MSC Industrial: A Good Bet As Valuation Multiple Continues To Re-Rate

Summary

- MSC Industrial Direct Co. is experiencing strong growth in the public sector business, which is expected to contribute to sales growth.

- The company's "mission-critical" initiatives focused on solidifying metalworking position, expanding in-plant solutions, growing e-commerce, and diversifying customers and end markets continue to gain traction.

- The company's operating margin is expected to see benefits from volume leverage, easing comps, and cost-cutting initiatives.

monsitj

Investment Thesis

MSC Industrial Direct Co., Inc. (NYSE:MSM) is up over 20% since my last bullish article in January this year, outperforming S&P 500's (SPY) ~11% gains. The company is poised to see continued growth in the near term thanks to the strong momentum it is seeing in the public end-market as well as good traction of its in-plant and vending machine offering. The company's medium to long-term outlook also looks favorable, with benefits from reshoring trends in the U.S. manufacturing sector fueled by the CHIPS and Science Act and other government stimulus funding such as the Inflation Reduction Act.

In terms of margin, the gross margin is expected to see near-term headwinds due to a mix shift toward public end market projects. However, the operating margin should see gains from volume leverage, easing comps, and cost-cutting initiatives. The company is trading at a discount to its peers and should continue to see a re-rating as execution improves. So, I continue to have a buy rating on the stock.

Revenue Analysis and Outlook

MSM has significantly improved its execution over the past couple of years and has gained market shares through the implementation of its "mission-critical" initiatives, including solidifying its position in metalworking business, expanding solutions (Vending, In-Plant, and Vendor Managed Inventory), leveraging portfolio strength, growing e-commerce, and diversifying customers and end markets with a particular focus on the public sector.

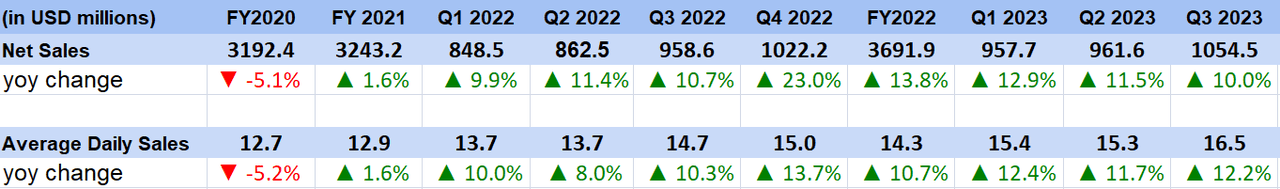

In the third quarter of 2023, the company recorded its sixth consecutive quarter of double-digit sales growth driven by the successful execution of these growth initiatives, which resulted in ongoing market share gains. The net sales increased 10% Y/Y and approximately 12% Y/Y on an average daily sales basis to $1.054 billion, which outperformed the Industrial Production Index by 11 percentage points. This growth was attributable to a 4 percentage point contribution from recent acquisitions, effective price realization, and strong momentum in the growth initiatives.

MSM's Revenue and Average Daily Sales Growth (Company Data, GS Analytics Research)

Looking forward, while the end markets are slightly down with industrial production seeing a modest Y/Y decline in July and PMI reading coming below 50, the company is executing well and should be able to grow its sales over the coming quarters. The biggest driver of the company's sales is its strategy to diversify its end markets, with a focus on the public sector work. The company is seeing strong momentum in this business and, in Q3, the public sector revenue increased 80% Y/Y. In addition to increasing penetration of existing contracts, the company is also benefiting from a recent contract win with a government entity. Under this contract, the company is getting a large number of small capital equipment orders. In addition to helping sales in the near term, these orders should also benefit the company in the long run as, once installed, these equipment will also need MRO supplies on a regular basis. Further, these types of orders also help the company deepen its relationship with public sector entities and try to gain more wallet share from their spending.

In addition to good momentum in the public sector, the company continues to see strong growth across its in-plant solutions and vending machines. In Q3, in-plant sales grew 13% Y/Y while vending machine average daily sales grew 10% Y/Y. These offerings have a good value proposition for manufacturing clients and should continue to gain traction.

Similarly, the company is doing a good job growing its eCommerce sales and cross-selling solutions like vendor-managed inventory to its existing clients, driving sales. So, I expect the company to continue outperforming its end markets and post good growth in the near term.

The company's medium to longer-term revenue outlook is also good given the increased reshoring of manufacturing in the U.S. helped by the CHIPS and Science Act and other government stimulus programs like Inflation Reduction Act. In particular, MSM is making efforts to target high-growth markets like Electric Vehicles (EV) and EV parts manufacturing to help it post above-market growth in the long run. The company's balance sheet is also healthy and its net leverage ratio at the end of Q3 was 0.7x, giving it ample leeway to do tuck-in M&As and drive growth through inorganic routes as well.

Margin Analysis and Outlook

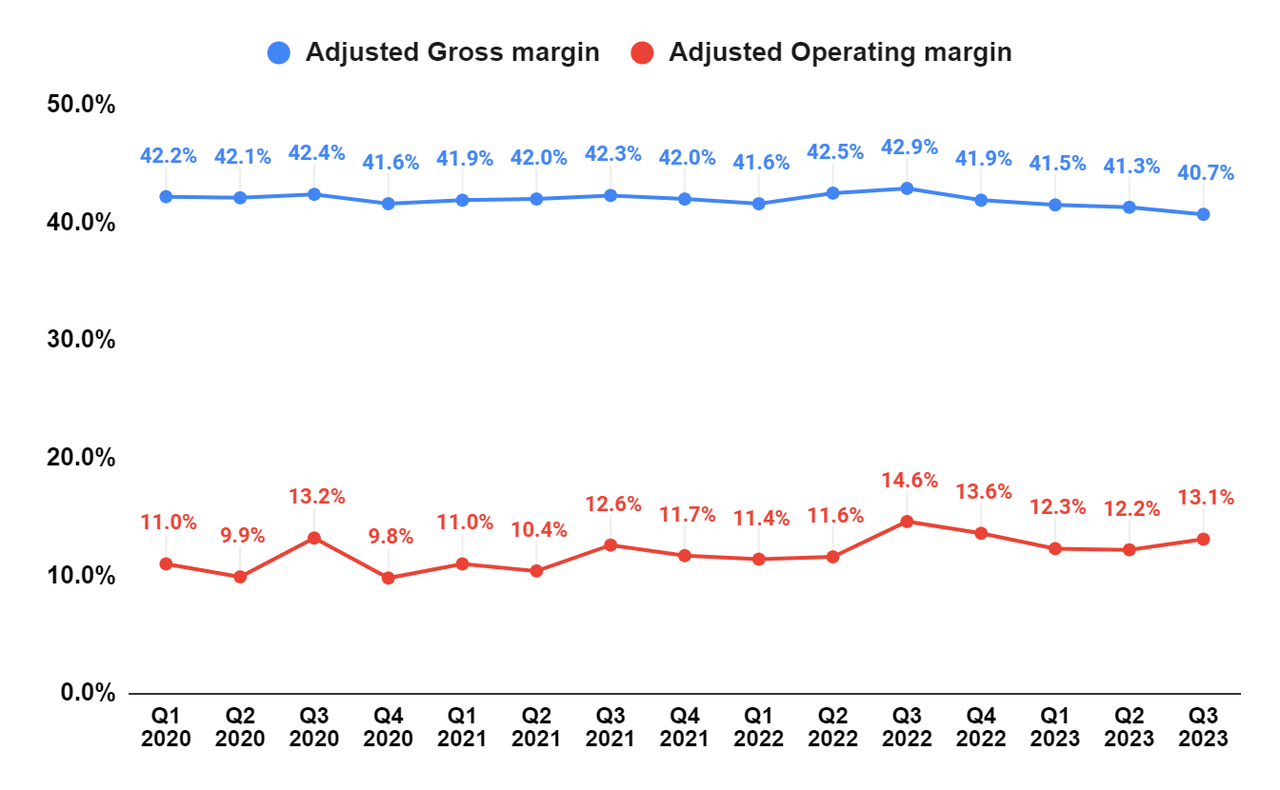

In Q3 2023, the company saw a 220 bps Y/Y contraction in adjusted gross margin driven by a 160 bps Y/Y decline due to the unfavorable customer mix as public sector work usually carries lower margins, a 40 bps Y/Y dilution related to recent acquisitions, and 20 bps Y/Y related to higher product costs. The adjusted operating expense as a percentage of net sales declined 80 bps Y/Y to 27.5%, helped by cost savings measures and productivity improvements resulting from the mission-critical initiatives. The lower gross margin more than offset the operating expense leverage, which resulted in a 150 bps Y/Y decrease in the adjusted operating margin to 13.1%.

MSM's Adjusted Gross Margin and Adjusted Operating Margin (Company Data, GS Analytics Research)

One of the downsides of good growth in public sector business is that the gross margin in this business is low. With the expectation of continued high growth in this market, the company's gross margins should be negatively impacted by mix shift. However, I am not too worried about it and believe as long as the company is getting additional operating profit dollars from the government projects, it makes sense to go after this market.

Further, the company is undertaking cost-cutting initiatives under its mission-critical program, and these cost-cutting initiatives together with SG&A leverage from higher volumes should help its operating margins. In Q3, the company witnessed an 80 bps decline in operating expenses as a percentage of sales. Also, while the gross margin of public end-market orders is low, the associated sales expense as a percentage of revenue is low as well given the large size of these orders. Further, last quarter was extraordinarily tough in terms of Y/Y operating margin comparisons, and comparisons are getting easier in the coming quarters. So, I believe while the company's gross margins should continue to get impacted by a mix-shift toward public end market projects, its operating margin can see improvement from volume leverage, easing comps, and cost-cutting initiatives.

Valuation and Conclusion

MSM stock is up nicely since my previous article. However, its valuation is still cheap compared to peers like Fastenal (FAST) and W.W. Grainger (GWW). While MSM is trading at 15.38x FY23 consensus EPS estimates, Fastenal and W.W. Grainger are trading at 27.38x and 19.11x, respectively.

A lot of interesting developments are happening at MSM which can help it re-rate. In addition to improving execution by management which has helped it post above-market growth rate in recent years, the company also recently announced changes related to its corporate governance under which the company's high voting class B shares held by Jacobson and Gershwind family will be converted to normal shares subject to shareholder approval. Further, the voting power of the Jacobson/Gershwind family will be limited to 15% of shares outstanding. The company has also replaced the two-thirds voting rule for approving mergers, asset sales, and other significant transactions and shifted to a standard simple majority.

I believe MSM's valuation can continue to re-rate higher as its growth continues to improve and management enacts shareholder-friendly initiatives. Hence, I maintain my buy rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.