KBA: Incoming Stimulus Not Enough To Reverse The Chinese Downturn

Summary

- China is stepping up on the stimulus front, but large-scale measures aren't in the toolkit this time around.

- Earnings growth has slowed, and as a result, mainland shares have continued to de-rate.

- With no quick fixes to China's structural issues, KBA's 50-stock portfolio remains exposed to more downside.

da-kuk

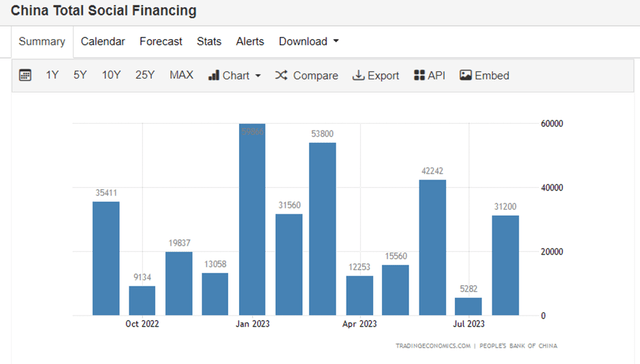

Since I last covered the KraneShares Bosera MSCI China A 50 Connect Index ETF (NYSEARCA:KBA), there's been a wave of new stimulus measures coming off the July Politburo meeting. No large-scale stimulus, though, and China's ongoing economic malaise reflects that. Yes, the latest headline consumer inflation did inflect upward in August alongside easing deflation on the producer side; but a closer look shows that higher crude oil prices, rather than demand improvement, was the main driver. The more encouraging data point, in my view, was on the credit side, with loan growth and total social financing data (a measure of funding to the real economy) rebounding strongly following weakness last month. But given a lot of the bounce was down to policy support, including via monetary easing and government bond issuances, rather than a fundamental upturn, it seems unlikely that this translates into improved earnings power for Chinese corporates.

For the most part, mainstream news flow has been decidedly negative on the state of the Chinese economy; rightly so, given the troubled property sector, the largest component of Chinese household wealth, continues to deteriorate. The knock-on effect of a prolonged property downturn, as well as the prospect of an ensuing balance sheet recession, could have profound impacts on the earnings power of Chinese large caps for the years ahead. So even with a tactical rally in mainland Chinese equities looking increasingly likely in Q4, as more stimulus is unleashed and foreign selling eventually bottoms out, a sustained rally seems unlikely for the KraneShares Bosera MSCI China A 50 Connect Index ETF. Pending a more meaningful de-rating or improvement in the structural issues underlying the Chinese economy, along with the easing of geopolitical tensions, I remain sidelined.

Fund Overview - Invest in Mainland China Via the Uber-Caps

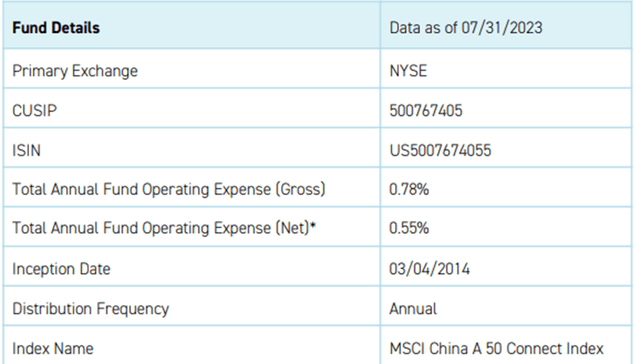

The KraneShares Bosera MSCI China A 50 Connect Index ETF now tracks (pre-expenses) the performance of a narrowed basket of the fifty largest mainland-listed large-cap stocks (i.e., A-shares) via the MSCI China A 50 Connect Index. Of note, the ETF has seen a further decline in its net asset base to ~$394m at the time of writing, not helped by the further de-rating of Chinese large caps over the last few months. The fund's gross expense ratio of ~0.8% remains intact, while an extension of contractual fee waivers through August 2024 means the net expense ratio has also been maintained at 0.55%. Relative to its closest comparable, the iShares MSCI China A ETF (CNYA), which charges 0.6%, KBA is competitively priced.

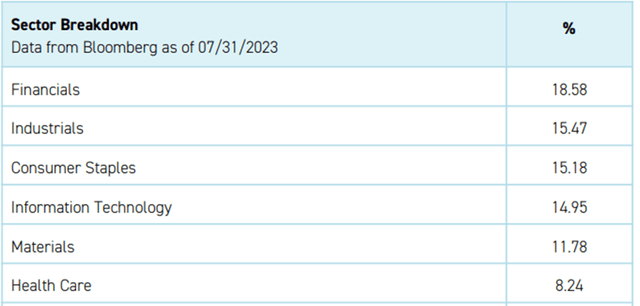

The most notable shift from the latest KBA factsheet is the fund's narrowed portfolio, now spread across 53 holdings (vs >90 before). KBA's portfolio composition, on the other hand, is in line with prior quarters. From a sector perspective, the fund is most heavily exposed to Financials (18.6%), followed by Industrials and Consumer Staples. Information Technology and Materials round up the top-five list at 15.0% and 11.8%, respectively. While the top five sectors contribute an outsized share of KBA, the portfolio generally does a good job of tracking China's broader economic composition.

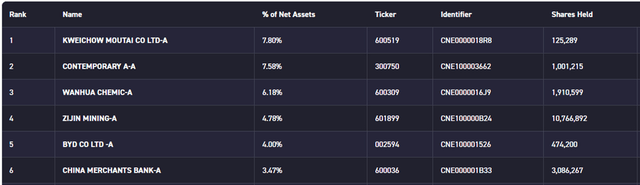

The updated single-stock allocation disclosure has seen limited changes at the top, with baijiu company Kweichow Moutai (7.8%) taking over as the largest holding from battery producer Contemporary Amperex Technology (7.6%). Other key holdings include chemical supplier Wanhua Chemical, mining company Zijin Mining, and EV producer BYD (OTCPK:BYDDY). From a single-stock perspective, the KBA portfolio bears many similarities to key A-share ETF comparable, CNYA, though the lower allocation to the major banks is a notable distinguishing factor. KBA also runs a higher portfolio concentration (top-five holdings contribute ~30%), a natural consequence of its smaller size (>50 holdings vs. >550 holdings for CNYA).

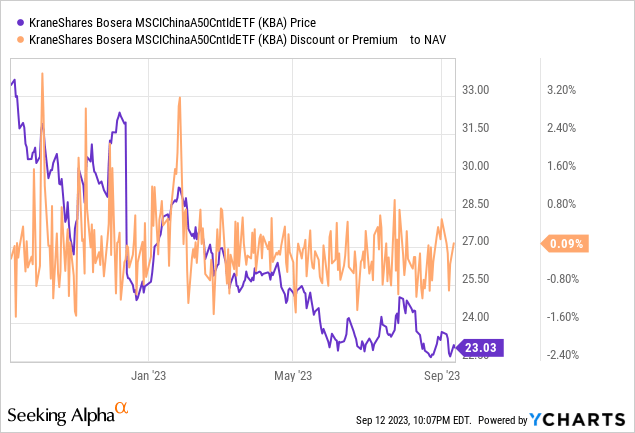

Fund Performance - Another Underwhelming Quarter Weighs on Overall Returns

The ETF has extended its YTD decline over the last quarter, and as a result, its return since inception in 2014 has now decayed to +4.5% (market price and NAV terms). In the likely event that KBA doesn't see a steep reversal through year-end, this would mark yet another year of negative returns, albeit at a slower pace than last year's double-digit % drawdown. On an annualized basis, KBA's three and five-year returns stand at -8.2% and +3.7%, respectively.

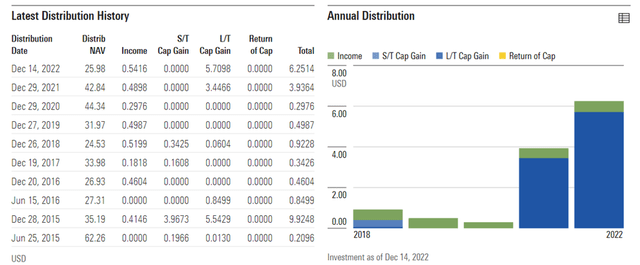

While the five-year return is slightly ahead of key A-share comparable, CNYA, it's probably not the kind of reward investors will be happy with for the risk they are taking on. The tracking error, on the other hand, has been pretty good at a 70-80bps delta between the index and NAV returns. But CNYA has done a better job here (20-30bps spread over the last five years). Meanwhile, KBA's narrower portfolio has yielded less than CNYA at a trailing income yield of ~2% (vs. ~3% for CNYA), though on a forward basis, the fund's exposure to more resilient mainland uber-caps could see the income gap narrow.

Incoming Stimulus Not Enough to Reverse the Chinese Downturn

China has begun unleashing its property-focused stimulus measures over the last month. Most notably, residential property purchases will now see lower initial downpayment requirements, while first and second-time home buyers will benefit from reduced mortgage rates (relative to the loan prime rate). These aren't quick fixes, though, and it will ultimately take time to address the deteriorating property situation (note that ~70% of Chinese wealth is tied to property). The balance sheet repair required across the private sector and local governments will be challenging as well. So even with recent inflation and credit data trending in the right direction (though consumer and producer prices were boosted by oil prices rather than a demand upturn), I wouldn't underwrite a turnaround just yet.

In the meantime, Chinese mainland stocks remain under pressure, with investor sentiment turning increasingly negative (foreign outflows reached new highs last month per Hong Kong Stock Connect data). On the one hand, large caps have de-rated to ~10x fwd earnings relative to a mid-teens % earnings growth outlook. But given the extent of recent downward earnings revisions (ex-consumer/tech), I wonder if there's still more downside ahead, particularly with structural economic issues (demographic, debt, and geopolitics) poised to worsen. Net, I continue to favor a more consumer-centric approach to China investing through the Global X MSCI China Consumer Discretionary ETF (CHIQ) vs. broad-based ETFs like KBA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.