Lululemon's Q2 Triumph: Beyond Athleisure To Building A Legacy

Summary

- Lululemon reports strong Q2 growth with an 18% increase in net revenue and surpassing expectations by $40M.

- The company's international expansion, particularly in China, contributes to its impressive revenue growth.

- Lululemon's commitment to sustainability and innovative initiatives, such as plant-based nylon and resale market, resonates with younger generations.

- Consistent high return on capital and reasonable valuation make it a good buy for long-term investors.

Justin Sullivan

On August 31st, the apparel world received a refreshing update from Lululemon (NASDAQ:LULU) with their second-quarter results. For many, Lululemon is not just another apparel brand; it's a lifestyle. While other apparel retailers have experienced sluggish growth in a post-pandemic world, Lululemon seems to be sprinting.

Robust Q2 Growth, Global Expansion, and Sustainable Initiatives

For Q2, Lululemon delivered stellar numbers, showcasing an 18% growth in net revenue, amounting to $2.21 billion, surpassing expectations by $40 million. This surge was powered by the company's broad-based strength across diverse business facets. Delving deeper into the numbers, total comparable sales rose by 11%, or 13% on a constant dollar basis, while comparable store sales experienced 7% growth, or 9% on a constant dollar basis. E-commerce, ever crucial in the current retail landscape, witnessed a 17% hike (or 15% on a constant dollar basis), solidifying its pivotal role. With digital channel revenues touching $894 million, they accounted for nearly 40% of the entire revenue.

Lululemon's Q2 GAAP EPS stood at $2.68, beating expectations by $0.14. While the focus on digital remains apparent, physical stores continue to play a major role in Lululemon's strategy, reflecting a 21% growth in store sales from last year. The quarter also witnessed the inauguration of 10 new company-operated stores, taking the total count to 672 stores globally, with a promising 19% growth in square footage.

Diversification in revenue sources was evident: an impressive 52% growth in international revenue, with Greater China blazing ahead with a 61% rise. When dissected by product categories, revenues from the women's segment grew by 16%, men's by 15%, and a robust 44% surge was noted in accessories. This demonstrates harmonious growth across the product board, emphasizing Lululemon's expansive brand outreach. The brand's gross profit for the quarter was another highlight, touching $1.3 billion, or 58.8% of the net revenue, showcasing a significant improvement from 56.5% in Q2 2022.

On the international front, the brand continues its robust push, especially targeting markets such as Australia, South Korea, the UK, and Germany. China, with its burgeoning yoga scene, stands out as a beacon of opportunity. Lululemon has not only positioned China as its potential second-largest market outside the US by 2026 but has also reaped substantial growth benefits from its focused endeavors in the region.

Furthermore, the brand's commitment to sustainable endeavors remains commendable. With investments in sustainable innovators like Genomatica, geared towards crafting plant-based nylon, and their foray into the resale market with "Lululemon Like New", the brand's dedication to a circular economy shines through. Such initiatives, apart from being ethically praiseworthy, also strike a chord with the value systems of millennials and Generation Z.

Forecast Double Digit Growth in Revenue and Profit

Peering into 2023, Lululemon's ambitions remain high. The brand projects its revenue to fall between $9.51 billion and $9.57 billion, marking a 17% to 18% growth from 2022. Their expansive strategy is evident with the plan to open around 55 new global stores, of which a significant portion will be in China. Lululemon's fiscal year 2023 aims to achieve diluted earnings per share in the range of $12.02 to $12.17, surpassing the 2022 adjusted EPS of $10.07.

It's worth noting that the projected capital expenditures of $670 million to $690 million for 2023, the largest amount of capital expenditure ever in the company's history. This emphasizes Lululemon's commitment to investing in the long-term growth of the business. Should Lululemon maintain its operating margin at around 22% (its average over the past decade), the projected operating profit would come in at approximately $2 billion.

Juicy Return but Relatively Low valuation

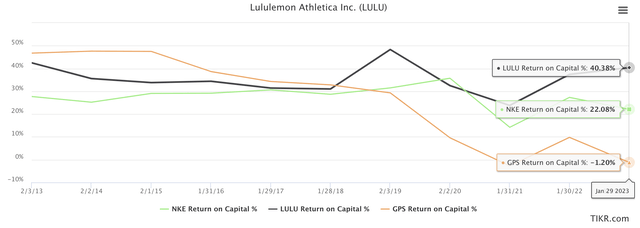

One of the standout aspects of Lululemon is its consistently impressive return on invested capital. In recent times, this metric has seen a steady upward trajectory, outpacing industry counterparts like Nike (NKE) and The Gap (GPS). For 2022, Lululemon recorded an enviable 40.44% return on capital, substantially outperforming Nike's 22% and leaving Gap behind, which reported a negative return.

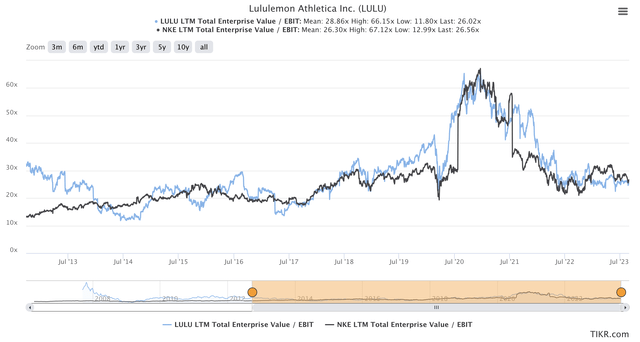

Over the past decade, the valuations of both Lulu and Nike have closely mirrored each other, suggesting that the market perceives them as closely matched in terms of growth prospects and stability.

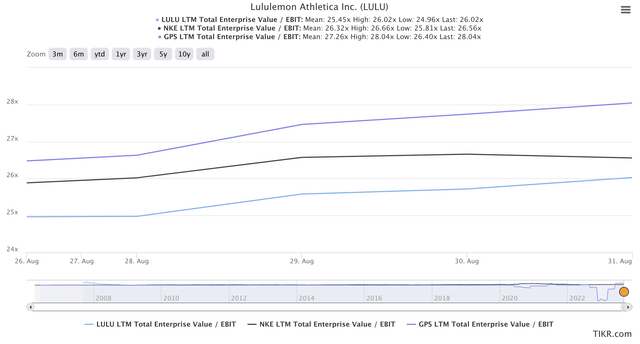

Even with the highest return on capital among the trio, Lululemon boasts the most attractive valuation at the time of writing. Its EBIT multiples stand at 26.02x, which is more favorable than Nike's 26.56x and Gap's 28.04x.

With the current valuation and the highest return on capital among the three, Lulu appears to be more attractive than both Nike and The Gap.

If one were to apply a median EBIT valuation of 25.5x on projected earnings of $2 billion, Lulu's enterprise value would approach approximately $51 billion. Incorporating Lululemon's net cash of $1 billion suggests a market capitalization nearing $50 billion. Divided across 121.6 million shares, this would imply a value of roughly $411 per share for Lululemon.

Key Takeaway

In an era where the retail terrain is constantly evolving, Lululemon's formidable second-quarter results affirm its resolute stance on growth, innovation, and sustainability. The brand's prowess in both the digital and physical arenas showcases its agility and resilience in navigating market challenges. Its visionary strategies, from penetrating burgeoning markets like China to championing sustainable causes, underscore Lululemon's foresight and commitment to a prosperous, inclusive future. Investors are presented with an opportunity to invest in a brand that not only promises robust returns on capital but does so at a reasonable price. In essence, Lululemon goes beyond athleisure; it is creating a legacy characterized by sustainable growth, innovation, and undeniable financial promise.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LULU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.