generate strong cash flow and support shareholder returns, with potential for margin expansion in 2024.

JazzIRT

HCA Healthcare, Inc. (NYSE:HCA) is a leading healthcare provider in the United States. The company operates nationwide hospitals, surgical centers, emergency rooms, and diagnostic centers. HCA Healthcare's primary focus is on delivering high-quality patient care and using its vast network of facilities to offer a full suite of healthcare services.

Coming out of COVID, the healthcare industry is facing systemic challenges, with both payers and expenses squeezing margins. However, HCA has outperformed industry expectations on both fronts with creative cost management and favorable contract renewals. The market has rewarded this performance as the stock is up over 22% over the last year.

I believe there is still additional upside for the stock and rate it a buy. Management's increased guidance, as well as 2024 implications, suggest continued outperformance. Cash flow will continue to cover shareholder returns and investment in growth. Also, multiple valuation methods suggest 10% upside is within reach.

Improving Profitability Across The P&L

HCA doesn't have a direct, publicly traded competitor, so it sits somewhat in a league of its own. Similar healthcare groups are either non-profit or government run. With that in mind, I turned to McKinsey's 2023 Healthcare Insights to benchmark across the industry.

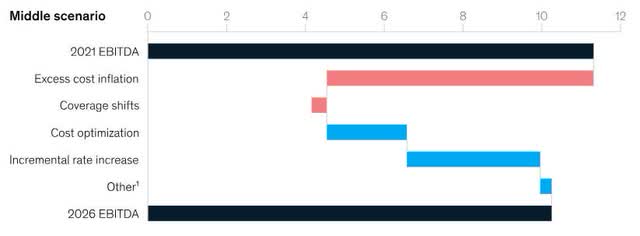

Despite an expected 4% CAGR for profit pools, McKinsey expects EBITDA to deteriorate between 90 and 250 basis points from 2023 to 2026 for healthcare companies as payers (insurance companies) push for lower reimbursement growth and as costs increase.

2023-2026 Healthcare EBITDA (McKinsey)

On the revenue side, HCA has grown over 5% in the first half of 2023 relative to the prior year. This is beating the industry by over a percentage point. Costs grew under 6% with a 48 basis point spread, again beating the industry.

Digging into expenses, salary and benefits expenses started to moderate in Q2, according to the earnings call discussion. Specifically, HCA has been making strides in hiring full-time nursing staff versus contract workers, with contract work down 20% year-over-year. Management mentioned hiring is going so well that labor as a % of revenue is below 2019 levels. HCA is making a $300 million investment in training nurses to improve their pipeline and continue to reduce reliance on contractors. This creative cost discipline, alongside moderating inflation, should continue to benefit the margin into 2024.

Digging into revenue, management mentioned that contract renewals are going well. While the industry is expected to renew at 3.5% per McKinsey, management discussed in the earnings call that 2024 and 2025 renewals are seeing mid-single-digit growth. HCA is also outpacing the industry in revenue growth.

Based on guidance and the revenue and expense trends above, I believe the EBITDA margin should actually expand as the business moves into 2024.

Q2 Guidance Bodes Well For Shareholder Returns

During Q2 earnings, management bumped up earnings guidance across the board.

Q2 2023 Earnings Guidance (HCA Investor Relations)

Net income margin expands by 25 basis points, and EBITDA margin expands by 8 basis points. Additional income more than offsets the increased capital, which is tied to future sites.

The increased guidance, which I expect to play into 2024, as discussed above, will easily support shareholder returns at a constant or increasing level. Over the trailing twelve months, HCA has produced an all-time high of $9.8 billion in operating cash. Capital represents less than half and debt service a quarter. The remaining amounts have been funneled to dividends and aggressive share repurchases.

Q2 guidance suggests that this level of cash flow should continue and may even expand.

Multiple Valuation Methods Point Up

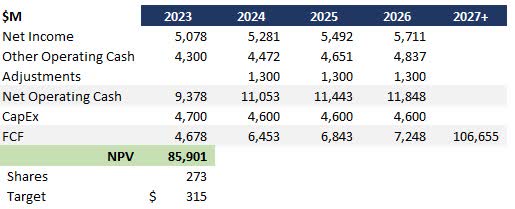

Using a conservative DCF analysis where HCA continues to beat industry growth by 1 percentage point and assuming a 10% discount rate due to high debt levels, I developed a price target of $315, 19% upside from today's price.

HCA DCF Analysis (Data: SA; Analysis: Author)

Wall Street analysts have an average price target of $317, 20% upside from today's pricing.

HCA Wall Street Price Target (Seeking Alpha)

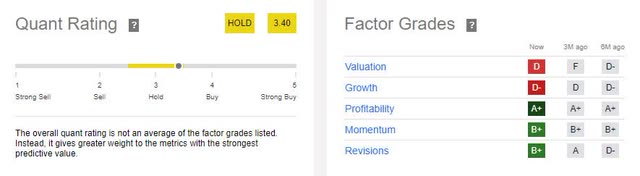

Quant ratings suggest a hold, borderline buy.

HCA Quant Rating (Seeking Alpha)

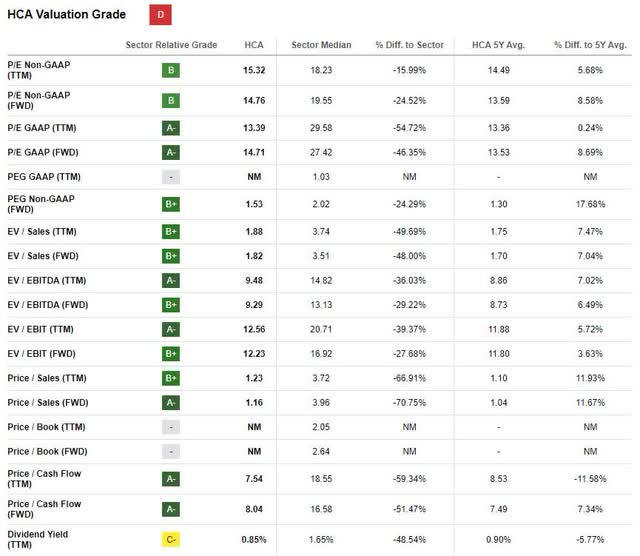

That said, digging into valuations, which received a D, I really don't see a rating for the low score. Valuation multiples are suppressed relative to the industry nearly across the board, and nearly all provide a buy or strong buy rating.

HCA Valuation Multiples (Seeking Alpha)

Downside Risk

The primary challenges that could potentially hinder HCA's growth trajectory are increased interest rates and physician contracts. HCA is highly leveraged, with $37 million in long-term debt to $54 million in assets. Rising interest rates could quickly increase the company's financing costs and impact its profit margins.

Additionally, a study published in the Journal of Healthcare Management highlighted the complexities around physician contracts, indicating how these changes could significantly impact healthcare organizations' financials. Envisions' bankruptcy put pressure on HCA, and it was called out as a risk during Earnings.

Verdict

HCA Healthcare presents a compelling investment opportunity with upside potential more than offsetting downside risk. The company is outpacing the industry, allowing it to generate substantial cash flow and reward shareholders through dividends and share repurchases. Its future prospects also appear promising, with Q2 guidance suggesting an upward trajectory and margin expansion.

While the company does carry a significant amount of debt, multiple valuation methods indicate substantial growth potential. Even with a conservative DCF analysis, HCA shows an 19% upside. This is further corroborated by Wall Street analysts, whose average $317 price target suggests a similar rise.

Potential risks should not be overlooked. Increased interest rates and the volatility of physician contracts pose challenges to HCA's growth. That said, the company's robust financial performance and future prospects offer a cushion against these risks.

With all of this in mind, I rate HCA Healthcare a buy and recommend investors add it to their portfolio.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.