KMLM: Meeting All The High Expectations

Summary

- Trend following (managed futures) performs well in the long run, with less risk, and offers crisis alpha during equity downturns.

- The KFA Mount Lucas Index Strategy ETF tracks the Mount Lucas Index and provides diversification benefits thanks to its low correlation to other asset classes.

- KMLM has performed well since its inception in 2022, outperforming the S&P 500 while offering lower risk and drawdowns.

phototechno/iStock via Getty Images

Trend following (or managed futures) performs in the long run as well as equities, but with less risk. It also offers crisis alpha: it performs very well when equities tumble. On top of that come the diversification benefits; managed futures have a low correlation with other asset classes.

The most famous managed futures index is the Mount Lucas Index. And there is an ETF that follows this index: the KFA Mount Lucas Index Strategy ETF (NYSEARCA:KMLM). Since its inception at the end of 2020 KMLM is meeting all and even surpassing some of these high expectations.

But since we previously wrote about KMLM the performance was ok but not great. This is a bit surprising because trend following performs normally very well in disinflationary periods.

This relative weakness presents us with a nice buying opportunity if trend following starts to perform as can be expected when we’re dealing with disinflation.

Trend following

Trend following involves taking long and short positions in futures contracts. The contracts can be in currencies, commodities, fixed income and equities. This strategy is used by so-called managed futures hedge funds. We use the terms trend following and managed futures interchangeably. The ability to go long and short allows to benefit from both up-and downtrends in markets. It goes without saying that trend followers perform best when there are clear trends in global markets.

Mount Lucas Management established already in 1988 the first index to measure the returns to trend following in futures markets: the Mount Lucas Index. And there is an ETF that tracks this index: KFA Mount Lucas Index Strategy ETF.

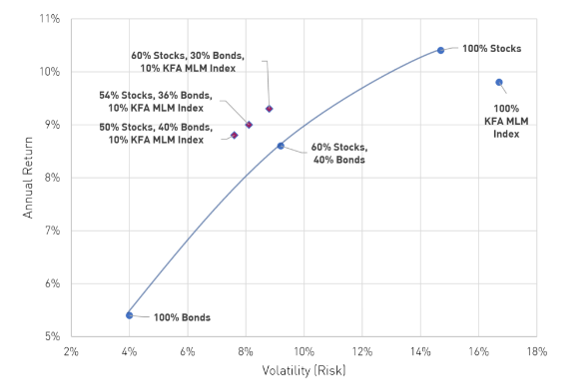

Trend following may reduce both risk and drawdown when used as a complement to a 60/40 portfolio. Allocating as little as 10% may yield risk-adjusted performance benefits.

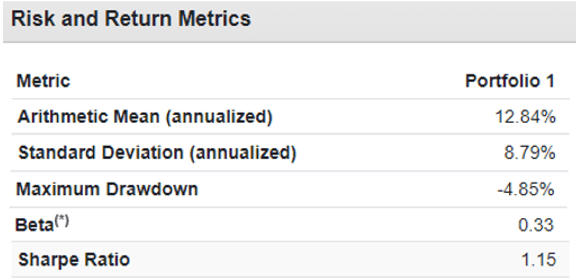

Figure 1: Risk return chart (KFA Funds)

KFA Mount Lucas Index Strategy ETF

KMLM is benchmarked to the KFA MLM Index. It’s a passive, rules based index that is rebalanced monthly. Of course the index is at the same time dynamic or active due to its ability to switch from long to short exposures.

Trend following is not only diversifying but also diversified on its own. The KFA MLM Index consists of a portfolio of twenty-two liquid futures contracts traded on U.S. and foreign exchanges. The Index includes futures contracts on:

- 11 commodities,

- 6 currencies, and

- 5 global bond markets.

These three baskets are weighted by their relative historical volatility, and within each basket, the constituent markets are equally weighted.

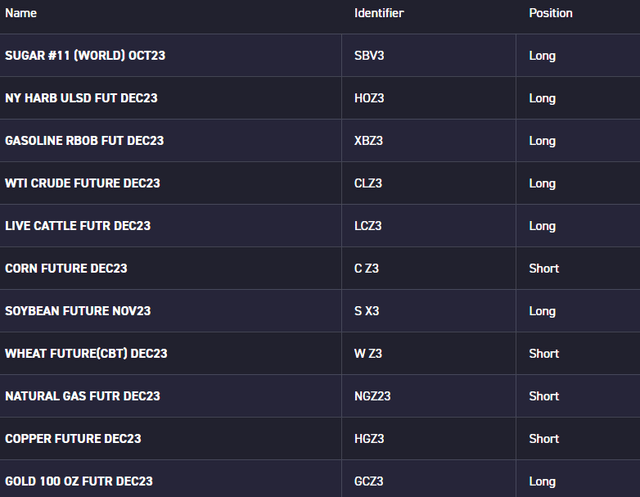

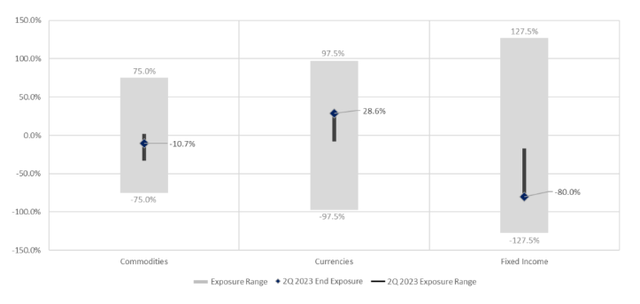

The current commodity exposures are a mix of long and short positions in base and precious metals, agricultural and energy commodities.

Figure 2: Commodity Exposures (KFA Funds)

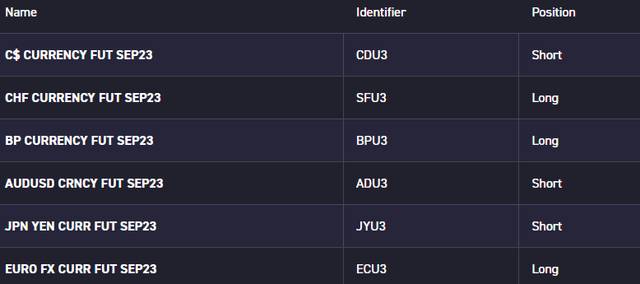

The fund is short the Canadian and the Australian dollar and the Japanese yen.

Figure 3: Currency Exposures (KFA Funds)

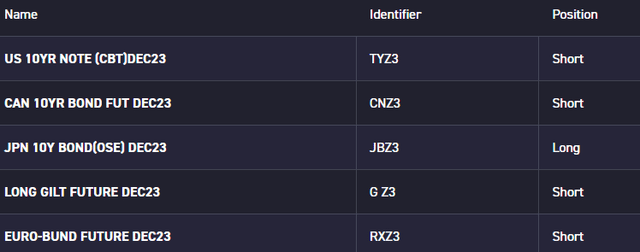

The fund is also short all the major global treasury bond markets with the exception of Japan.

Figure 4: Fixed Income Exposures (KFA Funds)

Man Group describes managed futures or trend following as follows: “Trend-following performs as well as equities in the long term, is lowly correlated, has better risk-management properties, and generally works well when equities don’t. “

Since its inception at the end of 2020 KMLM has performed very well. It even outperformed the S&P 500! And it did this indeed with lower risk.

Figure 5: Risk and return (Portfolio visualizer)

But we like KMLM not only for the good returns, but also for its diversification benefits. Below you can find the performance of a portfolio that consists of 50% KMLM and 50% the S&P 500. The results clearly show the diversification benefits you get by adding KMLM to an equity portfolio.

Figure 6: Risk and return (Portfolio visualizer)

The results are truly great. The return is better than that of the S&P 500 but the standard deviation is indeed much lower, as is the maximum drawdown!

Managed futures are also said to offer crisis alpha: they perform well when equities don’t. The result for the 50/50-portfolio a maximum drawdown of less than 5%!

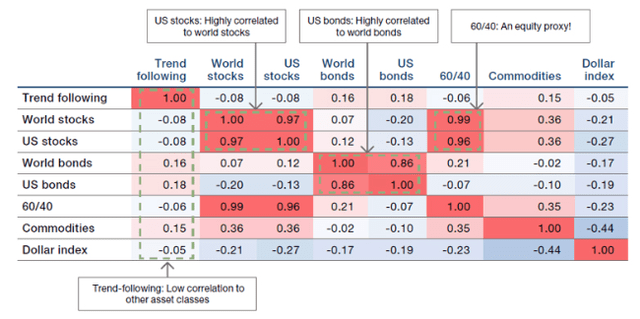

And managed futures aren’t only a good diversifier for equities. Trend following has a low correlation to other asset classes as well.

Figure 7: Trend following’s low correlation (Man Group)

What’s next?

Trend following performs in the long run as well as equities, but with less risk. On top of that come the diversification benefits.

We actually expect KMLM to continue its role as a great portfolio diversifier.

But what about the return?

It’s not always easy to explain the short term performance of a trend following strategy. They trade many markets across multiple asset classes. A positive beta to equities could originate from places other than equities. And the positioning can change as trends in different places emerge or disappear.

In the second quarter of this year, KMLM’s commodity exposures finished the quarter where they started at net short 11%. Currency exposures went from net short 11% to net long 29%. Global Fixed Income exposures went from net short 64% to net short 80%. Figure 7 shows how much exposure can change in one quarter.

Figure 8: Sector exposures (KFA Funds)

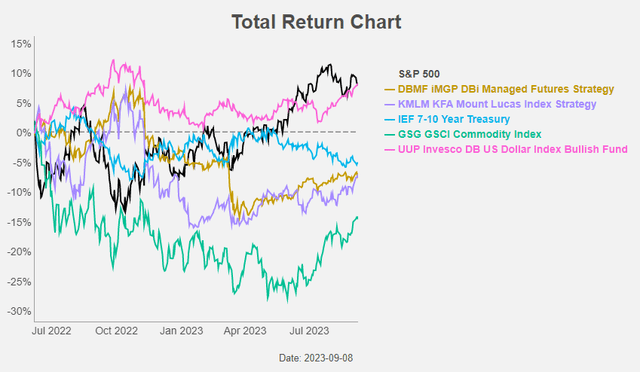

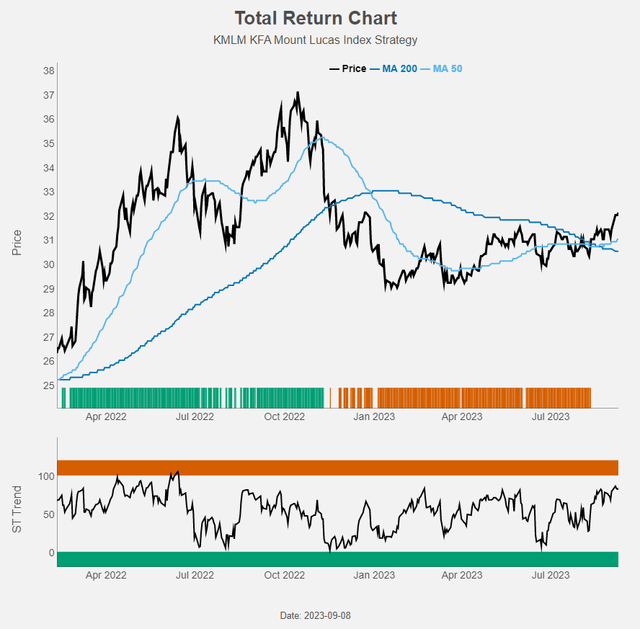

According to Man Group we are in a disinflationary period since June 2022. Since the top in oil prices in June 2022 KMLM’s return hasn’t been stellar.

Figure 9: Total Return Chart (Radar Insights)

This is a bit unexpected because trend following is normally performing ok during disinflationary periods with an expected return of 6%.

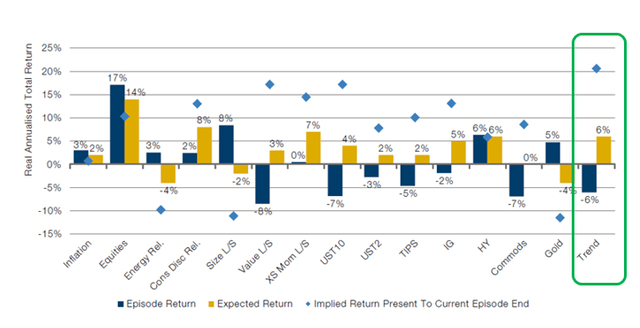

Figure 10: Implied returns (Man Group)

The yellow bars are the real annualised returns you would expect for a disinflationary period based on a century of historic data. The blue bars are the returns which have been realised so far in this disinflationary period episode (which began at the end of June 22).

The blue diamonds are, assuming the disinflation continues, the nominal return you would need for each asset to equalise the blue and the yellow bars. So, it’s what you could expect moving forward. The highest implied expected return is for … trend following. On the second place, we find value stocks and…. treasuries.

What about trend following’s own trend?

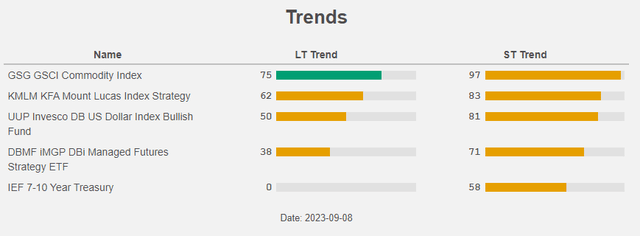

KMLM is itself no longer in a long term downtrend.

Figure 11: Trends (Radar Insights)

KMLM is already trading above both its 50 and 200 day moving average. It wouldn’t surprise us if it enters a long term uptrend in the near future.

Figure 12: Total Return Chart (Radar Insights)

Conclusion

Trend following has some very nice attributes: in the long term it performs as well as equities, but with less risk. It performs also very well, when equities tumble. On top of that come the diversification benefits; managed futures have a low correlation with other asset classes. The performance of KMLM since its inception at the end of 2020 ticks all these boxes.

Since the top in oil prices in June 2022 the performance is a bit weaker than expected. This offers us a nice entry point in case KMLM catches up and performs as historically can be expected in a disinflationary environment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in KMLM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)