Dow: Price Pressure Continues

Summary

- Dow's stock price has declined in the first quarter this year and has broadly traded sideways thereafter.

- The stock held up quite well as inflation, customer destocking and the economic slowdown has hit Dow midships if earnings are considered.

- In spite of a pandemic, high inflation and fluctuating earnings, Dow has consistently increased cashflow, lowered debt and kept investing in the business.

- Yet, assessing the bear case, continued price pressure may materialize if economic growth remains subdued in Eurasia.

- While the company is well managed, I will not expand my position yet.

jetcityimage

In January 2023 Dow's (NYSE:DOW) stock price reached a level of US$60 but declined in March after which it has been trading sideways at approximately US$55 per share. Yet, the stock price does not reflect the fact that the inflationary environment, customer destocking and overall economic slowdown has hit Dow midships if both sales and EBIT are considered.

While the company is well managed, a lack of earnings should not occur for too long. Even if management has the skills to weather such a storm, eventually it will be reflected in the share price. Given the expected continuation of price pressure this year, combined with the potential macroeconomic risks emanating from Eurasia, I will not expand my position yet.

1H23 performance

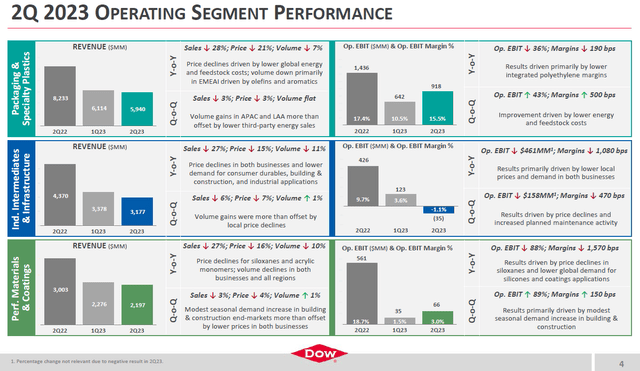

As predicted in my previous coverage of Dow back in October last year, the company showed strong performance over the entire year 2022 in spite of missing the estimates in the last quarter. Nevertheless, Dow reached a 52-week high in January this year after which the stock price has been declining. This is not surprising as sales, volumes and price have been dropping quarter over quarter. The only exception was formed by the Performance Materials and coatings division in 1Q23. In the second quarter, however, performance was further deteriorating, see figure 1.

Figure 1 - 2Q23 segment performance (investors.dow.com)

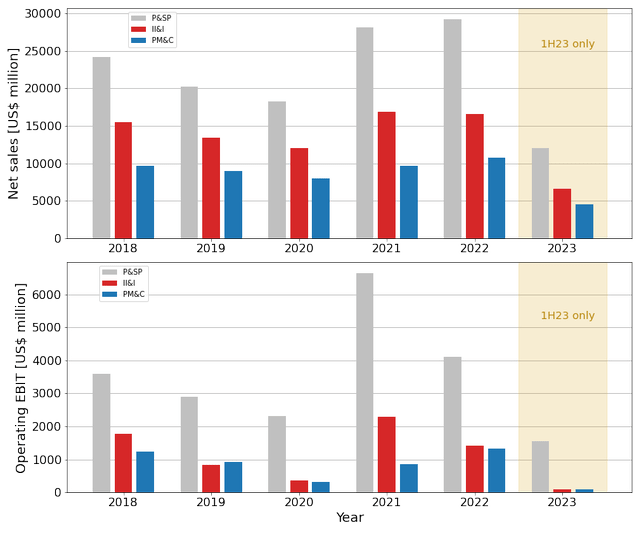

Yet, the quarter over quarter results generally cloud judgment as Dow is a capital intensive business where one needs to look through the cycle. Therefore, figure 2 shows the sales and EBIT results since the company was spun off DowDupont.

Figure 2 - Sales and Operating EBIT per segment since spin-off (investors.dow.com; chart by author)

The inflationary environment, customer destocking and the overall economic slowdown has hit Dow midships if both sales and EBIT are considered. While the '23 figures only show the performance booked in the first half of the year, it is very unlikely performance in the second half will be much better. This is further enforced by the expectation CEO Fitterling shared at the 2Q23 earnings call:

In terms of the look at the macro economy, my feeling is this, we know we're in a global economic slowdown. It really started mid last year. We saw GDP decline through the back half of last year. We saw a little spike up in Q1 of this year, but it's been down in Q2. And the expectation is it will be down in Q3 and Q4.

On the upside, however, the indicators' management uses (such as MEG, ethylene glycol, caustic and chlorine) indicate we are in a slowdown already. Again, from the earnings call:

I think it's setting up for a ramp back in 2024. People ask a lot of times are we in a recession? (…) So I would say all the indicators say we're in it right now. And it feels to me like third, fourth quarter is going to be that low point, and then we'd start to ramp back from there. And with the Fed seem to be nearing the ending of rate increases, a little bit of green shoots in housing, people moving back into the housing market, I think there are some areas to be optimistic for 2024.

Whether or not the economic environment will improve next year, 2023 will be a year with mediocre performance.

Key metrics

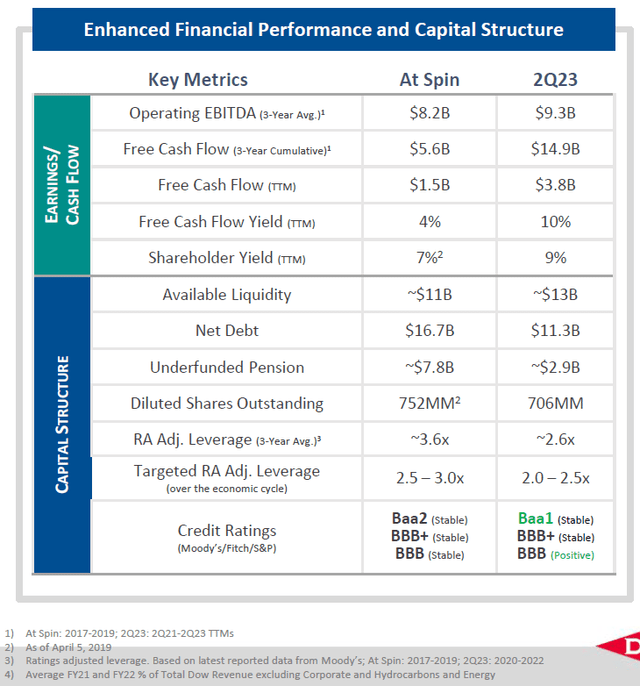

The overall operating performance has been under pressure for several quarters now and this is starting to show in the key metrics, see figure 3.

Figure 3 - Performance since spin (investors.dow.com)

While the comparison to 'the Spin' shows a favorable outcome, the 2Q23 numbers are deteriorating compared to those of 2Q22 for example. The differences are not alarming, but then again, the numbers are either valid for the trailing twelve months or averaged over 3 years. The effect of the current low earnings are therefore not immediately visualized as such. And this is a good thing as it helps management look over the economic cycle. The effect of this long term view is made more clear when the data in figure 4 is considered.

Figure 4 - Several metrics since 2018 (investors.dow.com)

In spite of a pandemic, high inflation and fluctuating earnings, Dow has consistently increased cashflow, lowered debt and kept investing in the business.

Capex development

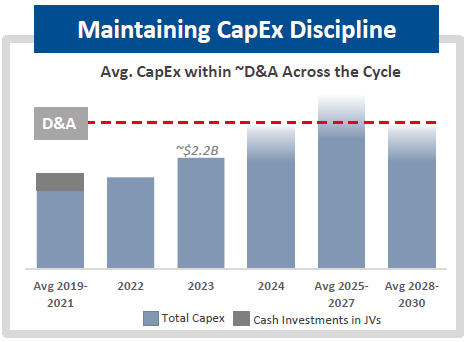

Regarding investments in its business, Dow is on the path to increase capex over the coming years. While management is clearly taking a long term view, it becomes important to assess how this will affect the balance sheet in the short term. After all, macroeconomic factors have caused the results to deteriorate, a situation that will most likely continue as management presented a muted outlook for 2H23.

Compared to the capex forecast shared at the 2021 Investor Day, the company is lagging in capex spending. Clearly, management takes note of the macroeconomic environment and adjusts the execution of its capex plan accordingly. Yet, with construction at the Alberta and Terneuzen sites starting in the next two years, capex will have to increase eventually, see figure 5.

Figure 5 - 2Q23 capex overview (investors.dow.com)

One could argue either of these capex intensive projects may be delayed to save cash, but this would imply the decarbonization targets will be pushed backwards. As it currently stands, the balance sheet looks healthy and while leverage is slightly higher than the target, see figure 3, it is explicitly stated management looks 'over the economic cycle'. In other words, temporary exceedance of the target is no problem. On top of this, liabilities have been reduced substantially over the last years, in anticipation of the higher capex spending.

2020 mode

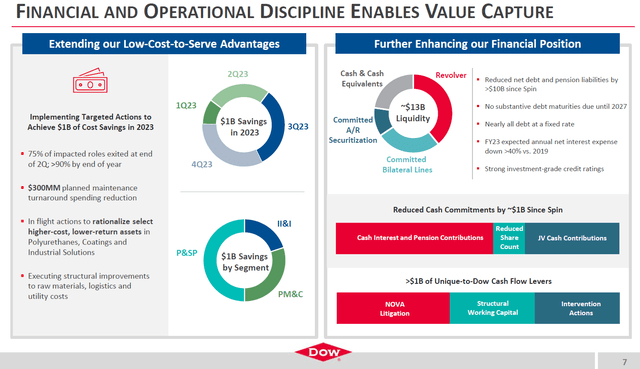

Referring to figure 2, the last time earnings took a hit was in 2020. However, this time around the starting point, from a financial perspective, is much better. The reduction in net debt and pension liabilities are noteworthy, but not too be overlooked is the fact that share count has been reduced by 6% since 2020. As shown in figure 6, this means the company has more financial flexibility compared to the situation when it was facing the previous crisis.

Figure 6 - Savings and cash commitments (investors.dow.com)

Furthermore, we now have a seasoned management team that knows which levers to use to maintain performance in an adverse environment. Just like three years age, a cost savings program is put in place and an additional source of income is present. In 2020 this was the sale of the company's railroad and terminal assets for the sum of US$0.9Bn, this time around management expects the Nova litigation to bring in more cash:

So we also have the NOVA litigation, which is several hundred million dollars that we fully expect to win in, I would say, the final round of that Canadian litigation. So there's another $1 billion out there over the next 12 to 18 months. And as we get that money and we have the room, we will continue to be even more opportunistic on stock buyback.

In this respect, it must be noted Dow has been successful in the Nova litigation matter, so there is little reason to contest the statement made by CFO Ungerleider.

Under pressure

Whereas in my previous coverage it was highlighted the income from European operations would be adversely affected by FX headwinds and energy prices, these concerns are currently of less interest. Europe has experienced a mild winter, reduced the usage of natural gas and ramped up imports of LNG with more terminals due to come online for the next winter.

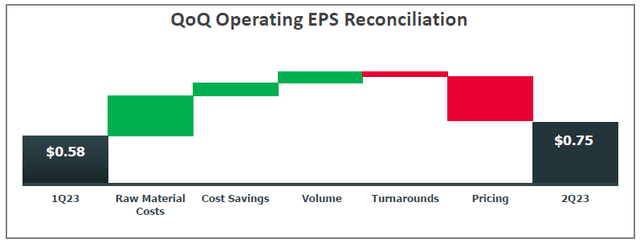

While the headache of elevated energy prices may have subsided, 2023 is becoming the year of hefty price pressure. Figure 7 shows the bulk of loss in earnings was driven by pricing, a trend that is continuing this year when the data in figure 8 is assessed.

Figure 7 - EPS Reconciliation from 1Q22 to 1Q23 (investors.dow.com) Figure 8 - EPS Reconciliation from 1Q23 to 2Q23 (investors.dow.com)

This trend will continue in 3Q23, according to remarks made by CFO Ungerleider in the second quarter earnings call:

We continue to expect a challenging macroeconomic environment in the third quarter. While inflation is beginning to moderate, the lagging effects of tighter monetary policy on consumer demand and a slower-than-expected demand recovery in China have resulted in a slowdown of industrial economic activity around the world.

The Eurasian risk factor

While CEO Fitterling sees green shoots in 2024, an investor should consider the possibility the economy may take a turn for the worse. While the Fed has not yet conclusively decided the rate hikes are over, it seems to be one of the most predictable central banks.

In Europe, for example, the Stability and Growth pact will come back into force next year after being suspended between 2020 and 2023 due to the pandemic. This set of regulations puts a limit on the debt-to-GDP ratio and government deficits, amongst others. The potential effect is summarized by ING (ING, OTCPK:INGVF):

An end to the escape clause and reinstatement of the SGP, be it in its existing or modified form, means that the budgets that have to be drafted this year for 2024 will need to foster some budget consolidation. As budget deficits for the eurozone as a whole are still likely to hover around 3.5% of GDP for 2023, fiscal policy will at least become less expansionary or even slightly contractionary in 2024. Which, in combination with a tight monetary policy, is a recipe for subdued growth next year.

This pact is put into force again at a time the European Central Bank is performing a balancing act to reduce inflation while business activity is already falling. Essentially, the ECB has been trying to contain inflation, while more than once urging national governments to do their part. Now it seems national governments will be forced to do their part, due to the Stability pact coming into force again, at a moment that economic activity is already under pressure.

Looking past Europe, the second largest economy in the World, China, may have different reasons to let economic growth dwindle. Recently, an article by Bloomberg suggested President Xi has the desire to move away from the debt-fueled growth model. I highlighted this in an article on Rio Tinto (RIO) as that company depends on the Chinese economy to a large extent. The point was the following:

… China and the US are locked in a trade-war over semiconductors amongst others. By not stimulating the Chinese economy, China can further the occurrence of a potential recession for the economies in developed countries without resorting to import tariffs or other 'unfriendly' practices.

With about 50% of Dow's sales coming from Europe and Asia Pacific, potential downturns in the economy will affect the company. While Dow is well managed, a lack of earnings should not occur for too long. Even if management has the skills to weather such a storm, the share price will be affected.

Conclusion

Since the final quarter of last year, volumes and price have been dropping quarter over quarter. Inflation, customer destocking and the economic slowdown has hit Dow midships if sales and earnings are considered. Yet, management believes we are in the midst of a recession, with performance potentially improving in 2024.

As management takes a long-term view, it is responding to the current environment by implementing a cost savings program, but has been working on debt reduction and increased performance over the last years. This implies the investment plans can be maintained for now as the company simply has more financial flexibility.

Yet, assessing the bear case, continued price pressure may materialize if economic growth remains subdued. As Dow is a global company, the Eurasian risk factor must be taken into account. Given the expected continuation of price pressure this year and the potential macroeconomic risks, the company appears to be in the eye of the storm meaning I won't expand my position yet.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ING, DOW, RIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

In this article I share the research upon which I base my personal investment decisions. Therefore the content or any information in this article should not be considered investment advice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)